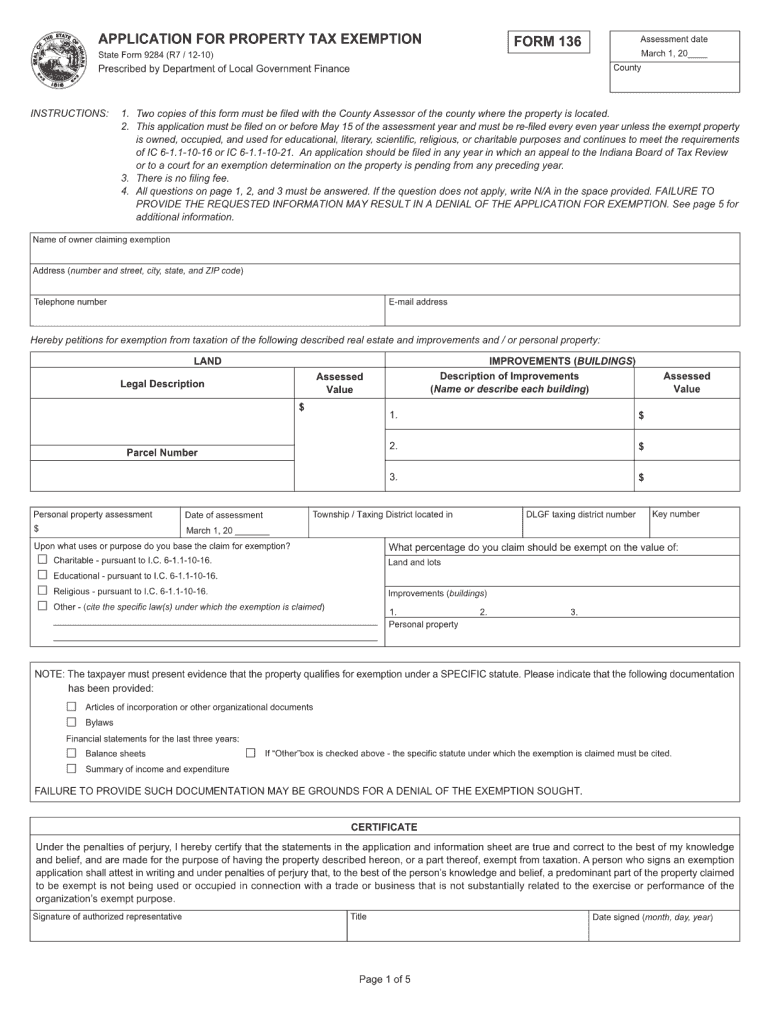

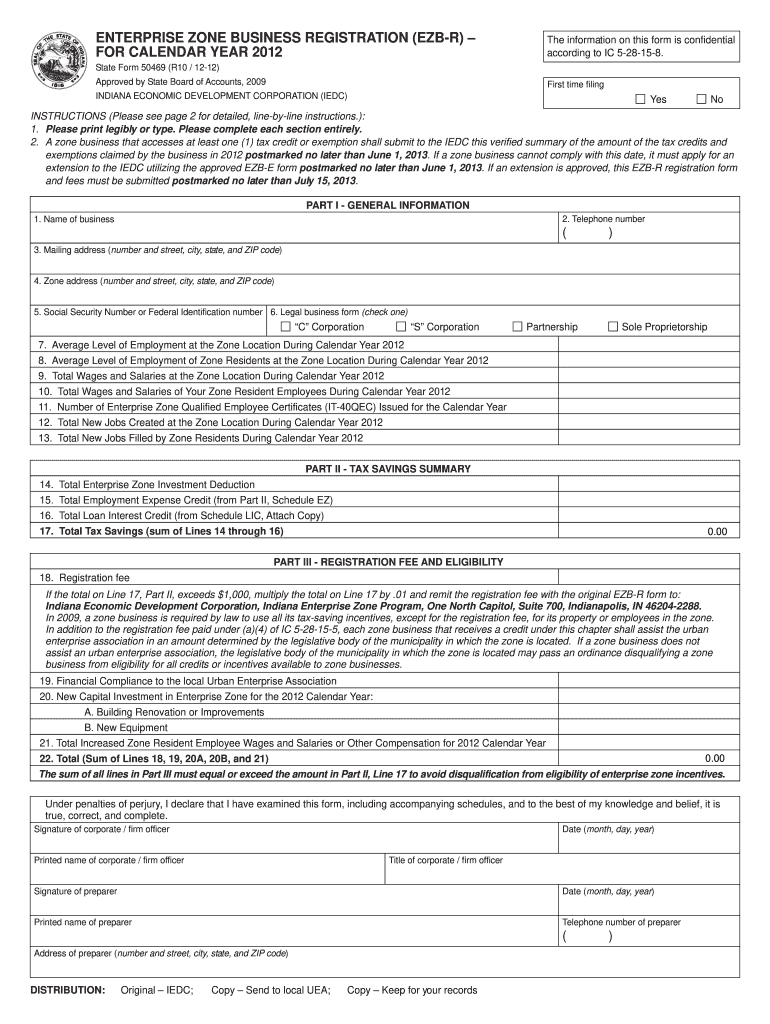

Indiana Form 136

Indiana Form 136 - You can also download it, export it or print it out. Last day to file a form 136 for exempt status. • if the property tax assessment board of appeals (“ptaboa”) denies the application, it has no later than april 25 to provide notice to the taxpayer. Sign it in a few clicks. Web to obtain exemption, indiana form 136 must be filed with the county assessor by april 1 of the assessment year. Web application (form 136) must be filed with the county assessor on or before april 1 of the assessment year. Application for property tax exemption (form 136) form. Type text, add images, blackout confidential details, add comments, highlights and more. Edit your form 136 online. Web you are here:

Application for property tax exemption. Web send form 136 indiana exemption via email, link, or fax. Web you are here: This is a indiana form and can be use in department of local government finance statewide. Web application (form 136) must be filed with the county assessor on or before april 1 of the assessment year. You can also download it, export it or print it out. Last day to file a form 136 for exempt status. • if the property tax assessment board of appeals (“ptaboa”) denies the application, it has no later than april 25 to provide notice to the taxpayer. Edit your form 136 online. Application for property tax exemption (form 136) form.

Edit your form 136 online. Application for property tax exemption (form 136) form. Application for property tax exemption. Sign it in a few clicks. You can also download it, export it or print it out. Web you are here: Web application (form 136) must be filed with the county assessor on or before april 1 of the assessment year. Last day to file a form 136 for exempt status. • if the property tax assessment board of appeals (“ptaboa”) denies the application, it has no later than april 25 to provide notice to the taxpayer. Web send form 136 indiana exemption via email, link, or fax.

