Irs Form 8937

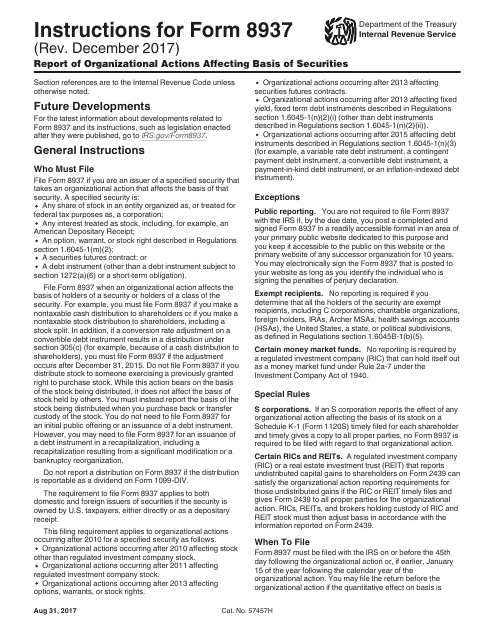

Irs Form 8937 - For example, you must file form 8937 if you make a nontaxable cash distribution to shareholders or if you make a nontaxable stock distribution to shareholders, including a stock split. Web file form 8937 when an organizational action affects the basis of holders of a security or holders of a class of the security. Each merck shareholder is urged to consult his, her or its own tax The information in form 8937 and this attachment does not constitute tax advice and does not purport to take into account the specific circumstances that may apply to particular categories of merck & co., inc. Web irs form 8937 nasdaq: Report of organizational actions affecting basis of securities. 2 issuer's employer identification number (ein) 3. Web form 8937 must be filed with the irs on or before the 45th day following the organizational action or, if earlier, january 15 of the year following the calendar year of the organizational action. Web send form 8937 (including accompanying statements) to: Intu 476.84 +13.14 (2.83%) pricing delayed by 20 minutes july 12, 2023 4:00 pm irs form 8937 the tax information contained herein is provided for informational purposes only and should not be construed as legal or tax advice.

