Independent Contractor Information Form

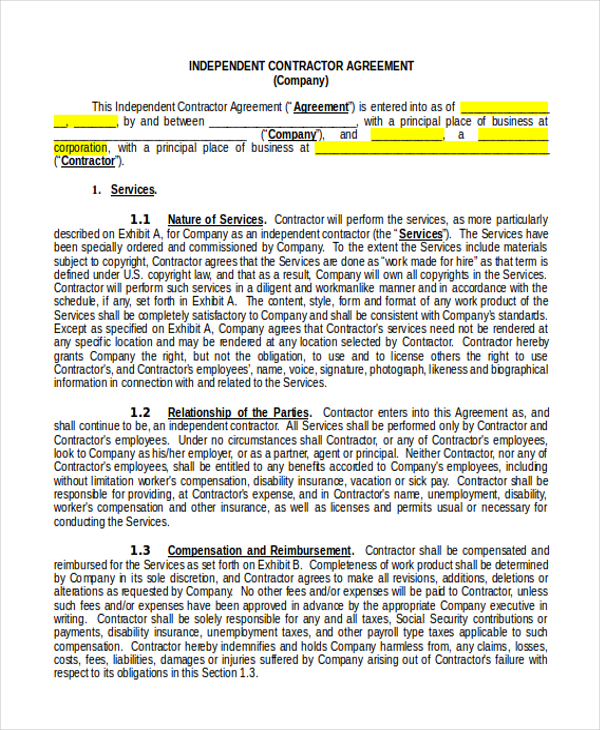

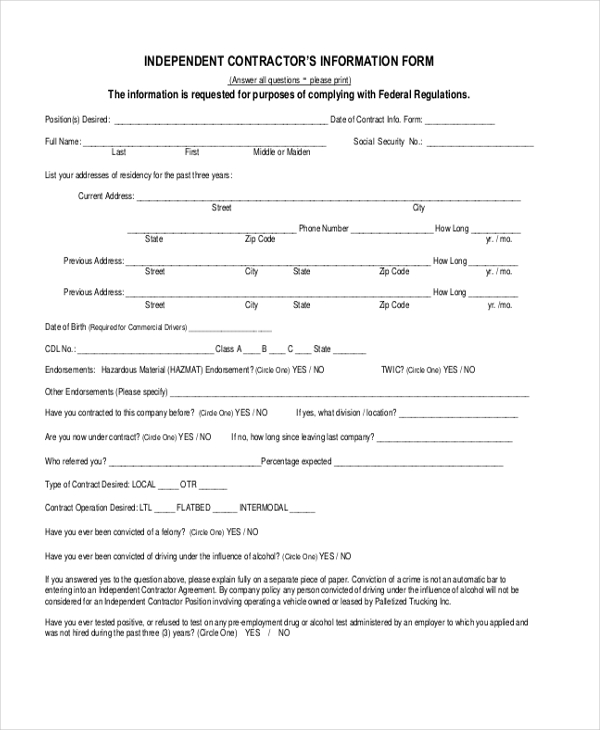

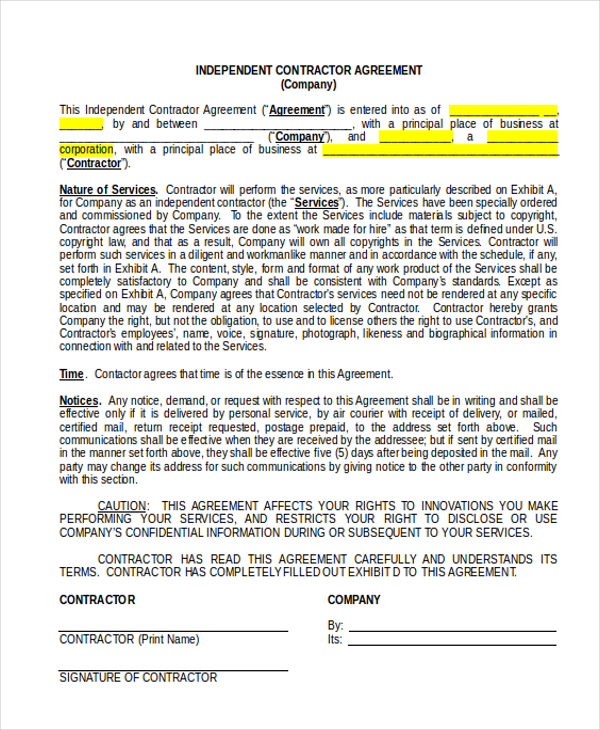

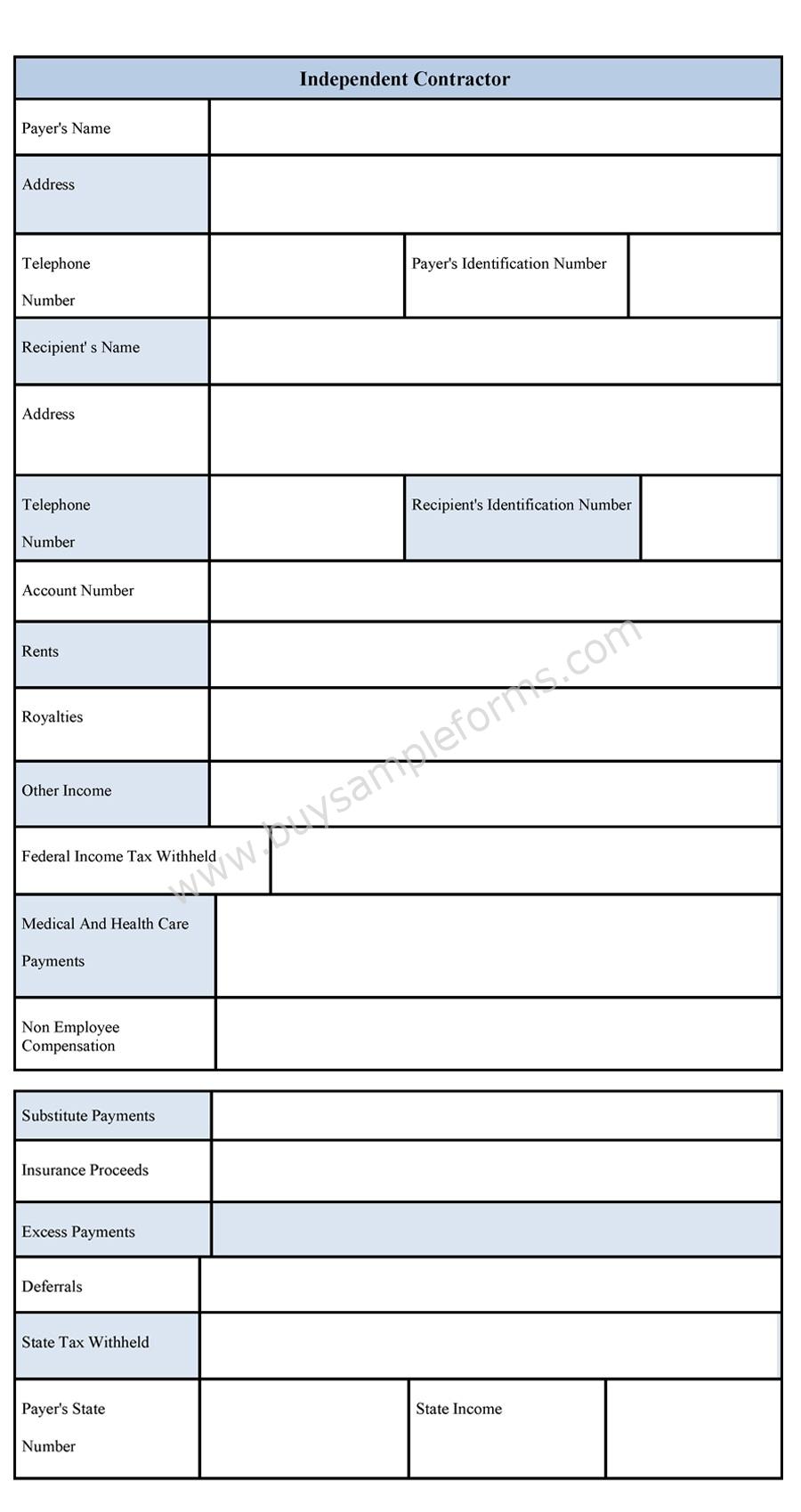

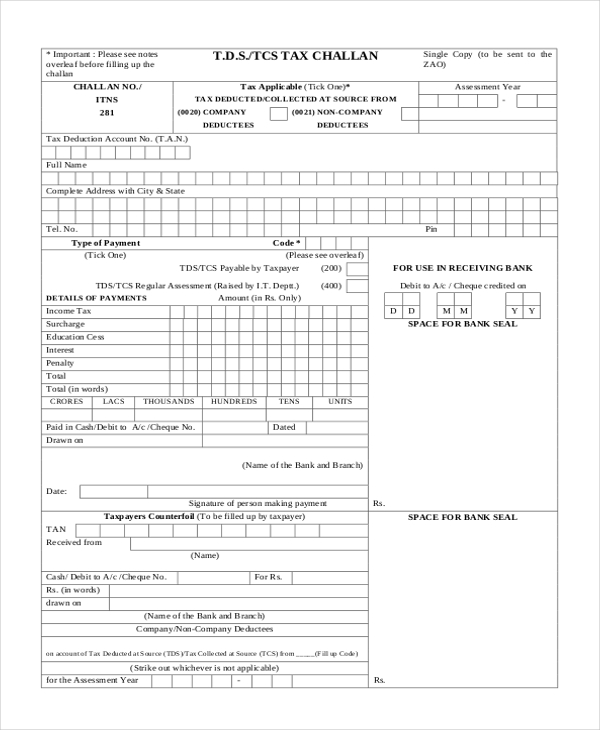

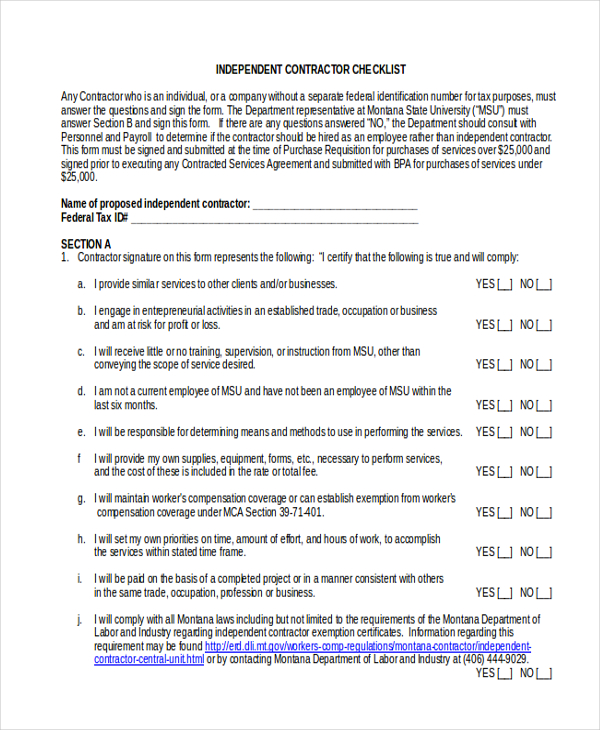

Independent Contractor Information Form - Web an independent contractor agreement is a legal document between a contractor that performs a service for a client in exchange for payment. Web as an independent contractor, you’re required to pay your federal and state (if applicable) taxes to the internal revenue service (irs) and state revenue departments on your own,. Web you carry on a trade or business as a sole proprietor or an independent contractor. Web independent contractor information form. Web workers who believe they have been improperly classified as independent contractors by an employer can use form 8919, uncollected social security and. Web submit a paper report of independent contractors using one of the following options: If you pay an independent contractor $600 or more (with limited exceptions) for services provided throughout the year, you must provide a form. This form is used to collect information from independent contractors, including their name and address, tax identification number, and other. Complete the proposed ic’s information as requested on the form. This form is used by the authorities of the state to gather information about the independent contractors operating in their area.

