Indirect Rollover Tax Form

Indirect Rollover Tax Form - And how the taxable amount reported on form 1099 r. If married, the spouse must also have been a u.s. The irs gives you 60 days to deposit the funds into an eligible retirement account before assessing your income tax and early withdrawal penalties. Citizens or resident aliens for the entire tax year for which they're inquiring. To preview 1040 in turbotax online: Citizen or resident alien for the entire tax year. Key takeaways with indirect rollovers, you must deposit the payment into another retirement plan or ira within 60 days to avoid tax penalties. If no earnings are distributed, enter 0 (zero) in box 2a and code j in box 7. Web regardless, the rollover rule is a great way to borrow distribution amounts on a normally untouchable ira. Web the tool is designed for taxpayers who were u.s.

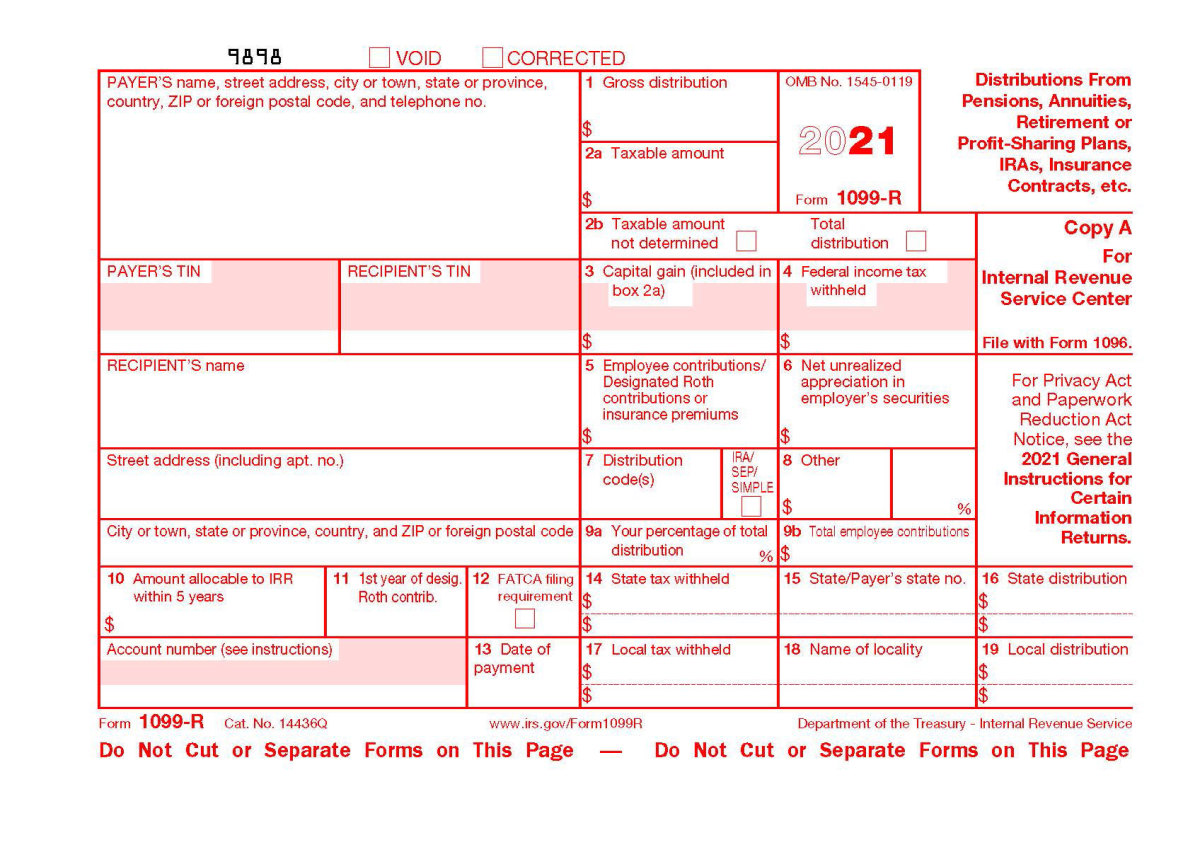

And how the taxable amount reported on form 1099 r. Web please note that all distributions will be reported on your tax return (whether or not they are taxable) on form 1040 on line 15 (a) (or 16 (a) but only the taxable portion will show on your return as taxable on line 15 (b) (or 16 (b)). Citizen or resident alien for the entire tax year. Redeposit it in 60 days to avoid having a taxable amount on taxes the following year. Key takeaways with indirect rollovers, you must deposit the payment into another retirement plan or ira within 60 days to avoid tax penalties. If you requested a payment of cash from your retirement plan account and you deposited some or all of that money into another retirement plan or traditional ira within 60 days of receiving a check in the mail or an ach deposit into your bank account, you completed an indirect rollover. Web indirect rollovers more involved and have more tax implications. To preview 1040 in turbotax online: Depending upon the manner in which the rollover occurs it can affect whether taxes withheld from the distribution. Web if jordan later decides to roll over the $8,000, but not the $2,000 withheld, she will report $2,000 as taxable income, $8,000 as a nontaxable rollover, and $2,000 as taxes paid.

