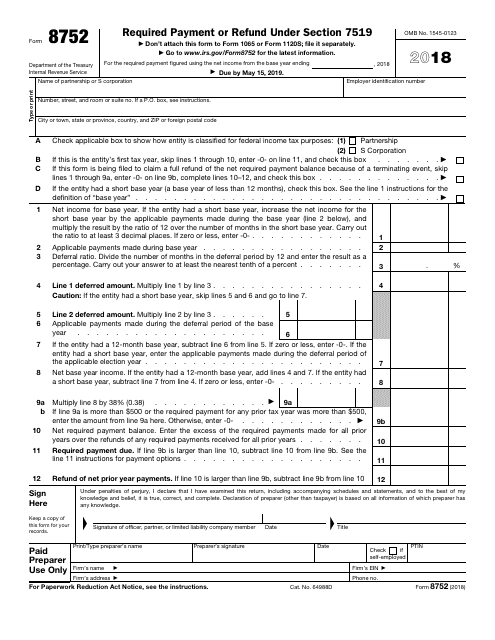

Irs Form 8752

Irs Form 8752 - If the entity's principal place of business or principal office or agency is located in. Form 8816, special loss discount account and special estimated tax payments for insurance companies: Web the way to complete the irs 8752 online: Required payment or refund under section 7519 1993 form 8752: For your base year ending in. Ad access irs tax forms. Click the button get form to open it and start modifying. In general, the term “applicable payments” means any amount deductible in the base year. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the. Ad access irs tax forms.

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the. Web per irs instructions, the 2019 form 8752 (required payment or refund under section 7519) must be mailed and the required payment made by may 15, 2020. It is expected that the new forms will be mailed to taxpayers by march 15, 1991. Required payment or refund under section 7519 1993 form 8752: The irs asks fiscal year, s corporation s, and partnership s to file a form 8752. Web for applicable election years beginning in 2022, form 8752 must be filed and the required payment made on or before may 15, 2023. Web s corporation that has elected under section 444 to have a tax year other than a required tax year. Ad access irs tax forms. Web hello i filed a form 8752 and i expect a refund of deposits paid of about 8000 dollars how can i check the status of my deposit refund. Web form 8752 is a federal other form.

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the. Required payment or refund under section 7519 1994 form 8752: Click the button get form to open it and start modifying. The form is used for. A partnership or s corporation must file form 8752 if it made a. Web per irs instructions, the 2019 form 8752 (required payment or refund under section 7519) must be mailed and the required payment made by may 15, 2020. If the entity's principal place of business or principal office or agency is located in. Web s corporation that has elected under section 444 to have a tax year other than a required tax year. The irs asks fiscal year, s corporation s, and partnership s to file a form 8752. Required payment or refund under section 7519 1993 form 8752:

3.11.249 Processing Form 8752 Internal Revenue Service

I would not have filled it out the way they. Doesn’t that just sound like a blast?. Required payment or refund under section 7519 1994 form 8752: Web for applicable election years beginning in 2022, form 8752 must be filed and the required payment made on or before may 15, 2023. It is expected that the new forms will be.

Form 8752 Required Payment or Refund under Section 7519 (2015) Free

Click the button get form to open it and start modifying. Web form 8752 is a federal other form. Web form 8752, required payment or refund under section 7519: For your base year ending in. A partnership or s corporation must file form 8752 if it made a.

3.12.249 Processing Form 8752 Internal Revenue Service

Web form 8752 (required payment or refund under section 7519) is a federal tax form designed and processed by the internal revenue service (irs). Web form 8752, required payment or refund under section 7519: Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today..

