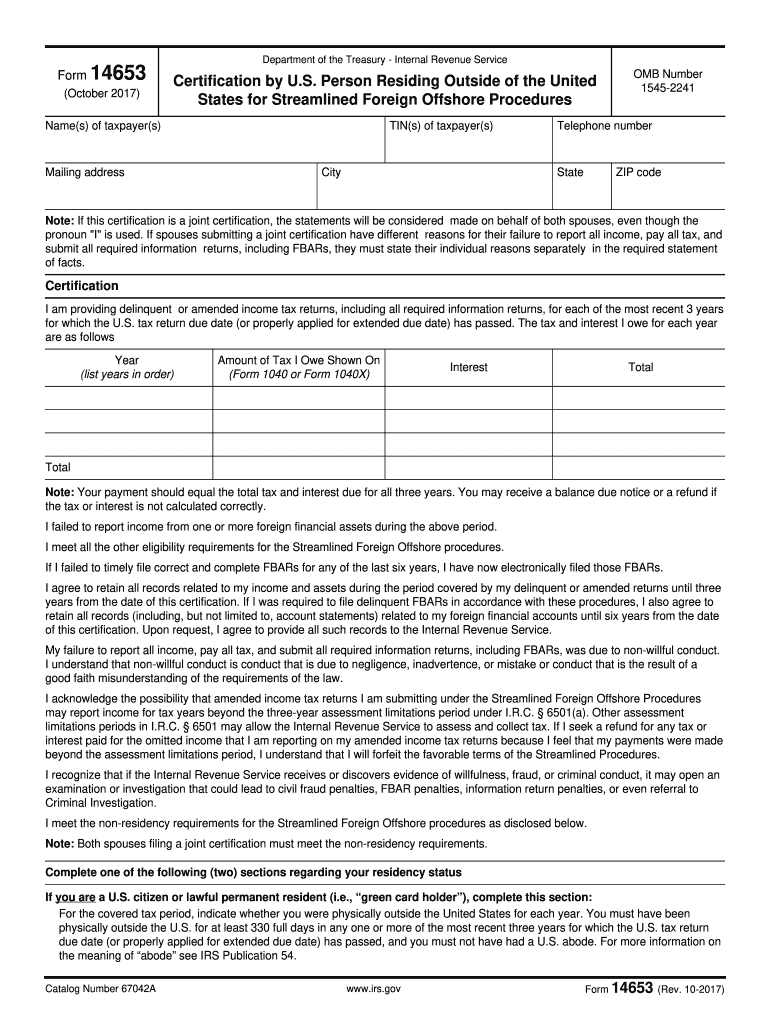

Irs Form 14653

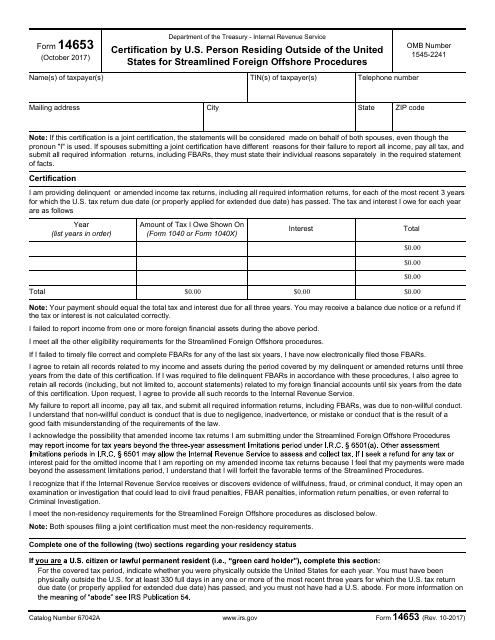

Irs Form 14653 - Taxpayer a's sfo submission includes a form 14653 and delinquent income tax returns for tax years, 2017, 2018, 2019, and 2020. On august 1, 2021, taxpayer makes a submission to the streamlined foreign offshore procedures (sfo). Here are some quick tips. The form 14653 certification by u.s. § 6501 may allow the internal revenue service to assess and collect tax. Person residing outside of the united states for streamlined foreign offshore procedures created date: Web complete and sign a statement on the certification by u.s. Tax return due date (or properly applied for extended due date) has passed. Other assessment limitations periods in i.r.c. Web form 14653 is an irs tax form expats must file when using the streamlined filing compliance procedures program.

Person residing outside of the u.s.(form 14653) pdf certifying (1) that you are eligible for the streamlined foreign offshore procedures; § 6501 may allow the internal revenue service to assess and collect tax. Here are some quick tips. Year list years in order (form 1040, line 76 Web what is irs form 14653? And (3) that the failure to file tax returns, report all income, pay all. Other assessment limitations periods in i.r.c. Web form 14653 is an irs tax form expats must file when using the streamlined filing compliance procedures program. Web i am providing delinquent or amended income tax returns, including all required information returns, for each of the most recent 3 years for which the u.s. The amended form 14653 must include all facts and circumstances concerning the error in the original streamlined submission.

