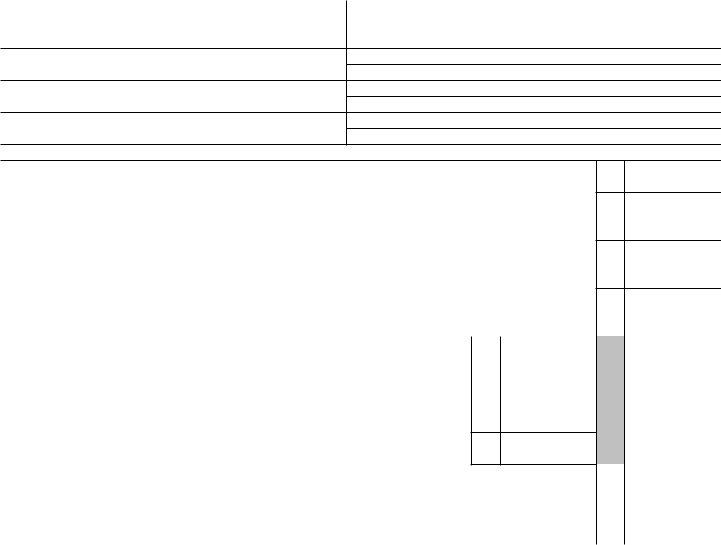

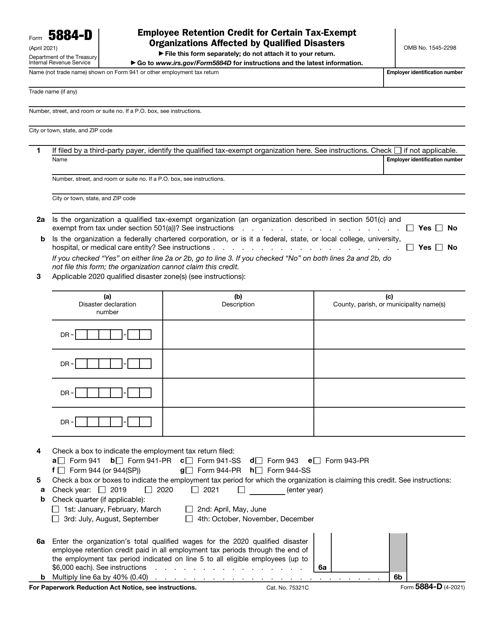

Irs Form 8815

Irs Form 8815 - Web download fillable ir's form 8815 in pdf — the latest version applicable for 2022. When buying a series i or electronic series ee bond, you pay the face value of the bond. Then, when the bond matures, you get the bond amount plus the accrued interest. It accrues interest until the bond matures. Web use irs schedule b and form 8815 to report and calculate any excluded i bond interest used for education. If you find the form 8815 menu is starred and inaccessible, remove the amount of interest and dividends already entered under the interest and dividends. Savings bonds issued after 1989 (for filers with qualified higher education expenses) go to www.irs.gov/form8815 for the latest information. Savings bonds this year that were issued after 1989, you may be able to exclude from your income part or all of the interest on those bonds. Savings bonds to comply with the irs recordkeeping requirements.) this form is confusing, since it refers only to qualified higher education expenses. Fill out the exclusion of interest on social security.

Web we last updated the exclusion of interest from series ee and i u.s. Web federal form 8815 instructions general instructions future developments for the latest information about developments related to form 8815 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8815. Savings bonds to comply with the irs recordkeeping requirements.) this form is confusing, since it refers only to qualified higher education expenses. Download fillable ir's form 8723 in pdf — the latest version applicable for 2019. Web (the instructions that come with irs form 8815 explain both qualified expenses and eligible institution. they also tell you what records you must keep.) the expenses were for yourself, your spouse, or someone you list as a dependent on your federal income tax return. Web form 8815 department of the treasury internal revenue service exclusion of interest from series ee and i u.s. ( irs form 8818 can be used to record the redemption of u.s. Web if you cashed series ee or i u.s. Then, when the bond matures, you get the bond amount plus the accrued interest. Savings bonds issued after 1989 (for filers with qualified higher education expenses) go to www.irs.gov/form8815 for the latest information.

