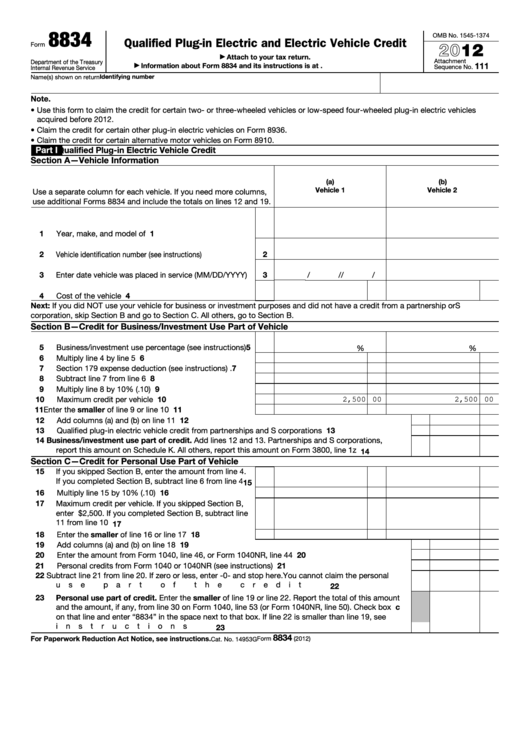

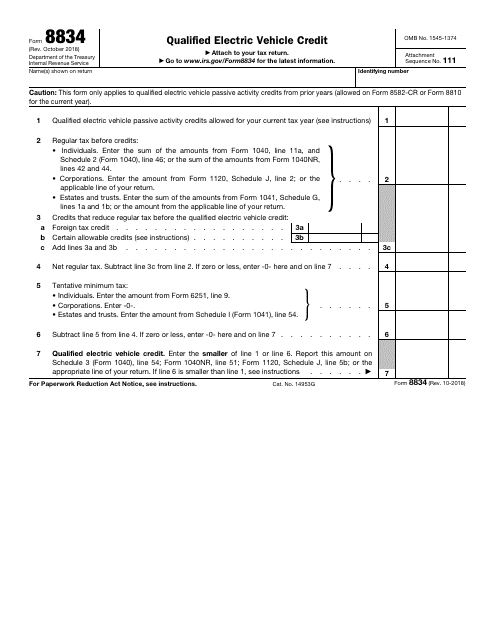

Irs Form 8834

Irs Form 8834 - It is ready and updated in turbo tax now. Deduct the sales tax paid on a new car. Attach to your tax return. It is only used for carryovers of the qualified electric vehicle. The total credit is limited to the excess of your regular tax liability, reduced by certain credits, over your tentative minimum tax. Web for the latest information about developments related to form 8834 and its instructions, such as legislation enacted after they were published, go to. Form 8834 (2009) page 3 if,. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Purpose of form use form 8834 to claim. You can download or print current.

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Deduct the sales tax paid on a new car. Purpose of form use form 8834 to claim. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web filing tax form 8936: December 2019) department of the treasury internal revenue service. October 2017) department of the treasury internal revenue service. Attach to your tax return. Web attach to your tax return. Web taxact does not support form 8834 qualified electric vehicle credit;

It is ready and updated in turbo tax now. Attach to your tax return. Web the credit is limited to $4,000 for each vehicle. Web you can use form 8834 to claim any qualified electric vehicle passive activity credit allowed for the current tax year. Web are you sure that form 8834 is the one that you need? Attach to your tax return. Web attach to your tax return. Web filing tax form 8936: Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web we last updated the qualified electric vehicle credit in february 2023, so this is the latest version of form 8834, fully updated for tax year 2022.

