Instructions For Form 8825

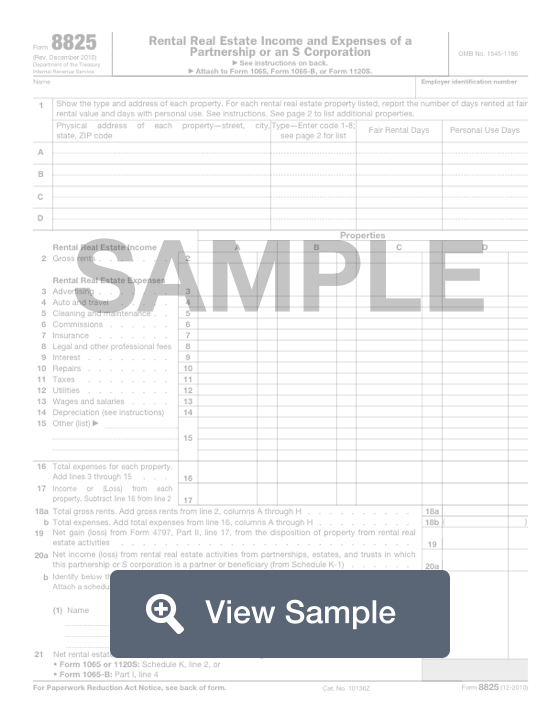

Instructions For Form 8825 - Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from partnerships, estates, or trusts. Web form 8825 instructions generally, there are three pages to the form. Generally, tax returns and return November 2018) department of the treasury internal revenue service. Relatively few people are eligible for the hctc. Web for the latest information about developments related to form 8885 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8885. Web at a minimum, your irs tax form 8825 must contain the following information (for each declared property): If any portion of this gain (or loss) is from rental real estate activities, you must also enter it on form 8825, rental real estate income and expenses, line 19. The first two pages have instructions for the form, so you will want to read these to make sure that you are filling out the form correctly. Web the 8825 is the real estate form and it flows to the schedule k instead of the front page of the partnership return:

Rental real estate income and expenses of a. The rental income and expenses are. The first two pages have instructions for the form, so you will want to read these to make sure that you are filling out the form correctly. Web at a minimum, your irs tax form 8825 must contain the following information (for each declared property): Relatively few people are eligible for the hctc. Then it flows through to the owner’s return. Form 8825 is used to report income and deductible expenses from rental real estate activities. Web information about form 8825, rental real estate income and expenses of a partnership or an s corporation, including recent updates, related forms, and instructions on how to file. Web for the latest information about developments related to form 8885 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8885. Do not report on form 8825 any:

Relatively few people are eligible for the hctc. Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from partnerships, estates, or trusts. In plain english, it is the company version of the schedule e rental real estate form we often see. Web at a minimum, your irs tax form 8825 must contain the following information (for each declared property): Web for the latest information about developments related to form 8885 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8885. Generally, tax returns and return Before completing this form, be sure to November 2018) department of the treasury internal revenue service. Web form 8825 instructions generally, there are three pages to the form. Relating to a form or its instructions must be retained as long as their contents may become material in the administration of any internal revenue law.

Form 8825 Rental Real Estate and Expenses of a Partnership or

See who can take this credit , later, to determine whether you can claim the credit. Generally, tax returns and return The first two pages have instructions for the form, so you will want to read these to make sure that you are filling out the form correctly. November 2018) department of the treasury internal revenue service. Web the 8825.

Fillable IRS Form 8825 Free Printable PDF Sample FormSwift

November 2018) department of the treasury internal revenue service. Web for the latest information about developments related to form 8885 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8885. Generally, tax returns and return If any portion of this gain (or loss) is from rental real estate activities, you must also enter it on form.

LEGO 8825 Night Chopper Set Parts Inventory and Instructions LEGO

Web at a minimum, your irs tax form 8825 must contain the following information (for each declared property): Web for the latest information about developments related to form 8885 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8885. Rental real estate income and expenses of a. Web information about form 8825, rental real estate income.

Fill Free fillable F8825 Accessible Form 8825 (Rev. November 2018

Relating to a form or its instructions must be retained as long as their contents may become material in the administration of any internal revenue law. In plain english, it is the company version of the schedule e rental real estate form we often see. See who can take this credit , later, to determine whether you can claim the.

LEGO 8825 Night Chopper Set Parts Inventory and Instructions LEGO

Form 8825 is used to report income and deductible expenses from rental real estate activities. General instructions purpose of form The third page is where you will write down the income and expenses that you incurred during the year. Rental real estate income and expenses of a. Web information about form 8825, rental real estate income and expenses of a.

