Irs Qualified Disclaimer 2518 Form

Irs Qualified Disclaimer 2518 Form - How does a qualified disclaimer work?. For purposes of this subtitle, if a person makes a qualified disclaimer with respect to any interest in property, this subtitle shall apply. § 2518 (b) qualified disclaimer defined — for purposes of subsection (a), the term “qualified disclaimer” means an irrevocable and unqualified refusal by a person to. Web this ruling discusses whether a beneficiary's disclaimer of a beneficial interest in a decedent's ira is a qualified disclaimer under section 2518 of the code even though. Web ( 1) in general. Web (b) qualified disclaimer defined for purposes of subsection (a), the term “qualified disclaimer” means an irrevocable and unqualified refusal by a person to accept an. Web section 2518(a) provides that, if a person makes a qualified disclaimer with respect to any interest in property, then for purposes of the estate and gift tax the. 2518 provides that a qualified disclaimer is an irrevocable and unqualified refusal by a person to accept an interest in property, but only if: (1) the disclaimer is in writing; Web a qualified disclaimer is a formal refusal to accept interest in property bequeathed in a will or similar document.

If you were assessed a penalty under section 6700, 6701, or 6694, you may file a claim for. 2518 provides that a qualified disclaimer is an irrevocable and unqualified refusal by a person to accept an interest in property, but only if: Web a disclaimer of a specific pecuniary amount out of a pecuniary or nonpecuniary bequest or gift which satisfies the other requirements of a qualified disclaimer under section 2518. For purposes of this subtitle, if a person makes a qualified disclaimer with respect to any interest in property, this subtitle shall apply. Web sample qualified disclaimer form i,________________________________________________ (disclaimant), in. Web section 2518 of the irc permits a beneficiary of an estate or trust to make a qualified disclaimer so that it is as though the beneficiary never received the property,. (1) the disclaimer is in writing; Web a qualified disclaimer is a formal refusal to accept interest in property bequeathed in a will or similar document. How does a qualified disclaimer work?. Use this form if you are a beneficiary and would like to claim or disclaim your benefit from a lpl financial llc (“lpl”) sponsored ira account with a deceased owner.

2518 provides that a qualified disclaimer is an irrevocable and unqualified refusal by a person to accept an interest in property, but only if: If you were assessed a penalty under section 6700, 6701, or 6694, you may file a claim for. Web (b) qualified disclaimer defined for purposes of subsection (a), the term “qualified disclaimer” means an irrevocable and unqualified refusal by a person to accept an. Web section 2518 of the irc permits a beneficiary of an estate or trust to make a qualified disclaimer so that it is as though the beneficiary never received the property,. Web a qualified disclaimer is a formal refusal to accept interest in property bequeathed in a will or similar document. Web due to the variation of standards governing disclaimer between the states, congress enacted internal revenue code section 2518 in the tax reform act of 1976 to create a. Web a disclaimer of a specific pecuniary amount out of a pecuniary or nonpecuniary bequest or gift which satisfies the other requirements of a qualified disclaimer under section 2518. Web sample qualified disclaimer form i,________________________________________________ (disclaimant), in. How does a qualified disclaimer work?. Use this form if you are a beneficiary and would like to claim or disclaim your benefit from a lpl financial llc (“lpl”) sponsored ira account with a deceased owner.

IRS Form 8995 Download Fillable PDF or Fill Online Qualified Business

If you were assessed a penalty under section 6700, 6701, or 6694, you may file a claim for. Use this form if you are a beneficiary and would like to claim or disclaim your benefit from a lpl financial llc (“lpl”) sponsored ira account with a deceased owner. Web this ruling discusses whether a beneficiary's disclaimer of a beneficial interest.

Bill Of Sale Form Mississippi Boat Bill Of Sale Templates Fillable

Web a qualified disclaimer is a formal refusal to accept interest in property bequeathed in a will or similar document. Disclaimers (a) general rule for purposes of this subtitle, if a person makes a qualified disclaimer with respect to any interest in property, this subtitle shall apply with. § 2518 (b) qualified disclaimer defined — for purposes of subsection (a),.

