Irs Form 8868 Electronic Filing

Irs Form 8868 Electronic Filing - Using your tax software or by using a tax professional who uses. You can file a paper form 4868 and. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on. However, they are not part of, nor do they have any special relationship with the internal revenue. Try it for free now! File form 8868 for free when you pay in advance for a 990 return with our package pricing. Web apply tax extension now we are now accepting extension form 8868 for the 2022 tax year. Start filing now instant approval no waiting in long lines, no inconvenient paper. You only need to complete 3 simple steps and your extension form will be filed. Web 1 enter your organization details 2 select the appropriate tax form to file an extension 3 review and transmit it to the irs ready to file your form 8868 electronically?

Web 1 enter your organization details 2 select the appropriate tax form to file an extension 3 review and transmit it to the irs ready to file your form 8868 electronically? Web to file form 8868 using taxact: Upload, modify or create forms. Ad file 990 extension form 8868 online in minutes & extend your 990 deadline up to 6 months. From within your taxact return ( online or desktop), click filing to expand, then click file extension. Web go to www.irs.gov/form8868 for the latest information. Web electronically file or mail an form 4868, application for automatic extension of time to file u.s. Web apply tax extension now we are now accepting extension form 8868 for the 2022 tax year. Web there are several ways to submit form 4868. You’ll receive an acknowledgment or.

You can file form 4868 electronically by accessing irs. You’ll receive an acknowledgment or. Web go to www.irs.gov/form8868 for the latest information. Ad file 990 extension form 8868 online in minutes & extend your 990 deadline up to 6 months. However, they are not part of, nor do they have any special relationship with the internal revenue. Web apply tax extension now we are now accepting extension form 8868 for the 2022 tax year. From within your taxact return ( online or desktop), click filing to expand, then click file extension. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on. Upload, modify or create forms. You only need to complete 3 simple steps and your extension form will be filed.

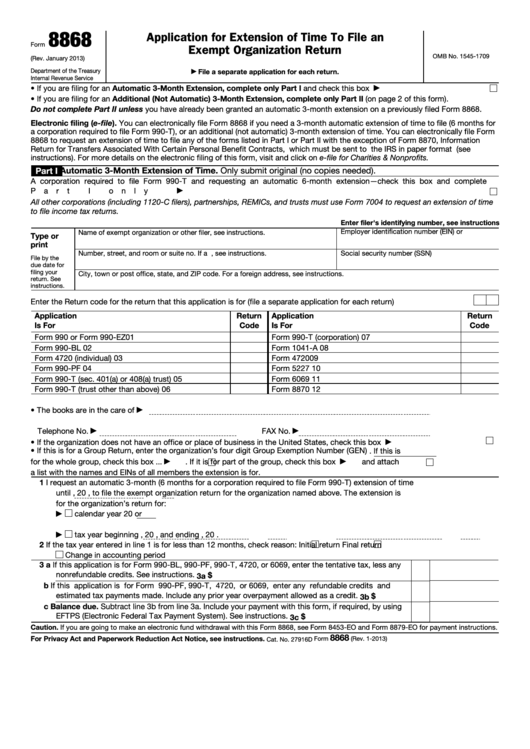

Form 8868 Application for Extension of Time to File an Exempt

You can complete your filing in a few simple steps: Ad file 990 extension form 8868 online in minutes & extend your 990 deadline up to 6 months. On smaller devices, click in the upper left. File form 8868 for free when you pay in advance for a 990 return with our package pricing. Try it for free now!

filing form 1041 Blog ExpressExtension Extensions Made Easy

Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on. From within your taxact return ( online or desktop), click filing to expand, then click file extension. You can complete your filing in a few simple steps: Ad file 990 extension form 8868 online in minutes.

Fillable Form 8868 Application For Extension Of Time To File An

Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on. Using your tax software or by using a tax professional who uses. Try it for free now! Web go to www.irs.gov/form8868 for the latest information. Web there are several ways to submit form 4868.

File Form 8868 Online Efile 990 Extension with the IRS

Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on. You can file a paper form 4868 and. Ad file 990 extension form 8868 online in minutes & extend your 990 deadline up to 6 months. Ad download or email irs 8868 & more fillable forms,.

File Form 8868 Online Efile 990 Extension with the IRS

You only need to complete 3 simple steps and your extension form will be filed. Web to file form 8868 using taxact: Web 1 enter your organization details 2 select the appropriate tax form to file an extension 3 review and transmit it to the irs ready to file your form 8868 electronically? Web information about form 8868, application for.