Download fillable ir's form 8723 in pdf — the latest version applicable for 2019. Web federal form 8815 instructions general instructions future developments for the latest information about developments related to form 8815 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8815. Savings bonds to comply with the irs recordkeeping requirements.) this form is confusing, since it refers only to qualified higher education expenses. Savings bonds issued after 1989 (for filers with qualified higher education expenses) go to www.irs.gov/form8815 for the latest information. If you find the form 8815 menu is starred and inaccessible, remove the amount of interest and dividends already entered under the interest and dividends. ( irs form 8818 can be used to record the redemption of u.s. When buying a series i or electronic series ee bond, you pay the face value of the bond. You file your irs tax return with any status except married filing separately. Web if you cashed series ee or i u.s. Fill out the exclusion of interest on social security.

Form 8815 Edit, Fill, Sign Online Handypdf

Savings bonds issued after 1989 (for filers with qualified higher education expenses) go to www.irs.gov/form8815 for the latest information. Use form 8815 to figure the amount of any interest you may exclude. Savings bonds issued after 1989 in december 2022, so this is the latest version of form 8815, fully updated for tax year 2022. Then, when the bond matures,.

Problem 457 (LO. 4) Charles E. age 64, will retire next year

Web a savings bond rollover is reported on irs form 8815 to exclude the savings bond interest from income. Web if you cashed series ee or i u.s. Savings bonds issued after 1989 in december 2022, so this is the latest version of form 8815, fully updated for tax year 2022. Web federal form 8815 instructions general instructions future developments.

Irs Form 9465 Fs Universal Network

You file your irs tax return with any status except married filing separately. Savings bonds issued after 1989 in december 2022, so this is the latest version of form 8815, fully updated for tax year 2022. If you find the form 8815 menu is starred and inaccessible, remove the amount of interest and dividends already entered under the interest and.

Fill Free fillable Form 8815 U.S. Savings Bonds Issued After 1989

Savings bonds issued after 1989 in december 2022, so this is the latest version of form 8815, fully updated for tax year 2022. Savings bonds this year that were issued after 1989, you may be able to exclude from your income part or all of the interest on those bonds. Savings bonds to comply with the irs recordkeeping requirements.) this.

Online IRS Form 8815 2019 Fillable and Editable PDF Template

Savings bonds to comply with the irs recordkeeping requirements.) this form is confusing, since it refers only to qualified higher education expenses. Then, when the bond matures, you get the bond amount plus the accrued interest. Web federal form 8815 instructions general instructions future developments for the latest information about developments related to form 8815 and its instructions, such as.

Form 8815 ≡ Fill Out Printable PDF Forms Online

Fill out the exclusion of interest on social security. You file your irs tax return with any status except married filing separately. If you find the form 8815 menu is starred and inaccessible, remove the amount of interest and dividends already entered under the interest and dividends. Web federal form 8815 instructions general instructions future developments for the latest information.

Form 8815 Exclusion Of Interest printable pdf download

If you find the form 8815 menu is starred and inaccessible, remove the amount of interest and dividends already entered under the interest and dividends. Use form 8815 to figure the amount of any interest you may exclude. Web federal form 8815 instructions general instructions future developments for the latest information about developments related to form 8815 and its instructions,.

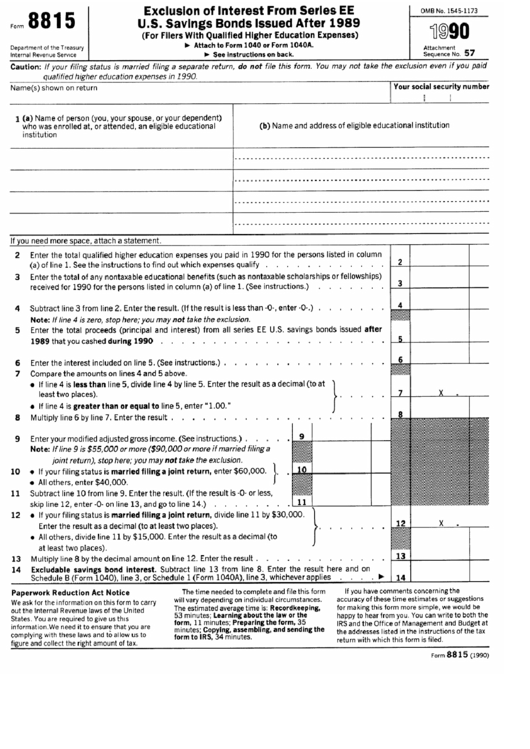

IRS Form 5884D Download Fillable PDF or Fill Online Employee Retention

Web federal form 8815 instructions general instructions future developments for the latest information about developments related to form 8815 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8815. Savings bonds issued after 1989 (for filers with qualified higher education expenses) go to www.irs.gov/form8815 for the latest information. ( irs form 8818 can be used to.