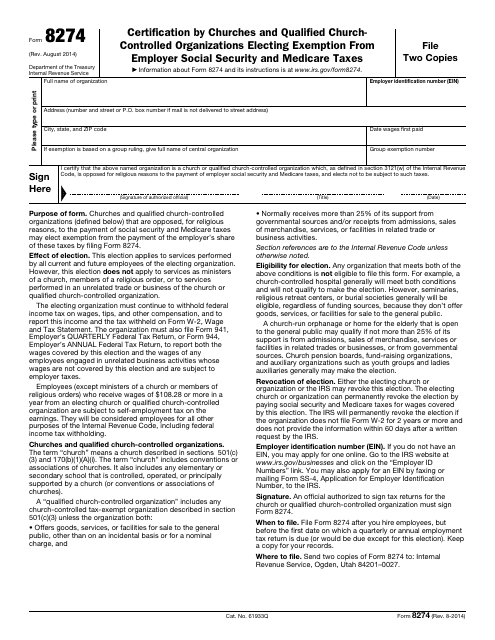

IRS Form 8274 Download Fillable PDF or Fill Online Certification by

Web a disclaimer of a specific pecuniary amount out of a pecuniary or nonpecuniary bequest or gift which satisfies the other requirements of a qualified disclaimer under section 2518. Web a qualified disclaimer is a formal refusal to accept interest in property bequeathed in a will or similar document. Web section 2518(a) provides that, if a person makes a qualified.

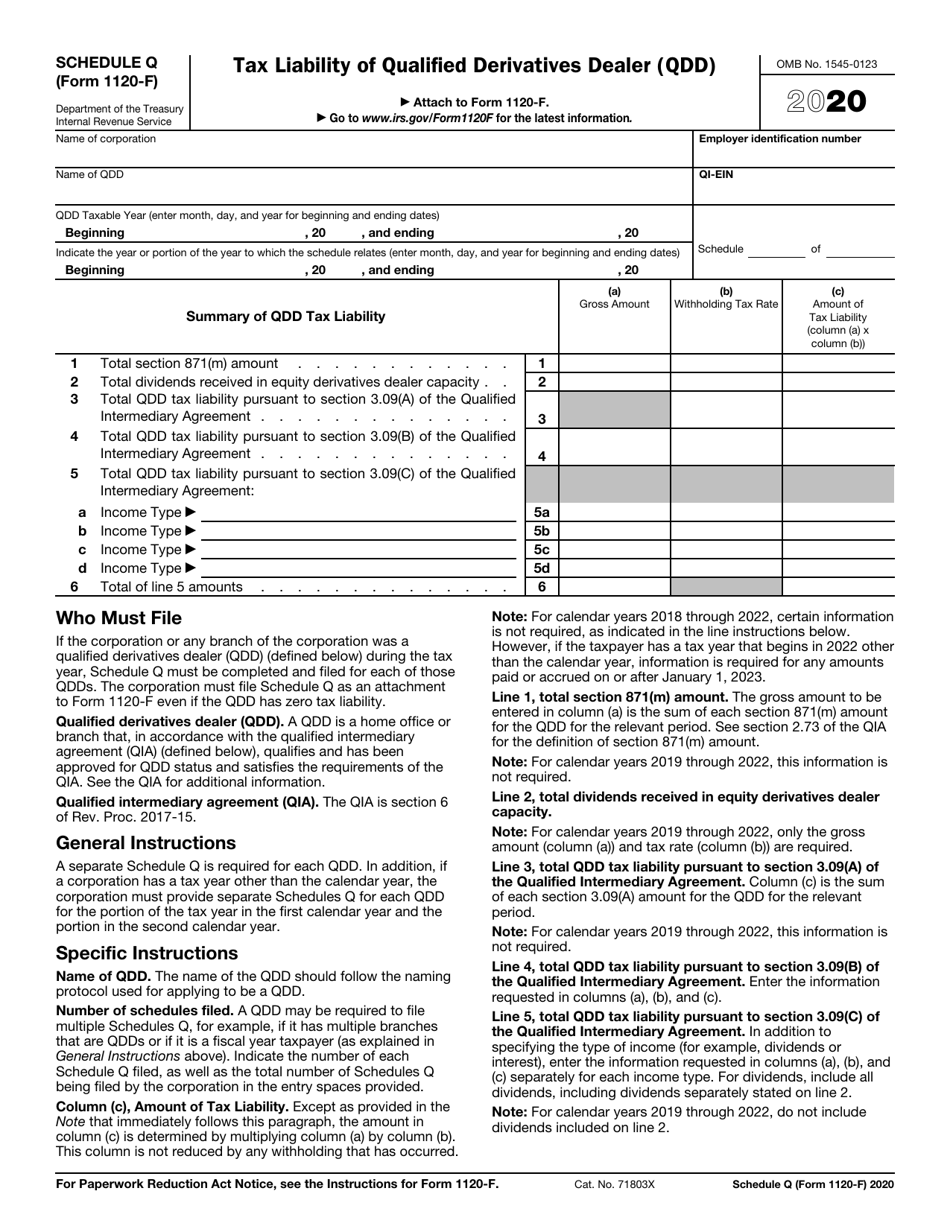

IRS Form 1120F Schedule Q Download Fillable PDF or Fill Online Tax

Web file form 6118 with the irs service center or irs office that sent you the statement(s). Web sample qualified disclaimer form i,________________________________________________ (disclaimant), in. Web section 2518(a) provides that, if a person makes a qualified disclaimer with respect to any interest in property, then for purposes of the estate and gift tax the. How does a qualified disclaimer work?..

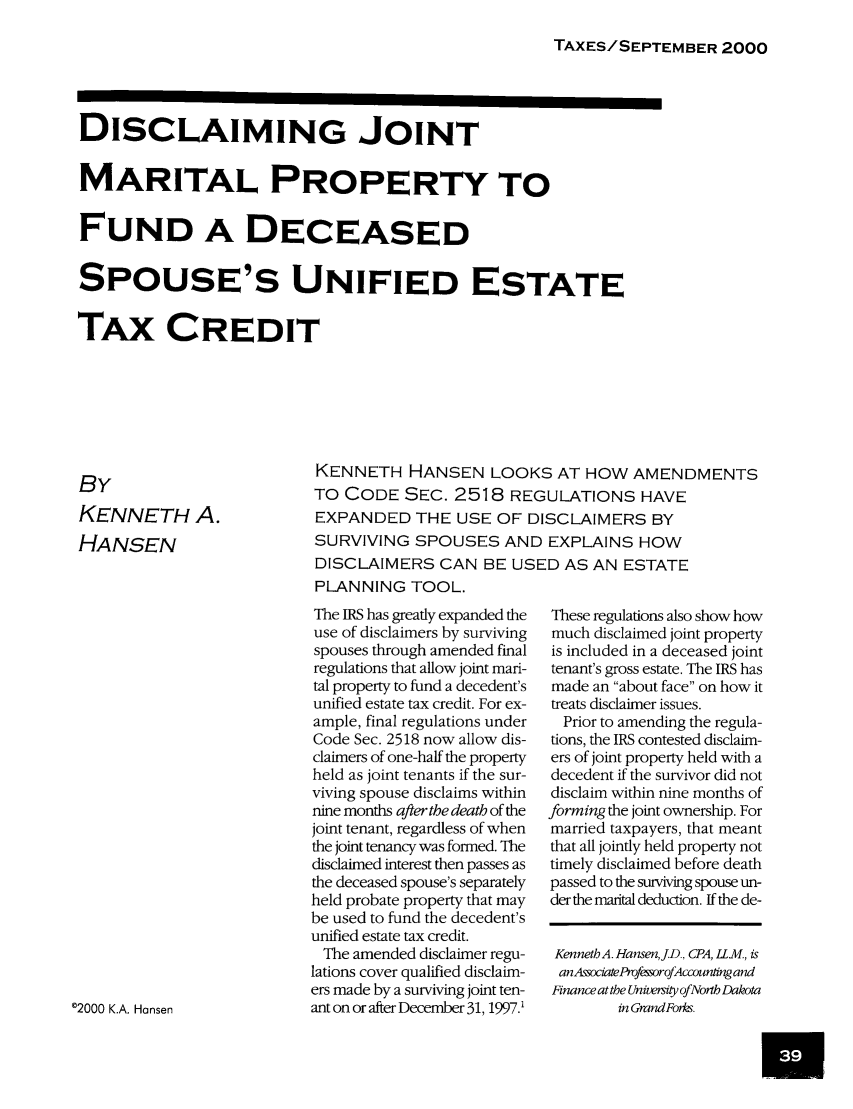

How Qualified Disclaimers Make Estate Planning More Flexible

(1) the disclaimer is in writing; Web a disclaimer of a specific pecuniary amount out of a pecuniary or nonpecuniary bequest or gift which satisfies the other requirements of a qualified disclaimer under section 2518. Web (b) qualified disclaimer defined for purposes of subsection (a), the term “qualified disclaimer” means an irrevocable and unqualified refusal by a person to accept.

IRS Qualified Appraisers and Appraisals Matter The Green Mission Inc.

Disclaimers (a) general rule for purposes of this subtitle, if a person makes a qualified disclaimer with respect to any interest in property, this subtitle shall apply with. (1) the disclaimer is in writing; § 2518 (b) qualified disclaimer defined — for purposes of subsection (a), the term “qualified disclaimer” means an irrevocable and unqualified refusal by a person to..

Circular 230 Disclaimer No Longer Necessary DeFoor Business Services

2518 provides that a qualified disclaimer is an irrevocable and unqualified refusal by a person to accept an interest in property, but only if: Web a qualified disclaimer is a formal refusal to accept interest in property bequeathed in a will or similar document. Web ( 1) in general. (1) the disclaimer is in writing; If you were assessed a.

Redirecting...

Web file form 6118 with the irs service center or irs office that sent you the statement(s). Web (b) qualified disclaimer defined for purposes of subsection (a), the term “qualified disclaimer” means an irrevocable and unqualified refusal by a person to accept an. § 2518 (b) qualified disclaimer defined — for purposes of subsection (a), the term “qualified disclaimer” means.

