Irs Form 4549 Explanation

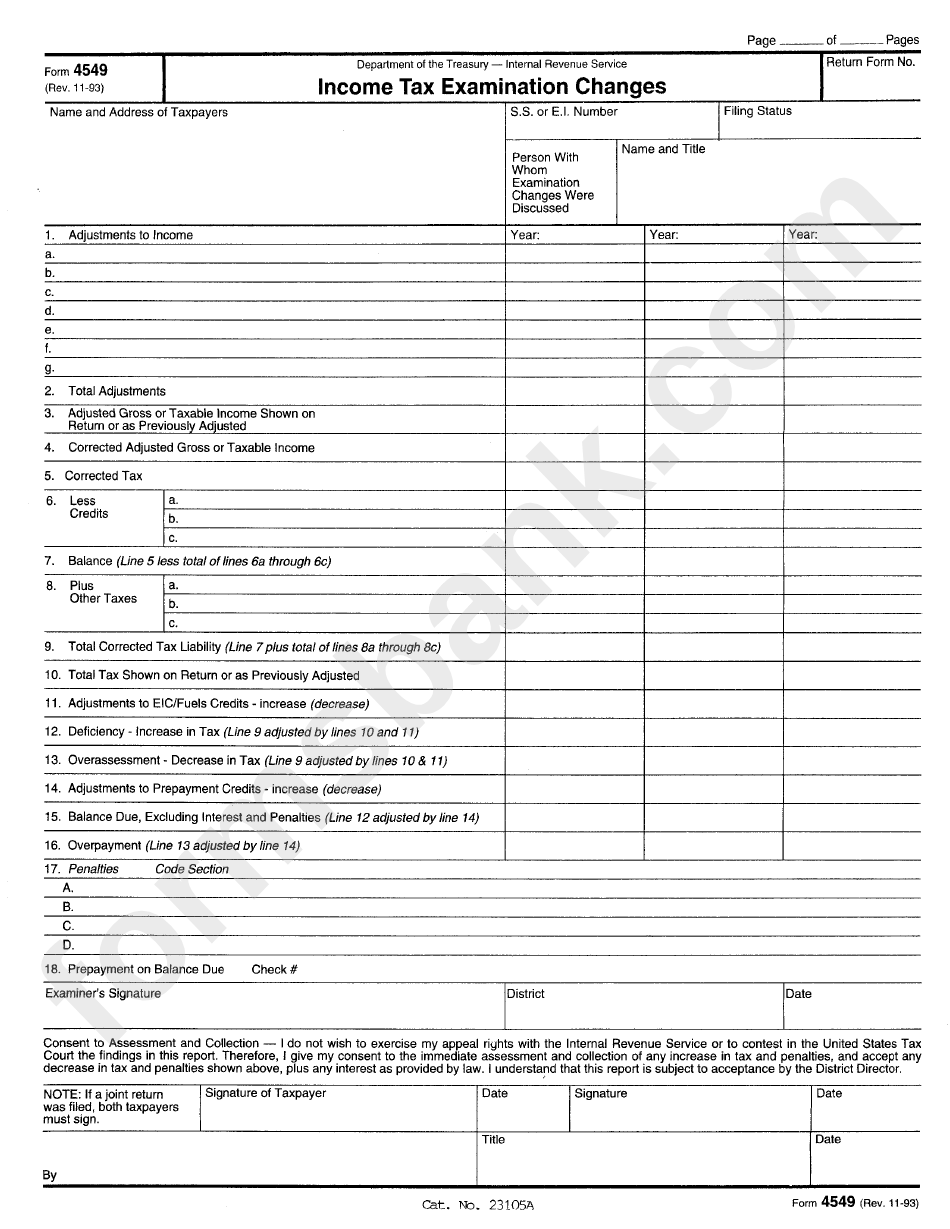

Irs Form 4549 Explanation - Web the irs form 4549 also called the income tax examination letter informs the taxpayer about the proposed changes to the tax return, penalties, and interest as a result of the audit. Web what happens when i get the form 4549 or audit letter? This form means the irs is questioning your tax return. Web form 4549, income tax examination changes, is used for cases that result in: Form 4549, report of income tax examination changes. Web the title of irs form 4549 is income tax examination changes, which of course signifies that your income tax return is being changed, often for the worse. Web form 4549 is an irs form that is sent to taxpayers whose returns have been audited. If you agree with us, sign and return the agreement part of the audit. Web the irs form 4549 is the income tax examination changes letter. Web an irs form 4549 is a statement of income tax examination changes. this is merely a proposed adjustment if it is attached to a letter 525, 692 or 1912.