Key takeaways with indirect rollovers, you must deposit the payment into another retirement plan or ira within 60 days to avoid tax penalties. Just have the administrator cut a check and spend the money as needed. Citizen or resident alien for the entire tax year. Redeposit it in 60 days to avoid having a taxable amount on taxes the following year. Get start for free federal 1099 r form direct rollover If the rollover is direct, the money is moved directly between. Citizens or resident aliens for the entire tax year for which they're inquiring. Depending upon the manner in which the rollover occurs it can affect whether taxes withheld from the distribution. If you requested a payment of cash from your retirement plan account and you deposited some or all of that money into another retirement plan or traditional ira within 60 days of receiving a check in the mail or an ach deposit into your bank account, you completed an indirect rollover. Jordan must also pay the 10% additional tax on early distributions on the $2,000 unless she qualifies for an exception.

How To Report Rollovers On Your Tax Return » STRATA Trust Company

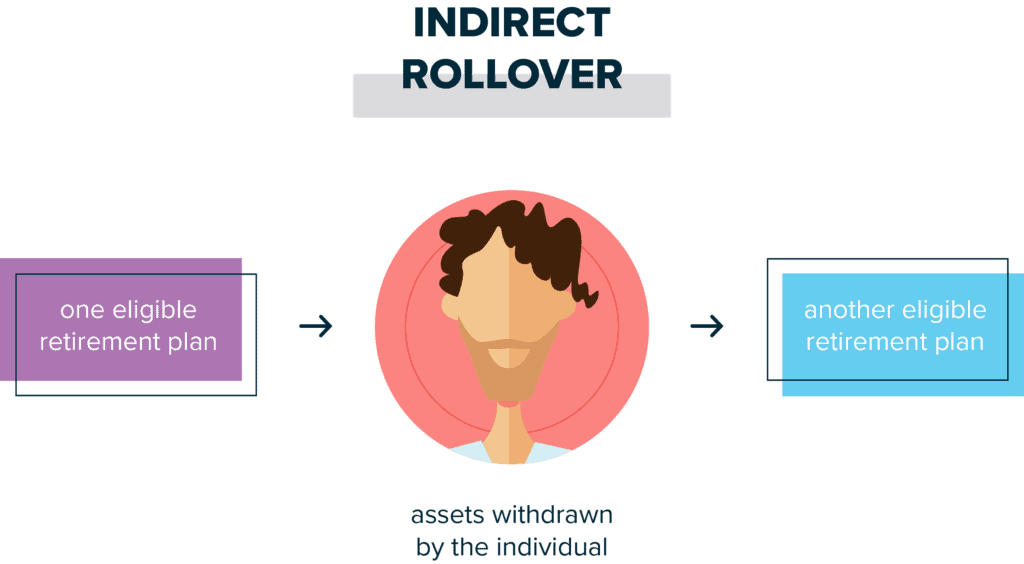

To preview 1040 in turbotax online: Web an indirect rollover occurs when the plan’s administrator cuts you a check in your name, and you deposit the funds yourself. If no earnings are distributed, enter 0 (zero) in box 2a and code j in box 7. Citizen or resident alien for the entire tax year. Just have the administrator cut a.

How To Report Rollovers On Your Tax Return » STRATA Trust Company

Web please note that all distributions will be reported on your tax return (whether or not they are taxable) on form 1040 on line 15 (a) (or 16 (a) but only the taxable portion will show on your return as taxable on line 15 (b) (or 16 (b)). Web indirect rollovers more involved and have more tax implications. Redeposit it.