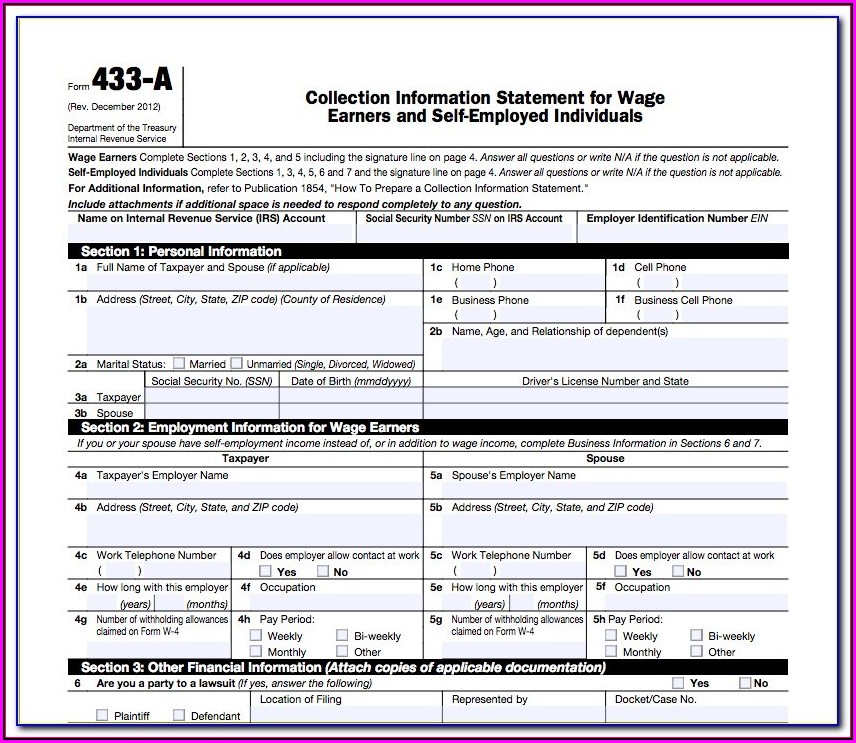

How to use form 9465 instructions for your irs payment plan Artofit

It is only used for carryovers of the qualified electric vehicle. This form only applies to qualified electric. Web attach to your tax return. Web we last updated the qualified electric vehicle credit in february 2023, so this is the latest version of form 8834, fully updated for tax year 2022. December 2019) department of the treasury internal revenue service.

Fillable Form 8834 Qualified PlugIn Electric And Electric Vehicle

Web are you sure that form 8834 is the one that you need? October 2017) department of the treasury internal revenue service. • use this form to claim the credit. In the list of federal individual forms available says that it it is, but. Taxpayers can file form 4868 by mail, but remember to get your request in the mail.

Fillable W 9 Tax Form Form Resume Examples N8VZaW3Ywe

This form only applies to qualified electric. October 2017) department of the treasury internal revenue service. October 2018) department of the treasury internal revenue service. Web we last updated the qualified electric vehicle credit in february 2023, so this is the latest version of form 8834, fully updated for tax year 2022. Web there are several ways to submit form.

Irs Form Section 1031 Universal Network

Web the credit is limited to $4,000 for each vehicle. The total credit is limited to the excess of your regular tax liability, reduced by certain credits, over your tentative minimum tax. Purpose of form use form 8834 to claim. Web are you sure that form 8834 is the one that you need? Form 8834 (2009) page 3 if,.

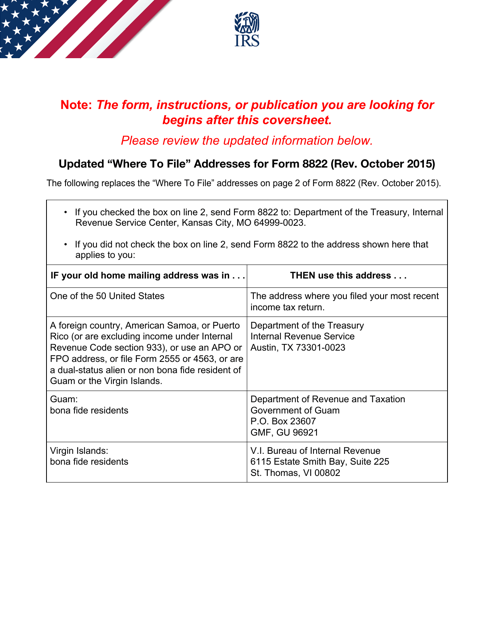

IRS Form 8822 Download Fillable PDF or Fill Online Change of Address

Web the credit is limited to $4,000 for each vehicle. Web we last updated the qualified electric vehicle credit in february 2023, so this is the latest version of form 8834, fully updated for tax year 2022. Web attach to your tax return. Attach to your tax return. Web filing tax form 8936:

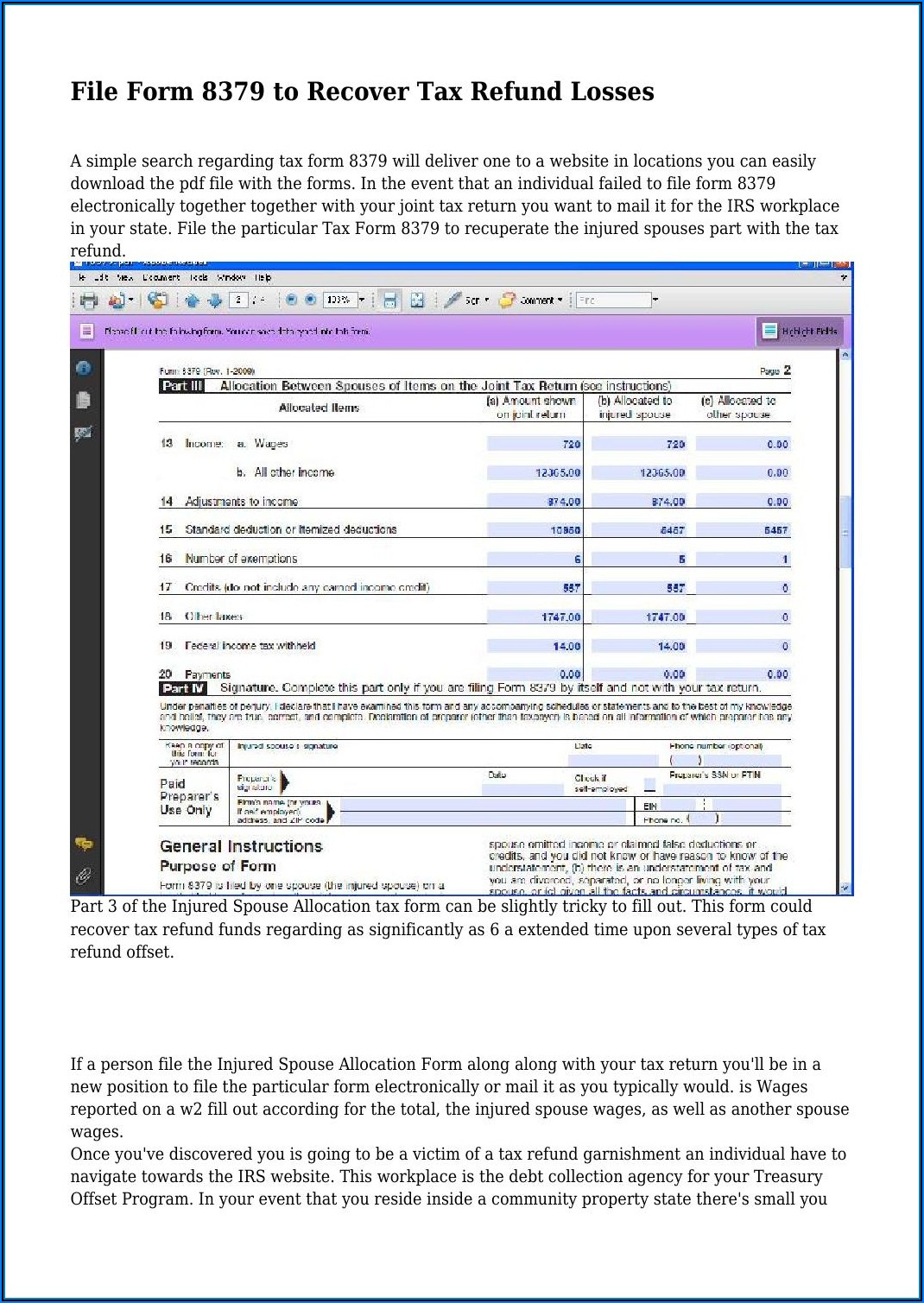

Irs Form 8379 Injured Spouse Allocation Form Resume Examples

Web for the latest information about developments related to form 8834 and its instructions, such as legislation enacted after they were published, go to. Web taxact does not support form 8834 qualified electric vehicle credit; The total credit is limited to the excess of your regular tax liability, reduced by certain credits, over your tentative minimum tax. Employers who withhold.

IRS Form 8834 Download Fillable PDF or Fill Online Qualified Electric

Web employer's quarterly federal tax return. Taxact does not support form 8834, but you can still prepare your return with taxact and mail it to the irs, and include form 8834. Web filing tax form 8936: Web are you sure that form 8834 is the one that you need? Attach to your tax return.

Form 8834 Qualified Electric Vehicle Credit (2014) Free Download

It is ready and updated in turbo tax now. • use this form to claim the credit. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Attach to your tax return. Form 8834 (2009) page 3 if,.

Printable Irs Form 8822 B Form Resume Examples X42M7drYkG

It is only used for carryovers of the qualified electric vehicle. Attach to your tax return. Web there are several ways to submit form 4868. Taxact does not support form 8834, but you can still prepare your return with taxact and mail it to the irs, and include form 8834. This form only applies to qualified electric.

Purpose Of Form Use Form 8834 To Claim.

Web are you sure that form 8834 is the one that you need? Web attach to your tax return. The total credit is limited to the excess of your regular tax liability, reduced by certain credits, over your tentative minimum tax. Web employer's quarterly federal tax return.

General Instructions Section References Are To The Internal Revenue Code.

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. You can download or print current. October 2017) department of the treasury internal revenue service. In the list of federal individual forms available says that it it is, but.

Form 8834 (2009) Page 3 If,.

Attach to your tax return. Form 8834, qualified electric vehicle credit is not available yet in tt. It is ready and updated in turbo tax now. Deduct the sales tax paid on a new car.

Taxact Does Not Support Form 8834, But You Can Still Prepare Your Return With Taxact And Mail It To The Irs, And Include Form 8834.

It is only used for carryovers of the qualified electric vehicle. Web filing tax form 8936: Web for the latest information about developments related to form 8834 and its instructions, such as legislation enacted after they were published, go to. Attach to your tax return.