Web as an independent contractor, you’re required to pay your federal and state (if applicable) taxes to the internal revenue service (irs) and state revenue departments on your own,. Complete the proposed ic’s information as requested on the form. Web workers who believe they have been improperly classified as independent contractors by an employer can use form 8919, uncollected social security and. Web an independent contractor agreement is a legal document between a contractor that performs a service for a client in exchange for payment. This form is used by the authorities of the state to gather information about the independent contractors operating in their area. This form is used to collect information from independent contractors, including their name and address, tax identification number, and other. Web fill online, printable, fillable, blank independent contractor agreement form. Web the independent contractor request form shall not be required for individuals reporting income/payments to a federal identification number (fid). The form has multiple fields in which the. If you pay an independent contractor $600 or more (with limited exceptions) for services provided throughout the year, you must provide a form.

Web an independent contractor information form is a document that records the contract terms and conditions between a company and an independent contractor. Web workers who believe they have been improperly classified as independent contractors by an employer can use form 8919, uncollected social security and. Web as an independent contractor, you’re required to pay your federal and state (if applicable) taxes to the internal revenue service (irs) and state revenue departments on your own,. The form has multiple fields in which the. If you pay an independent contractor $600 or more (with limited exceptions) for services provided throughout the year, you must provide a form. Ad answer simple questions to make your contractor agreement. You are a member of a partnership that carries on a trade or business. Use fill to complete blank online others pdf forms for free. This form is used to collect information from independent contractors, including their name and address, tax identification number, and other. Web you carry on a trade or business as a sole proprietor or an independent contractor.