Web a regular agreed report (form 4549) may contain up to three tax years. It will include information, including: The agency may think you failed to report some income, took too many deductions, or didn't pay enough taxes. You could have received the form 4549 along with a notice of deficiency when you have unfiled returns and the irs has determined that you owe. Web the title of irs form 4549 is income tax examination changes, which of course signifies that your income tax return is being changed, often for the worse. The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of the audit. This form means the irs is questioning your tax return. This letter is intended to inform the taxpayer about not only what the irs found, but also the proposed changes they made to the taxpayer’s tax form. Web what happens when i get the form 4549 or audit letter? Form 4549, report of income tax examination changes.

The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of the audit. This letter is intended to inform the taxpayer about not only what the irs found, but also the proposed changes they made to the taxpayer’s tax form. Web form 4549 is an irs form that is sent to taxpayers whose returns have been audited. Web the irs form 4549 also called the income tax examination letter informs the taxpayer about the proposed changes to the tax return, penalties, and interest as a result of the audit. This form means the irs is questioning your tax return. You could have received the form 4549 along with a notice of deficiency when you have unfiled returns and the irs has determined that you owe. It will include information, including: If your return (s) are not filed: Web the title of irs form 4549 is income tax examination changes, which of course signifies that your income tax return is being changed, often for the worse. Web form 4549, income tax examination changes, is used for cases that result in:

4.10.8 Report Writing Internal Revenue Service

However, if form 4549 is attached to a notice of deficiency then the irs has made a. Web form 4549 is an irs form that is sent to taxpayers whose returns have been audited. Web the irs form 4549 also called the income tax examination letter informs the taxpayer about the proposed changes to the tax return, penalties, and interest.