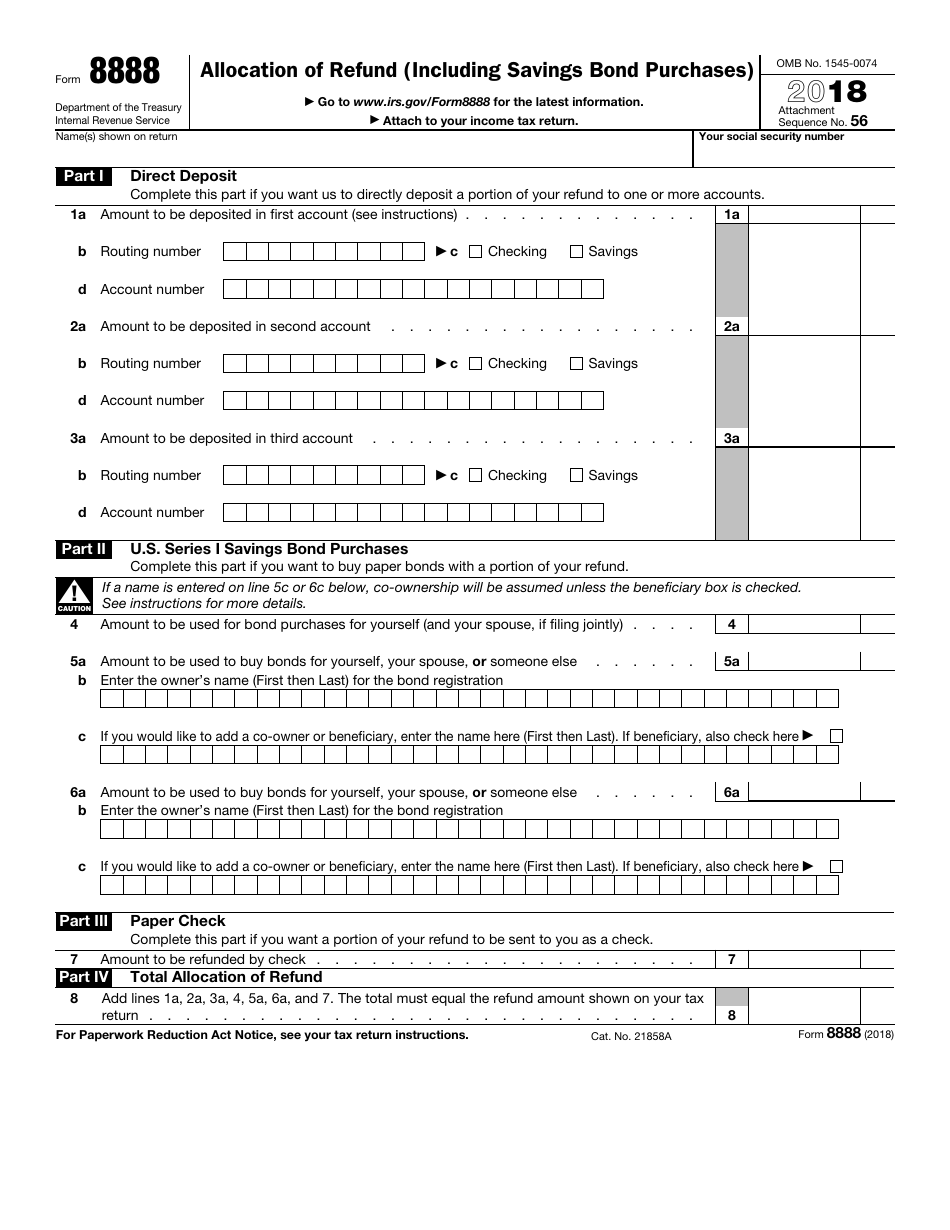

IRS Form 8888 Download Fillable PDF or Fill Online Allocation of Refund

Web the way to complete the irs 8752 online: Ad access irs tax forms. It is expected that the new forms will be mailed to taxpayers by march 15, 1991. Web hello i filed a form 8752 and i expect a refund of deposits paid of about 8000 dollars how can i check the status of my deposit refund. Complete,.

2.3.59 Command Codes BMFOL and BMFOR Internal Revenue Service

I would not have filled it out the way they. Web mailing addresses for forms 8752. Form 8816, special loss discount account and special estimated tax payments for insurance companies: A partnership or s corporation must file form 8752 if it made a. Required payment or refund under section 7519 1994 form 8752:

3.11.249 Processing Form 8752 Internal Revenue Service

Get ready for tax season deadlines by completing any required tax forms today. Web form 8752 is a federal other form. Required payment or refund under section 7519 1993 form 8752: Web the way to complete the irs 8752 online: Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department.

IRS FORM 13825 PDF

It is expected that the new forms will be mailed to taxpayers by march 15, 1991. I would not have filled it out the way they. Get ready for tax season deadlines by completing any required tax forms today. Web mailing addresses for forms 8752. Web s corporation that has elected under section 444 to have a tax year other.

3.11.249 Processing Form 8752 Internal Revenue Service

Required payment or refund under section 7519 1993 form 8752: If the entity's principal place of business or principal office or agency is located in. Doesn’t that just sound like a blast?. Web hello i filed a form 8752 and i expect a refund of deposits paid of about 8000 dollars how can i check the status of my deposit.

IRS Form 8752 Download Fillable PDF or Fill Online Required Payment or

Get ready for tax season deadlines by completing any required tax forms today. Required payment or refund under section 7519 1993 form 8752: The irs asks fiscal year, s corporation s, and partnership s to file a form 8752. Ad access irs tax forms. Doesn’t that just sound like a blast?.

Fill Free fillable IRS PDF forms

In general, the term “applicable payments” means any amount deductible in the base year. Web s corporation that has elected under section 444 to have a tax year other than a required tax year. Web form 8752 is a federal other form. I would not have filled it out the way they. Web hello i filed a form 8752 and.

Web S Corporation That Has Elected Under Section 444 To Have A Tax Year Other Than A Required Tax Year.

If the entity's principal place of business or principal office or agency is located in. Web form 8752 (required payment or refund under section 7519) is a federal tax form designed and processed by the internal revenue service (irs). Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today.

Web Per Irs Instructions, The 2019 Form 8752 (Required Payment Or Refund Under Section 7519) Must Be Mailed And The Required Payment Made By May 15, 2020.

Web for applicable election years beginning in 2022, form 8752 must be filed and the required payment made on or before may 15, 2023. Web mailing addresses for forms 8752. It is expected that the new forms will be mailed to taxpayers by march 15, 1991. In general, the term “applicable payments” means any amount deductible in the base year.

Web Hello I Filed A Form 8752 And I Expect A Refund Of Deposits Paid Of About 8000 Dollars How Can I Check The Status Of My Deposit Refund.

The irs asks fiscal year, s corporation s, and partnership s to file a form 8752. For your base year ending in. Web file form 8752 at the applicable irs address listed below. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the.

Complete, Edit Or Print Tax Forms Instantly.

The form is used for. Required payment or refund under section 7519 1994 form 8752: Complete, edit or print tax forms instantly. Web the new form 8752 replaces the old form 720, which should no longer be used.