Web i am providing delinquent or amended income tax returns, including all required information returns, for each of the most recent 3 years for which the u.s. Here are some quick tips. Person residing outside of the u.s.(form 14653) pdf certifying (1) that you are eligible for the streamlined foreign offshore procedures; Other assessment limitations periods in i.r.c. Tax return due date (or properly applied for extended due date) has passed. Form 14653 is intended to verify that your tax delinquency was not willful, which is required to utilize the streamlined program for getting caught up on taxes without penalties. On august 1, 2021, taxpayer makes a submission to the streamlined foreign offshore procedures (sfo). The amended form 14653 must include all facts and circumstances concerning the error in the original streamlined submission. Person residing outside of the united states for streamlined foreign offshore procedures created date: (2) that all required fbars have now been filed (see instruction 8 below);

IRS Form 14653 Download Fillable PDF or Fill Online Certification by U

The amended form 14653 must include all facts and circumstances concerning the error in the original streamlined submission. Web complete and sign a statement on the certification by u.s. (2) that all required fbars have now been filed (see instruction 8 below); Person residing outside of the united states for streamlined foreign offshore procedures, is a very important irs certification.

Form 14653 Fill out & sign online DocHub

Web form 14653 is an irs tax form expats must file when using the streamlined filing compliance procedures program. Web she must provide amended income tax returns for tax years 2012, 2013, and 2014, an amended streamlined certification on form 14653, and payment for increases in tax and interest. The tax and interest i owe for each year are as.

Streamlined Procedure How to File Form 14653

Other assessment limitations periods in i.r.c. Person residing outside of the u.s.(form 14653) pdf certifying (1) that you are eligible for the streamlined foreign offshore procedures; Person residing outside of the united states for streamlined foreign offshore procedures, is a very important irs certification form used with the streamlined foreign offshore procedures (sfop). On august 1, 2021, taxpayer makes a.

What to Know About Form 14653? Example and Useful Tips Munchkin Press

Web she must provide amended income tax returns for tax years 2012, 2013, and 2014, an amended streamlined certification on form 14653, and payment for increases in tax and interest. The amended form 14653 must include all facts and circumstances concerning the error in the original streamlined submission. Web i am providing delinquent or amended income tax returns, including all.