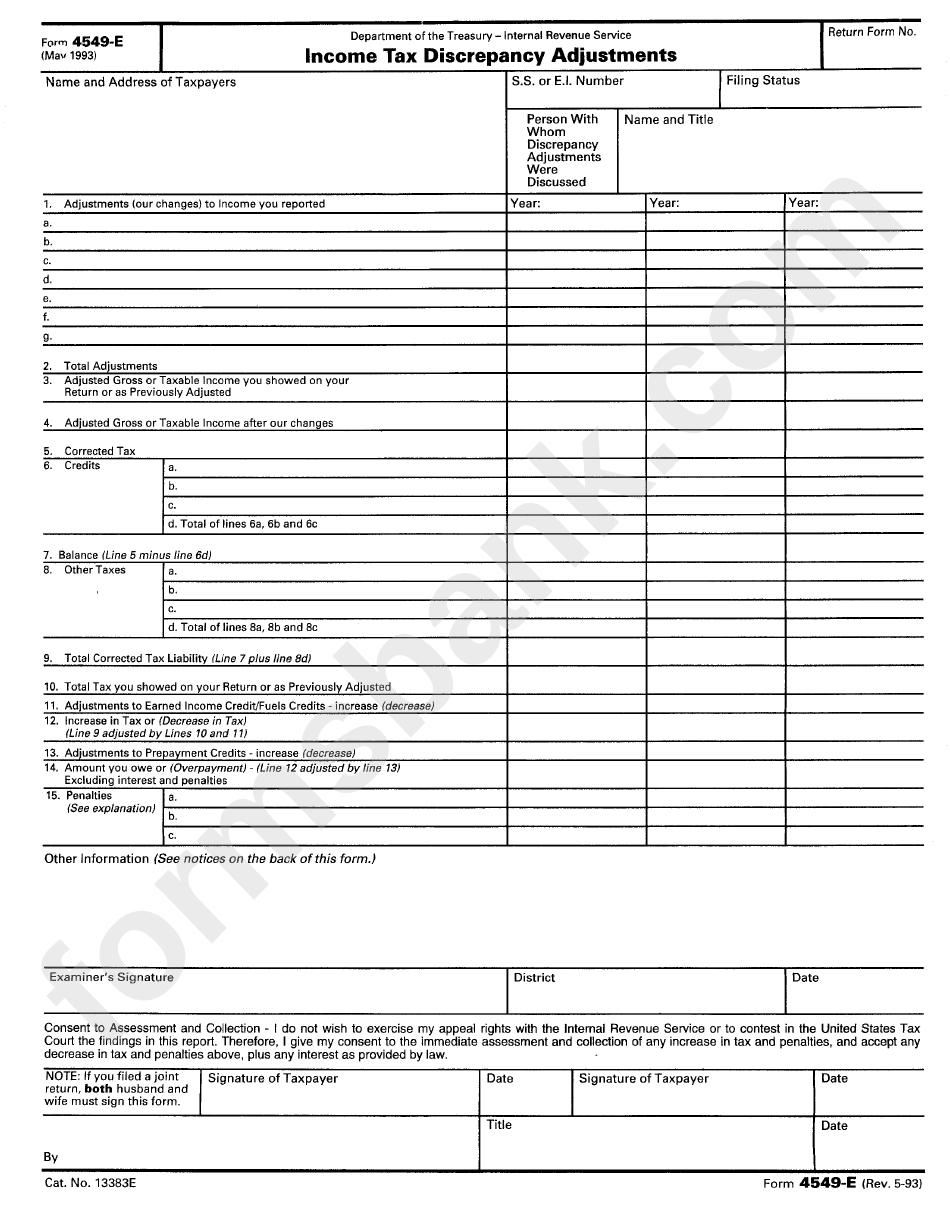

Form 4549E Tax Discrepancy Adjustments 1993 printable pdf

However, if form 4549 is attached to a notice of deficiency then the irs has made a. Form 4549, report of income tax examination changes. The agency may think you failed to report some income, took too many deductions, or didn't pay enough taxes. If you agree with us, sign and return the agreement part of the audit. This letter.

Top 9 Form 4549 Templates free to download in PDF format

Web the irs form 4549 is the income tax examination changes letter. Web form 4549, income tax examination changes, is used for cases that result in: Web the title of irs form 4549 is income tax examination changes, which of course signifies that your income tax return is being changed, often for the worse. This letter is intended to inform.

The Tax Times RA's Report Was Initial Determination For Penalty

Web the title of irs form 4549 is income tax examination changes, which of course signifies that your income tax return is being changed, often for the worse. Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the acceptance of the area director, area manager, specialty tax program chief, or director of field.

Form 4549 Tax Examination Changes Internal Revenue Service

Normally, the irs will use the form for the initial report only, and the irs reasonably expects agreement. Web a regular agreed report (form 4549) may contain up to three tax years. However, if form 4549 is attached to a notice of deficiency then the irs has made a. It will include information, including: This form means the irs is.

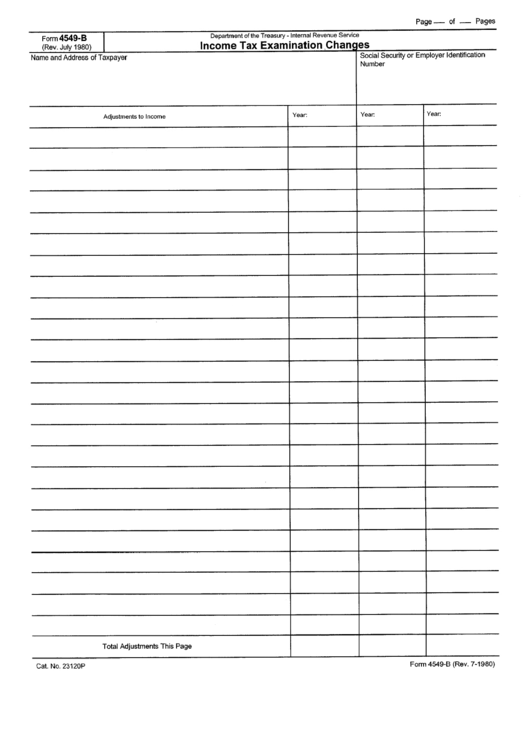

Form 4549B Tax Examitation Changes printable pdf download

If you agree with us, sign and return the agreement part of the audit. It will include information, including: Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the acceptance of the area director, area manager, specialty tax program chief, or director of field operations. Web the irs form 4549 is the income.

