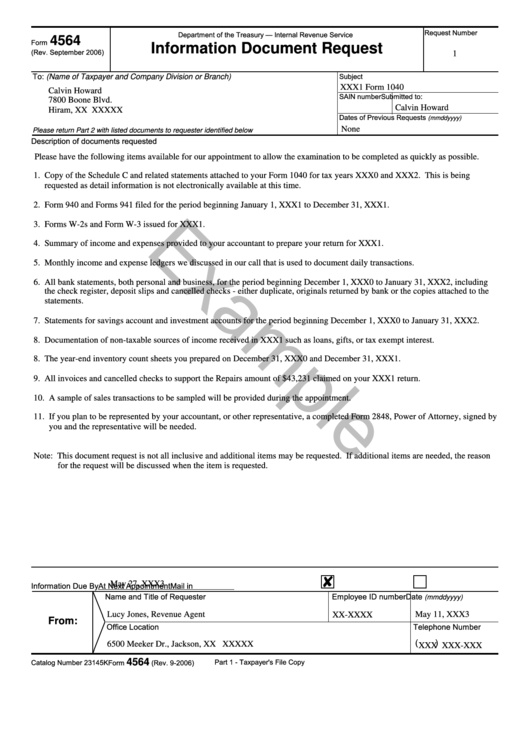

Irs Form 4564

Irs Form 4564 - If you receive an idr, you should answer the request within the prescribed. Web request for transcript of tax return use this form to order a transcript or other return information free of charge, or designate a third party to receive the information. Web the irs uses form 4564 to request information from you in an audit. One primary method for the irs to obtain this information is through information document requests, or idrs for short. The form is called an information document request (idr). This is an extremely important document. Web guide to irs information document request (idr) and form 4564. Intervention in political campaign submitted to: Dates of previous requests (mmddyyyy) description of. The irs has broad statutory authority to examine a taxpayer’s records during an audit.

Web what is irs form 4564? _____ purpose of this idr One primary method for the irs to obtain this information is through information document requests, or idrs for short. The irs uses this form to request documents during tax audits. The irs has broad statutory authority to examine a taxpayer’s records during an audit. This is an extremely important document. Form 4564 is an information document request (idr). Web request for transcript of tax return use this form to order a transcript or other return information free of charge, or designate a third party to receive the information. The form is called an information document request (idr). Web the irs uses form 4564 to request information from you in an audit.

Dates of previous requests (mmddyyyy) description of. The irs serves you with form 4564 when they seek a detailed examination of you. Web guide to irs information document request (idr) and form 4564. [insert name of taxpayer] tax year(s): Web the irs uses form 4564 to request information from you in an audit. The irs has broad statutory authority to examine a taxpayer’s records during an audit. Web request for transcript of tax return use this form to order a transcript or other return information free of charge, or designate a third party to receive the information. If you receive an idr, you should answer the request within the prescribed. (name of taxpayer and company, division or branch) taxpayer name address line 1 city, st zipcode subject: The goal of submitting form 4564 is to prove your case for what you filed or are getting back as a deduction, but this can be difficult.

IRS Audit Letter 3573 Sample 1

Web form 4564 department of the treasury internal revenue service information document request request #1 to: Web catalog number 23145k www.irs.gov form 4564 (rev. [insert name of taxpayer] tax year(s): The form explains the issue being audited and the type of documents you. Dates of previous requests (mmddyyyy) description of.

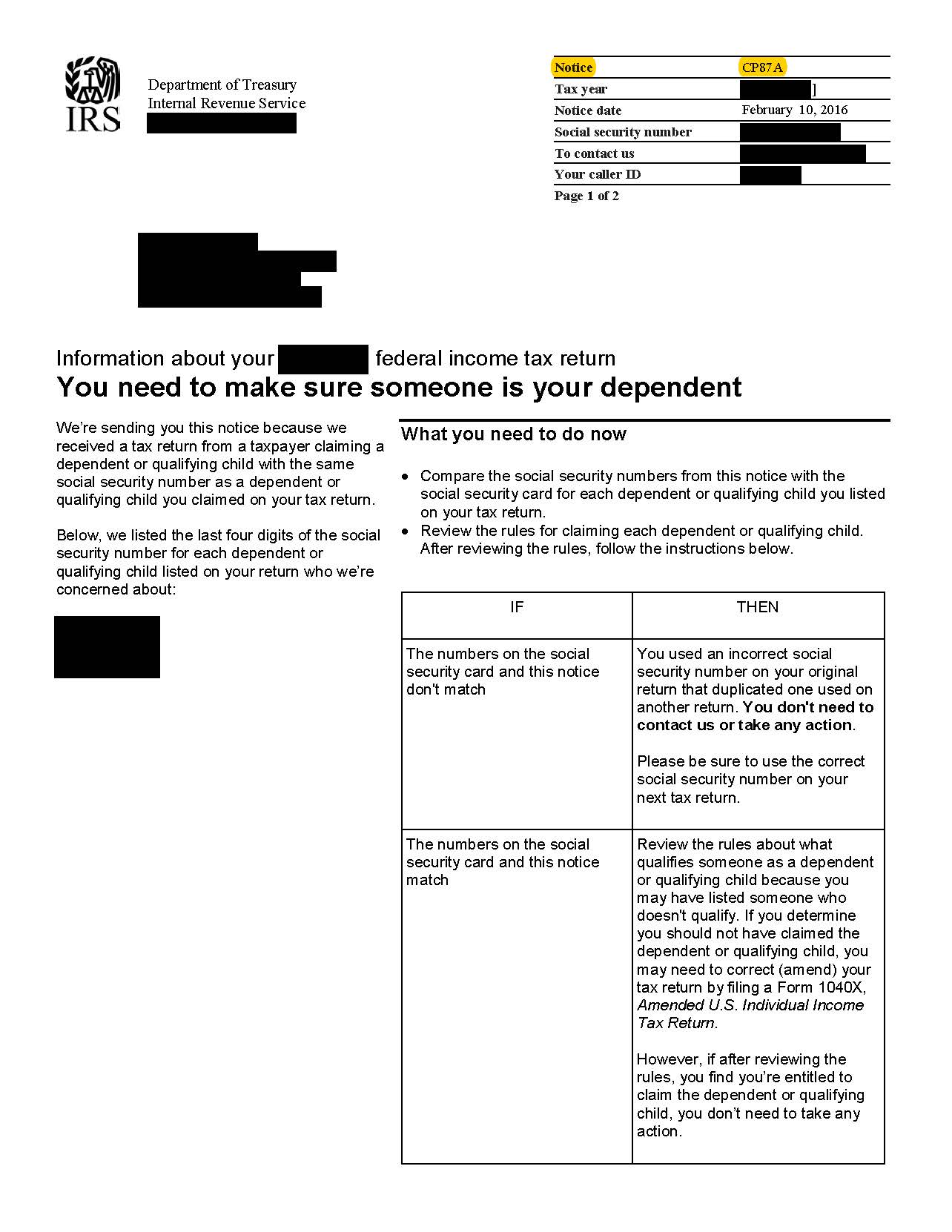

IRS Notice CP87A Tax Attorney Steps to Answer

The form is called an information document request (idr). This is an extremely important document. Web request for transcript of tax return use this form to order a transcript or other return information free of charge, or designate a third party to receive the information. [insert name of taxpayer] tax year(s): Web guide to irs information document request (idr) and.

Form 4564 (2006) Information Document Request printable pdf download

This is an extremely important document. Dates of previous requests (mmddyyyy) description of. Web what is irs form 4564? [insert name of taxpayer] tax year(s): (name of taxpayer and company, division or branch) taxpayer name address line 1 city, st zipcode subject:

Irs 4564 Information Request Form Online PDF Template

The goal of submitting form 4564 is to prove your case for what you filed or are getting back as a deduction, but this can be difficult. Web form 4564 department of the treasury internal revenue service information document request request #1 to: _____ purpose of this idr Web what is irs form 4564? One primary method for the irs.