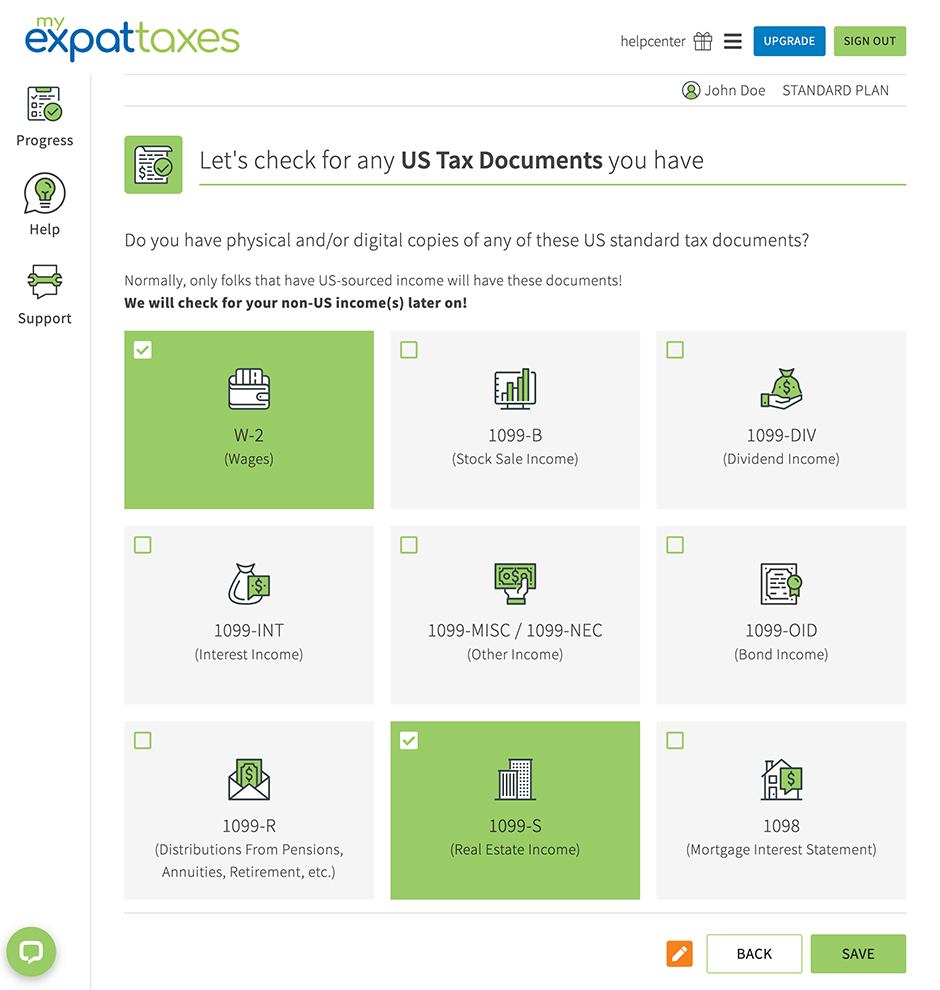

Most Affordable IRS Streamlining Option for US Expats MyExpatTaxes

On august 1, 2021, taxpayer makes a submission to the streamlined foreign offshore procedures (sfo). The form 14653 certification by u.s. Year list years in order (form 1040, line 76 As of today, no separate filing guidelines for the form are provided by the irs. And (3) that the failure to file tax returns, report all income, pay all.

A Form 14653 Tax Certification Guide What You Must Know

§ 6501 may allow the internal revenue service to assess and collect tax. (2) that all required fbars have now been filed (see instruction 8 below); As of today, no separate filing guidelines for the form are provided by the irs. Web what is irs form 14653? The streamlined foreign offshore disclosure requires the applicant to complete form 14653.

IRS Form 14653 Download Fillable PDF or Fill Online Certification by U

Web she must provide amended income tax returns for tax years 2012, 2013, and 2014, an amended streamlined certification on form 14653, and payment for increases in tax and interest. Person residing outside of the united states for streamlined foreign offshore procedures created date: Person residing outside of the u.s.(form 14653) pdf certifying (1) that you are eligible for the.