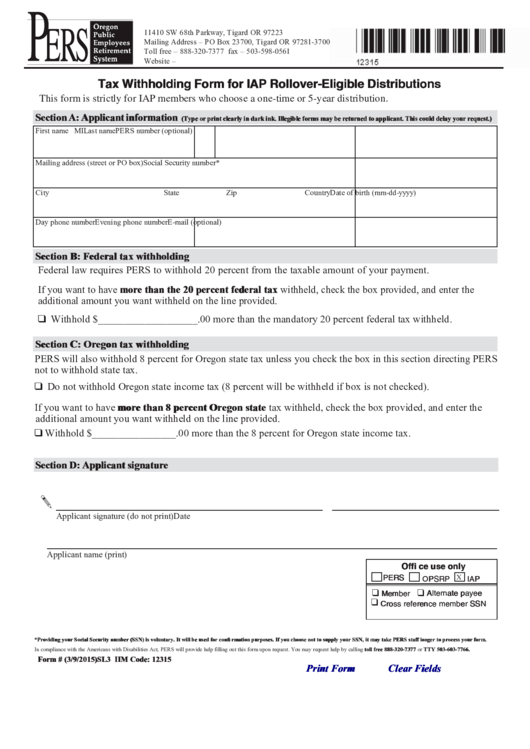

Fillable Tax Withholding Form For Iap RolloverEligible Distributions

Key takeaways with indirect rollovers, you must deposit the payment into another retirement plan or ira within 60 days to avoid tax penalties. To preview 1040 in turbotax online: Web please note that all distributions will be reported on your tax return (whether or not they are taxable) on form 1040 on line 15 (a) (or 16 (a) but only.

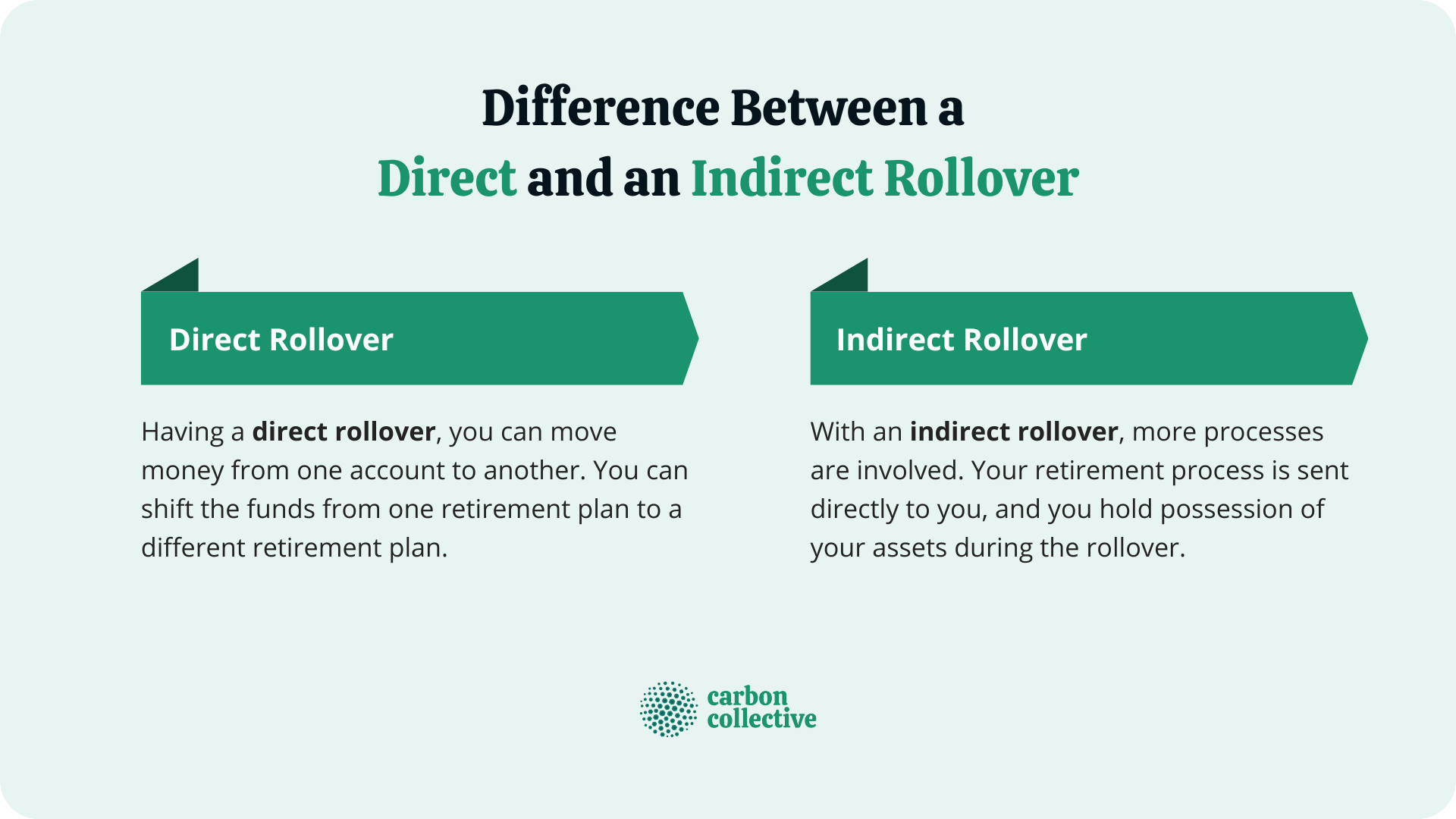

Direct Rollover vs Indirect Rollover Differences and Rules

Web regardless, the rollover rule is a great way to borrow distribution amounts on a normally untouchable ira. If married, the spouse must also have been a u.s. Web an indirect rollover occurs when the plan’s administrator cuts you a check in your name, and you deposit the funds yourself. Redeposit it in 60 days to avoid having a taxable.