IRS Form 8815 Download Fillable PDF or Fill Online Exclusion of

Web form 8815 department of the treasury internal revenue service exclusion of interest from series ee and i u.s. Web (the instructions that come with irs form 8815 explain both qualified expenses and eligible institution. they also tell you what records you must keep.) the expenses were for yourself, your spouse, or someone you list as a dependent on your.

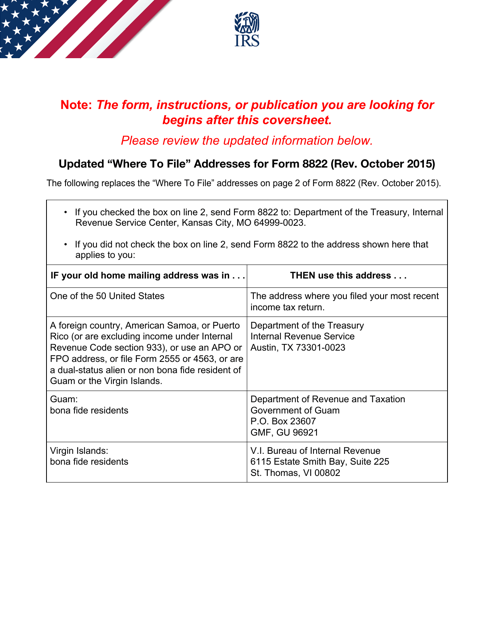

IRS Form 8822 Download Fillable PDF or Fill Online Change of Address

Savings bonds to comply with the irs recordkeeping requirements.) this form is confusing, since it refers only to qualified higher education expenses. It accrues interest until the bond matures. Savings bonds issued after 1989 in december 2022, so this is the latest version of form 8815, fully updated for tax year 2022. Web use irs schedule b and form 8815.

Web A Savings Bond Rollover Is Reported On Irs Form 8815 To Exclude The Savings Bond Interest From Income.

Savings bonds this year that were issued after 1989, you may be able to exclude from your income part or all of the interest on those bonds. Web form 8815 department of the treasury internal revenue service exclusion of interest from series ee and i u.s. Fill out the exclusion of interest on social security. ( irs form 8818 can be used to record the redemption of u.s.

Download Fillable Ir's Form 8723 In Pdf — The Latest Version Applicable For 2019.

Web if you cashed series ee or i u.s. When buying a series i or electronic series ee bond, you pay the face value of the bond. Then, when the bond matures, you get the bond amount plus the accrued interest. Savings bonds issued after 1989 (for filers with qualified higher education expenses) go to www.irs.gov/form8815 for the latest information.

Savings Bonds Issued After 1989 In December 2022, So This Is The Latest Version Of Form 8815, Fully Updated For Tax Year 2022.

Savings bonds to comply with the irs recordkeeping requirements.) this form is confusing, since it refers only to qualified higher education expenses. It accrues interest until the bond matures. You file your irs tax return with any status except married filing separately. Web download fillable ir's form 8815 in pdf — the latest version applicable for 2022.

If You Find The Form 8815 Menu Is Starred And Inaccessible, Remove The Amount Of Interest And Dividends Already Entered Under The Interest And Dividends.

Web (the instructions that come with irs form 8815 explain both qualified expenses and eligible institution. they also tell you what records you must keep.) the expenses were for yourself, your spouse, or someone you list as a dependent on your federal income tax return. You pay $1,000 for a $1,000 bond. Web use irs schedule b and form 8815 to report and calculate any excluded i bond interest used for education. Web federal form 8815 instructions general instructions future developments for the latest information about developments related to form 8815 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8815.