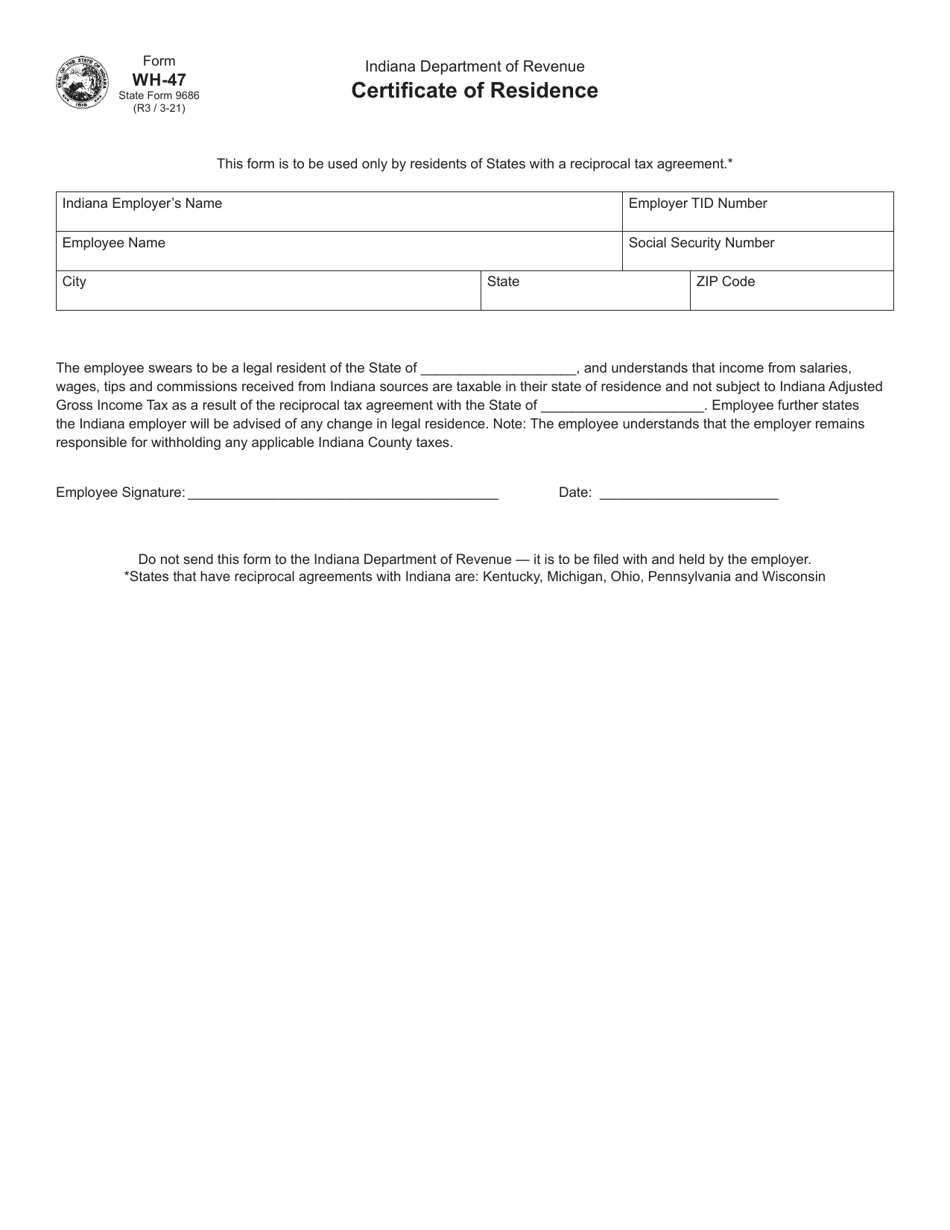

Form WH47 (State Form 9686) Download Printable PDF or Fill Online

Web send form 136 indiana exemption via email, link, or fax. Application for property tax exemption. This is a indiana form and can be use in department of local government finance statewide. Last day to file a form 136 for exempt status. Sign it in a few clicks.

Indiana Property Tax Exemption Form 136 propertyvb

Web send form 136 indiana exemption via email, link, or fax. Web you are here: Application for property tax exemption. Web to obtain exemption, indiana form 136 must be filed with the county assessor by april 1 of the assessment year. Application for property tax exemption (form 136) form.