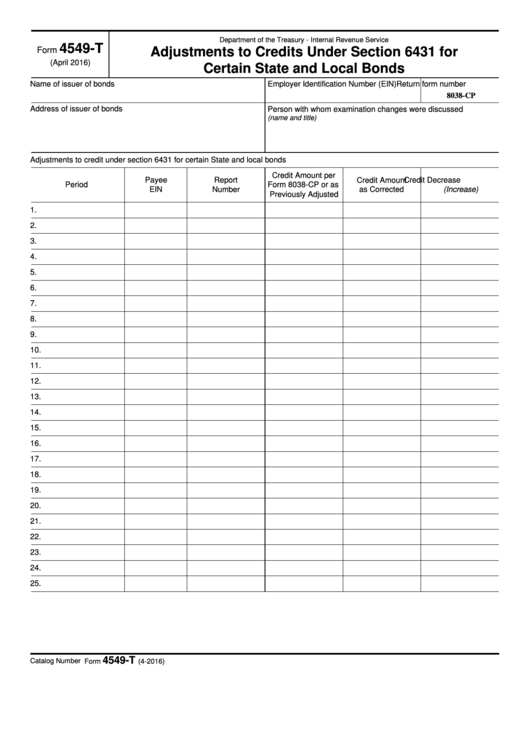

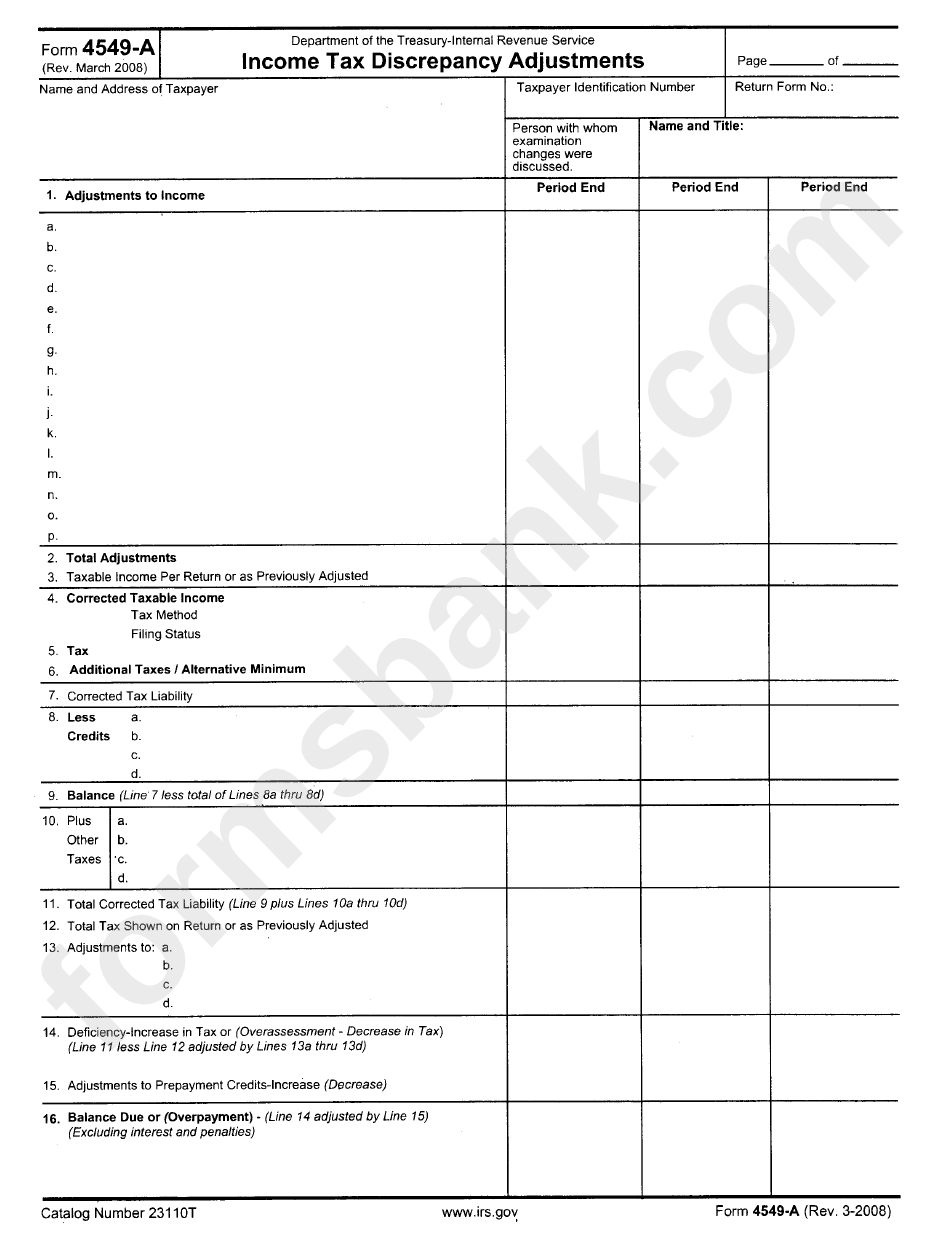

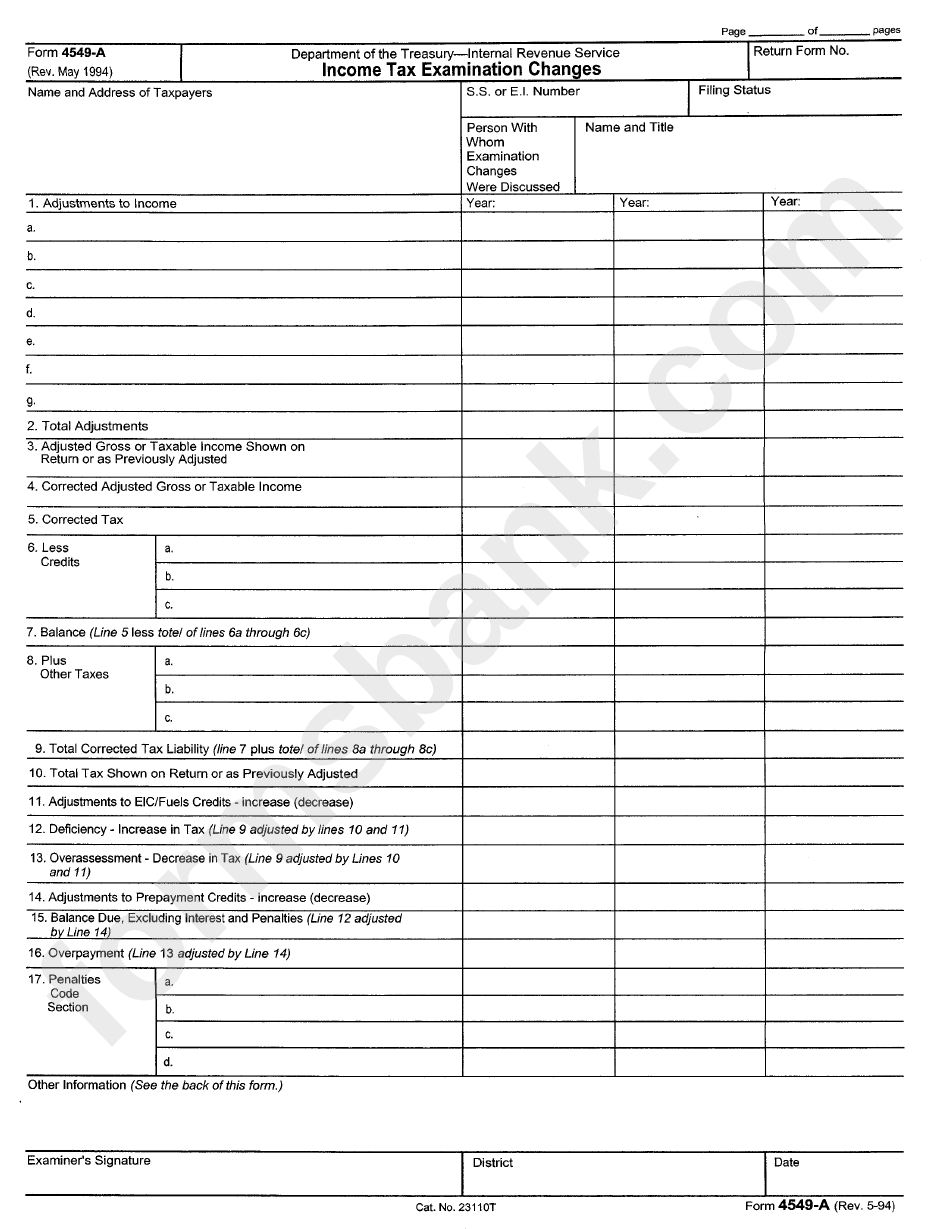

Form 4549A Tax Discrepancy Adjustments printable pdf download

Web form 4549 is an irs form that is sent to taxpayers whose returns have been audited. It will include information, including: You could have received the form 4549 along with a notice of deficiency when you have unfiled returns and the irs has determined that you owe. If you understand and agree with the proposed changes, sign and date.

36 Irs Form 886 A Worksheet support worksheet

Web what happens when i get the form 4549 or audit letter? It will include information, including: Form 4549, report of income tax examination changes. If you agree with us, sign and return the agreement part of the audit. Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the acceptance of the area.

IRS Audit Letter 692 Sample 1

Web the title of irs form 4549 is income tax examination changes, which of course signifies that your income tax return is being changed, often for the worse. Web a regular agreed report (form 4549) may contain up to three tax years. Web what happens when i get the form 4549 or audit letter? The agency may think you failed.

