Il Form 2210

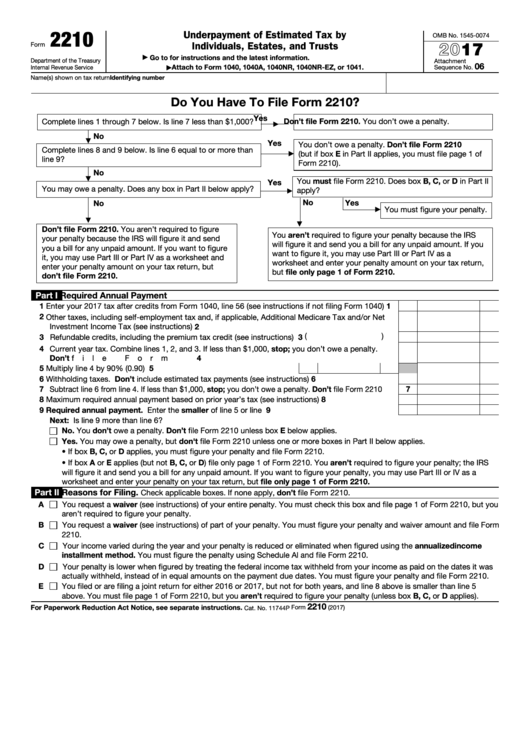

Il Form 2210 - The irs will generally figure your penalty for you and you should not file. Send il 2210 form via email, link, or fax. The irs will generally figure your penalty for you and you should not file form 2210. Circuit court for thejudicial circuit county state of. The irs will generally figure your penalty for you and you should not file form 2210. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. This includes any corrected return fi led before the extended due date of the. Department of the treasury internal revenue service. This form is for income earned in tax year 2022, with tax returns due in april. Web irs form 2210 (underpayment of estimated tax by individuals, estates, and trusts) calculates the underpayment penalty if you didn't withhold or pay enough taxes.

This form allows you to figure penalties you may owe if you did not make timely estimated. This includes any corrected return fi led before the extended due date of the. This form is for income earned in tax year 2022, with tax returns due in april. You can also download it, export it or print it out. Circuit court for thejudicial circuit county state of. To begin the form, utilize the fill & sign online button or tick the preview image. Underpayment of estimated tax by individuals, estates, and trusts. Send il 2210 form via email, link, or fax. Pick the document template you need from the collection of legal form samples. Certain illinois residents who haven't complied with the requisite tax payments or have paid late need to file this form.

Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. You can also download it, export it or print it out. To begin the form, utilize the fill & sign online button or tick the preview image. Get everything done in minutes. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. The irs will generally figure your penalty for you and you should not file form 2210. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web share your form with others. Web irs form 2210 (underpayment of estimated tax by individuals, estates, and trusts) calculates the underpayment penalty if you didn't withhold or pay enough taxes.

Ssurvivor Irs Form 2210 Instructions 2017

This form allows you to figure penalties you may owe if you did not make timely estimated. Pick the document template you need from the collection of legal form samples. This form allows you to figure penalties you may owe if you did not make timely estimated. Circuit court for thejudicial circuit county state of. Web purpose of form use.

تعليمات نموذج الضريبة الفيدرالية 2210 أساسيات 2021

Web who should file the il form 2210? This form is for income earned in tax year 2022, with tax returns due in april. The irs will generally figure your penalty for you and you should not file. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. To begin the.

Ssurvivor Form 2210 Instructions 2020

This form allows you to figure penalties you may owe if you did not make timely estimated. Certain illinois residents who haven't complied with the requisite tax payments or have paid late need to file this form. This includes any corrected return fi led before the extended due date of the. To begin the form, utilize the fill & sign.

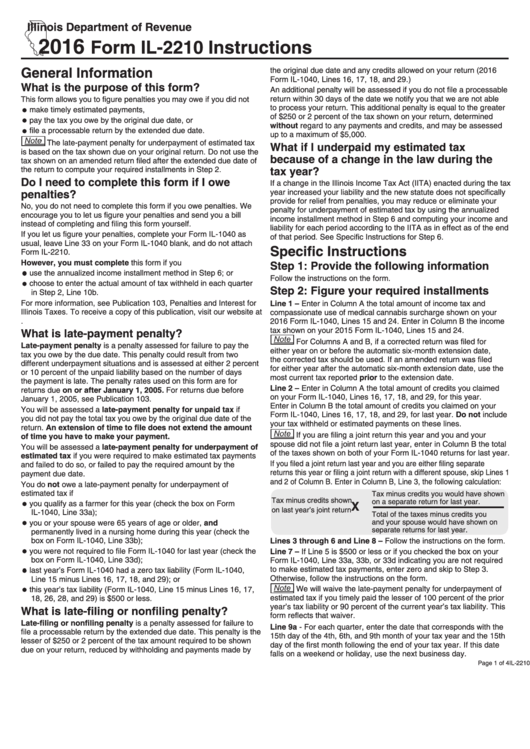

Form Il2210 Instructions 2016 printable pdf download

This includes any corrected return fi led before the extended due date of the. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. This form allows you to figure penalties you may owe if you did not make timely estimated. Send il 2210 form via email, link, or fax. Web.

Estimated vs Withholding Tax Penalty rules Saverocity Finance

Underpayment of estimated tax by individuals, estates, and trusts. Edit your illinois il 2210 online. Web irs form 2210 (underpayment of estimated tax by individuals, estates, and trusts) calculates the underpayment penalty if you didn't withhold or pay enough taxes. The irs will generally figure your penalty for you and you should not file form 2210. Web use form 2210.

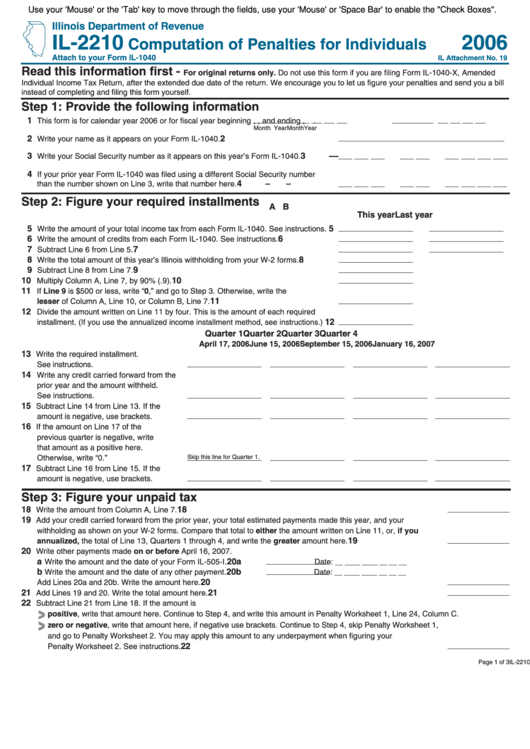

Fillable Form Il2210 Computation Of Penalties For Individuals 2006

Web share your form with others. To begin the form, utilize the fill & sign online button or tick the preview image. Circuit court for thejudicial circuit county state of. This form is for income earned in tax year 2022, with tax returns due in april. The irs will generally figure your penalty for you and you should not file.

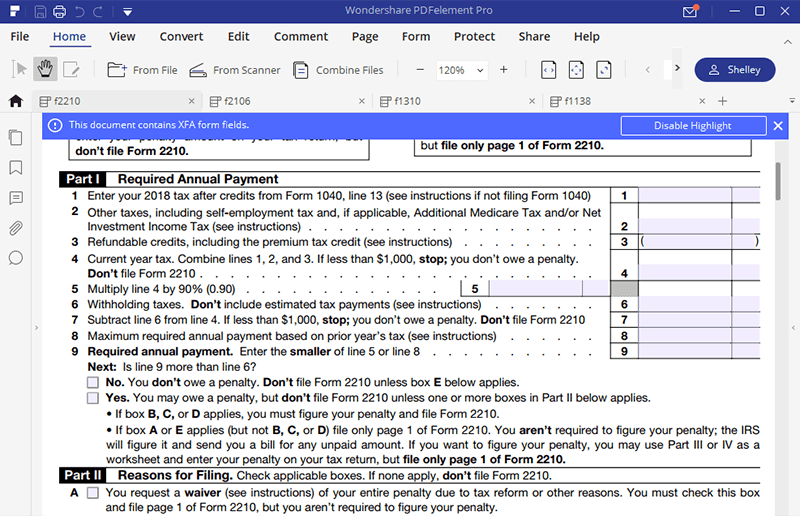

Ssurvivor Form 2210 Instructions 2018

Pick the document template you need from the collection of legal form samples. This form allows you to figure penalties you may owe if you did not make timely estimated. Web who should file the il form 2210? The irs will generally figure your penalty for you and you should not file form 2210. To begin the form, utilize the.

Top 18 Form 2210 Templates free to download in PDF format

Statement of person claiming refund due a deceased taxpayer: Circuit court for thejudicial circuit county state of. Edit your illinois il 2210 online. Pick the document template you need from the collection of legal form samples. This form is for income earned in tax year 2022, with tax returns due in april.

Fill Free fillable Form 2210F Underpayment of Estimated Tax Farmers

Send il 2210 form via email, link, or fax. You can also download it, export it or print it out. Get everything done in minutes. To begin the form, utilize the fill & sign online button or tick the preview image. The irs will generally figure your penalty for you and you should not file form 2210.

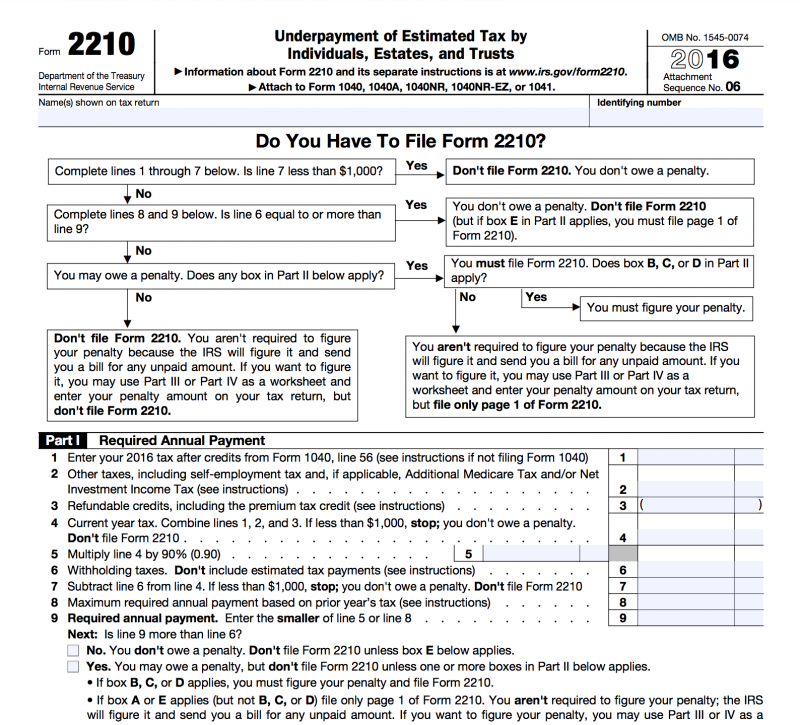

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web who should file the il form 2210? Web irs form 2210 (underpayment of estimated tax by individuals, estates, and trusts) calculates the underpayment penalty if you didn't withhold or pay enough taxes. You can also download it, export it or.

You Can Also Download It, Export It Or Print It Out.

Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Edit your illinois il 2210 online. This includes any corrected return fi led before the extended due date of the. The irs will generally figure your penalty for you and you should not file.

Send Il 2210 Form Via Email, Link, Or Fax.

Circuit court for thejudicial circuit county state of. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Underpayment of estimated tax by individuals, estates, and trusts. This form allows you to figure penalties you may owe if you did not make timely estimated.

The Irs Will Generally Figure Your Penalty For You And You Should Not File Form 2210.

The irs will generally figure your penalty for you and you should not file form 2210. This form is for income earned in tax year 2022, with tax returns due in april. Statement of person claiming refund due a deceased taxpayer: Web share your form with others.

Web Who Should File The Il Form 2210?

Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Certain illinois residents who haven't complied with the requisite tax payments or have paid late need to file this form. Web irs form 2210 (underpayment of estimated tax by individuals, estates, and trusts) calculates the underpayment penalty if you didn't withhold or pay enough taxes. Pick the document template you need from the collection of legal form samples.