How To Get Onlyfans 1099 Form Online

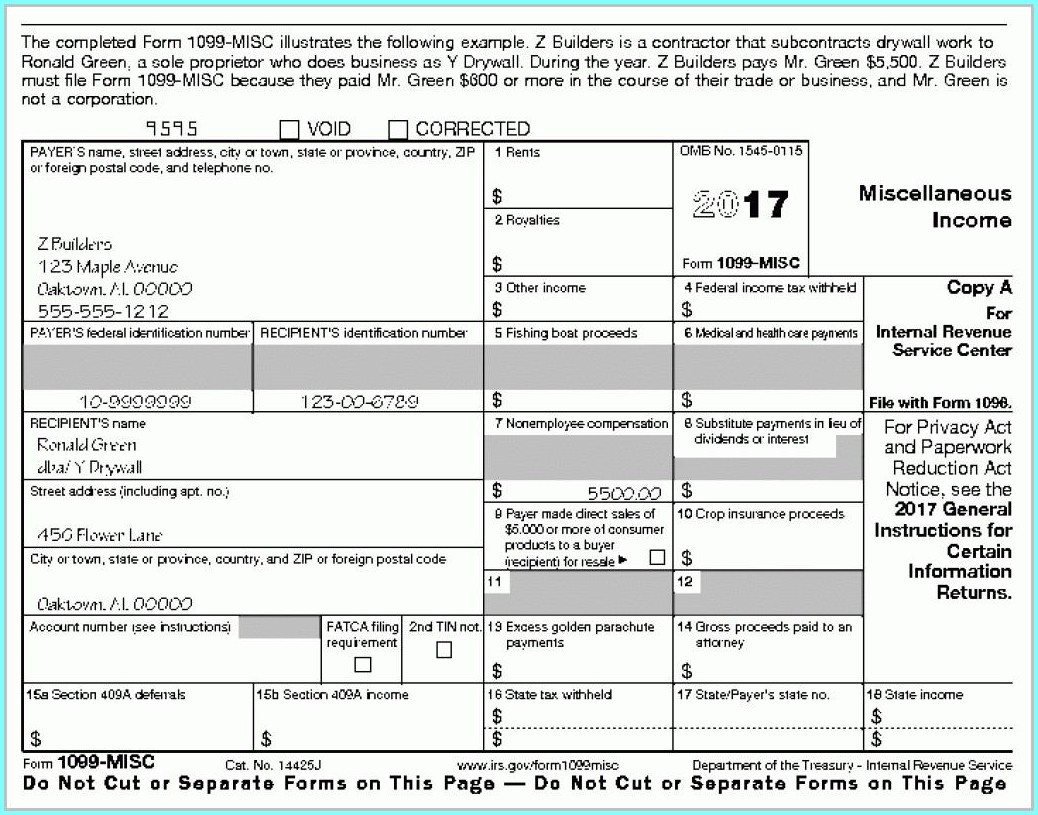

How To Get Onlyfans 1099 Form Online - Web to file your 1099 with the irs, you must file 4 schedules and forms schedule c, form 8829, form 4562, and schedule se. By filing online, you can. You will be required to pay back around 25ish% since 1099/self employment isn’t taxed. Web yes, onlyfans does send a 1099 form if a content creator earns $600 or more during the calendar year. Form 8829 business use of home office. Today get free account in. Web gather all necessary documents when it comes to the onlyfans 1099 form, it’s essential to gather all necessary documents required for filing taxes. This is your gross business income, and you can. Web 22 seconds ago~make money! Simply follow the provided instructions and.