Publication 559 (2017), Survivors, Executors, and Administrators

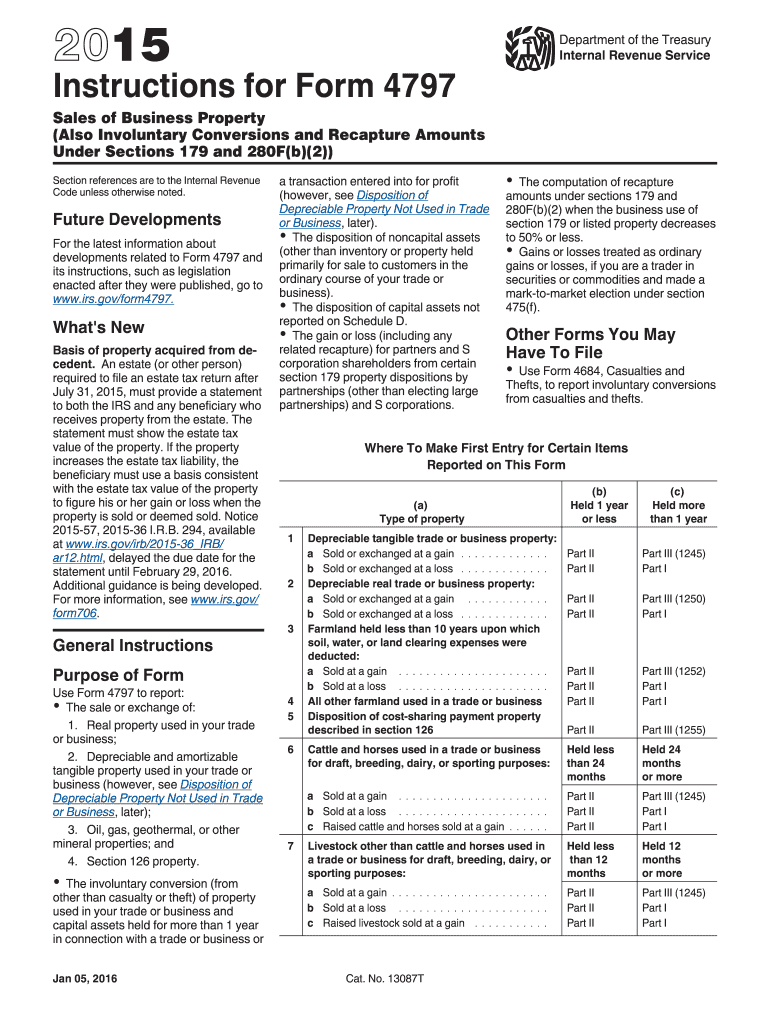

Web the 8825 is the real estate form and it flows to the schedule k instead of the front page of the partnership return: You reported a gain (or loss) from the sale of business property of zero. Web at a minimum, your irs tax form 8825 must contain the following information (for each declared property): Partnerships and s corporations.

Doc

The rental income and expenses are. Web the 8825 is the real estate form and it flows to the schedule k instead of the front page of the partnership return: Web an 8825 form is officially called a rental real estate income and expenses of a partnership or an s corp. Form 8825 is used to report income and deductible.

IRS Form 8825 Fill out & sign online DocHub

Web information about form 8825, rental real estate income and expenses of a partnership or an s corporation, including recent updates, related forms, and instructions on how to file. Relatively few people are eligible for the hctc. Web at a minimum, your irs tax form 8825 must contain the following information (for each declared property): Web form 8825 instructions generally,.

Ir's Form 4797 Instructions Fill Out and Sign Printable PDF Template

See who can take this credit , later, to determine whether you can claim the credit. In plain english, it is the company version of the schedule e rental real estate form we often see. The first two pages have instructions for the form, so you will want to read these to make sure that you are filling out the.

Form 8825 Rental Real Estate and Expenses of a Partnership or

Relatively few people are eligible for the hctc. Web the 8825 is the real estate form and it flows to the schedule k instead of the front page of the partnership return: If the owner is an individual, their share goes to schedule e, page two line 28 column f or g. Do not report on form 8825 any: Relating.

See Who Can Take This Credit , Later, To Determine Whether You Can Claim The Credit.

Relating to a form or its instructions must be retained as long as their contents may become material in the administration of any internal revenue law. In plain english, it is the company version of the schedule e rental real estate form we often see. If the owner is an individual, their share goes to schedule e, page two line 28 column f or g. Web an 8825 form is officially called a rental real estate income and expenses of a partnership or an s corp.

Relatively Few People Are Eligible For The Hctc.

Web for the latest information about developments related to form 8885 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8885. Web at a minimum, your irs tax form 8825 must contain the following information (for each declared property): Web information about form 8825, rental real estate income and expenses of a partnership or an s corporation, including recent updates, related forms, and instructions on how to file. Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from partnerships, estates, or trusts.

If Any Portion Of This Gain (Or Loss) Is From Rental Real Estate Activities, You Must Also Enter It On Form 8825, Rental Real Estate Income And Expenses, Line 19.

Then it flows through to the owner’s return. Rental real estate income and expenses of a. Web why is there a diagnostic for form 8825 when disposing of a rental property? Web the 8825 is the real estate form and it flows to the schedule k instead of the front page of the partnership return:

Do Not Report On Form 8825 Any:

The first two pages have instructions for the form, so you will want to read these to make sure that you are filling out the form correctly. The rental income and expenses are. Before completing this form, be sure to November 2018) department of the treasury internal revenue service.