Irs Form 982 Credit Card Settlement

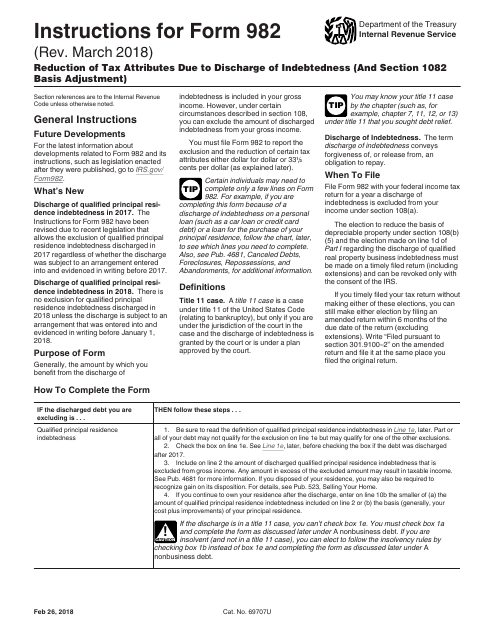

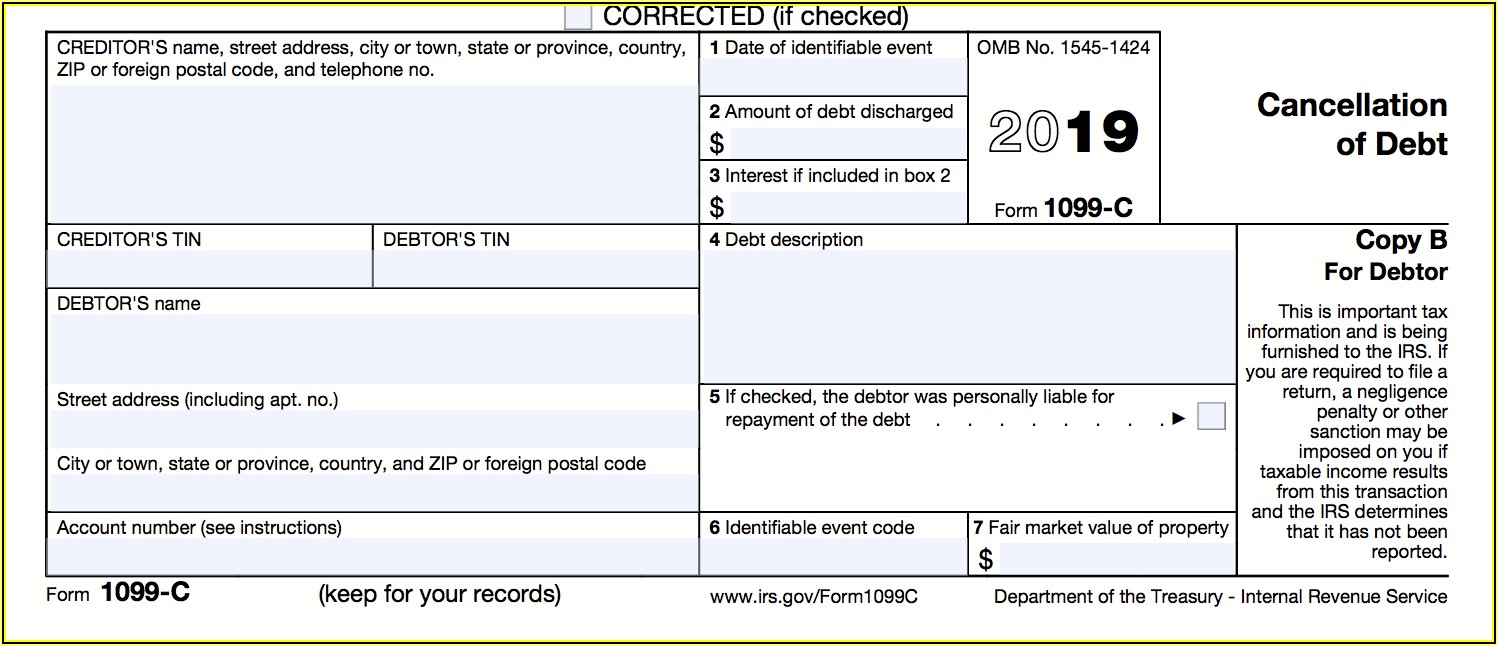

Irs Form 982 Credit Card Settlement - Use part iii to exclude from gross income under section 1081 (b) any amounts of income attributable to the transfer of property described in that section. About form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) | internal revenue service Web generally, you abandon property when you voluntarily and permanently give up possession and use of property you own with the intention of ending your ownership but without passing it on to anyone else. Web how to fill out irs form 982 with credit card debt. Web any foreign tax credit carryover to or from the tax year of the discharge (33 1 / 3 cents per dollar). Figuring your gain or loss and income from canceled debt arising from an abandonment is discussed later under abandonments. For this, you'll need to have a list of your assets and liabilities at the time the debt was canceled. Form 982 notifies the irs of the amount of canceled debt that should be excluded from the gross income and under which exclusion. Look carefully at the bottom of the form and you will see, Web the actual balance at the time of settlement was $ 3,440 and the total settlement was for $1,500.

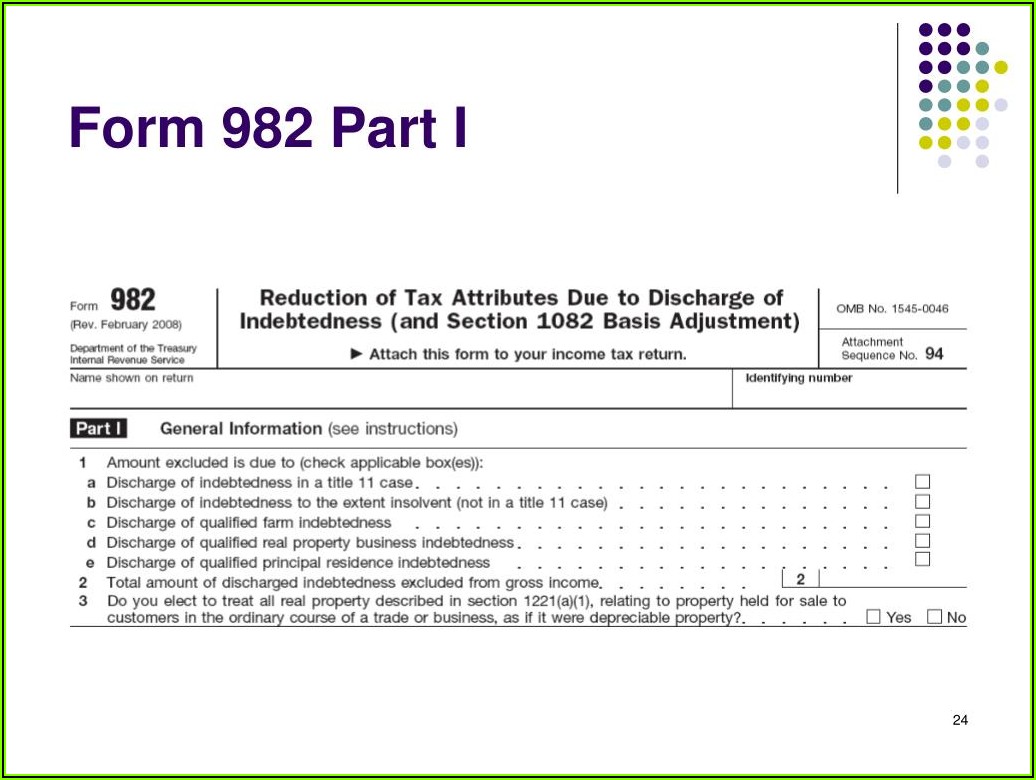

The internal revenue service considers that the cancellation or forgiveness of a taxpayer's indebtedness results in taxable income to the taxpayer. Form 982 notifies the irs of the amount of canceled debt that should be excluded from the gross income and under which exclusion. Use part iii to exclude from gross income under section 1081 (b) any amounts of income attributable to the transfer of property described in that section. Web how to fill out irs form 982 with credit card debt. Web you must attach a description of any transactions resulting in the reduction in basis under section 1017. Web form 982, reduction of tax attributes due to discharge of indebtedness at the top of form 982, you’ll find a series of check boxes that indicated why you are filling out this form. Look carefully at the bottom of the form and you will see, Web the actual balance at the time of settlement was $ 3,440 and the total settlement was for $1,500. About form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) | internal revenue service Even though this was a reduction of $1,940, the creditor has excluded the added interest and fees in reporting the settlement to the irs.