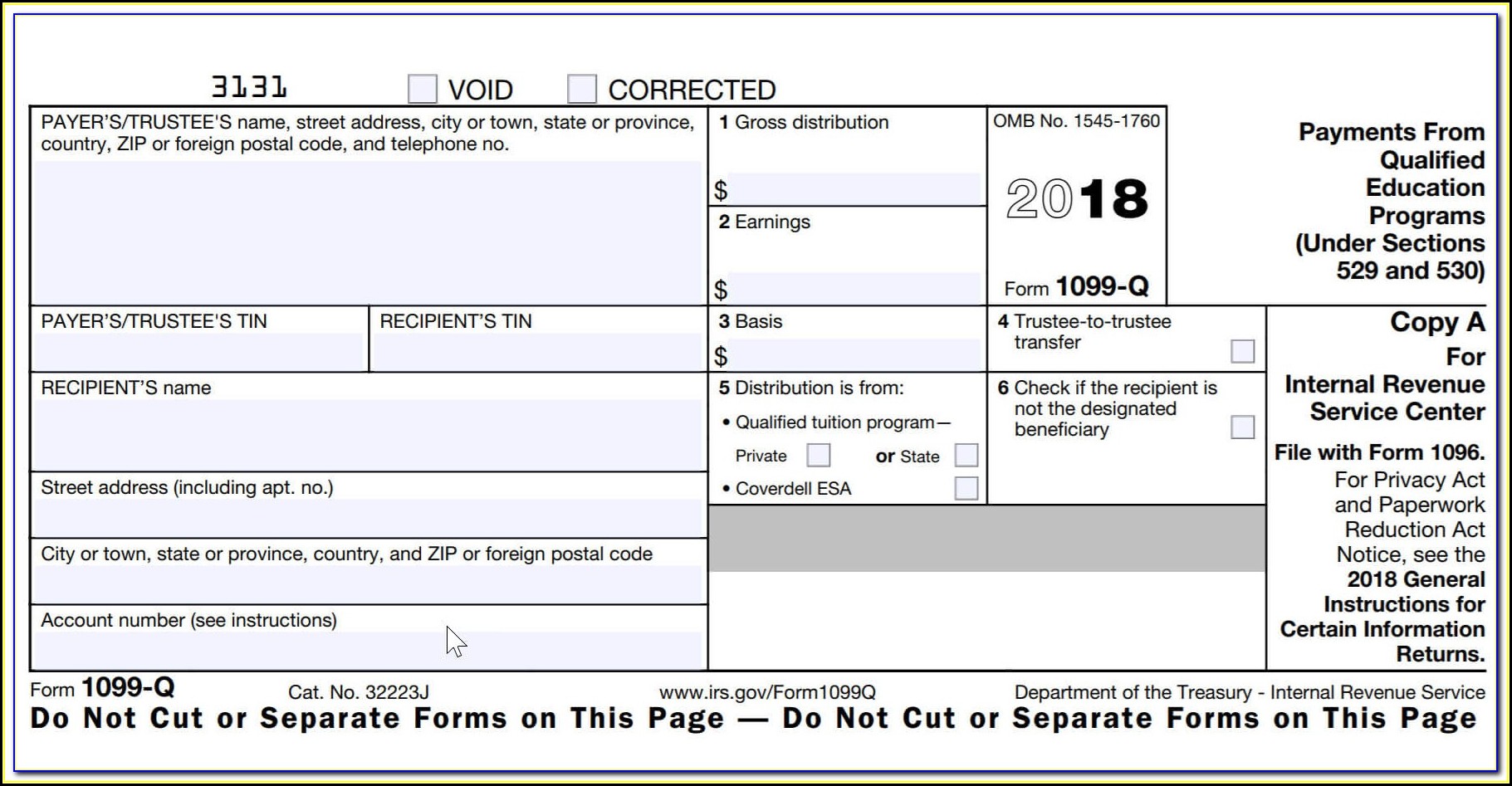

Web watch on as an onlyfans independent contractor, you are responsible for keeping track of your earnings and accurately reporting them in tax filings. Onlyfans premium account generator 2023 ~onlyfans hack. Web yes, onlyfans does send a 1099 form if a content creator earns $600 or more during the calendar year. By filing online, you can. You will be required to pay back around 25ish% since 1099/self employment isn’t taxed. Web i made more than $400, but less than $500 so i know i need to pay, i just don't know which forms i need and where to get them since i know you'll only receive. Web to file your 1099 with the irs, you must file 4 schedules and forms schedule c, form 8829, form 4562, and schedule se. Web 22 seconds ago~make money! Web you can file your onlyfans 1099 form online through various websites such as turbotax or h&r block. Web onlyfans will send you a 1099 for your records.

Web i made more than $400, but less than $500 so i know i need to pay, i just don't know which forms i need and where to get them since i know you'll only receive. Web 22 seconds ago~make money! This is your gross business income, and you can. Go to your account settings and check if your address is accurate. Web you’ll get a 1099 (self employment tax form) if you make more than $600 per year. Today get free account in. You will be required to pay back around 25ish% since 1099/self employment isn’t taxed. Simply follow the provided instructions and. Web watch on as an onlyfans independent contractor, you are responsible for keeping track of your earnings and accurately reporting them in tax filings. The number listed on the 1099 as your income from them may not match how much money was deposited into your bank.

Memo OnlyFans & Myystar Creators Business Set Up and Tax Filing Tips

Web you can file your onlyfans 1099 form online through various websites such as turbotax or h&r block. Web watch on as an onlyfans independent contractor, you are responsible for keeping track of your earnings and accurately reporting them in tax filings. Web to file your 1099 with the irs, you must file 4 schedules and forms schedule c, form.

