Is Form 7203 Filed With 1120S Or 1040

Is Form 7203 Filed With 1120S Or 1040 - Income tax return for an s corporation. 501 page is at irs.gov/pub501; Web starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a shareholder’s stock and debt basis) in the 1040 return. Form 1040 received an overhaul and revamp in 2018. See the instructions for form 7203 for details. Web the irs recently issued the official draft form 7203, s corporation shareholder stock and debt basis limitations. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. Web all form 7203 revisions. If you have any specific questions. Web the 7203 is not required on the 1120s return and needs to be completed on the 1040 return by the shareholders.

Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Web form 7203 and its separate instructions are developed to replace the worksheet for figuring a shareholder's stock and debt basis. Web keep an eye out for the form 7203 when analyzing your borrower’s returns to capture any contributions by a shareholder to the s corporation. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. Web the 1040 tax form is the one most people use for filing taxes. General instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions,. Web for example, the form 1040 page is at irs.gov/form1040; If you have any specific questions. Form 1040 received an overhaul and revamp in 2018. And the schedule a (form.

Form 1040 received an overhaul and revamp in 2018. If you have any specific questions. This form is required to be attached. Web for example, the form 1040 page is at irs.gov/form1040; It's not the easiest to understand, though. Web keep an eye out for the form 7203 when analyzing your borrower’s returns to capture any contributions by a shareholder to the s corporation. Web the 1040 tax form is the one most people use for filing taxes. Income tax return for an s corporation. And the schedule a (form. Web form 7203 is generated for a 1040 return when:

3.11.217 Form 1120S Corporation Tax Returns Internal Revenue

The final form is expected to be available. This form is required to be attached. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file..

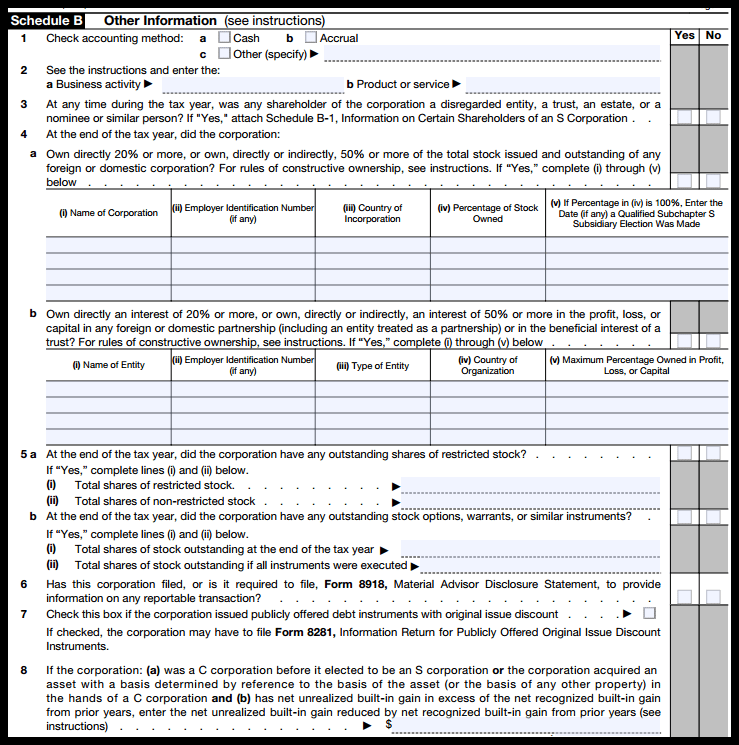

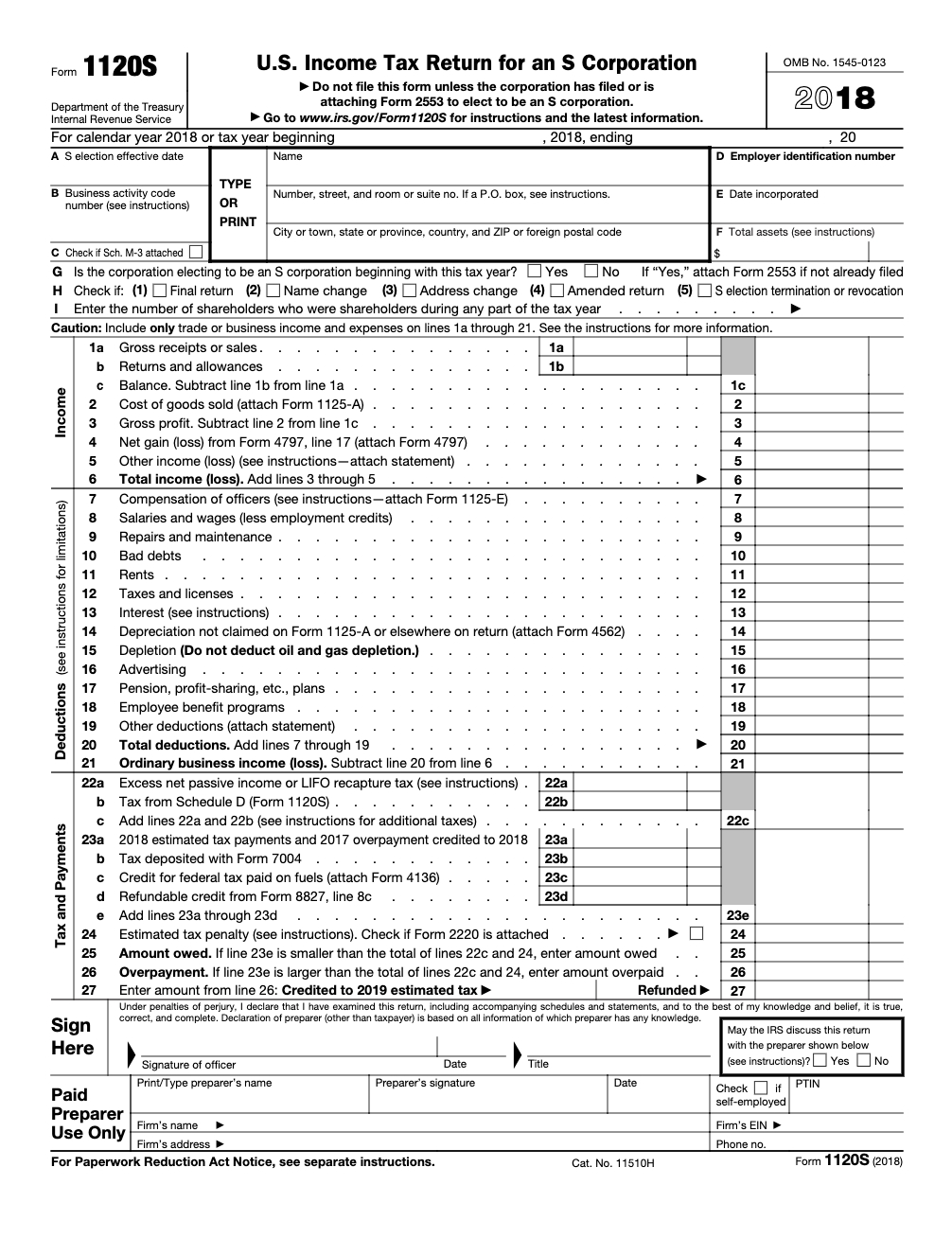

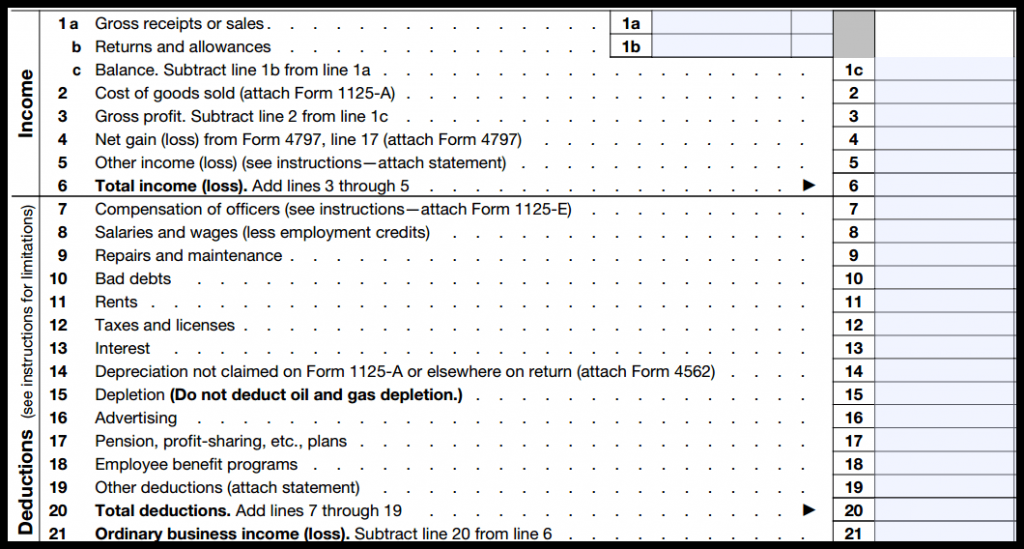

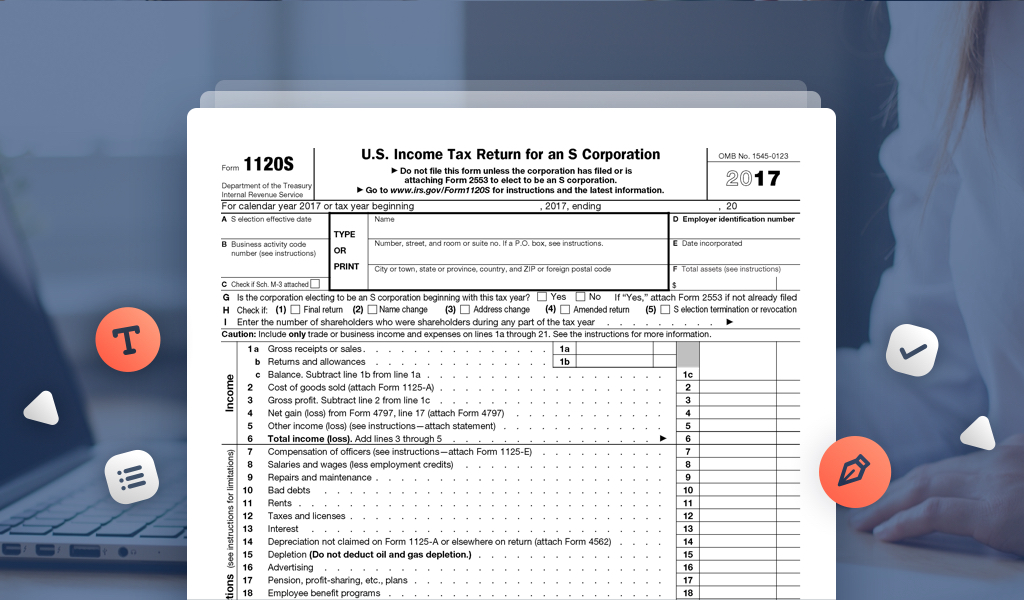

IRS Form 1120S Definition, Download, & 1120S Instructions

Income tax return for an s corporation. Web form 7203 and its separate instructions are developed to replace the worksheet for figuring a shareholder's stock and debt basis. Web keep an eye out for the form 7203 when analyzing your borrower’s returns to capture any contributions by a shareholder to the s corporation. Web form 7203 is used to calculate.

S Corp Calendar Year Month Calendar Printable

It's not the easiest to understand, though. Web all form 7203 revisions. Income tax return for an s corporation. Web starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a shareholder’s stock and debt basis) in the 1040 return. This form is required to be attached.

Can you look over this corporate tax return form 1120 I did based on

If you have any specific questions. This form is required to be attached. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. It's not the easiest to understand, though. Form 1040 received an overhaul and revamp in 2018.

IRS Form 1120S Definition, Download, & 1120S Instructions

Web the irs recently issued the official draft form 7203, s corporation shareholder stock and debt basis limitations. See the instructions for form 7203 for details. Income tax return for an s corporation. Form 7203 is filed by shareholders. Web starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a shareholder’s stock and debt.

Form 1120S Tax Return for an S Corporation (2013) Free Download

Web all form 7203 revisions. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. See the instructions for form 7203 for details. Web for example, the form 1040 page is at irs.gov/form1040; Web the 1040 tax form is the one most people use for filing taxes.

Peerless Turbotax Profit And Loss Statement Cvp

Web form 7203 and its separate instructions are developed to replace the worksheet for figuring a shareholder's stock and debt basis. Web the 7203 is not required on the 1120s return and needs to be completed on the 1040 return by the shareholders. Web form 7203 is generated for a 1040 return when: Web starting in tax year 2021, form.