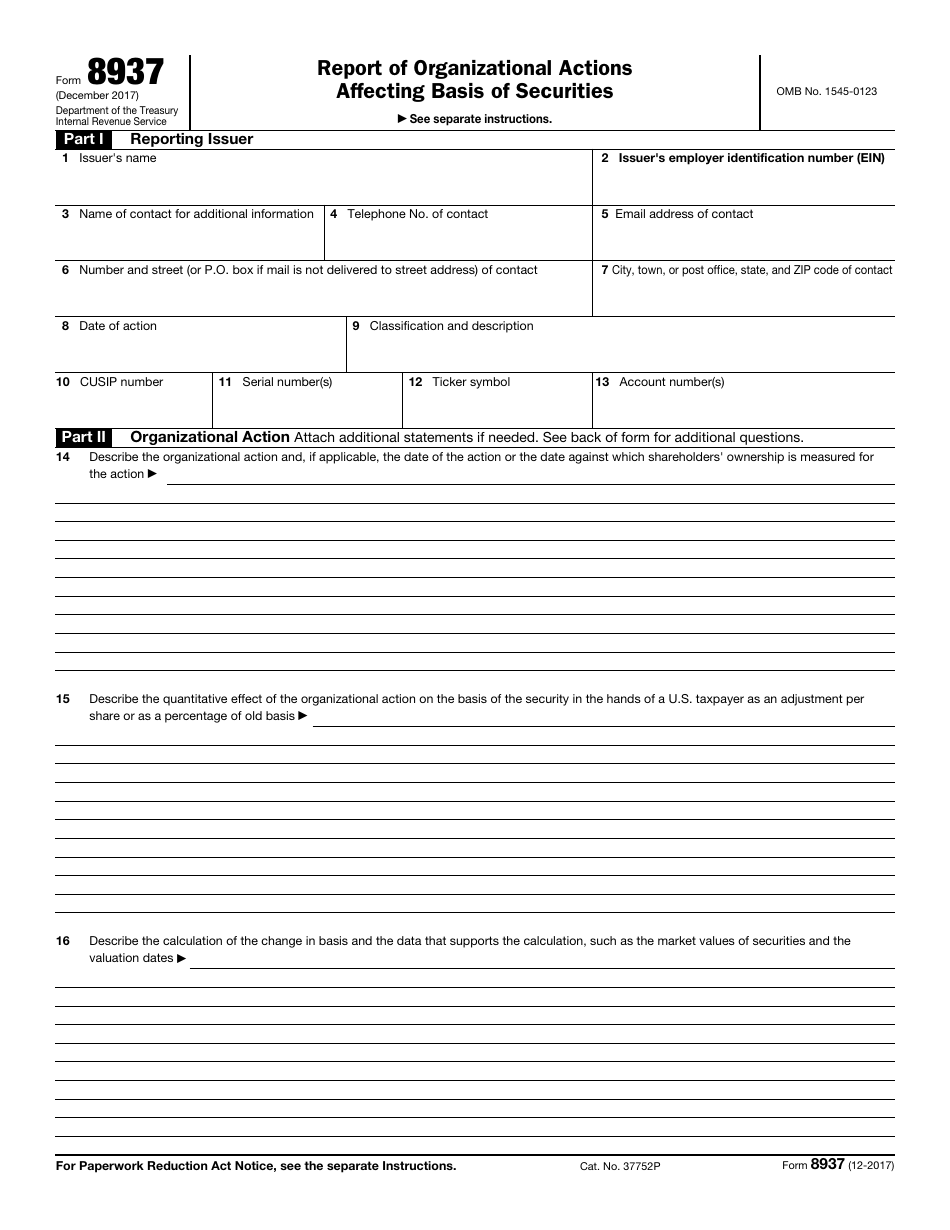

For example, you must file form 8937 if you make a nontaxable cash distribution to shareholders or if you make a nontaxable stock distribution to shareholders, including a stock split. Issuers of a specified security that take an organizational action that affect the basis of that security file form 8937. Each merck shareholder is urged to consult his, her or its own tax Web form 8937 (december 2017) department of the treasury internal revenue service. Web send form 8937 (including accompanying statements) to: Intu 476.84 +13.14 (2.83%) pricing delayed by 20 minutes july 12, 2023 4:00 pm irs form 8937 the tax information contained herein is provided for informational purposes only and should not be construed as legal or tax advice. Name of contact for additional information. Web information about form 8937, report of organizational actions affecting basis of securities, including recent updates, related forms, and instructions on how to file. You may file the return before the organizational action if the quantitative effect on basis is determinable. Web irs form 8937 nasdaq:

For example, you must file form 8937 if you make a nontaxable cash distribution to shareholders or if you make a nontaxable stock distribution to shareholders, including a stock split. Web irs form 8937 nasdaq: Web organizational actions form 8937 form 8937 is filed by issuers of specified securities to report organizational actions that affect the basis of the securities. Report of organizational actions affecting basis of securities. Each merck shareholder is urged to consult his, her or its own tax Issuers of a specified security that take an organizational action that affect the basis of that security file form 8937. Name of contact for additional information. Web form 8937 (december 2017) department of the treasury internal revenue service. Intu 476.84 +13.14 (2.83%) pricing delayed by 20 minutes july 12, 2023 4:00 pm irs form 8937 the tax information contained herein is provided for informational purposes only and should not be construed as legal or tax advice. The information in form 8937 and this attachment does not constitute tax advice and does not purport to take into account the specific circumstances that may apply to particular categories of merck & co., inc.