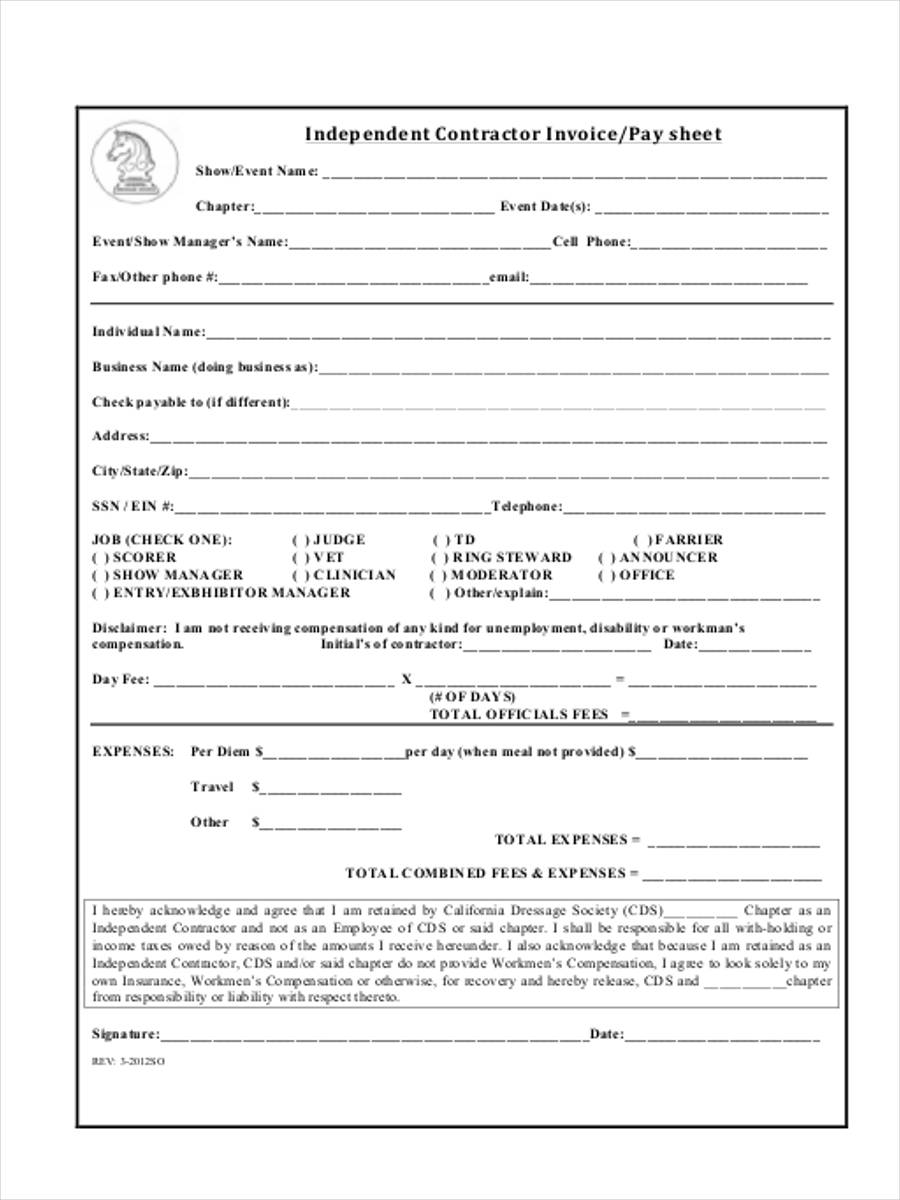

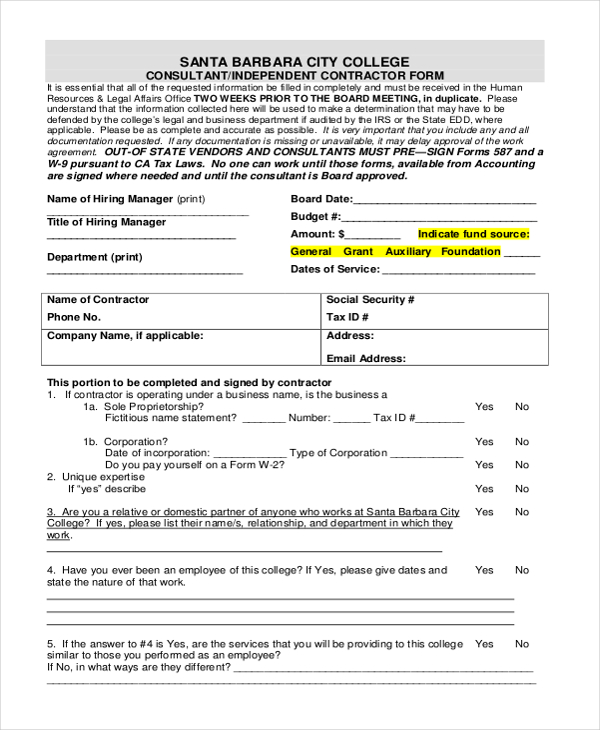

FREE 9+ Sample Independent Contractor Forms in MS Word PDF Excel

Order the de 542 form from our online forms. Web fill online, printable, fillable, blank independent contractor agreement form. This form is used by the authorities of the state to gather information about the independent contractors operating in their area. You are a member of a partnership that carries on a trade or business. Web an independent contractor information form.

FREE 9+ Sample Independent Contractor Forms in MS Word PDF Excel

Web the independent contractor request form shall not be required for individuals reporting income/payments to a federal identification number (fid). This form is used to collect information from independent contractors, including their name and address, tax identification number, and other. Ad answer simple questions to make your contractor agreement. If you pay an independent contractor $600 or more (with limited.

FREE 12+ Sample Independent Contractor Agreement forms in PDF MS Word

Web as an independent contractor, you’re required to pay your federal and state (if applicable) taxes to the internal revenue service (irs) and state revenue departments on your own,. Ad answer simple questions to make your contractor agreement. Web workers who believe they have been improperly classified as independent contractors by an employer can use form 8919, uncollected social security.

Independent Contractor Form Sample Forms

Web submit a paper report of independent contractors using one of the following options: Complete the proposed ic’s information as requested on the form. Web an independent contractor information form is a document that records the contract terms and conditions between a company and an independent contractor. This form is used to collect information from independent contractors, including their name.

FREE 8+ Contractor Invoice Forms in PDF Ms Word

Web as an independent contractor, you’re required to pay your federal and state (if applicable) taxes to the internal revenue service (irs) and state revenue departments on your own,. You are a member of a partnership that carries on a trade or business. Web an independent contractor agreement is a legal document between a contractor that performs a service for.

FREE 9+ Sample Independent Contractor Forms in MS Word PDF Excel

If you pay an independent contractor $600 or more (with limited exceptions) for services provided throughout the year, you must provide a form. This form is used by the authorities of the state to gather information about the independent contractors operating in their area. You are a member of a partnership that carries on a trade or business. The form.