Form 4549A Tax Examination Changes printable pdf download

This form means the irs is questioning your tax return. Web the title of irs form 4549 is income tax examination changes, which of course signifies that your income tax return is being changed, often for the worse. Form 4549, report of income tax examination changes. The form will include a summary of the proposed changes to the tax return,.

Web Form 4549 Is An Irs Form That Is Sent To Taxpayers Whose Returns Have Been Audited.

Web an irs form 4549 is a statement of income tax examination changes. this is merely a proposed adjustment if it is attached to a letter 525, 692 or 1912. This letter is intended to inform the taxpayer about not only what the irs found, but also the proposed changes they made to the taxpayer’s tax form. Form 4549, report of income tax examination changes. This form means the irs is questioning your tax return.

Agreed Rars Require The Taxpayer’s Signature And Include A Statement That The Report Is Subject To The Acceptance Of The Area Director, Area Manager, Specialty Tax Program Chief, Or Director Of Field Operations.

Web a regular agreed report (form 4549) may contain up to three tax years. If you agree with us, sign and return the agreement part of the audit. The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of the audit. The agency may think you failed to report some income, took too many deductions, or didn't pay enough taxes.

However, If Form 4549 Is Attached To A Notice Of Deficiency Then The Irs Has Made A.

You could have received the form 4549 along with a notice of deficiency when you have unfiled returns and the irs has determined that you owe. Web the title of irs form 4549 is income tax examination changes, which of course signifies that your income tax return is being changed, often for the worse. Normally, the irs will use the form for the initial report only, and the irs reasonably expects agreement. If your return (s) are not filed:

Web Form 4549, Income Tax Examination Changes, Is Used For Cases That Result In:

If you understand and agree with the proposed changes, sign and date the form 4549. Web the irs form 4549 is the income tax examination changes letter. It will include information, including: Web what happens when i get the form 4549 or audit letter?