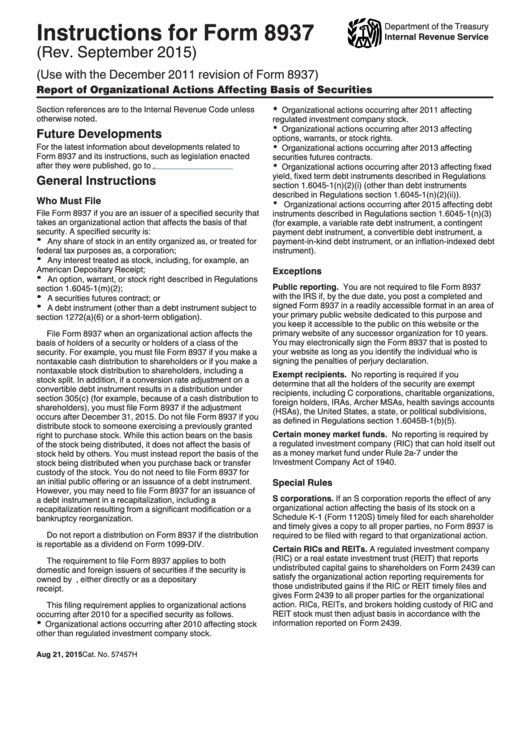

Instructions For Form 8937 (Rev. 2015) printable pdf download

Web form 8937 (december 2017) department of the treasury internal revenue service. You may file the return before the organizational action if the quantitative effect on basis is determinable. The information in form 8937 and this attachment does not constitute tax advice and does not purport to take into account the specific circumstances that may apply to particular categories of.

IRS Form 8937 Benefit Street Partners

Web information about form 8937, report of organizational actions affecting basis of securities, including recent updates, related forms, and instructions on how to file. Report of organizational actions affecting basis of securities. For example, you must file form 8937 if you make a nontaxable cash distribution to shareholders or if you make a nontaxable stock distribution to shareholders, including a.

Form 8937 Report of Organizational Actions Affecting Basis of

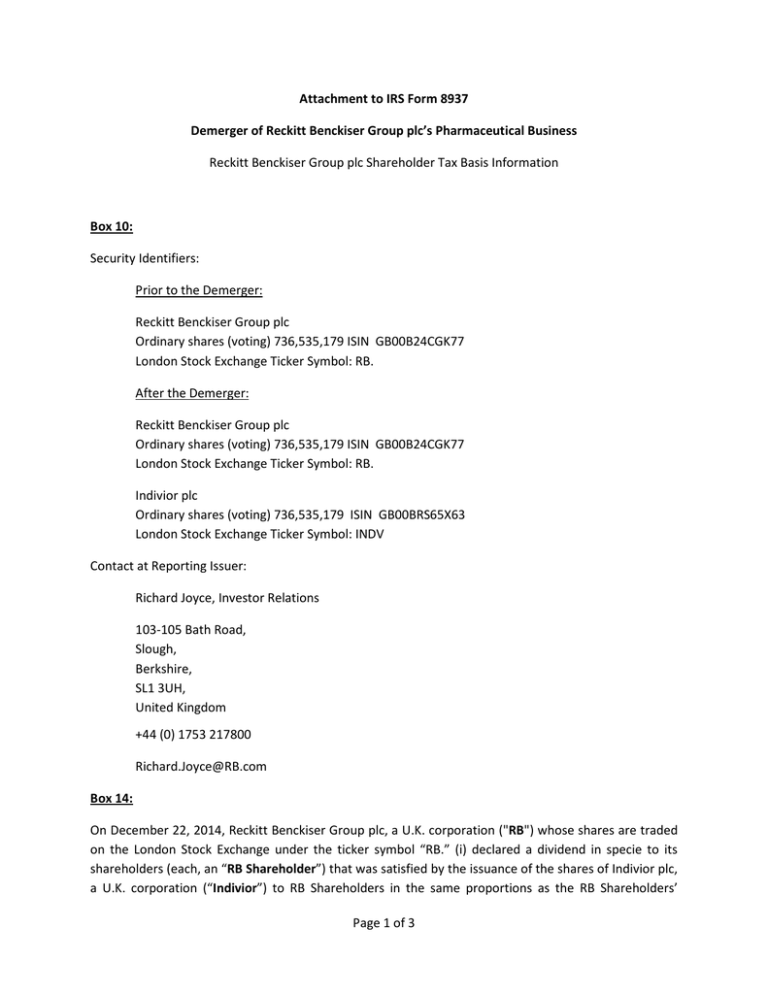

Web information about form 8937, report of organizational actions affecting basis of securities, including recent updates, related forms, and instructions on how to file. For example, you must file form 8937 if you make a nontaxable cash distribution to shareholders or if you make a nontaxable stock distribution to shareholders, including a stock split. Web attachment to form 8937. 2.