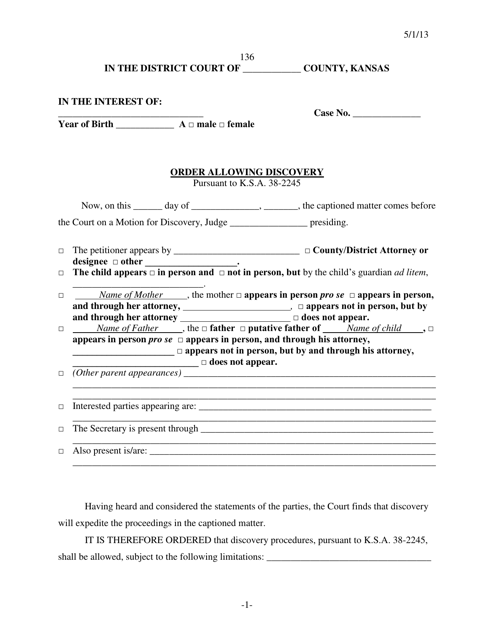

Form 136 Download Printable PDF or Fill Online Order Allowing Discovery

Sign it in a few clicks. Edit your form 136 online. Application for property tax exemption (form 136) form. Last day to file a form 136 for exempt status. Application for property tax exemption.

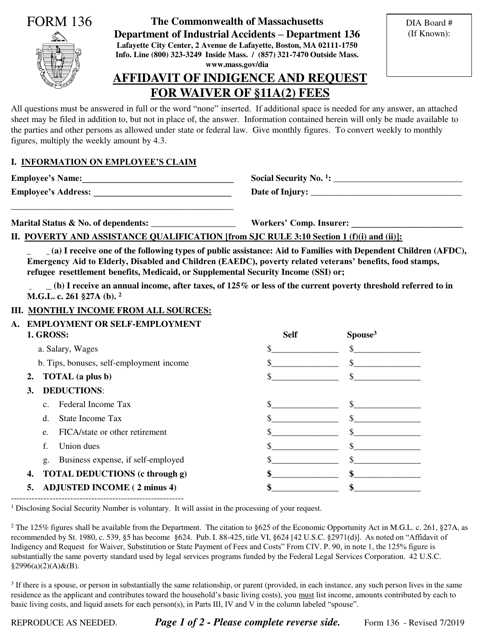

Form 136 Download Fillable PDF or Fill Online Affidavit of Indigence

Web to obtain exemption, indiana form 136 must be filed with the county assessor by april 1 of the assessment year. • if the property tax assessment board of appeals (“ptaboa”) denies the application, it has no later than april 25 to provide notice to the taxpayer. This is a indiana form and can be use in department of local.