FREE 9+ Sample Independent Contractor Forms in MS Word PDF Excel

Web you carry on a trade or business as a sole proprietor or an independent contractor. This form is used by the authorities of the state to gather information about the independent contractors operating in their area. Web independent contractor information form. Order the de 542 form from our online forms. Web as an independent contractor, you’re required to pay.

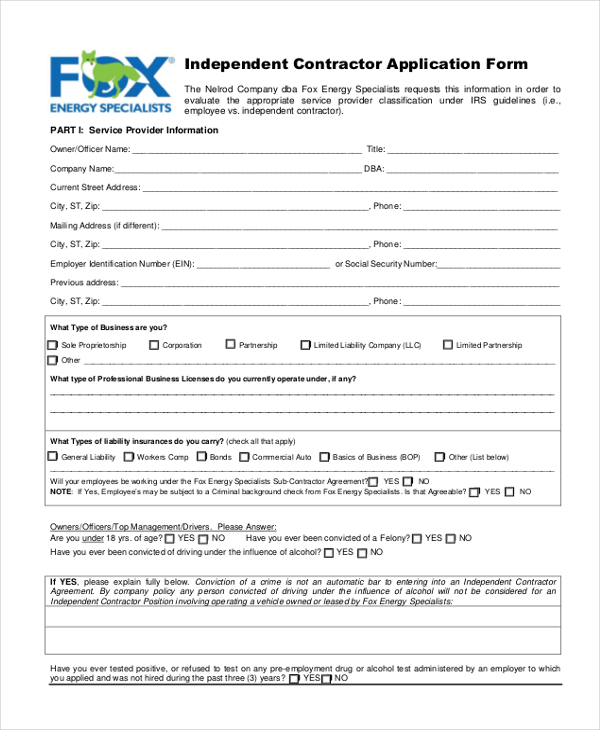

Application For Independent Contractor Fill Out and Sign Printable

Web the independent contractor request form shall not be required for individuals reporting income/payments to a federal identification number (fid). Web fill online, printable, fillable, blank independent contractor agreement form. Web an independent contractor agreement is a legal document between a contractor that performs a service for a client in exchange for payment. Web as an independent contractor, you’re required.

FREE 9+ Sample Independent Contractor Forms in MS Word PDF Excel

If you pay an independent contractor $600 or more (with limited exceptions) for services provided throughout the year, you must provide a form. Web fill online, printable, fillable, blank independent contractor agreement form. Complete the proposed ic’s information as requested on the form. Web workers who believe they have been improperly classified as independent contractors by an employer can use.

FREE 9+ Sample Independent Contractor Forms in MS Word PDF Excel

Web independent contractor information form. Web the independent contractor request form shall not be required for individuals reporting income/payments to a federal identification number (fid). You are a member of a partnership that carries on a trade or business. Web as an independent contractor, you’re required to pay your federal and state (if applicable) taxes to the internal revenue service.

Web An Independent Contractor Agreement Is A Legal Document Between A Contractor That Performs A Service For A Client In Exchange For Payment.

Web submit a paper report of independent contractors using one of the following options: This form is used to collect information from independent contractors, including their name and address, tax identification number, and other. Web fill online, printable, fillable, blank independent contractor agreement form. If you pay an independent contractor $600 or more (with limited exceptions) for services provided throughout the year, you must provide a form.

Ad Answer Simple Questions To Make Your Contractor Agreement.

Web an independent contractor information form is a document that records the contract terms and conditions between a company and an independent contractor. Use fill to complete blank online others pdf forms for free. Web as an independent contractor, you’re required to pay your federal and state (if applicable) taxes to the internal revenue service (irs) and state revenue departments on your own,. Web you carry on a trade or business as a sole proprietor or an independent contractor.

You Are A Member Of A Partnership That Carries On A Trade Or Business.

Web contractor information worksheet. Web the independent contractor request form shall not be required for individuals reporting income/payments to a federal identification number (fid). The form has multiple fields in which the. This form is used by the authorities of the state to gather information about the independent contractors operating in their area.

Web Workers Who Believe They Have Been Improperly Classified As Independent Contractors By An Employer Can Use Form 8919, Uncollected Social Security And.

Web independent contractor information form. Order the de 542 form from our online forms. Complete the proposed ic’s information as requested on the form.