IRS Form 8937 Download Fillable PDF or Fill Online Report of

Name of contact for additional information. Web form 8937 must be filed with the irs on or before the 45th day following the organizational action or, if earlier, january 15 of the year following the calendar year of the organizational action. Web attachment to form 8937. Web information about form 8937, report of organizational actions affecting basis of securities, including.

Easy Ways to Decorate a Dorm Room BMT

Web information about form 8937, report of organizational actions affecting basis of securities, including recent updates, related forms, and instructions on how to file. Name of contact for additional information. Web send form 8937 (including accompanying statements) to: You may file the return before the organizational action if the quantitative effect on basis is determinable. Report of organizational actions affecting.

IRS Reporting Requirements for Foreign Account Ownership and Trust

Issuers of a specified security that take an organizational action that affect the basis of that security file form 8937. Please contact us at the telephone number on the form if you have any questions. Web form 8937 (december 2017) department of the treasury internal revenue service. Name of contact for additional information. Web file form 8937 when an organizational.

What to Do with Your Tax Refund

Web file form 8937 when an organizational action affects the basis of holders of a security or holders of a class of the security. For example, you must file form 8937 if you make a nontaxable cash distribution to shareholders or if you make a nontaxable stock distribution to shareholders, including a stock split. Issuers of a specified security that.

Form 8937 Report of Organizational Actions Affecting Basis of

Issuers of a specified security that take an organizational action that affect the basis of that security file form 8937. Web send form 8937 (including accompanying statements) to: Web form 8937 must be filed with the irs on or before the 45th day following the organizational action or, if earlier, january 15 of the year following the calendar year of.

Download Instructions for IRS Form 8937 Report of Organizational

2 issuer's employer identification number (ein) 3. Name of contact for additional information. Web form 8937 (december 2017) department of the treasury internal revenue service. You may file the return before the organizational action if the quantitative effect on basis is determinable. Intu 476.84 +13.14 (2.83%) pricing delayed by 20 minutes july 12, 2023 4:00 pm irs form 8937 the.

Page 1 of 3 Attachment to IRS Form 8937 Demerger of Reckitt

Web attachment to form 8937. 2 issuer's employer identification number (ein) 3. Web organizational actions form 8937 form 8937 is filed by issuers of specified securities to report organizational actions that affect the basis of the securities. For example, you must file form 8937 if you make a nontaxable cash distribution to shareholders or if you make a nontaxable stock.

Web Organizational Actions Form 8937 Form 8937 Is Filed By Issuers Of Specified Securities To Report Organizational Actions That Affect The Basis Of The Securities.

Web irs form 8937 nasdaq: You may file the return before the organizational action if the quantitative effect on basis is determinable. Please contact us at the telephone number on the form if you have any questions. 2 issuer's employer identification number (ein) 3.

Report Of Organizational Actions Affecting Basis Of Securities.

Name of contact for additional information. Web form 8937 must be filed with the irs on or before the 45th day following the organizational action or, if earlier, january 15 of the year following the calendar year of the organizational action. Web form 8937 (december 2017) department of the treasury internal revenue service. Web attachment to form 8937.

Web Information About Form 8937, Report Of Organizational Actions Affecting Basis Of Securities, Including Recent Updates, Related Forms, And Instructions On How To File.

Web file form 8937 when an organizational action affects the basis of holders of a security or holders of a class of the security. Each merck shareholder is urged to consult his, her or its own tax The information in form 8937 and this attachment does not constitute tax advice and does not purport to take into account the specific circumstances that may apply to particular categories of merck & co., inc. Intu 476.84 +13.14 (2.83%) pricing delayed by 20 minutes july 12, 2023 4:00 pm irs form 8937 the tax information contained herein is provided for informational purposes only and should not be construed as legal or tax advice.

For Example, You Must File Form 8937 If You Make A Nontaxable Cash Distribution To Shareholders Or If You Make A Nontaxable Stock Distribution To Shareholders, Including A Stock Split.

Issuers of a specified security that take an organizational action that affect the basis of that security file form 8937. Web send form 8937 (including accompanying statements) to: