How To Read A 990 Form

How To Read A 990 Form - It might be helpful to look at examples of 990s as you read along. Web charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form 990 series) see the form 990 filing thresholds page to determine. Web on this page you may download the 990 series filings on record for 2021. Web how to read a nonprofit 990: Web header this covers the basics—the name of the organization and the year the 990 was filed. Web 7 tips for reading the form 990 1. Web updated may 25, 2023. Web the form 990, entitled “return of organization exempt from income tax,” is a report that must be filed each year with the internal revenue service (irs) by organizations exempt. Check out the fair market value of assets. Web how to read form 990:

Web the fairings on the rc 990 clearly hark back to some of ktm’s previous fully faired sport successes, from the rc8 and rc8 c to team orange’s rc16 motogp. This is an important figure to. Web how to read a nonprofit 990: The download files are organized by month. It might be helpful to look at examples of 990s as you read along. Web charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form 990 series) see the form 990 filing thresholds page to determine. Web to get a charity’s 990 tax form, see how to check out a charity. Some months may have more than one. Web the form 990, entitled “return of organization exempt from income tax,” is a report that must be filed each year with the internal revenue service (irs) by organizations exempt. To be required to file form 990, a nonprofit should have a.

Some months may have more than one. Web the form 990, entitled “return of organization exempt from income tax,” is a report that must be filed each year with the internal revenue service (irs) by organizations exempt. Check out the fair market value of assets. Web how to read a 990? We indicate just the most important part. Web header this covers the basics—the name of the organization and the year the 990 was filed. Web which form an organization must file generally depends on its financial activity, as indicated in the chart below. Check out total assets for the end of year. Web to get a charity’s 990 tax form, see how to check out a charity. Web how to read a nonprofit 990:

Blog 1 Tips on How to Read Form 990

Web how to read a 990? Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web 7 tips for reading the form 990 1. Web the fairings on the rc 990 clearly hark back to some of ktm’s previous fully faired sport successes,.

Know where the money goes How to read a nonprofit’s I990 form WLNS

Web charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form 990 series) see the form 990 filing thresholds page to determine. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web header this covers the basics—the name.

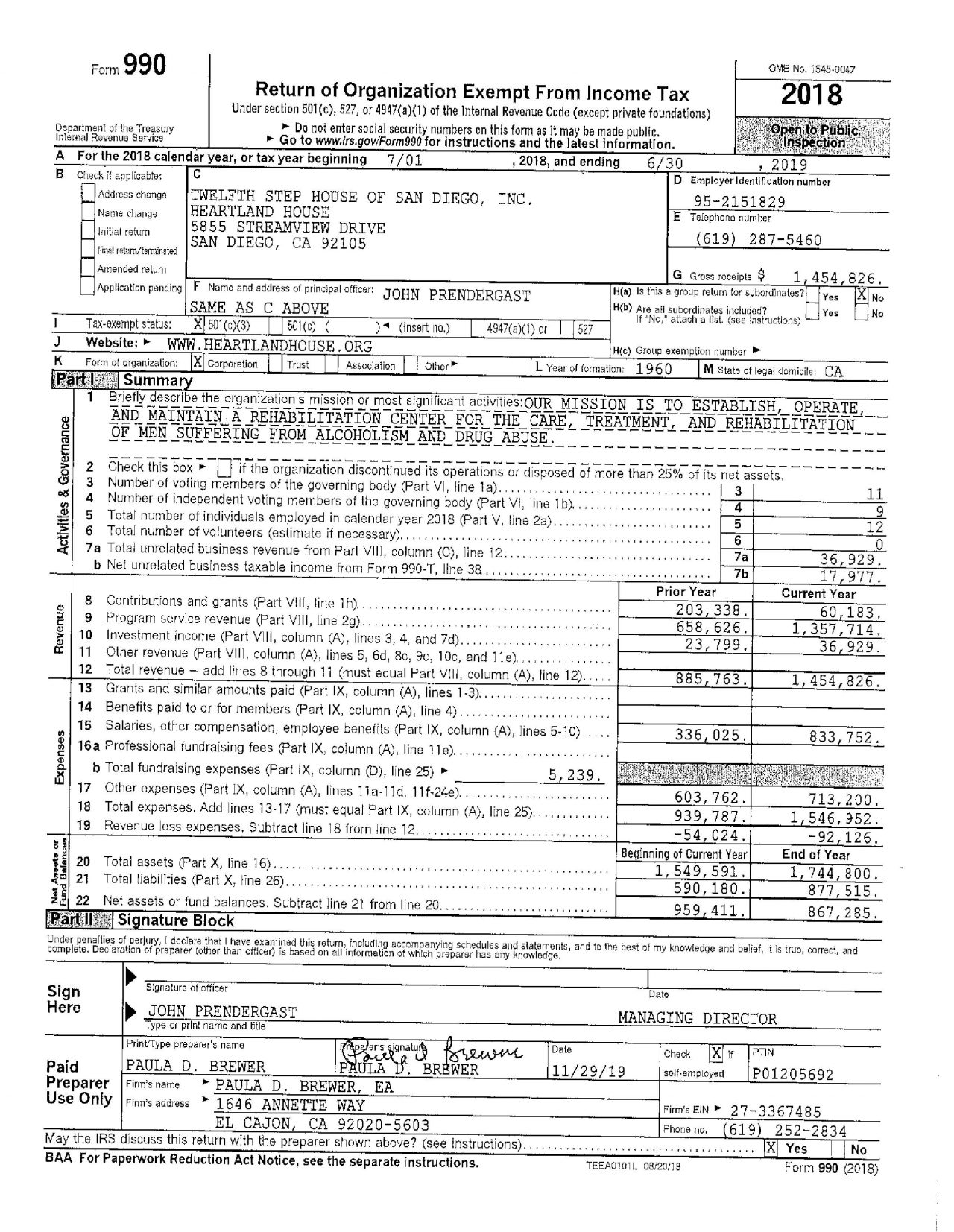

IRS Form 990 Heartland House

Web how to read a 990? Web on this page you may download the 990 series filings on record for 2021. Check out total assets for the end of year. The download files are organized by month. Web how to read a nonprofit 990:

Blog 1 Tips on How to Read Form 990

Web which form an organization must file generally depends on its financial activity, as indicated in the chart below. Web how to read a 990? Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Check out total assets for the end of year..

Meet the May 17, 2021 EPostcard Form 990N Deadline In 3 Simple Steps

Web header this covers the basics—the name of the organization and the year the 990 was filed. Web which form an organization must file generally depends on its financial activity, as indicated in the chart below. We indicate just the most important part. (in some cases an item refers to more than one part of the form 990. Web updated.

File Form 990 Online Efile 990 990 Filing Deadline 2021

It might be helpful to look at examples of 990s as you read along. Web how to read a nonprofit 990: Web charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form 990 series) see the form 990 filing thresholds page to determine. Some months may have more than one. Web how to read a.

What is Form 990EZ and Who Qualifies for it? Foundation Group, Inc.

Some months may have more than one. Web header this covers the basics—the name of the organization and the year the 990 was filed. Web the fairings on the rc 990 clearly hark back to some of ktm’s previous fully faired sport successes, from the rc8 and rc8 c to team orange’s rc16 motogp. To be required to file form.

What is a Form 990 Bookstime

We indicate just the most important part. What are the key sections? Start on page one, and search through the 990 for the fields and pages. Summary mission statement (line 1): (in some cases an item refers to more than one part of the form 990.

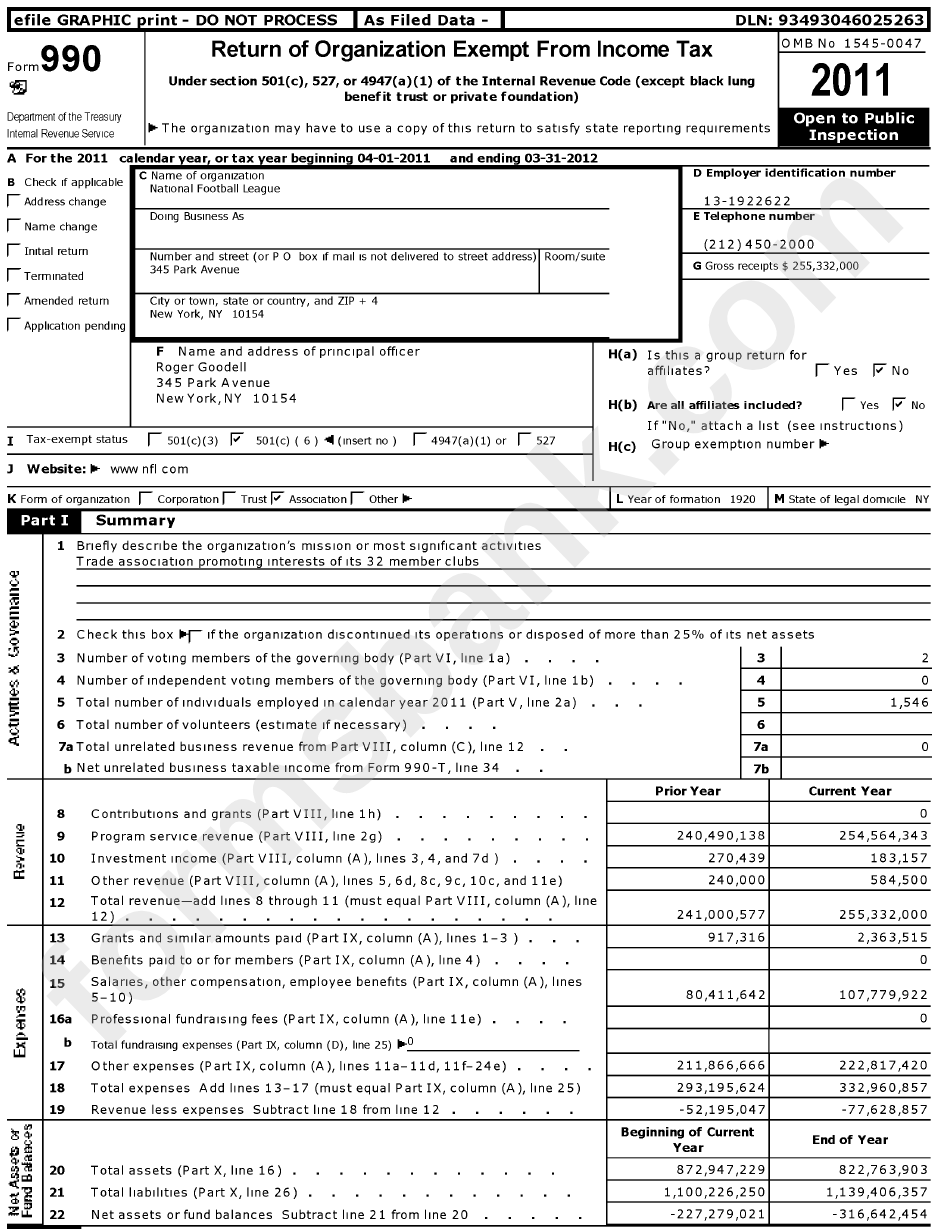

Form 990 2011 Sample printable pdf download

(in some cases an item refers to more than one part of the form 990. Web on this page you may download the 990 series filings on record for 2021. Web how to read a nonprofit 990: Summary mission statement (line 1): Web which form an organization must file generally depends on its financial activity, as indicated in the chart.

Don’t to File Form 990 Charity Lawyer Blog Nonprofit Law

This is an important figure to. Web which form an organization must file generally depends on its financial activity, as indicated in the chart below. Web how to read a 990? What are the key sections? Web header this covers the basics—the name of the organization and the year the 990 was filed.

Web How To Read A Nonprofit 990:

Web to get a charity’s 990 tax form, see how to check out a charity. Web how to read a 990? Some months may have more than one. A clearly defined mission lies at the core of.

Web The Form 990, Entitled “Return Of Organization Exempt From Income Tax,” Is A Report That Must Be Filed Each Year With The Internal Revenue Service (Irs) By Organizations Exempt.

Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. This is an important figure to. Web how to read form 990: Web which form an organization must file generally depends on its financial activity, as indicated in the chart below.

What Are The Key Sections?

Summary mission statement (line 1): Start on page one, and search through the 990 for the fields and pages. We indicate just the most important part. Web 7 tips for reading the form 990 1.

Web Header This Covers The Basics—The Name Of The Organization And The Year The 990 Was Filed.

It might be helpful to look at examples of 990s as you read along. The first page will give you a summary of the organization’s revenue and expenses during the most recent two years. To be required to file form 990, a nonprofit should have a. Check out the fair market value of assets.