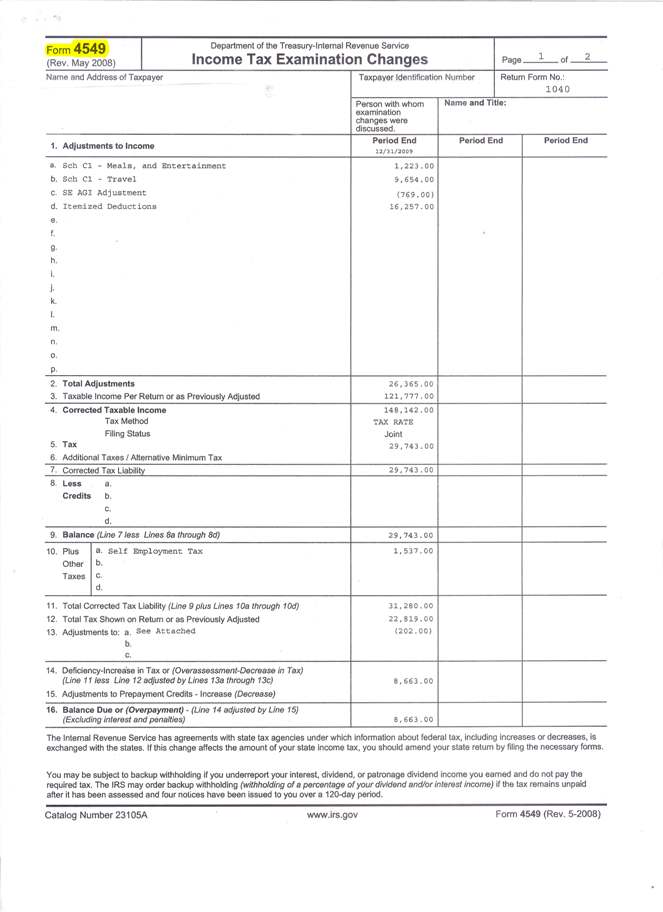

Audit Form 4549 Tax Lawyer Response to IRS Determination

[insert name of taxpayer] tax year(s): The irs uses this form to request documents during tax audits. Web catalog number 23145k www.irs.gov form 4564 (rev. (name of taxpayer and company, division or branch) taxpayer name address line 1 city, st zipcode subject: Intervention in political campaign submitted to:

IRS Audit Letter 2205A Sample 5

The form explains the issue being audited and the type of documents you. There are several versions of the form 4564 so yours may not be exactly the same as this example, nor will the irs requests be the same. Form 4564 is an information document request (idr). Intervention in political campaign submitted to: If you receive an idr, you.

IRS Audit Letter 3572 Sample 2

The form explains the issue being audited and the type of documents you. This is an extremely important document. None description of documents requested: Web form 4564 department of the treasury internal revenue service information document request request #1 to: Web catalog number 23145k www.irs.gov form 4564 (rev.

What is an IRS Information Document Request (IDR)? Abajian Law

The form explains the issue being audited and the type of documents you. None description of documents requested: (name of taxpayer and company division or branch) please return part 2 with listed documents to requester identified below subject sain number submitted to: One primary method for the irs to obtain this information is through information document requests, or idrs for.