Don’t Miss the Deadline for Reporting Your Shareholding with

501 page is at irs.gov/pub501; If you have any specific questions. And the schedule a (form. General instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions,. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file.

IRS Form 720 Instructions for the PatientCentered Research

Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. It's not the easiest to understand, though. Web keep an eye out for the form 7203 when analyzing your borrower’s returns to capture any contributions by a shareholder to the s corporation. Income tax return for an s corporation. Web the 1040.

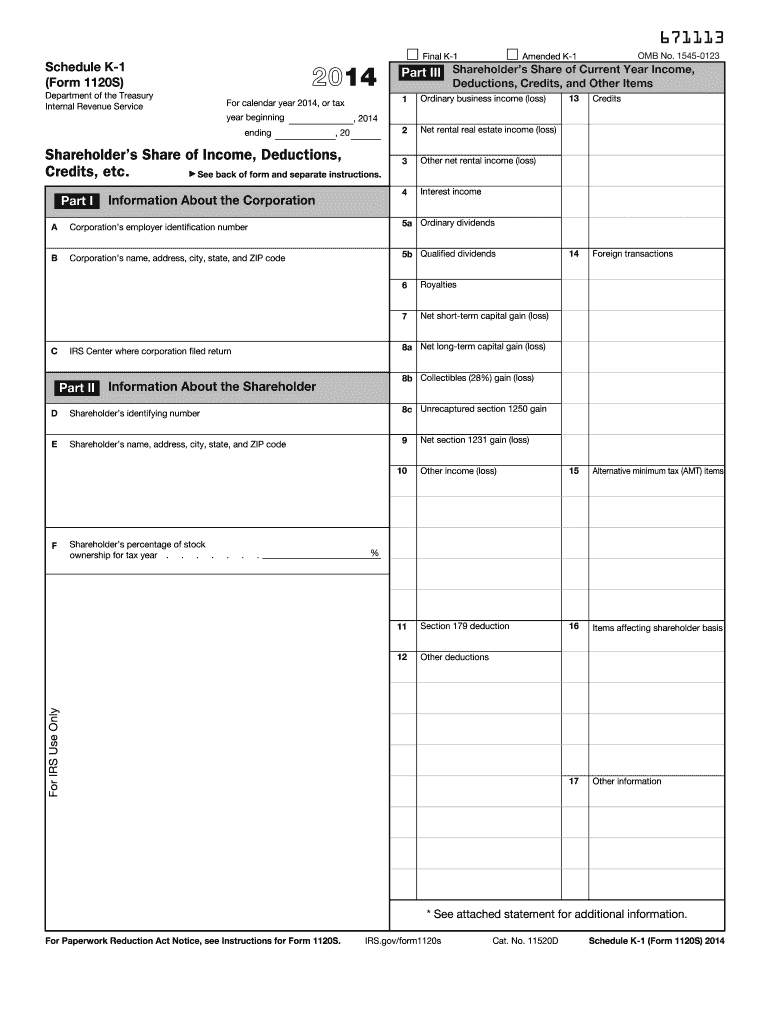

2014 Form IRS 1120S Schedule K1 Fill Online, Printable, Fillable

The final form is expected to be available. It's not the easiest to understand, though. General instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions,. And the schedule a (form. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an.

If You Have Any Specific Questions.

And the schedule a (form. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. Income tax return for an s corporation. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items.

Web The 1040 Tax Form Is The One Most People Use For Filing Taxes.

Web all form 7203 revisions. Form 7203 is filed by shareholders. See the instructions for form 7203 for details. Web form 7203 and its separate instructions are developed to replace the worksheet for figuring a shareholder's stock and debt basis.

501 Page Is At Irs.gov/Pub501;

General instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions,. This form is required to be attached. Web the irs recently issued the official draft form 7203, s corporation shareholder stock and debt basis limitations. Web the irs has released the official draft of the proposed form 7203, s corporation shareholder stock and debt basis limitations, [1] to be used to report s.

Web Form 7203 Is Generated For A 1040 Return When:

The final form is expected to be available. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web for example, the form 1040 page is at irs.gov/form1040; Web the 7203 is not required on the 1120s return and needs to be completed on the 1040 return by the shareholders.