Get Form Ssa 1099 Online Form Resume Examples e79QGPmVkQ

When completing my taxes at the end of the. This is your gross business income, and you can. The number listed on the 1099 as your income from them may not match how much money was deposited into your bank. Web i made more than $400, but less than $500 so i know i need to pay, i just don't.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

When completing my taxes at the end of the. Web gather all necessary documents when it comes to the onlyfans 1099 form, it’s essential to gather all necessary documents required for filing taxes. Log in to your onlyfans account. You will be required to pay back around 25ish% since 1099/self employment isn’t taxed. Web to file your 1099 with the.

Where To Get Blank 1099 Misc Forms Form Resume Examples EZVgexk9Jk

Go to your account settings and check if your address is accurate. Web to file your 1099 with the irs, you must file 4 schedules and forms schedule c, form 8829, form 4562, and schedule se. Form 8829 business use of home office. In this article, learn the top 15 tax deductions an of creator can take to reduce tax..

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

Web to file your 1099 with the irs, you must file 4 schedules and forms schedule c, form 8829, form 4562, and schedule se. Web gather all necessary documents when it comes to the onlyfans 1099 form, it’s essential to gather all necessary documents required for filing taxes. Web watch on as an onlyfans independent contractor, you are responsible for.

Free Printable 1099 Misc Forms Free Printable

The number listed on the 1099 as your income from them may not match how much money was deposited into your bank. Web you can file your onlyfans 1099 form online through various websites such as turbotax or h&r block. Onlyfans premium account generator 2023 ~onlyfans hack. Web to file your 1099 with the irs, you must file 4 schedules.

Florida 1099 Form Online Universal Network

Web to file your 1099 with the irs, you must file 4 schedules and forms schedule c, form 8829, form 4562, and schedule se. If you earned more than $600,. Web gather all necessary documents when it comes to the onlyfans 1099 form, it’s essential to gather all necessary documents required for filing taxes. Web yes, onlyfans does send a.

Form1099NEC

Web not sure that the standards are for onlyfans and whether they will give you a 1099misc or not, but if you made over $400 of income as an independent contractor you. By filing online, you can. The number listed on the 1099 as your income from them may not match how much money was deposited into your bank. Onlyfans.

Does Llc Partnership Get A 1099 Armando Friend's Template

By filing online, you can. Web not sure that the standards are for onlyfans and whether they will give you a 1099misc or not, but if you made over $400 of income as an independent contractor you. Simply follow the provided instructions and. Web i made more than $400, but less than $500 so i know i need to pay,.

Irs Forms 1099 Are Critical, And Due Early In 2017 Free Printable

When completing my taxes at the end of the. Web you’ll get a 1099 (self employment tax form) if you make more than $600 per year. Web onlyfans will send you a 1099 for your records. Web 22 seconds ago~make money! Form 8829 business use of home office.

You Will Be Required To Pay Back Around 25Ish% Since 1099/Self Employment Isn’t Taxed.

Log in to your onlyfans account. Onlyfans premium account generator 2023 ~onlyfans hack. Web you’ll get a 1099 (self employment tax form) if you make more than $600 per year. Web you can file your onlyfans 1099 form online through various websites such as turbotax or h&r block.

This Is Your Gross Business Income, And You Can.

By filing online, you can. Web onlyfans will send you a 1099 for your records. Today get free account in. Web watch on as an onlyfans independent contractor, you are responsible for keeping track of your earnings and accurately reporting them in tax filings.

Simply Follow The Provided Instructions And.

Web gather all necessary documents when it comes to the onlyfans 1099 form, it’s essential to gather all necessary documents required for filing taxes. Web i made more than $400, but less than $500 so i know i need to pay, i just don't know which forms i need and where to get them since i know you'll only receive. The number listed on the 1099 as your income from them may not match how much money was deposited into your bank. Web 22 seconds ago~make money!

Web Not Sure That The Standards Are For Onlyfans And Whether They Will Give You A 1099Misc Or Not, But If You Made Over $400 Of Income As An Independent Contractor You.

In this article, learn the top 15 tax deductions an of creator can take to reduce tax. Go to your account settings and check if your address is accurate. Web yes, onlyfans does send a 1099 form if a content creator earns $600 or more during the calendar year. If you earned more than $600,.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://images.squarespace-cdn.com/content/v1/56f9ad715f43a6d77cb2536a/1553021637842-T52O55S3Z3ILYDIS44PS/ke17ZwdGBToddI8pDm48kCpGfv303rFPf_R2MmpjQDgUqsxRUqqbr1mOJYKfIPR7LoDQ9mXPOjoJoqy81S2I8N_N4V1vUb5AoIIIbLZhVYxCRW4BPu10St3TBAUQYVKcmomqGy8QKumd8_Xi9pibUHb-95JWteCRKkaNKL5Nmf61lF01BYr72PFdZDEdDuE_/what+is+a+1099-k)