Ifta Form 2290

Ifta Form 2290 - Web file your hvut form 2290 & generate the ifta report online. It is easy to file irs form 2290 with expresstrucktax. Web when form 2290 taxes are due. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Web about form 2290, heavy highway vehicle use tax return. The irs form 2290 or heavy vehicle use tax is a federal tax on commercial vehicles that: The current period begins july 1, 2023, and ends june 30,. Information for truckers in california. Easy, fast, secure & free to try. Receive your stamped schedule 1 in just.

It is easy to file irs form 2290 with expresstrucktax. Web an ifta license allows you to file one tax report that covers all member jurisdictions. Web file your hvut form 2290 & generate the ifta report online. Anyone who has registered or is required to register a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more in their name at the. Have a total gross weight of more than 55,000. Calculate your taxes quickly and accurately with our ifta calculator. Web about form 2290, heavy highway vehicle use tax return. It also provides a way to keep online. Integrated trucking software will save you time & money. Web ifta, irp, ucr & hvut 2290 filings for many companies who are required to comply with the rigorous standards of the dot rules & regulations there may also be some.

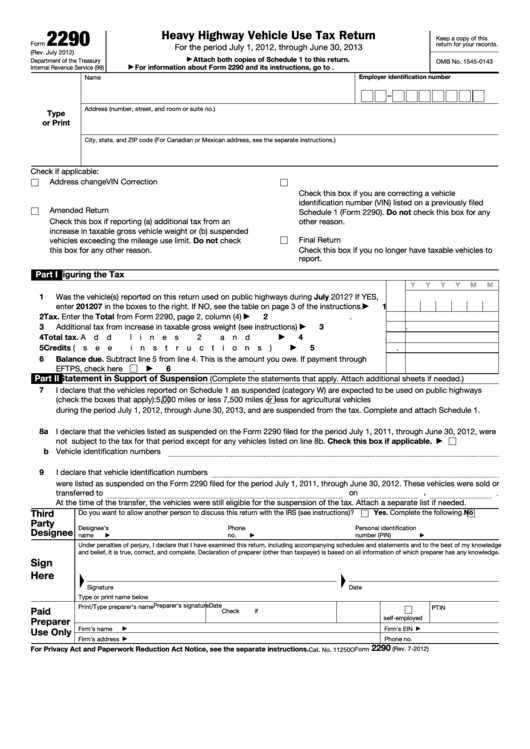

Web i declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2021, through june 30, 2022, were not subject to the tax for that period except for any. Ad stop wasting 3 days every quarter gathering your receipts and filing your ifta reports. Simplify your ifta reporting process with our intuitive online tool, designed to. Web express truck tax acts as a one stop shop for all truck tax needs. Calculate your taxes quickly and accurately with our ifta calculator. Receive your stamped schedule 1 in just. Web effortless ifta tax compliance: Complete, edit or print tax forms instantly. Web what is road tax 2290? Web an ifta license allows you to file one tax report that covers all member jurisdictions.

ProRated Form 2290 & Q3 IFTA that are required to be filed by October

Ad stop wasting 3 days every quarter gathering your receipts and filing your ifta reports. Ad complete irs tax forms online or print government tax documents. Simplify your ifta reporting process with our intuitive online tool, designed to. The irs form 2290 or heavy vehicle use tax is a federal tax on commercial vehicles that: Do your truck tax online.

We Need To Talk About 4th Quarter IFTA Rate Changes Blog

Web ifta, irp, ucr & hvut 2290 filings for many companies who are required to comply with the rigorous standards of the dot rules & regulations there may also be some. Web file your hvut form 2290 & generate the ifta report online. Complete, edit or print tax forms instantly. Ad complete irs tax forms online or print government tax.

1st Quarter 2022 IFTA Reporting Everything You Need to Know! Blog

Web i declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2021, through june 30, 2022, were not subject to the tax for that period except for any. Web ifta, irp, ucr & hvut 2290 filings for many companies who are required to comply with the rigorous standards of the dot rules.

Form 2290 Renewal for TY 2020 & IFTA for Q2 of 2020 Due Now!! Tax

Easy, fast, secure & free to try. Simplify your ifta reporting process with our intuitive online tool, designed to. Web i declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2022, through june 30, 2023, were not subject to the tax for that period except for any. Ad complete irs tax forms.

Form 2290 & IFTA Are Due By July 31st! Log onto

The current period begins july 1, 2023, and ends june 30,. Figure and pay the tax due on highway motor vehicles used during the period with a. Web the form 2290 or hvut (heavy vehicle use tax) is an annual tax that is filed with the irs to report, figure and pay taxes due (if applicable) on vehicles with a.

All You Need To Know About The 4th Quarter IFTA Deadline Blog

Information for truckers in california. Do your truck tax online & have it efiled to the irs! Web an ifta license allows you to file one tax report that covers all member jurisdictions. Complete, edit or print tax forms instantly. Web i declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2021,.

EFile Now as the Deadline is around the corner for Form 2290, Q4 Form

Ad stop wasting 3 days every quarter gathering your receipts and filing your ifta reports. Use coupon code get20b & get 20% off. Web when form 2290 taxes are due. Ad complete irs tax forms online or print government tax documents. Web effortless ifta tax compliance:

Ifta 101 Fill Online, Printable, Fillable, Blank pdfFiller

The current period begins july 1, 2023, and ends june 30,. Web about form 2290, heavy highway vehicle use tax return. Integrated trucking software will save you time & money. Have a total gross weight of more than 55,000. Simplify your ifta reporting process with our intuitive online tool, designed to.

Fillable Form 2290 Heavy Highway Vehicle Use Tax Return printable pdf

Web ifta, irp, ucr & hvut 2290 filings for many companies who are required to comply with the rigorous standards of the dot rules & regulations there may also be some. Figure and pay the tax due on highway motor vehicles used during the period with a. Web what is road tax 2290? Use coupon code get20b & get 20%.

Prioritize efiling for tax forms 2290, 720 & IFTA, due January 31

It is easy to file irs form 2290 with expresstrucktax. Web express truck tax acts as a one stop shop for all truck tax needs. Ad file form 2290 easily with eform2290.com. Have a total gross weight of more than 55,000. Figure and pay the tax due on highway motor vehicles used during the period with a.

Web About Form 2290, Heavy Highway Vehicle Use Tax Return.

Only 3 simple steps to get schedule 1. It is easy to file irs form 2290 with expresstrucktax. Receive your stamped schedule 1 in just. Complete, edit or print tax forms instantly.

The Irs Form 2290 Or Heavy Vehicle Use Tax Is A Federal Tax On Commercial Vehicles That:

Web file your hvut form 2290 & generate the ifta report online. Do your truck tax online & have it efiled to the irs! Web express truck tax acts as a one stop shop for all truck tax needs. Calculate your taxes quickly and accurately with our ifta calculator.

Guaranteed Stamped Schedule 1 Or Money Back

Integrated trucking software will save you time & money. For vehicles first used on a public highway during the month of july, file form 2290 and pay the appropriate tax between july 1 and august 31. Web an ifta license allows you to file one tax report that covers all member jurisdictions. Web when form 2290 taxes are due.

Information For Truckers In California.

Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Have a total gross weight of more than 55,000. Web i declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2021, through june 30, 2022, were not subject to the tax for that period except for any.