Instructions For Form 4797

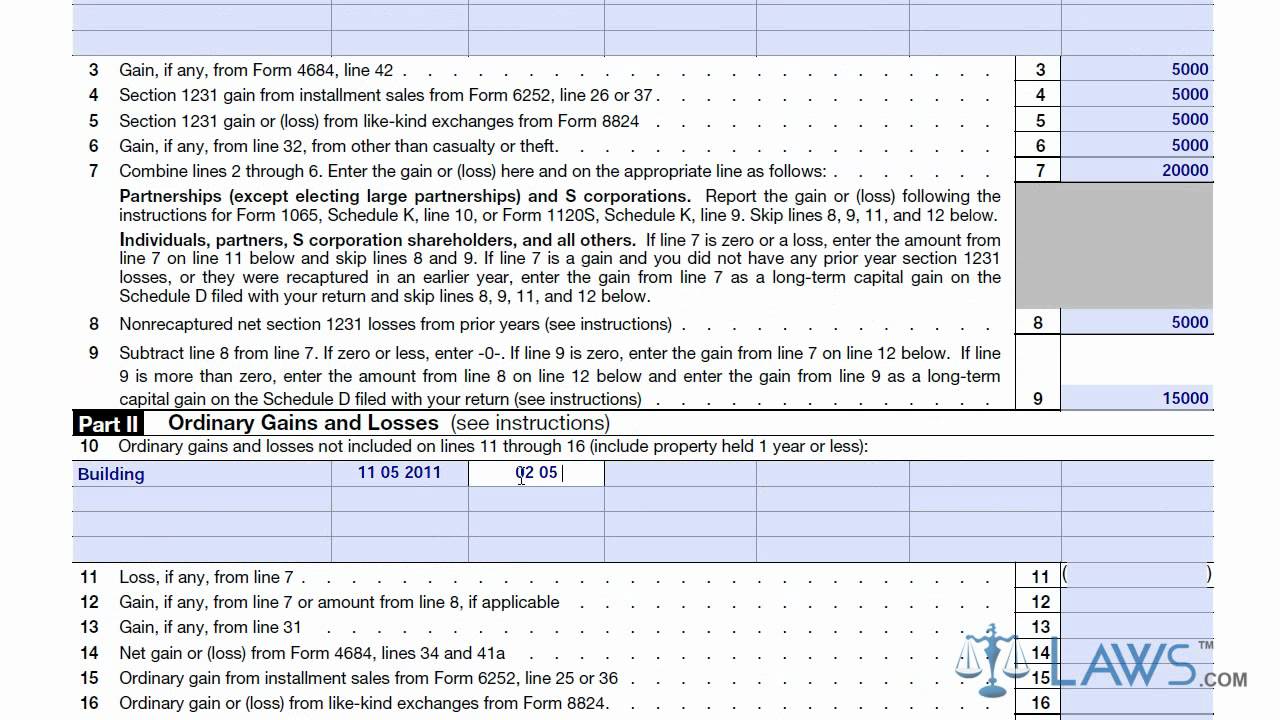

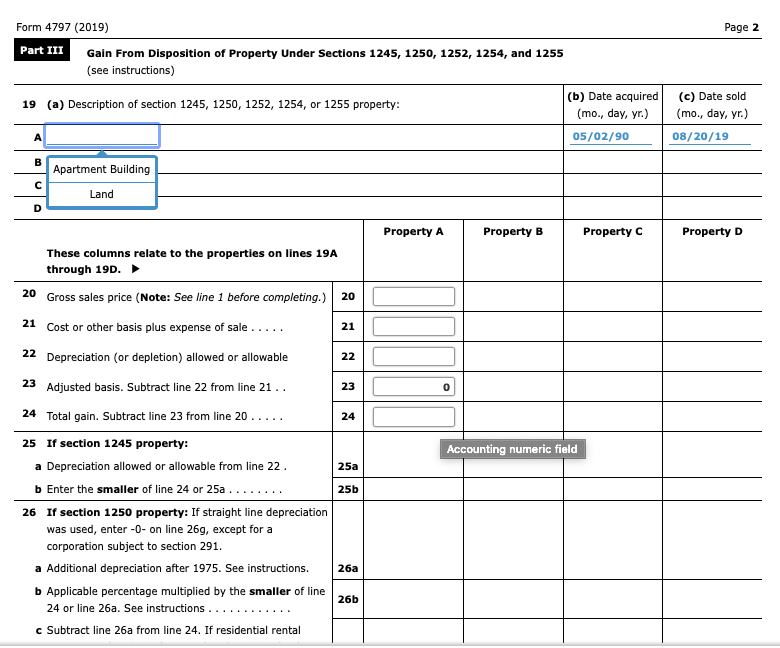

Instructions For Form 4797 - Web complete form 4797, line 19, columns (a), (b), and (c); Web for more information, refer to the irs instructions for form 4797. Go to www.irs.gov/form4797 for instructions and the latest information. The sale or exchange of property. Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets. Enter the name and identifying number at the top of the form. Web information about form 4797, sales of business property, including recent updates, related forms and instructions on how to file. Web form 4797, line 2, report the qualified section 1231 gains you are electing to defer as a result of an investment into a qof within 180 days of the date sold. The disposition of noncapital assets. In column (a), identify the section

The disposition of capital assets not reported on schedule d. Web according to the irs, you should use your 4797 form to report all of the following: Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) attach to your tax return. Web complete form 4797, line 19, columns (a), (b), and (c); Form 6252, lines 1 through 4; Note that any link in the information above is updated each year automatically and will take you to the most recent version of the document at the time it is accessed. Web information about form 4797, sales of business property, including recent updates, related forms and instructions on how to file. Web form 4797, line 2, report the qualified section 1231 gains you are electing to defer as a result of an investment into a qof within 180 days of the date sold. • report the amount from line 1 above on form 4797, line 20; In column (a), identify the section

The disposition of capital assets not reported on schedule d. The disposition of noncapital assets. Note that any link in the information above is updated each year automatically and will take you to the most recent version of the document at the time it is accessed. On line 1, enter the gross proceeds from sales to you for the year 2022. It is used to report gains made from the sale or exchange of business property, including. Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) attach to your tax return. Or form 8824, line 12 or 16. If you are reporting the sale directly on form 4797, line 2, use the line directly below the line on which you reported the sale. Or form 6252, line 8. Line 2 is where tax filers will record any properties they purchased or sold and held for longer than a year.

Form 4797 instructions irs bad debt dlevgob

Web form 4797, line 2, report the qualified section 1231 gains you are electing to defer as a result of an investment into a qof within 180 days of the date sold. Web form 4797 (sales of business property) is a tax form distributed by the internal revenue service (irs). Form 6252, lines 1 through 4; In column (a), identify.

IRS Form 4797 Guide for How to Fill in IRS Form 4797

First of all, you can get this form from the department of treasury or you can just download the irs form 4797 here. Or form 8824, line 12 or 16. The disposition of capital assets not reported on schedule d. Web form 4797 instructions part i: Web form 4797 is a tax form required to be filed with the internal.

Form 4797 1996 Fill out & sign online DocHub

Or form 8824, line 12 or 16. If you are reporting the sale directly on form 4797, line 2, use the line directly below the line on which you reported the sale. Web form 4797, line 2, report the qualified section 1231 gains you are electing to defer as a result of an investment into a qof within 180 days.

