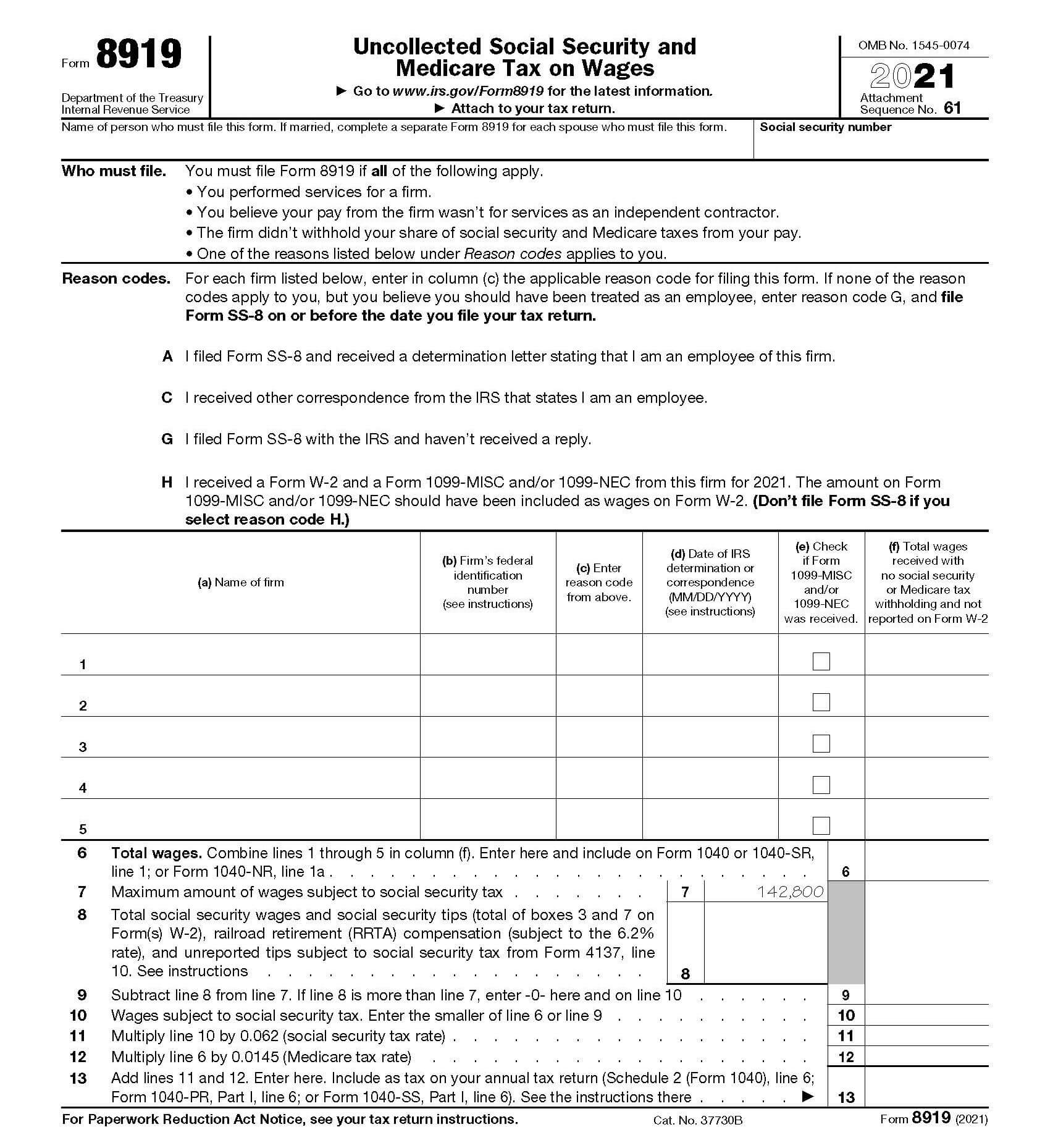

Irs Form 8919

Irs Form 8919 - The purpose of form 8919 is to calculate and report the employee’s share of uncollected social security and medicare taxes due on their compensation. Per irs form 8919, you must file this form if all of the following apply. Web form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation. You can print other federal tax forms here. Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed they should have been. 61 name of person who must file this form. Web form 8919, uncollected social security and medicare tax on wages use irs form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your earnings, if you were an employee who was. You performed services for a firm. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages a go to www.irs.gov/form8919 for the latest information. A attach to your tax return.

Perform services for a company as an independent contractor but the irs considers you an employee and social security and medicare taxes were not withheld from your pay; A attach to your tax return. You believe your pay from the firm wasn’t for services as an independent contractor. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages a go to www.irs.gov/form8919 for the latest information. Web form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation. Per irs form 8919, you must file this form if all of the following apply. Web form 8919, uncollected social security and medicare tax on wages use irs form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your earnings, if you were an employee who was. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach to your tax return. Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed they should have been. Web when to use form 8919.

Use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as an independent contractor by your employer. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages a go to www.irs.gov/form8919 for the latest information. 61 name of person who must file this form. Perform services for a company as an independent contractor but the irs considers you an employee and social security and medicare taxes were not withheld from your pay; Per irs form 8919, you must file this form if all of the following apply. Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like independent contractors by their employers to figure and report the uncollected fica taxes due on their income. A attach to your tax return. The purpose of form 8919 is to calculate and report the employee’s share of uncollected social security and medicare taxes due on their compensation. You performed services for a firm. You believe your pay from the firm wasn’t for services as an independent contractor.

When to Use IRS Form 8919

You may need to file form 8919 if you: A attach to your tax return. You performed services for a firm. Web form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation. 61 name of person who must file this form.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

You performed services for a firm. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. 61 name of person who must file this form. You may need to file form 8919 if you: Web form 8919 department of.

Got a 1099MISC when you thought you would get a W2? Meet IRS Form

You performed services for a firm. Perform services for a company as an independent contractor but the irs considers you an employee and social security and medicare taxes were not withheld from your pay; You may need to file form 8919 if you: Web we last updated the uncollected social security and medicare tax on wages in december 2022, so.

When to Fill IRS Form 8919?

Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages a go to www.irs.gov/form8919 for the latest information. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. Web when to.

Form 8839 Edit, Fill, Sign Online Handypdf

Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like independent contractors by their employers to figure and report the uncollected fica taxes due on their income. The purpose of form 8919 is to calculate and report the employee’s share of uncollected social security and medicare.

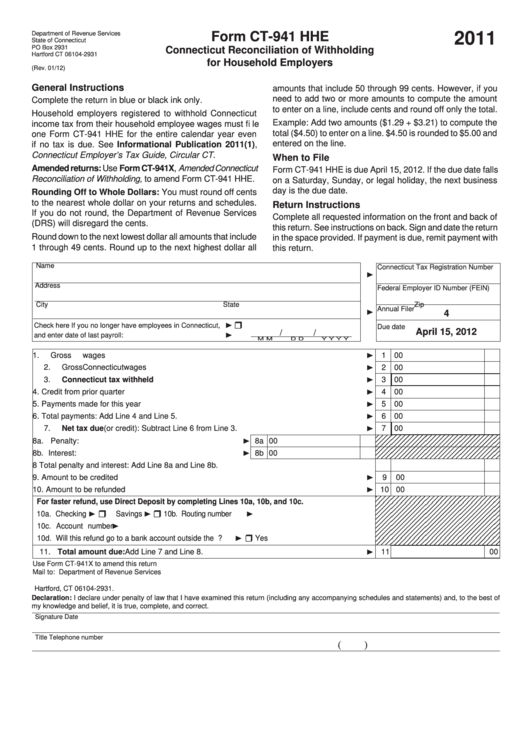

Form Ct941 Hhe Connecticut Reconciliation Of Withholding For

You may need to file form 8919 if you: 61 name of person who must file this form. A attach to your tax return. You believe your pay from the firm wasn’t for services as an independent contractor. You performed services for a firm.

IRS 8824 2019 Fill out Tax Template Online US Legal Forms

Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach to your tax return. Web form 8919, uncollected social security and medicare tax on wages use irs form 8919 to figure and report your share of the uncollected social security and medicare taxes due.

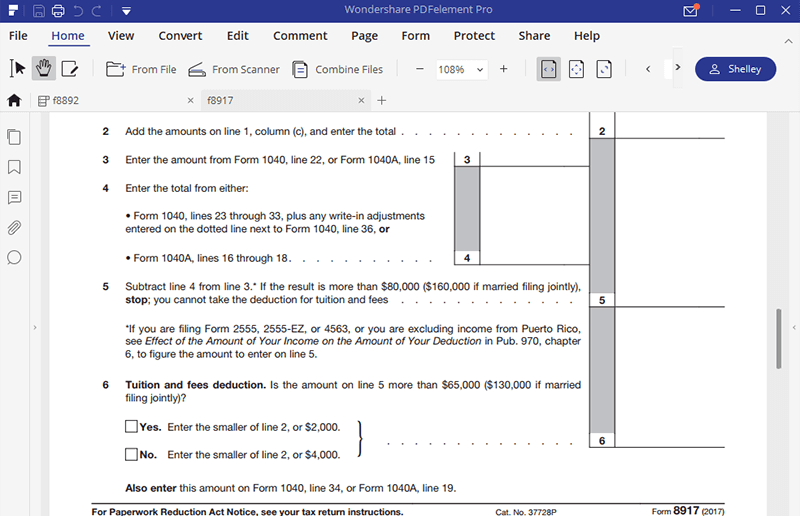

for How to Fill in IRS Form 8917

61 name of person who must file this form. Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed they should have been. Use form 8919 to figure and report your share of the uncollected social security and medicare taxes due.

Fill Form 8919 Uncollected Social Security and Medicare Tax

You may need to file form 8919 if you: A attach to your tax return. Per irs form 8919, you must file this form if all of the following apply. 61 name of person who must file this form. Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who.

Fill Free fillable IRS PDF forms

Web form 8919, uncollected social security and medicare tax on wages use irs form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your earnings, if you were an employee who was. Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees.

Web Form 8919 Department Of The Treasury Internal Revenue Service Uncollected Social Security And Medicare Tax On Wages Go To Www.irs.gov/Form8919 For The Latest Information Attach To Your Tax Return.

The purpose of form 8919 is to calculate and report the employee’s share of uncollected social security and medicare taxes due on their compensation. You believe your pay from the firm wasn’t for services as an independent contractor. Web when to use form 8919. 61 name of person who must file this form.

Use Form 8919 To Figure And Report Your Share Of The Uncollected Social Security And Medicare Taxes Due On Your Compensation If You Were An Employee But Were Treated As An Independent Contractor By Your Employer.

You performed services for a firm. 61 name of person who must file this form. Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed they should have been. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages a go to www.irs.gov/form8919 for the latest information.

A Attach To Your Tax Return.

Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like independent contractors by their employers to figure and report the uncollected fica taxes due on their income. Perform services for a company as an independent contractor but the irs considers you an employee and social security and medicare taxes were not withheld from your pay; Per irs form 8919, you must file this form if all of the following apply. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022.

You May Need To File Form 8919 If You:

Web form 8919, uncollected social security and medicare tax on wages use irs form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your earnings, if you were an employee who was. You can print other federal tax forms here. Web form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation.