Il Form 2848

Il Form 2848 - Use form 2848 to authorize an individual to represent you. Web edit your il 2848 form online. Attach a copy of this form to each specifc tax return or item of correspondence for which. Check this box if the appointee(s) is not authorized to sign tax return. See substitute form 2848, later, for information about using a power of attorney other than a form. Web illinois department of revenue. Web form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. Complete the following taxpayer information (* indicates required field) 1 3 2 taxpayer’s. Web it appears you don't have a pdf plugin for this browser. Because a partnership representative is.

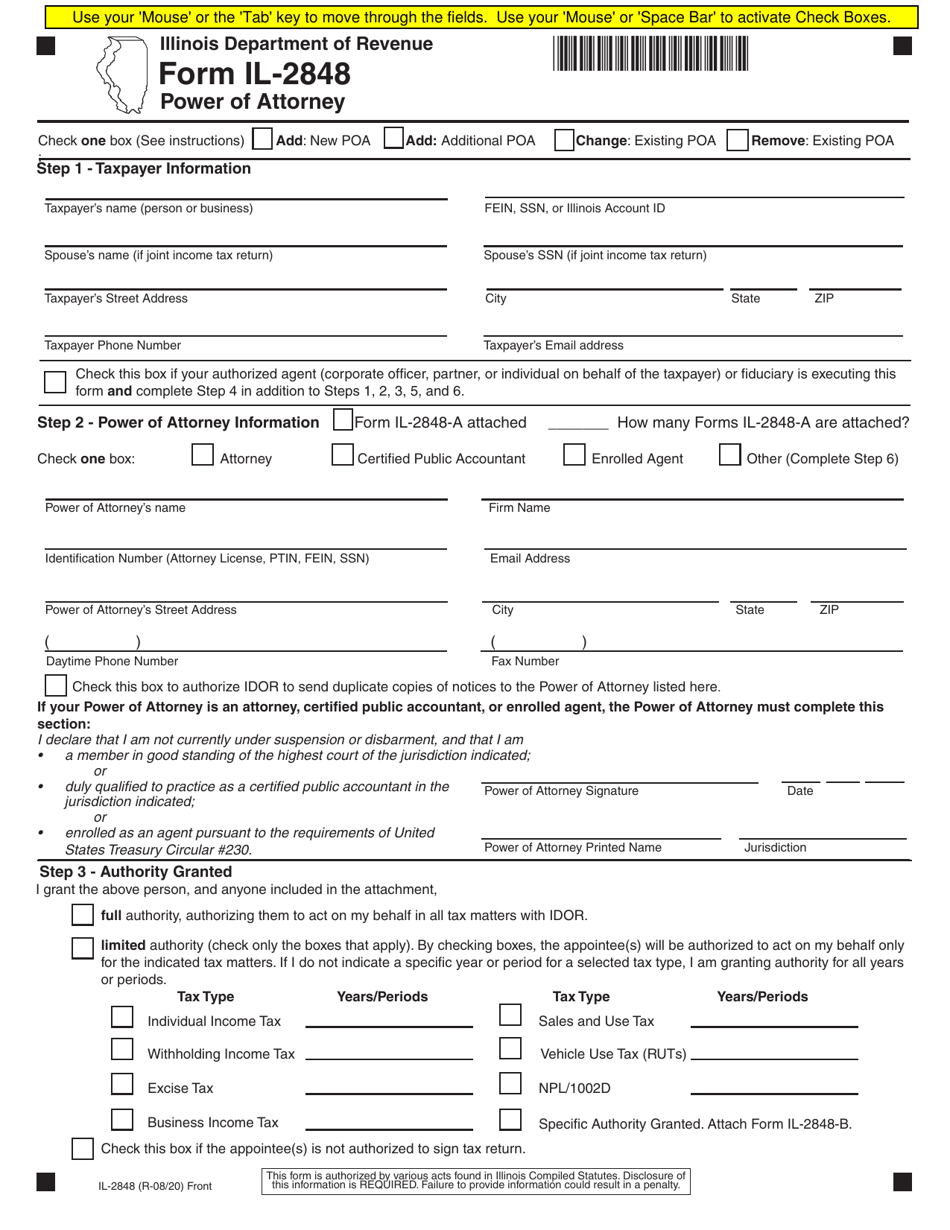

Web use form 2848 to authorize an individual to represent you before the irs. Web illinois department of revenue. Attach a copy of this form to each specifc tax return or item of correspondence for which. Web form 2848 is used to authorize an eligible individual to represent another person before the irs. Web form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. Get ready for tax season deadlines by completing any required tax forms today. Check only the items below you do wish to grant and provide the specifics in. See substitute form 2848, later, for information about using a power of attorney other than a form. Because a partnership representative is. Check this box if your authorized agent (corporate officer,.

Get ready for tax season deadlines by completing any required tax forms today. Web edit your il 2848 form online. Web it appears you don't have a pdf plugin for this browser. Because a partnership representative is. Web form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. Mytax illinois — upload it as a single. Web use form 2848 to authorize an individual to represent you before the irs. Get ready for tax season deadlines by completing any required tax forms today. Type text, add images, blackout confidential details, add comments, highlights and more. See substitute form 2848, later, for information about using a power of attorney other than a form.

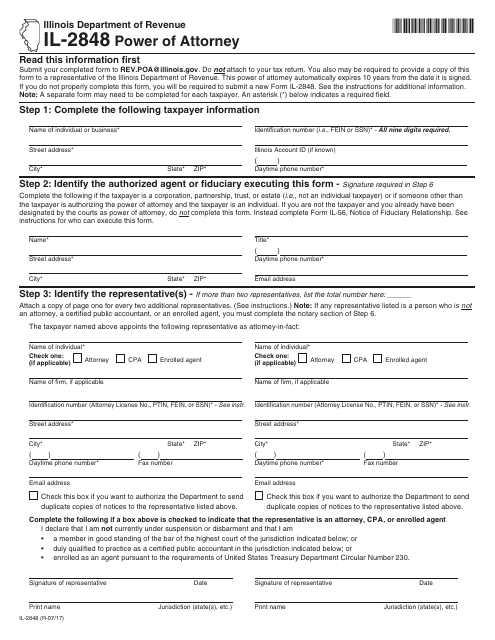

Form IL2848 Download Fillable PDF or Fill Online Power of Attorney

Complete the following taxpayer information (* indicates required field) 1 3 2 taxpayer’s. Because a partnership representative is. Web it appears you don't have a pdf plugin for this browser. Web edit your il 2848 form online. Check this box if the appointee(s) is not authorized to sign tax return.

IL2848 Power of Attorney Form Illinois Department of Revenue Free

Web use form 2848 to authorize an individual to represent you before the irs. Complete the following taxpayer information (* indicates required field) 1 3 2 taxpayer’s. Attach a copy of this form to each specifc tax return or item of correspondence for which. See substitute form 2848, later, for information about using a power of attorney other than a.

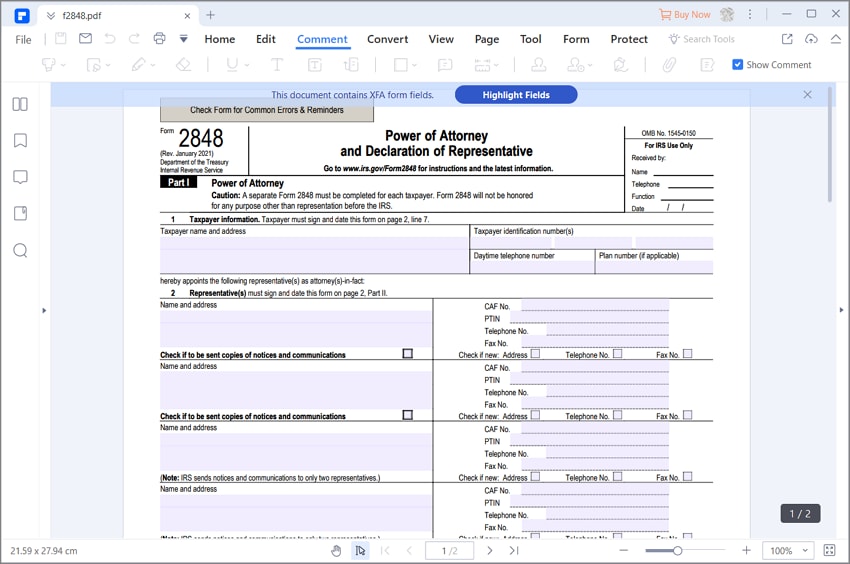

Form 2848 YouTube

Web use form 2848 to authorize an individual to represent you before the irs. Web edit your il 2848 form online. Use form 2848 to authorize an individual to represent you. Type text, add images, blackout confidential details, add comments, highlights and more. Check this box if the appointee(s) is not authorized to sign tax return.

Form 2848 Instructions for IRS Power of Attorney Community Tax

Web edit your il 2848 form online. • email your completed form to rev.poa@illinois.gov. Use form 2848 to authorize an individual to represent you. Web it appears you don't have a pdf plugin for this browser. Because a partnership representative is.

Form 2848 Power of Attorney and Declaration of Representative IRS

Web use form 2848 to authorize an individual to represent you before the irs. Get ready for tax season deadlines by completing any required tax forms today. Web form 2848 is used to authorize an eligible individual to represent another person before the irs. Check this box if your authorized agent (corporate officer,. Type text, add images, blackout confidential details,.

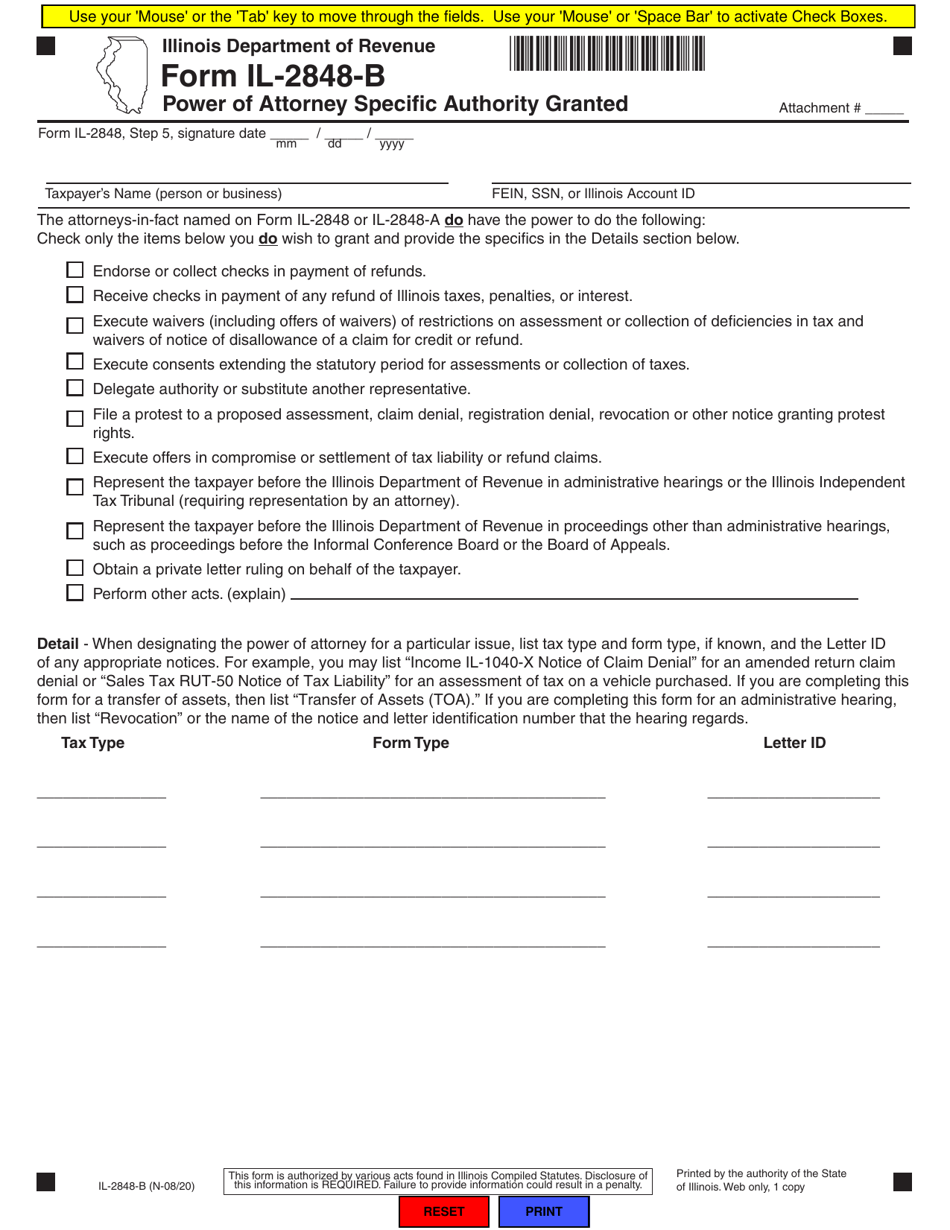

Form IL2848B Download Fillable PDF or Fill Online Power of Attorney

Check this box if your authorized agent (corporate officer,. Sign it in a few clicks. Complete the following taxpayer information (* indicates required field) 1 3 2 taxpayer’s. Web form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. Attach a copy.

IRS Form 2848 Filling Instructions You Can’t Miss

Web form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. Draw your signature, type it,. Get ready for tax season deadlines by completing any required tax forms today. See substitute form 2848, later, for information about using a power of attorney.

Form IL2848 Download Fillable PDF or Fill Online Power of Attorney

Get ready for tax season deadlines by completing any required tax forms today. Sign it in a few clicks. Check this box if your authorized agent (corporate officer,. Web it appears you don't have a pdf plugin for this browser. Check only the items below you do wish to grant and provide the specifics in.

Instructions for Form 2848 IRS Tax Lawyer

Web it appears you don't have a pdf plugin for this browser. Mytax illinois — upload it as a single. Type text, add images, blackout confidential details, add comments, highlights and more. Web edit your il 2848 form online. Web use form 2848 to authorize an individual to represent you before the irs.

IL2848 Power of Attorney Form Illinois Department of Revenue Free

Complete the following taxpayer information (* indicates required field) 1 3 2 taxpayer’s. Check this box if the appointee(s) is not authorized to sign tax return. Web use form 2848 to authorize an individual to represent you before the irs. Use form 2848 to authorize an individual to represent you. Mytax illinois — upload it as a single.

Web Edit Your Il 2848 Form Online.

Web illinois department of revenue. Draw your signature, type it,. Because a partnership representative is. Mytax illinois — upload it as a single.

Attach A Copy Of This Form To Each Specifc Tax Return Or Item Of Correspondence For Which.

Check only the items below you do wish to grant and provide the specifics in. Web form 2848 is used to authorize an eligible individual to represent another person before the irs. Get ready for tax season deadlines by completing any required tax forms today. See substitute form 2848, later, for information about using a power of attorney other than a form.

Complete The Following Taxpayer Information (* Indicates Required Field) 1 3 2 Taxpayer’s.

Get ready for tax season deadlines by completing any required tax forms today. Web it appears you don't have a pdf plugin for this browser. Check this box if your authorized agent (corporate officer,. Use form 2848 to authorize an individual to represent you.

• Email Your Completed Form To Rev.poa@Illinois.gov.

Sign it in a few clicks. Web use form 2848 to authorize an individual to represent you before the irs. Type text, add images, blackout confidential details, add comments, highlights and more. Check this box if the appointee(s) is not authorized to sign tax return.