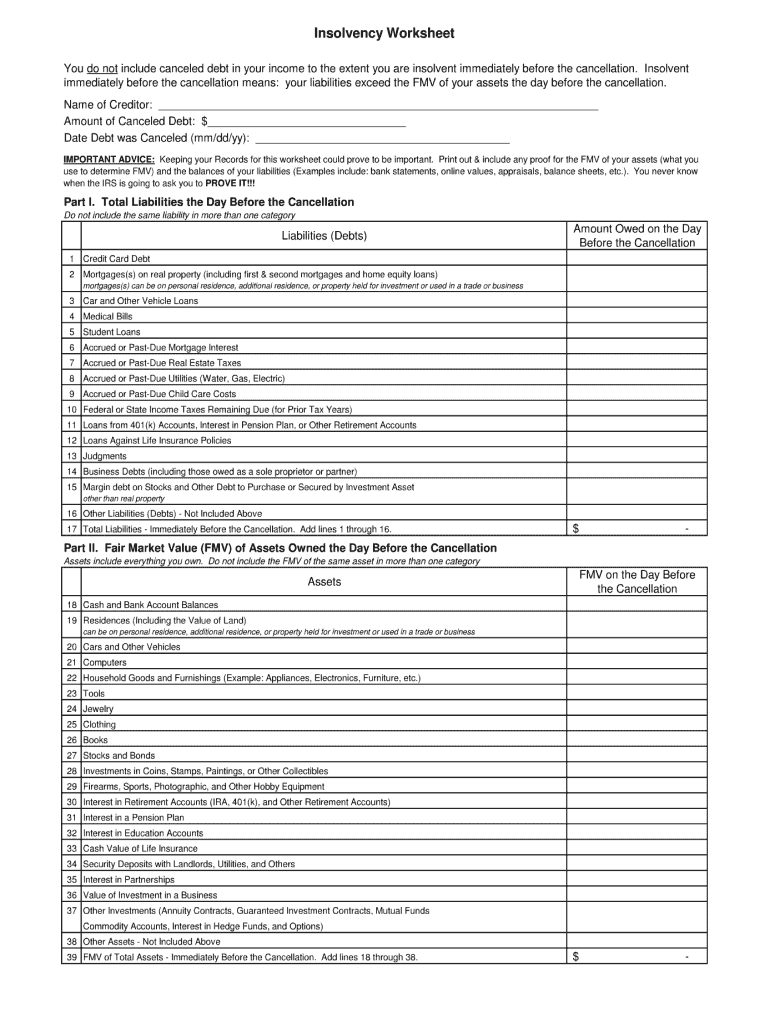

Look carefully at the bottom of the form and you will see, Web form 982, reduction of tax attributes due to discharge of indebtedness at the top of form 982, you’ll find a series of check boxes that indicated why you are filling out this form. Web if your liabilities might exceed your assets, he recommends that you review irs form 982 with your tax preparer to determine whether you qualify as insolvent. Even though this was a reduction of $1,940, the creditor has excluded the added interest and fees in reporting the settlement to the irs. The internal revenue service considers that the cancellation or forgiveness of a taxpayer's indebtedness results in taxable income to the taxpayer. For this, you'll need to have a list of your assets and liabilities at the time the debt was canceled. Web you must attach a description of any transactions resulting in the reduction in basis under section 1017. About form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) | internal revenue service Use part iii to exclude from gross income under section 1081 (b) any amounts of income attributable to the transfer of property described in that section. Figuring your gain or loss and income from canceled debt arising from an abandonment is discussed later under abandonments.

Debt Irs Form 982 Form Resume Examples 0g27K7n2Pr

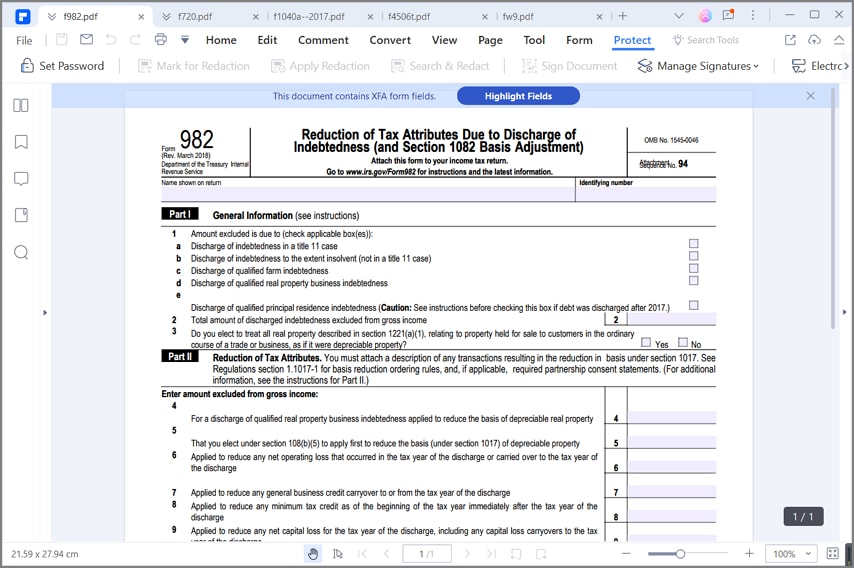

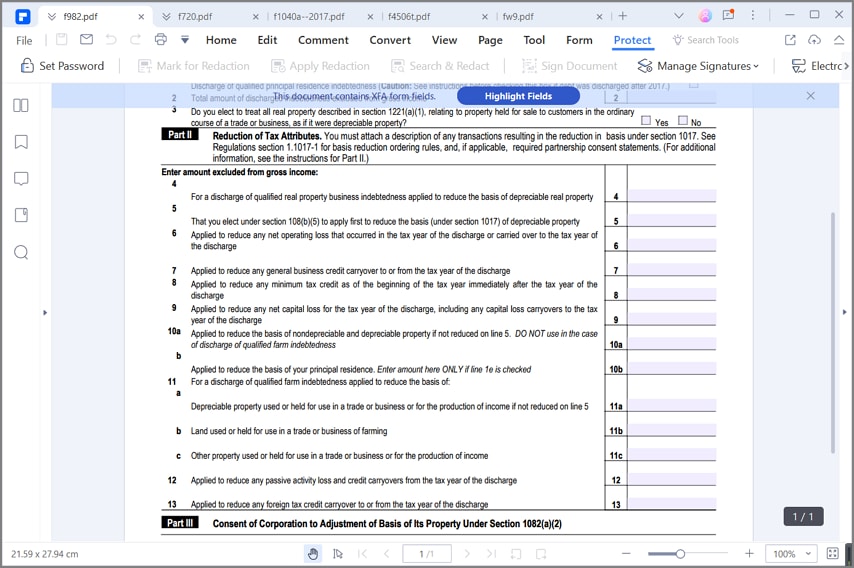

(for additional information, see the instructions for part ii.) Web how to fill out irs form 982 with credit card debt. Web form 982 is used to determine, under certain circumstances described in section 108, the amount of discharged indebtedness that can be excluded from gross income. Web any foreign tax credit carryover to or from the tax year of.

Tax form 982 Insolvency Worksheet

(for additional information, see the instructions for part ii.) Web you must attach a description of any transactions resulting in the reduction in basis under section 1017. Web generally, you abandon property when you voluntarily and permanently give up possession and use of property you own with the intention of ending your ownership but without passing it on to anyone.

form 982 line 10a Fill Online, Printable, Fillable Blank

The internal revenue service considers that the cancellation or forgiveness of a taxpayer's indebtedness results in taxable income to the taxpayer. Figuring your gain or loss and income from canceled debt arising from an abandonment is discussed later under abandonments. About form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) | internal revenue.

Modulo IRS 982 Come compilarlo correttamente

Web how to fill out irs form 982 with credit card debt. Web to claim the insolvency exemption, you must file irs form 982, reduction of tax attributes due to discharge of indebtedness. Web any foreign tax credit carryover to or from the tax year of the discharge (33 1 / 3 cents per dollar). Even though this was a.

understanding irs form 982 Fill Online, Printable, Fillable Blank

Cancellation or forgiveness of a taxpayer's indebtedness results in taxable income to the taxpayer. Web form 982, reduction of tax attributes due to discharge of indebtedness at the top of form 982, you’ll find a series of check boxes that indicated why you are filling out this form. Web generally, you abandon property when you voluntarily and permanently give up.

IRS Form 982 How to Fill it Right

Web form 982, reduction of tax attributes due to discharge of indebtedness at the top of form 982, you’ll find a series of check boxes that indicated why you are filling out this form. Web you must attach a description of any transactions resulting in the reduction in basis under section 1017. The internal revenue service considers that the cancellation.

Download Instructions for IRS Form 982 Reduction of Tax Attributes Due

For this, you'll need to have a list of your assets and liabilities at the time the debt was canceled. Even though this was a reduction of $1,940, the creditor has excluded the added interest and fees in reporting the settlement to the irs. Look carefully at the bottom of the form and you will see, (for additional information, see.

Form 982 Insolvency Worksheet —

Form 982 notifies the irs of the amount of canceled debt that should be excluded from the gross income and under which exclusion. (for additional information, see the instructions for part ii.) Web the actual balance at the time of settlement was $ 3,440 and the total settlement was for $1,500. Web any foreign tax credit carryover to or from.