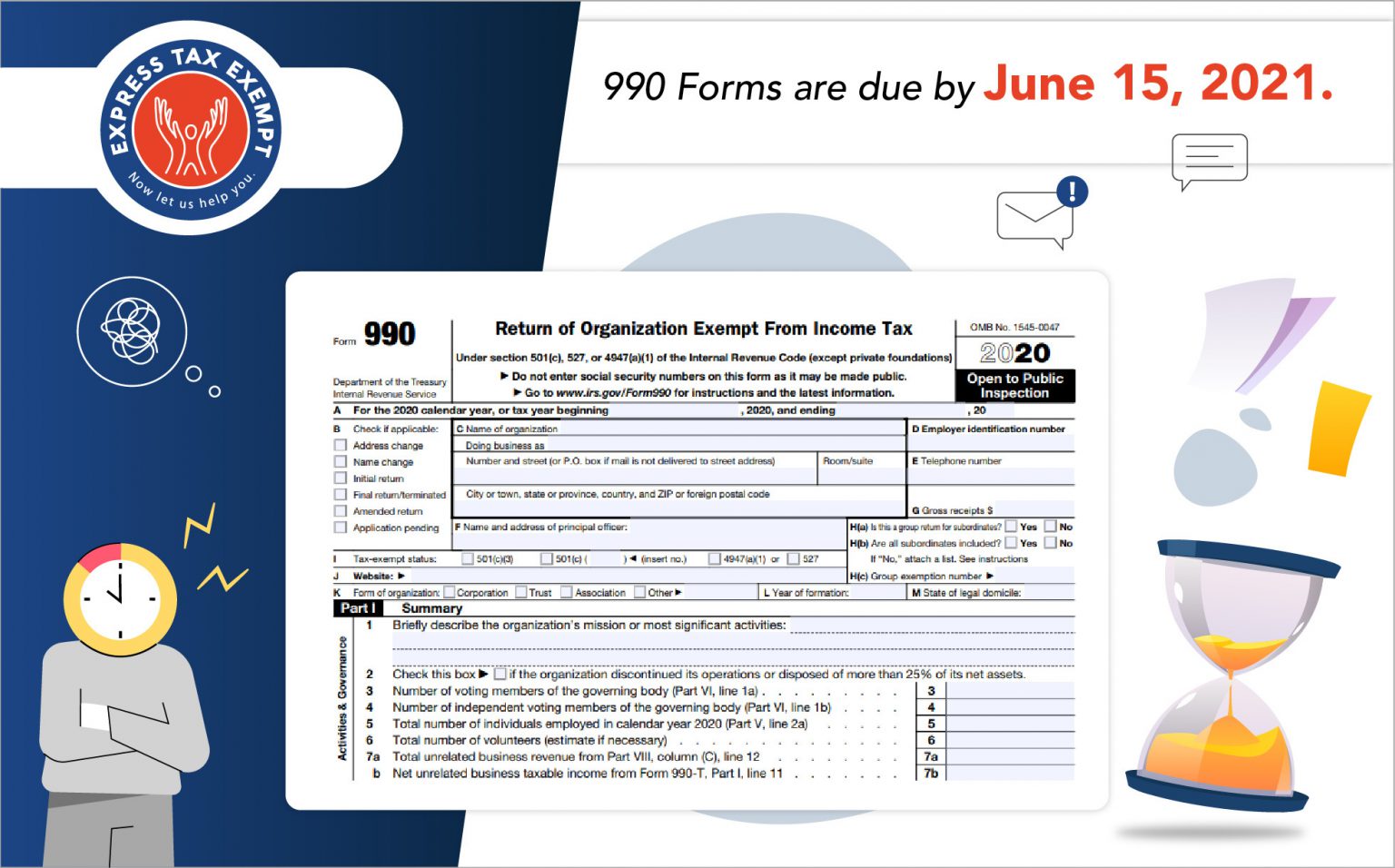

Is June 15, 2021 Your IRS Form 990 Deadline? What You Need to Know

Web electronically file or mail an form 4868, application for automatic extension of time to file u.s. Upload, modify or create forms. Web there are several ways to submit form 4868. From within your taxact return ( online or desktop), click filing to expand, then click file extension. Web 1 enter your organization details 2 select the appropriate tax form.

Form 8868 Fillable and Editable PDF Template

Web 1 enter your organization details 2 select the appropriate tax form to file an extension 3 review and transmit it to the irs ready to file your form 8868 electronically? You can complete your filing in a few simple steps: Using your tax software or by using a tax professional who uses. Web how to file form 8868 electronically.

Form 8868 Edit, Fill, Sign Online Handypdf

Web how to file form 8868 electronically add organization details search for your ein to import your organization’s data from the irs or enter your organization’s details. From within your taxact return ( online or desktop), click filing to expand, then click file extension. Web go to www.irs.gov/form8868 for the latest information. However, they are not part of, nor do.