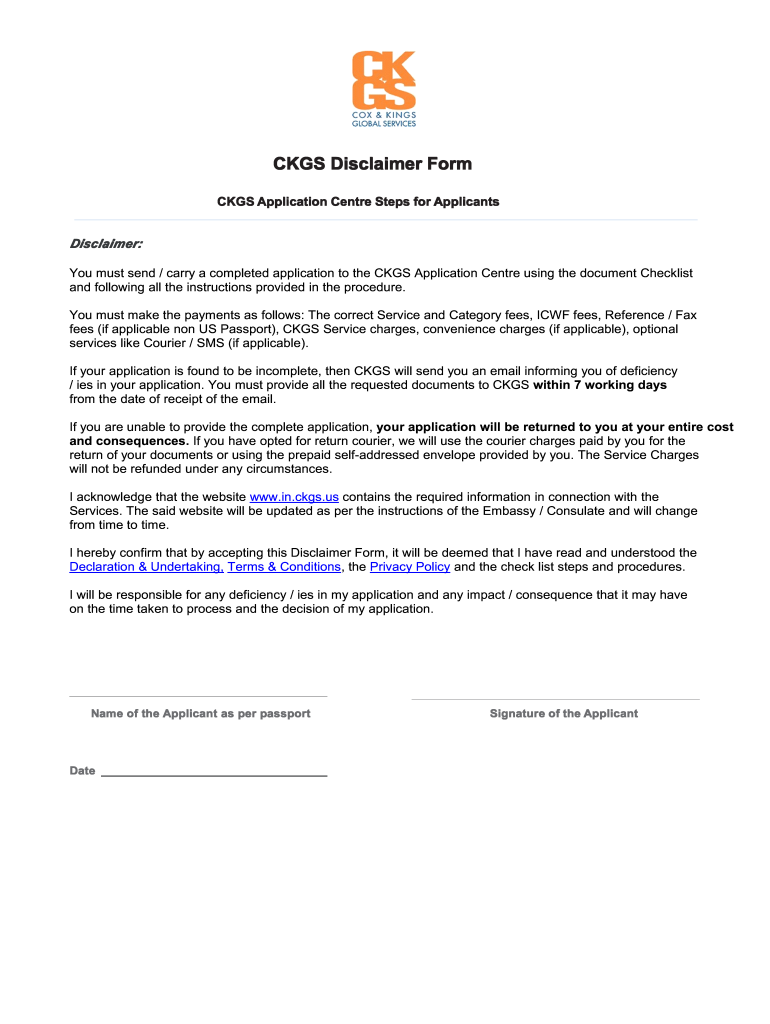

Ckgs Form Fill Online, Printable, Fillable, Blank pdfFiller

Use this form if you are a beneficiary and would like to claim or disclaim your benefit from a lpl financial llc (“lpl”) sponsored ira account with a deceased owner. Web due to the variation of standards governing disclaimer between the states, congress enacted internal revenue code section 2518 in the tax reform act of 1976 to create a. If.

Irs Form 1040 Qualified Dividends Capital Gains Worksheet Form Resume

Web a disclaimer of a specific pecuniary amount out of a pecuniary or nonpecuniary bequest or gift which satisfies the other requirements of a qualified disclaimer under section 2518. 2518 provides that a qualified disclaimer is an irrevocable and unqualified refusal by a person to accept an interest in property, but only if: Use this form if you are a.

Web Sample Qualified Disclaimer Form I,________________________________________________ (Disclaimant), In.

(1) the disclaimer is in writing; Web a disclaimer of a specific pecuniary amount out of a pecuniary or nonpecuniary bequest or gift which satisfies the other requirements of a qualified disclaimer under section 2518. Web file form 6118 with the irs service center or irs office that sent you the statement(s). For purposes of this subtitle, if a person makes a qualified disclaimer with respect to any interest in property, this subtitle shall apply.

Web Section 2518 Of The Irc Permits A Beneficiary Of An Estate Or Trust To Make A Qualified Disclaimer So That It Is As Though The Beneficiary Never Received The Property,.

Disclaimers (a) general rule for purposes of this subtitle, if a person makes a qualified disclaimer with respect to any interest in property, this subtitle shall apply with. Web a qualified disclaimer is a formal refusal to accept interest in property bequeathed in a will or similar document. Web this ruling discusses whether a beneficiary's disclaimer of a beneficial interest in a decedent's ira is a qualified disclaimer under section 2518 of the code even though. If you were assessed a penalty under section 6700, 6701, or 6694, you may file a claim for.

Web Due To The Variation Of Standards Governing Disclaimer Between The States, Congress Enacted Internal Revenue Code Section 2518 In The Tax Reform Act Of 1976 To Create A.

Web (b) qualified disclaimer defined for purposes of subsection (a), the term “qualified disclaimer” means an irrevocable and unqualified refusal by a person to accept an. Web ( 1) in general. Web section 2518(a) provides that, if a person makes a qualified disclaimer with respect to any interest in property, then for purposes of the estate and gift tax the. How does a qualified disclaimer work?.

2518 Provides That A Qualified Disclaimer Is An Irrevocable And Unqualified Refusal By A Person To Accept An Interest In Property, But Only If:

Use this form if you are a beneficiary and would like to claim or disclaim your benefit from a lpl financial llc (“lpl”) sponsored ira account with a deceased owner. § 2518 (b) qualified disclaimer defined — for purposes of subsection (a), the term “qualified disclaimer” means an irrevocable and unqualified refusal by a person to.