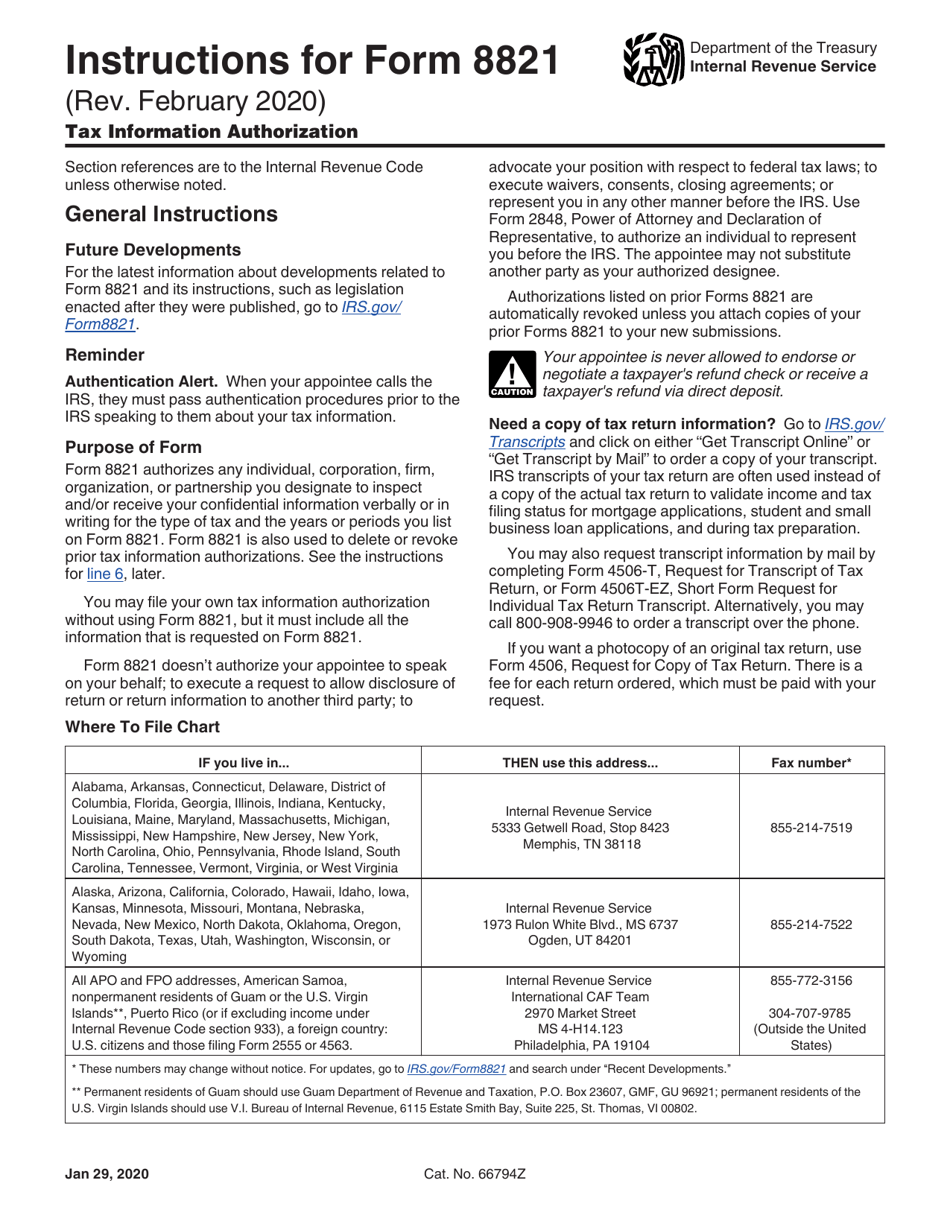

Download Instructions for IRS Form 8821 Tax Information Authorization

For this, you'll need to have a list of your assets and liabilities at the time the debt was canceled. Use part iii to exclude from gross income under section 1081 (b) any amounts of income attributable to the transfer of property described in that section. Web you must attach a description of any transactions resulting in the reduction in.

Irs Debt Form 982 Form Resume Examples MeVRkgq2Do

Cancellation or forgiveness of a taxpayer's indebtedness results in taxable income to the taxpayer. Unless your debt forgiveness falls into a defined category, line 1b may help relieve you of your tax burden. (for additional information, see the instructions for part ii.) Even though this was a reduction of $1,940, the creditor has excluded the added interest and fees in.

Look Carefully At The Bottom Of The Form And You Will See,

(for additional information, see the instructions for part ii.) Cancellation or forgiveness of a taxpayer's indebtedness results in taxable income to the taxpayer. Web to claim the insolvency exemption, you must file irs form 982, reduction of tax attributes due to discharge of indebtedness. Web any foreign tax credit carryover to or from the tax year of the discharge (33 1 / 3 cents per dollar).

Web Form 982, Reduction Of Tax Attributes Due To Discharge Of Indebtedness At The Top Of Form 982, You’ll Find A Series Of Check Boxes That Indicated Why You Are Filling Out This Form.

About form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) | internal revenue service Web the actual balance at the time of settlement was $ 3,440 and the total settlement was for $1,500. Unless your debt forgiveness falls into a defined category, line 1b may help relieve you of your tax burden. Even though this was a reduction of $1,940, the creditor has excluded the added interest and fees in reporting the settlement to the irs.

Web Form 982 Is Used To Determine, Under Certain Circumstances Described In Section 108, The Amount Of Discharged Indebtedness That Can Be Excluded From Gross Income.

For this, you'll need to have a list of your assets and liabilities at the time the debt was canceled. Figuring your gain or loss and income from canceled debt arising from an abandonment is discussed later under abandonments. Form 982 notifies the irs of the amount of canceled debt that should be excluded from the gross income and under which exclusion. Web generally, you abandon property when you voluntarily and permanently give up possession and use of property you own with the intention of ending your ownership but without passing it on to anyone else.

Web How To Fill Out Irs Form 982 With Credit Card Debt.

Use part iii to exclude from gross income under section 1081 (b) any amounts of income attributable to the transfer of property described in that section. Web you must attach a description of any transactions resulting in the reduction in basis under section 1017. Web to claim a canceled debt amount should be excluded from gross income, the taxpayer needs to complete irs form 982 and attach the completed form to their return. The internal revenue service considers that the cancellation or forgiveness of a taxpayer's indebtedness results in taxable income to the taxpayer.