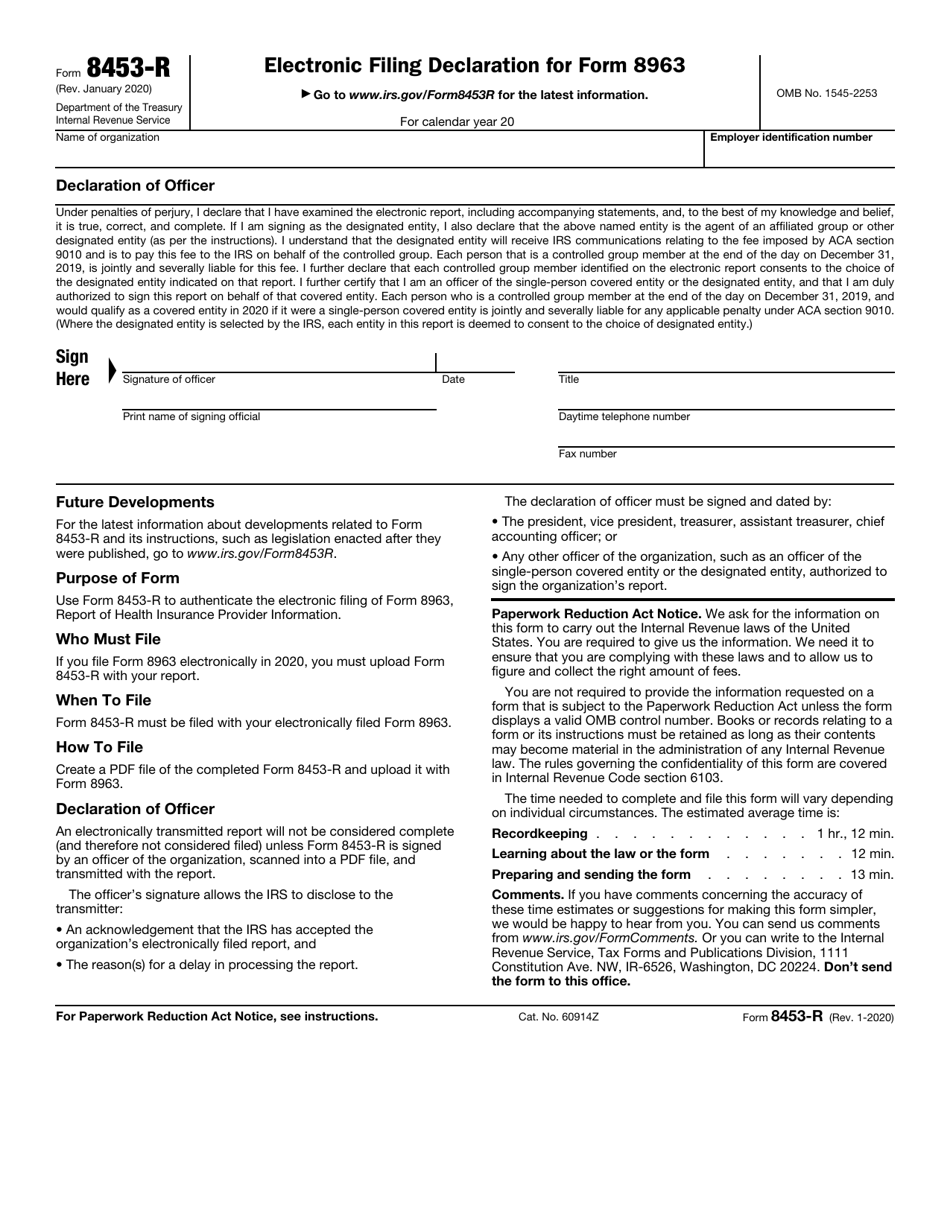

IRS Form 8453R Download Fillable PDF or Fill Online Electronic Filing

From within your taxact return ( online or desktop), click filing to expand, then click file extension. Try it for free now! Upload, modify or create forms. You’ll receive an acknowledgment or. You can file form 4868 electronically by accessing irs.

IRS Extension Form 8868 of Time To File an Non Profit or Exempt

Complete, edit or print tax forms instantly. Web to file form 8868 using taxact: Web 1 enter your organization details 2 select the appropriate tax form to file an extension 3 review and transmit it to the irs ready to file your form 8868 electronically? Start filing now instant approval no waiting in long lines, no inconvenient paper. Taxpayers can.

Web There Are Several Ways To Submit Form 4868.

Upload, modify or create forms. However, they are not part of, nor do they have any special relationship with the internal revenue. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on. You can file form 4868 electronically by accessing irs.

Web To File Form 8868 Using Taxact:

You’ll receive an acknowledgment or. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web apply tax extension now we are now accepting extension form 8868 for the 2022 tax year. You can complete your filing in a few simple steps:

Web Electronically File Or Mail An Form 4868, Application For Automatic Extension Of Time To File U.s.

You only need to complete 3 simple steps and your extension form will be filed. You can file a paper form 4868 and. Start filing now instant approval no waiting in long lines, no inconvenient paper. File form 8868 for free when you pay in advance for a 990 return with our package pricing.

From Within Your Taxact Return ( Online Or Desktop), Click Filing To Expand, Then Click File Extension.

On smaller devices, click in the upper left. Try it for free now! Web how to file form 8868 electronically add organization details search for your ein to import your organization’s data from the irs or enter your organization’s details. Using your tax software or by using a tax professional who uses.