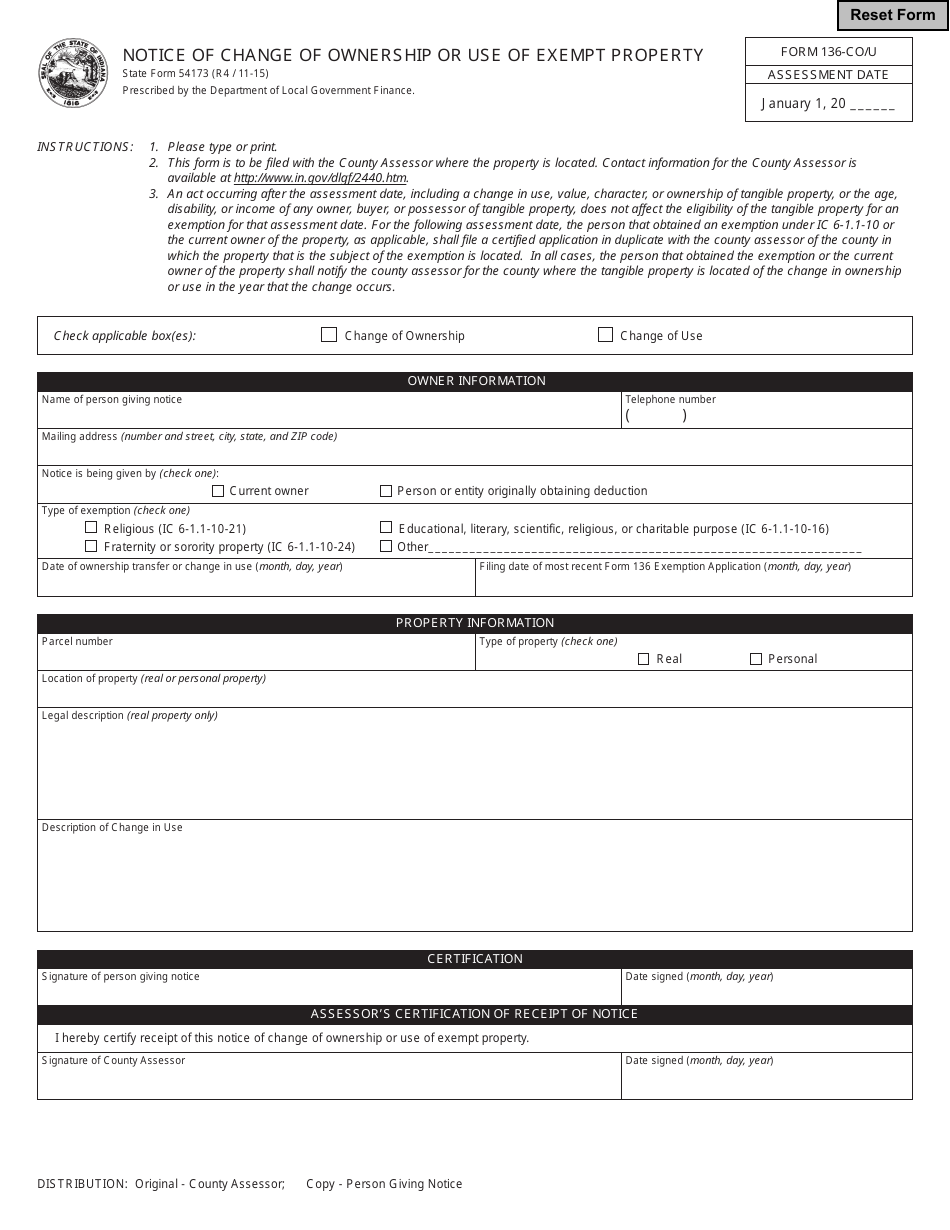

Form 136CO/U (State Form 54173) Download Fillable PDF or Fill Online

You can also download it, export it or print it out. Last day to file a form 136 for exempt status. Web application (form 136) must be filed with the county assessor on or before april 1 of the assessment year. Web you are here: Web send form 136 indiana exemption via email, link, or fax.

1996 IN Form 46800 Fill Online, Printable, Fillable, Blank pdfFiller

Last day to file a form 136 for exempt status. Web send form 136 indiana exemption via email, link, or fax. Type text, add images, blackout confidential details, add comments, highlights and more. Application for property tax exemption. You can also download it, export it or print it out.