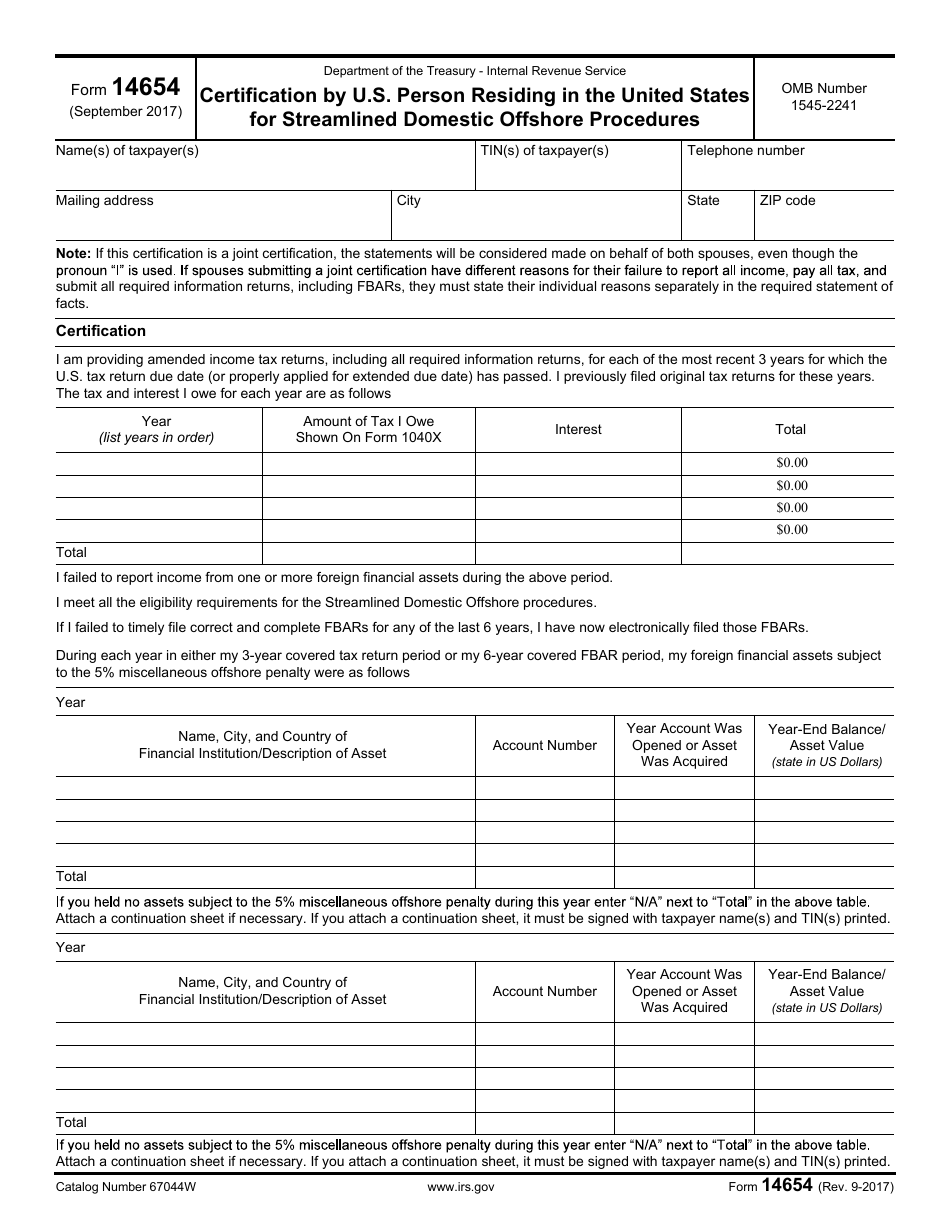

IRS Form 14654 Fill Out, Sign Online and Download Fillable PDF

Person residing outside of the united states for streamlined foreign offshore procedures created date: Tax return due date (or properly applied for extended due date) has passed. Person residing outside of the united states for streamlined foreign offshore procedures, is a very important irs certification form used with the streamlined foreign offshore procedures (sfop). And (3) that the failure to.

Streamlined Foreign Offshore Procedure and Form 14653 SDG Accountant

The streamlined foreign offshore disclosure requires the applicant to complete form 14653. § 6501 may allow the internal revenue service to assess and collect tax. Person residing outside of the united states for streamlined foreign offshore procedures, is a very important irs certification form used with the streamlined foreign offshore procedures (sfop). Here are some quick tips. Web i am.

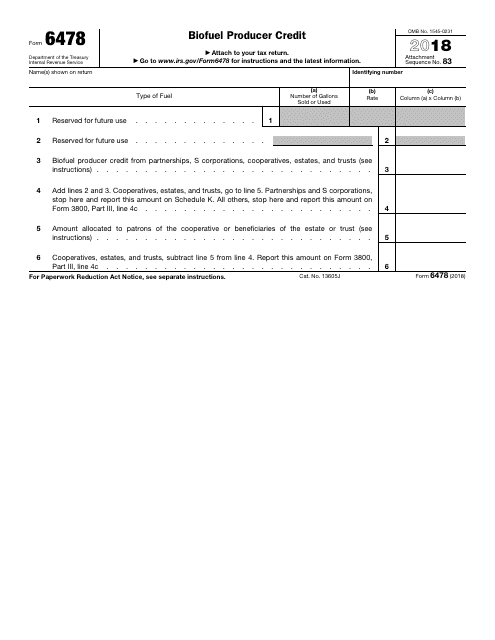

IRS Form 6478 Download Fillable PDF or Fill Online Biofuel Producer

As of today, no separate filing guidelines for the form are provided by the irs. The amended form 14653 must include all facts and circumstances concerning the error in the original streamlined submission. The form 14653 certification by u.s. Web complete and sign a statement on the certification by u.s. Department of the treasury on october 1, 2017.

The Tax And Interest I Owe For Each Year Are As Follows:

Web what is irs form 14653? Taxpayer a's sfo submission includes a form 14653 and delinquent income tax returns for tax years, 2017, 2018, 2019, and 2020. Tax return due date (or properly applied for extended due date) has passed. Year list years in order (form 1040, line 76

As Of Today, No Separate Filing Guidelines For The Form Are Provided By The Irs.

(2) that all required fbars have now been filed (see instruction 8 below); The amended form 14653 must include all facts and circumstances concerning the error in the original streamlined submission. And (3) that the failure to file tax returns, report all income, pay all. The form 14653 certification by u.s.

The Streamlined Foreign Offshore Disclosure Requires The Applicant To Complete Form 14653.

Other assessment limitations periods in i.r.c. Person residing outside of the u.s.(form 14653) pdf certifying (1) that you are eligible for the streamlined foreign offshore procedures; Web form 14653 is an irs tax form expats must file when using the streamlined filing compliance procedures program. Person residing outside of the united states for streamlined foreign offshore procedures, is a very important irs certification form used with the streamlined foreign offshore procedures (sfop).

Web I Am Providing Delinquent Or Amended Income Tax Returns, Including All Required Information Returns, For Each Of The Most Recent 3 Years For Which The U.s.

Form 14653 is intended to verify that your tax delinquency was not willful, which is required to utilize the streamlined program for getting caught up on taxes without penalties. Person residing outside of the united states for streamlined foreign offshore procedures created date: On august 1, 2021, taxpayer makes a submission to the streamlined foreign offshore procedures (sfo). § 6501 may allow the internal revenue service to assess and collect tax.