Irs Form 8823

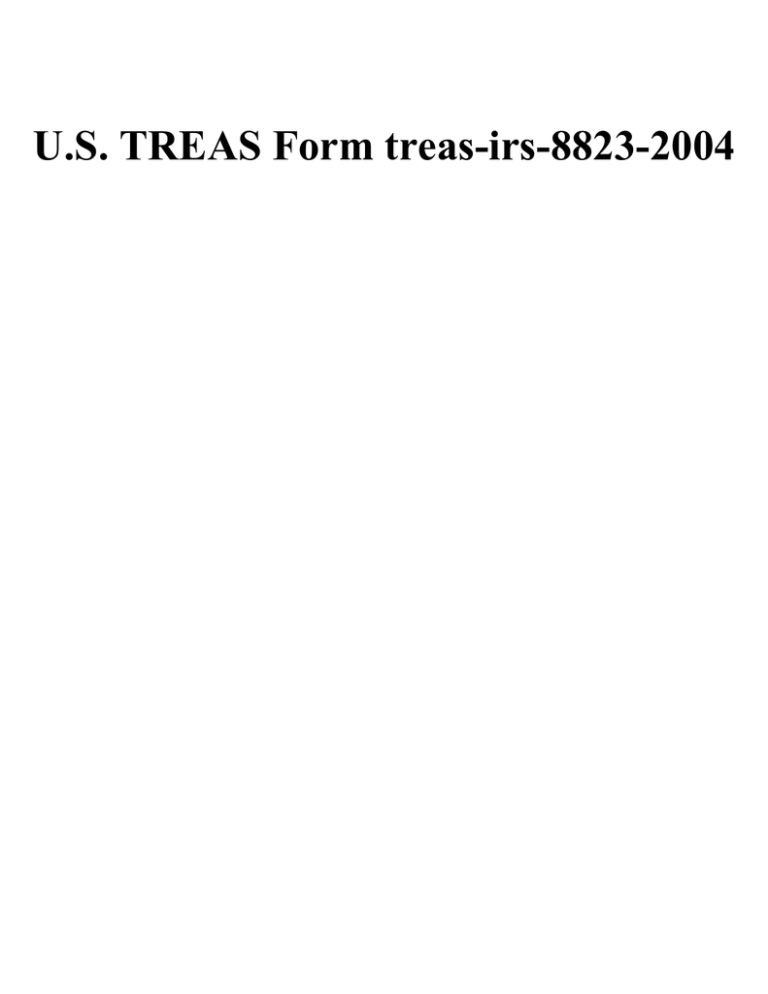

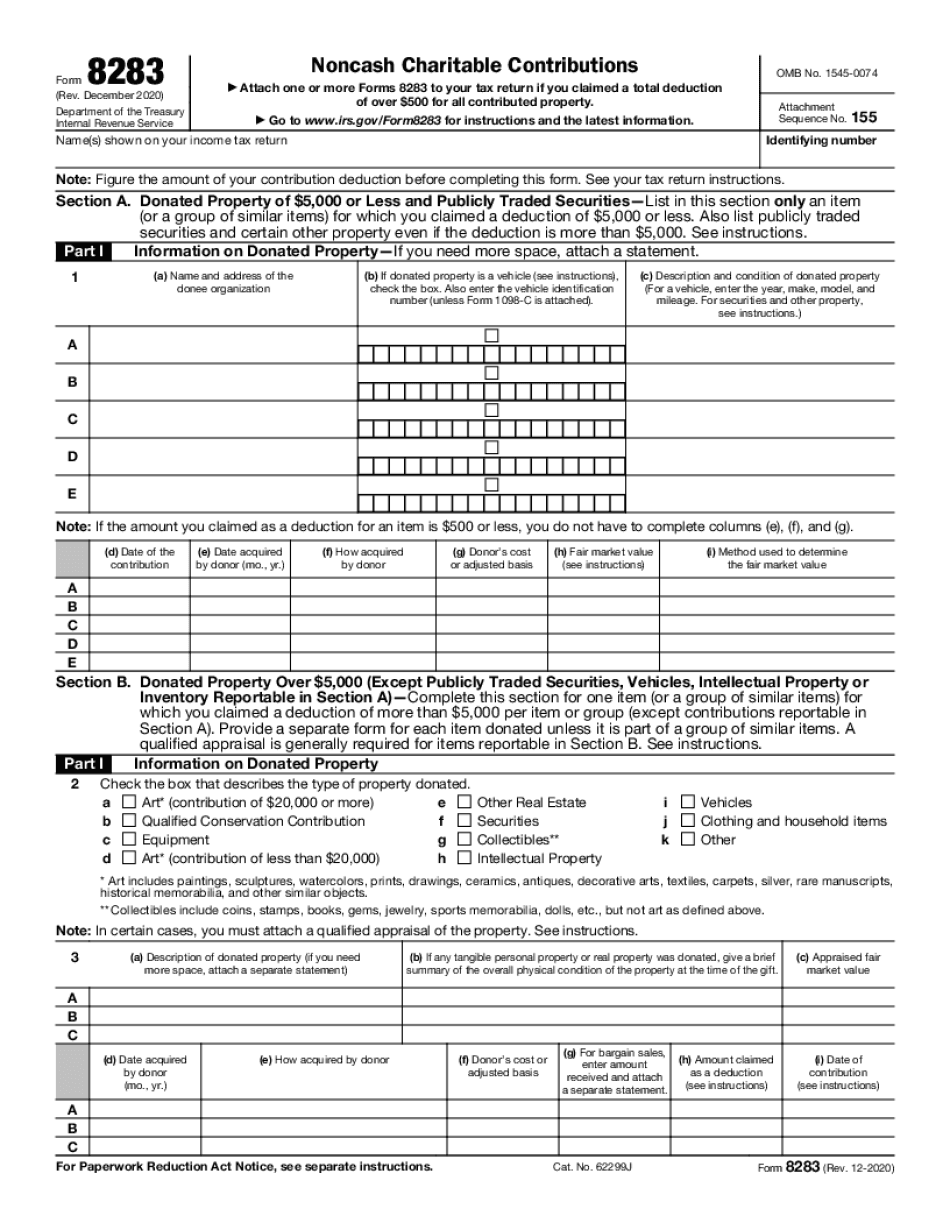

Irs Form 8823 - Web there are 17 categories of noncompliance on the irs form 8823 and each has a corresponding chapter in the guide that frames what it means to comply, what would trigger an event of noncompliance and how to correct if noncompliance occurs. Written comments should be received on or before [insert date 60 days after date of publication in the federal register] to be assured of. See exhibit 1 at the end of this chapter for a complete description of the process. Web the paperwork reduction act of 1995. C corporations, other than personal service corporations and closely held corporations, must file form 8283 only if the amount claimed as a deduction is more than $5,000 per item or group of similar items. June 2023) department of the treasury internal revenue service. Web form 8283 is filed by individuals, partnerships, and corporations. Forms 8823 are routinely analyzed by the irs. If the noncompliance is corrected within three years after the end of the correction period, the state agency must file a form 8823. Web a corrected 8823 tells the irs that the state agency found reportable noncompliance, a reasonable period to correct it was given and that the owner/agent complied with the requirements and is now back in compliance.

June 2023) department of the treasury internal revenue service. If the noncompliance is corrected within three years after the end of the correction period, the state agency must file a form 8823. Web the internal revenue service (irs) on march 25 released an updated version of its guide for completing form 8823: Web there are 17 categories of noncompliance on the irs form 8823 and each has a corresponding chapter in the guide that frames what it means to comply, what would trigger an event of noncompliance and how to correct if noncompliance occurs. Web a corrected 8823 tells the irs that the state agency found reportable noncompliance, a reasonable period to correct it was given and that the owner/agent complied with the requirements and is now back in compliance. Web the paperwork reduction act of 1995. Web guide for completing form 8823: Web internal revenue service (irs) form 8823 and its accompanying handbook, the guide to completing form 8823, are critical pieces to the rather complicated puzzle of establishing and maintaining compliance with the program’s federal regulatory requirements as detailed in section 42 of the internal revenue code. C corporations, other than personal service corporations and closely held corporations, must file form 8283 only if the amount claimed as a deduction is more than $5,000 per item or group of similar items. See exhibit 1 at the end of this chapter for a complete description of the process.

Web there are 17 categories of noncompliance on the irs form 8823 and each has a corresponding chapter in the guide that frames what it means to comply, what would trigger an event of noncompliance and how to correct if noncompliance occurs. Web a corrected 8823 tells the irs that the state agency found reportable noncompliance, a reasonable period to correct it was given and that the owner/agent complied with the requirements and is now back in compliance. Web the paperwork reduction act of 1995. If the noncompliance is corrected within three years after the end of the correction period, the state agency must file a form 8823. Web the internal revenue service (irs) on march 25 released an updated version of its guide for completing form 8823: Forms 8823 are routinely analyzed by the irs. Written comments should be received on or before [insert date 60 days after date of publication in the federal register] to be assured of. C corporations, other than personal service corporations and closely held corporations, must file form 8283 only if the amount claimed as a deduction is more than $5,000 per item or group of similar items. Irs analysis of forms 8823 submitted by state agencies. See exhibit 1 at the end of this chapter for a complete description of the process.

U.S. TREAS Form treasirs88232004

File a separate form 8823 for each building that is disposed of or goes out of compliance. Web guide for completing form 8823: C corporations, other than personal service corporations and closely held corporations, must file form 8283 only if the amount claimed as a deduction is more than $5,000 per item or group of similar items. If the noncompliance.