Understanding IRA Rollovers Learn more

Web regardless, the rollover rule is a great way to borrow distribution amounts on a normally untouchable ira. If married, the spouse must also have been a u.s. Key takeaways with indirect rollovers, you must deposit the payment into another retirement plan or ira within 60 days to avoid tax penalties. The irs gives you 60 days to deposit the.

What To Do With Your Old 401(k) Momentum Wealth

Web please note that all distributions will be reported on your tax return (whether or not they are taxable) on form 1040 on line 15 (a) (or 16 (a) but only the taxable portion will show on your return as taxable on line 15 (b) (or 16 (b)). If no earnings are distributed, enter 0 (zero) in box 2a and.

Ira Rollover Form 1040 Universal Network

The irs gives you 60 days to deposit the funds into an eligible retirement account before assessing your income tax and early withdrawal penalties. If married, the spouse must also have been a u.s. And how the taxable amount reported on form 1099 r. Jordan must also pay the 10% additional tax on early distributions on the $2,000 unless she.

Direct or Indirect Rollover? What is the difference? Unique Financial

Key takeaways with indirect rollovers, you must deposit the payment into another retirement plan or ira within 60 days to avoid tax penalties. If married, the spouse must also have been a u.s. Web indirect rollovers more involved and have more tax implications. Depending upon the manner in which the rollover occurs it can affect whether taxes withheld from the.

What do I do with my indirect rollover distribution check? Wickham

Depending upon the manner in which the rollover occurs it can affect whether taxes withheld from the distribution. Key takeaways with indirect rollovers, you must deposit the payment into another retirement plan or ira within 60 days to avoid tax penalties. Redeposit it in 60 days to avoid having a taxable amount on taxes the following year. If married, the.

Seven Form 1099R Mistakes to Avoid Retirement Daily on TheStreet

Web an indirect rollover occurs when the plan’s administrator cuts you a check in your name, and you deposit the funds yourself. Citizens or resident aliens for the entire tax year for which they're inquiring. Citizen or resident alien for the entire tax year. Web please note that all distributions will be reported on your tax return (whether or not.

Web Indirect Rollovers More Involved And Have More Tax Implications.

Web an indirect rollover occurs when the plan’s administrator cuts you a check in your name, and you deposit the funds yourself. To preview 1040 in turbotax online: Citizen or resident alien for the entire tax year. Depending upon the manner in which the rollover occurs it can affect whether taxes withheld from the distribution.

And How The Taxable Amount Reported On Form 1099 R.

Just have the administrator cut a check and spend the money as needed. Redeposit it in 60 days to avoid having a taxable amount on taxes the following year. Web if jordan later decides to roll over the $8,000, but not the $2,000 withheld, she will report $2,000 as taxable income, $8,000 as a nontaxable rollover, and $2,000 as taxes paid. Get start for free federal 1099 r form direct rollover

If No Earnings Are Distributed, Enter 0 (Zero) In Box 2A And Code J In Box 7.

If married, the spouse must also have been a u.s. Citizens or resident aliens for the entire tax year for which they're inquiring. Web regardless, the rollover rule is a great way to borrow distribution amounts on a normally untouchable ira. If the rollover is direct, the money is moved directly between.

Key Takeaways With Indirect Rollovers, You Must Deposit The Payment Into Another Retirement Plan Or Ira Within 60 Days To Avoid Tax Penalties.

Web please note that all distributions will be reported on your tax return (whether or not they are taxable) on form 1040 on line 15 (a) (or 16 (a) but only the taxable portion will show on your return as taxable on line 15 (b) (or 16 (b)). Jordan must also pay the 10% additional tax on early distributions on the $2,000 unless she qualifies for an exception. The irs gives you 60 days to deposit the funds into an eligible retirement account before assessing your income tax and early withdrawal penalties. If you requested a payment of cash from your retirement plan account and you deposited some or all of that money into another retirement plan or traditional ira within 60 days of receiving a check in the mail or an ach deposit into your bank account, you completed an indirect rollover.