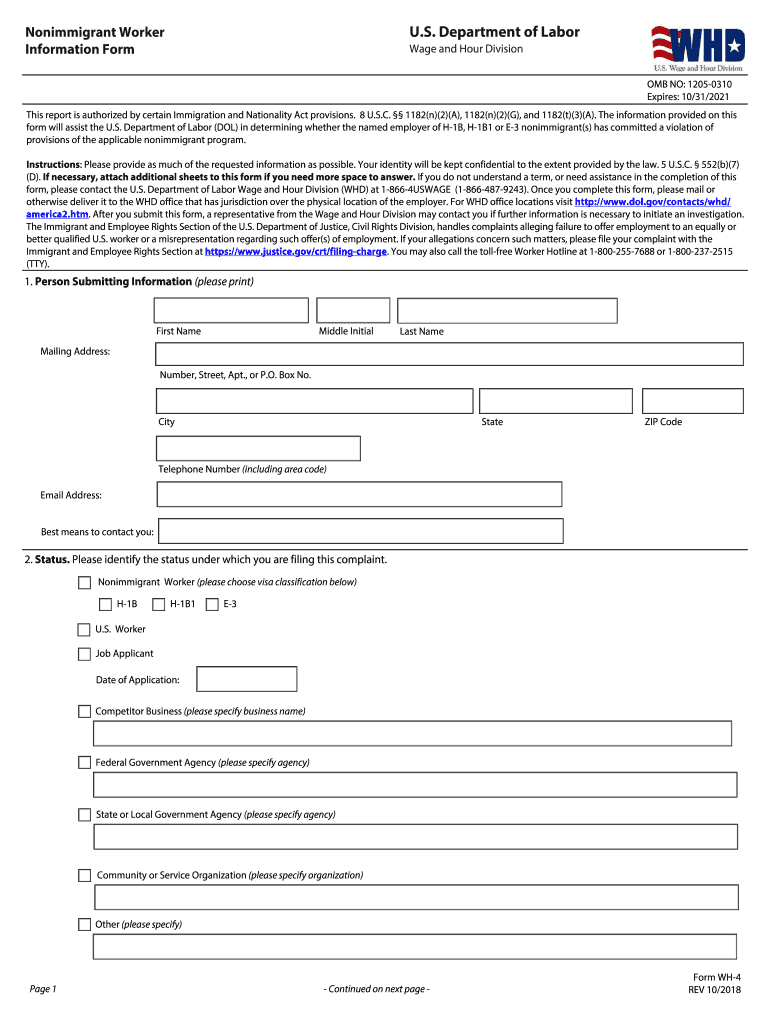

Form Wh 4 Fill Out and Sign Printable PDF Template signNow

Application for property tax exemption. Web send form 136 indiana exemption via email, link, or fax. Web application (form 136) must be filed with the county assessor on or before april 1 of the assessment year. • if the property tax assessment board of appeals (“ptaboa”) denies the application, it has no later than april 25 to provide notice to.

AETC Form 136 Download Fillable PDF or Fill Online Repair Enhancement

Sign it in a few clicks. • if the property tax assessment board of appeals (“ptaboa”) denies the application, it has no later than april 25 to provide notice to the taxpayer. Type text, add images, blackout confidential details, add comments, highlights and more. Application for property tax exemption (form 136) form. Last day to file a form 136 for.

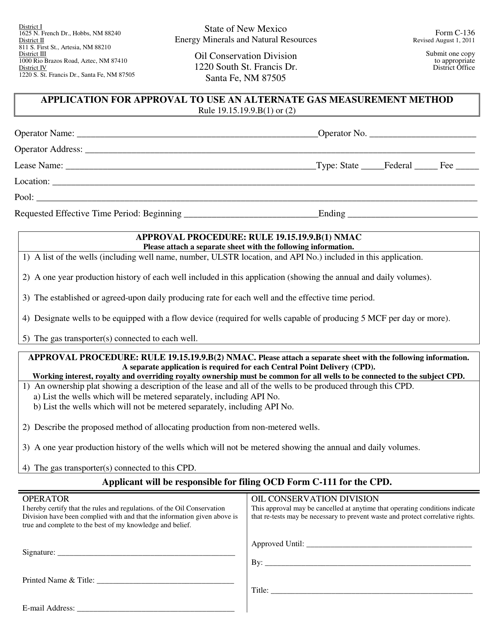

Form C136 Download Printable PDF or Fill Online Application for

This is a indiana form and can be use in department of local government finance statewide. Type text, add images, blackout confidential details, add comments, highlights and more. Web application (form 136) must be filed with the county assessor on or before april 1 of the assessment year. Last day to file a form 136 for exempt status. Application for.

Application For Property Tax Exemption.

Type text, add images, blackout confidential details, add comments, highlights and more. Last day to file a form 136 for exempt status. Edit your form 136 online. Web send form 136 indiana exemption via email, link, or fax.

Sign It In A Few Clicks.

Web you are here: Application for property tax exemption (form 136) form. Web to obtain exemption, indiana form 136 must be filed with the county assessor by april 1 of the assessment year. This is a indiana form and can be use in department of local government finance statewide.

Web Application (Form 136) Must Be Filed With The County Assessor On Or Before April 1 Of The Assessment Year.

You can also download it, export it or print it out. • if the property tax assessment board of appeals (“ptaboa”) denies the application, it has no later than april 25 to provide notice to the taxpayer.