IRS 1041T 2019 Fill and Sign Printable Template Online US Legal Forms

See exhibit 1 at the end of this chapter for a complete description of the process. An uncorrected 8823 is a bit more complex and is cause for concern. C corporations, other than personal service corporations and closely held corporations, must file form 8283 only if the amount claimed as a deduction is more than $5,000 per item or group.

form 8823 instructions Fill Online, Printable, Fillable Blank form

Web the paperwork reduction act of 1995. Web there are 17 categories of noncompliance on the irs form 8823 and each has a corresponding chapter in the guide that frames what it means to comply, what would trigger an event of noncompliance and how to correct if noncompliance occurs. Web a corrected 8823 tells the irs that the state agency.

IRS Form 8823 Download Fillable PDF or Fill Online Housing

C corporations, other than personal service corporations and closely held corporations, must file form 8283 only if the amount claimed as a deduction is more than $5,000 per item or group of similar items. Web form 8283 is filed by individuals, partnerships, and corporations. See exhibit 1 at the end of this chapter for a complete description of the process..

Form 8823 General Instructions printable pdf download

Web form 8283 is filed by individuals, partnerships, and corporations. Web the paperwork reduction act of 1995. If the noncompliance is corrected within three years after the end of the correction period, the state agency must file a form 8823. Written comments should be received on or before [insert date 60 days after date of publication in the federal register].

IRS 8829 Instructions 2019 Fill and Sign Printable Template Online

Web the internal revenue service (irs) on march 25 released an updated version of its guide for completing form 8823: Irs analysis of forms 8823 submitted by state agencies. If the noncompliance is corrected within three years after the end of the correction period, the state agency must file a form 8823. Web the paperwork reduction act of 1995. Written.

IRS Instructions 1065 2019 Fill out Tax Template Online US Legal Forms

Irs analysis of forms 8823 submitted by state agencies. Forms 8823 are routinely analyzed by the irs. File a separate form 8823 for each building that is disposed of or goes out of compliance. June 2023) department of the treasury internal revenue service. C corporations, other than personal service corporations and closely held corporations, must file form 8283 only if.

IRS Instruction 1099R & 5498 2019 Fill and Sign Printable Template

C corporations, other than personal service corporations and closely held corporations, must file form 8283 only if the amount claimed as a deduction is more than $5,000 per item or group of similar items. Forms 8823 are routinely analyzed by the irs. If the noncompliance is corrected within three years after the end of the correction period, the state agency.

IRS Instructions 941 2019 Fill and Sign Printable Template Online

See exhibit 1 at the end of this chapter for a complete description of the process. Irs analysis of forms 8823 submitted by state agencies. Web guide for completing form 8823: Web internal revenue service (irs) form 8823 and its accompanying handbook, the guide to completing form 8823, are critical pieces to the rather complicated puzzle of establishing and maintaining.

What is Form 8821 or Tax Guard Excel Capital Management

Written comments should be received on or before [insert date 60 days after date of publication in the federal register] to be assured of. Forms 8823 are routinely analyzed by the irs. File a separate form 8823 for each building that is disposed of or goes out of compliance. Web the paperwork reduction act of 1995. Irs analysis of forms.

File A Separate Form 8823 For Each Building That Is Disposed Of Or Goes Out Of Compliance.

Web the paperwork reduction act of 1995. Web internal revenue service (irs) form 8823 and its accompanying handbook, the guide to completing form 8823, are critical pieces to the rather complicated puzzle of establishing and maintaining compliance with the program’s federal regulatory requirements as detailed in section 42 of the internal revenue code. Forms 8823 are routinely analyzed by the irs. Web guide for completing form 8823:

An Uncorrected 8823 Is A Bit More Complex And Is Cause For Concern.

Web there are 17 categories of noncompliance on the irs form 8823 and each has a corresponding chapter in the guide that frames what it means to comply, what would trigger an event of noncompliance and how to correct if noncompliance occurs. If the noncompliance is corrected within three years after the end of the correction period, the state agency must file a form 8823. C corporations, other than personal service corporations and closely held corporations, must file form 8283 only if the amount claimed as a deduction is more than $5,000 per item or group of similar items. Written comments should be received on or before [insert date 60 days after date of publication in the federal register] to be assured of.

June 2023) Department Of The Treasury Internal Revenue Service.

Web a corrected 8823 tells the irs that the state agency found reportable noncompliance, a reasonable period to correct it was given and that the owner/agent complied with the requirements and is now back in compliance. See exhibit 1 at the end of this chapter for a complete description of the process. Web the internal revenue service (irs) on march 25 released an updated version of its guide for completing form 8823: Web form 8283 is filed by individuals, partnerships, and corporations.