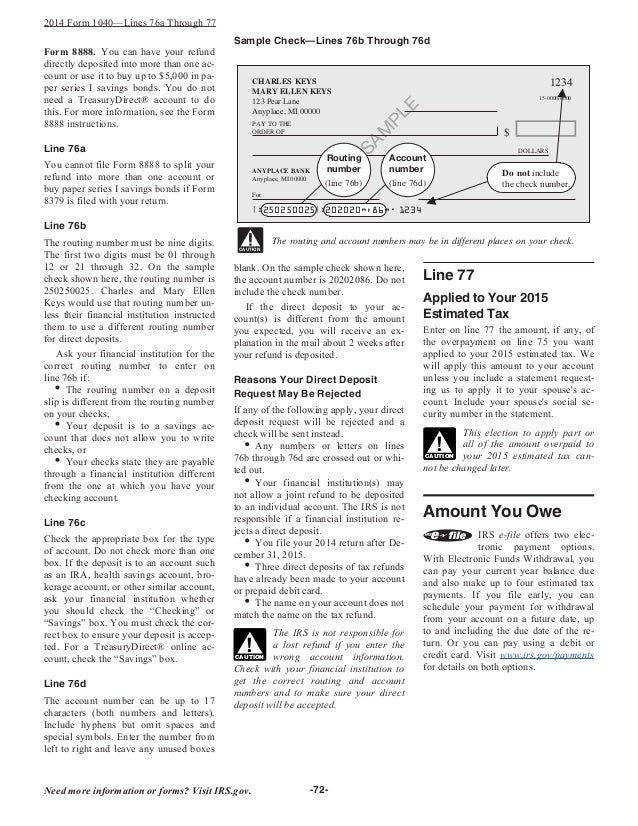

Irs Form 1040 Lines 7+12+18 Form Resume Examples

First of all, you can get this form from the department of treasury or you can just download the irs form 4797 here. Sales or exchanges of property the first section of form 4749 will cover line 2 through line 9 and deals primarily with the subject property’s sale and exchange. Web information about form 4797, sales of business property,.

Form 4797 (2019) Page 2 Part III Gain From

Or form 8824, parts i and ii. It is used to report gains made from the sale or exchange of business property, including. Enter the name and identifying number at the top of the form. Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or.

Irs form 8288 b instructions

It is used to report gains made from the sale or exchange of business property, including. Web form 4797, line 2, report the qualified section 1231 gains you are electing to defer as a result of an investment into a qof within 180 days of the date sold. Or form 6252, line 8. Note that any link in the information.

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

Web for more information, refer to the irs instructions for form 4797. Or form 8824, line 12 or 16. • report the amount from line 2 above on form 4797, line 21; Form 6252, lines 1 through 4; If you are reporting the sale directly on form 4797, line 2, use the line directly below the line on which you.

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

Enter the name and identifying number at the top of the form. Web complete form 4797, line 19, columns (a), (b), and (c); Note that any link in the information above is updated each year automatically and will take you to the most recent version of the document at the time it is accessed. Form 6252, lines 1 through 4;.

Irs Form 4797 Instructions 2022 Fill online, Printable, Fillable Blank

Form 6252, lines 1 through 4; Note that any link in the information above is updated each year automatically and will take you to the most recent version of the document at the time it is accessed. Web complete form 4797, line 19, columns (a), (b), and (c); Web according to the irs, you should use your 4797 form to.

Form 4797 YouTube

Note that any link in the information above is updated each year automatically and will take you to the most recent version of the document at the time it is accessed. Or form 6252, line 8. If you are reporting the sale directly on form 4797, line 2, use the line directly below the line on which you reported the.

The Disposition Of Capital Assets Not Reported On Schedule D.

Enter the name and identifying number at the top of the form. It is used to report gains made from the sale or exchange of business property, including. Note that any link in the information above is updated each year automatically and will take you to the most recent version of the document at the time it is accessed. Web form 4797 instructions part i:

The Sale Or Exchange Of Property.

If you are reporting the sale directly on form 4797, line 2, use the line directly below the line on which you reported the sale. Web information about form 4797, sales of business property, including recent updates, related forms and instructions on how to file. Sales or exchanges of property the first section of form 4749 will cover line 2 through line 9 and deals primarily with the subject property’s sale and exchange. • report the amount from line 1 above on form 4797, line 20;

Or Form 8824, Line 12 Or 16.

Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets. Or form 6252, line 8. Web form 4797, line 2, report the qualified section 1231 gains you are electing to defer as a result of an investment into a qof within 180 days of the date sold. Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property, including but not limited to properties that generate rental income and properties that are used for industrial, agricultural, or extractive resources.

Line 2 Is Where Tax Filers Will Record Any Properties They Purchased Or Sold And Held For Longer Than A Year.

• report the amount from line 2 above on form 4797, line 21; In column (a), identify the section First of all, you can get this form from the department of treasury or you can just download the irs form 4797 here. Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) attach to your tax return.

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://media.cheggcdn.com/media/a30/a30da289-81cf-40ec-9a9f-f199303815c7/image)

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://media.cheggcdn.com/media/96c/s1024x708/96c0b013-86a1-4a1d-b75f-35a8de765ec8/phpsAAWmx.png)