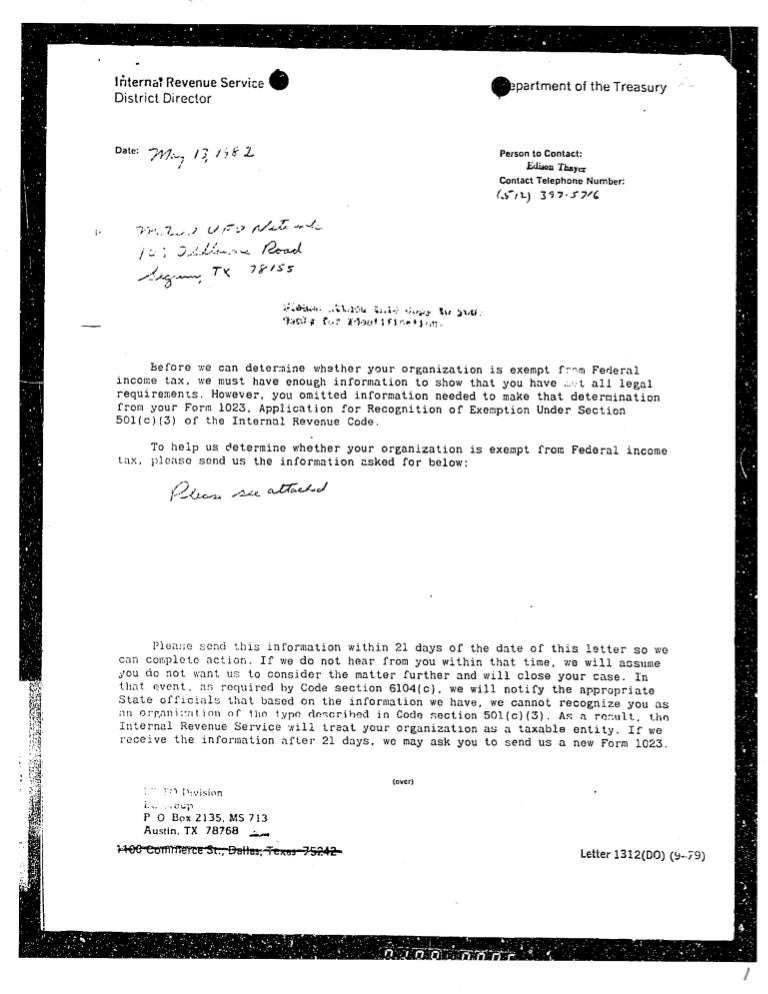

1982 irs form 4564 13 may 82. irs letter 24 june 82

This is an extremely important document. One primary method for the irs to obtain this information is through information document requests, or idrs for short. The irs serves you with form 4564 when they seek a detailed examination of you. If you receive an idr, you should answer the request within the prescribed. Web the irs uses form 4564 to.

Handling IRS Audits IRS Information Document Request (Form 4564

The form is called an information document request (idr). (name of taxpayer and company, division or branch) taxpayer name address line 1 city, st zipcode subject: The irs serves you with form 4564 when they seek a detailed examination of you. This is an extremely important document. Web what is irs form 4564?

The Irs Has Broad Statutory Authority To Examine A Taxpayer’s Records During An Audit.

The irs uses this form to request documents during tax audits. The form explains the issue being audited and the type of documents you. The irs serves you with form 4564 when they seek a detailed examination of you. [insert name of taxpayer] tax year(s):

There Are Several Versions Of The Form 4564 So Yours May Not Be Exactly The Same As This Example, Nor Will The Irs Requests Be The Same.

None description of documents requested: Web the irs tends to use idr form 4564 for more serious investigations. Web guide to irs information document request (idr) and form 4564. Web the irs uses form 4564 to request information from you in an audit.

One Primary Method For The Irs To Obtain This Information Is Through Information Document Requests, Or Idrs For Short.

(name of taxpayer and company division or branch) please return part 2 with listed documents to requester identified below subject sain number submitted to: This is an extremely important document. The goal of submitting form 4564 is to prove your case for what you filed or are getting back as a deduction, but this can be difficult. (name of taxpayer and company, division or branch) taxpayer name address line 1 city, st zipcode subject:

Web Request For Transcript Of Tax Return Use This Form To Order A Transcript Or Other Return Information Free Of Charge, Or Designate A Third Party To Receive The Information.

Web catalog number 23145k www.irs.gov form 4564 (rev. Form 4564 is an information document request (idr). _____ purpose of this idr Dates of previous requests (mmddyyyy) description of.