Kentucky State Tax Form 2023

Kentucky State Tax Form 2023 - Web current individual income tax forms schedule p, kentucky pension income exclusion for all individuals who are retired from the federal government, the commonwealth of kentucky, or a kentucky local government with service performed prior to january 1, 1998, you may be able to exclude more than $31,110*. The new individual income tax rate for 2023 has also been established to be 4.5%, a reduction by.5% from the 2022 tax rate. Web this amount will be incorporated into 2023 tax forms and should be used for tax planning in the new year. Visit our individual income tax page for more information. Be sure to verify that the form you are downloading is for the correct year. Income tax liability thresholds— the 2022 filingthreshold amount based upon federal poverty level is expected to be $13,590 for a family The kentucky general assembly's 2023 session kicks off next week. Web the kentucky withholding tax rate will be 4.5% for tax year 2023. Web • for 2023, you expect a refund of all your kentucky income tax withheld. Tobacco and vapor products taxes;

Web current individual income tax forms schedule p, kentucky pension income exclusion for all individuals who are retired from the federal government, the commonwealth of kentucky, or a kentucky local government with service performed prior to january 1, 1998, you may be able to exclude more than $31,110*. Web the kentucky withholding tax rate will be 4.5% for tax year 2023. Utility gross receipts license tax; Web this amount will be incorporated into 2023 tax forms and should be used for tax planning in the new year. Income tax liability thresholds— the 2022 filingthreshold amount based upon federal poverty level is expected to be $13,590 for a family Web • for 2023, you expect a refund of all your kentucky income tax withheld. Motor vehicle rental/ride share excise tax; Visit our individual income tax page for more information. Be sure to verify that the form you are downloading is for the correct year. Keep in mind that some states will not update their tax forms for 2023 until january 2024.

The new individual income tax rate for 2023 has also been established to be 4.5%, a reduction by.5% from the 2022 tax rate. Keep in mind that some states will not update their tax forms for 2023 until january 2024. Web current individual income tax forms schedule p, kentucky pension income exclusion for all individuals who are retired from the federal government, the commonwealth of kentucky, or a kentucky local government with service performed prior to january 1, 1998, you may be able to exclude more than $31,110*. Kentucky revised statute chapter 141 requires employers to withhold income tax for both residents and nonresidents employees (unless exempted by law). Web • for 2023, you expect a refund of all your kentucky income tax withheld. Be sure to verify that the form you are downloading is for the correct year. The kentucky general assembly's 2023 session kicks off next week. Utility gross receipts license tax; Motor vehicle rental/ride share excise tax; Visit our individual income tax page for more information.

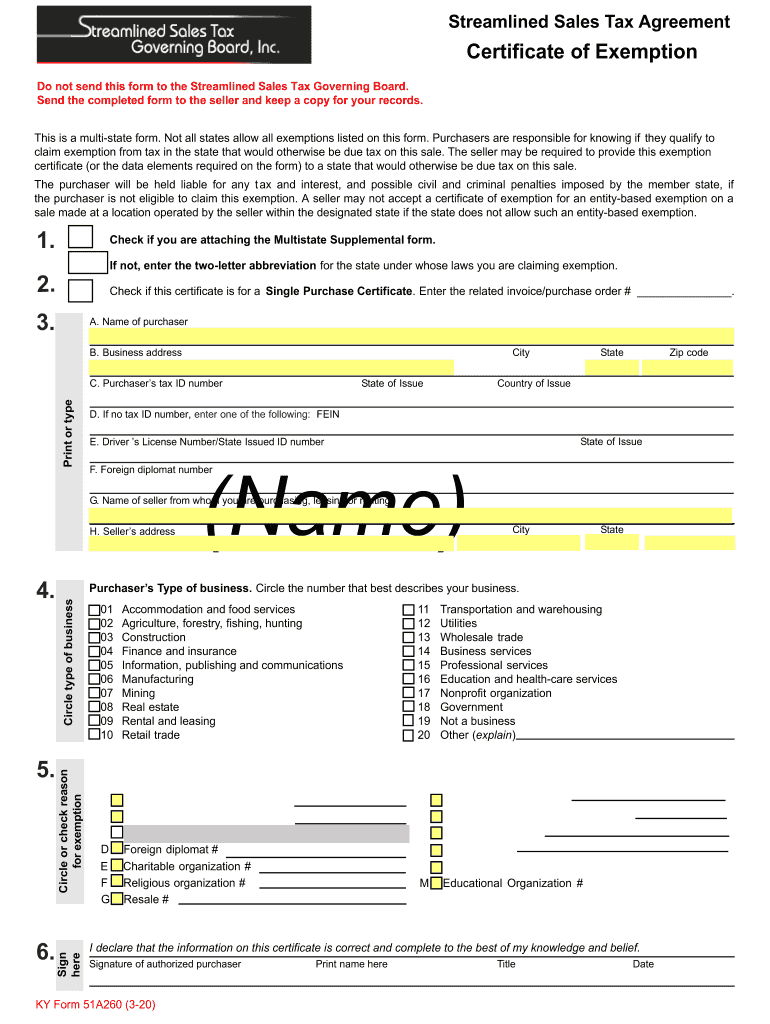

2020 Form KY 51A260 Fill Online, Printable, Fillable, Blank pdfFiller

Web the kentucky withholding tax rate will be 4.5% for tax year 2023. Kentucky revised statute chapter 141 requires employers to withhold income tax for both residents and nonresidents employees (unless exempted by law). The new individual income tax rate for 2023 has also been established to be 4.5%, a reduction by.5% from the 2022 tax rate. Utility gross receipts.

New Employee Sample Form 2023 Employeeform Net Kentucky State

Utility gross receipts license tax; Kentucky revised statute chapter 141 requires employers to withhold income tax for both residents and nonresidents employees (unless exempted by law). The new individual income tax rate for 2023 has also been established to be 4.5%, a reduction by.5% from the 2022 tax rate. Web current individual income tax forms schedule p, kentucky pension income.

Ky Exemption Tax Form Fill Out and Sign Printable PDF Template signNow

Kentucky revised statute chapter 141 requires employers to withhold income tax for both residents and nonresidents employees (unless exempted by law). Be sure to verify that the form you are downloading is for the correct year. Motor vehicle rental/ride share excise tax; Tobacco and vapor products taxes; Web current individual income tax forms schedule p, kentucky pension income exclusion for.

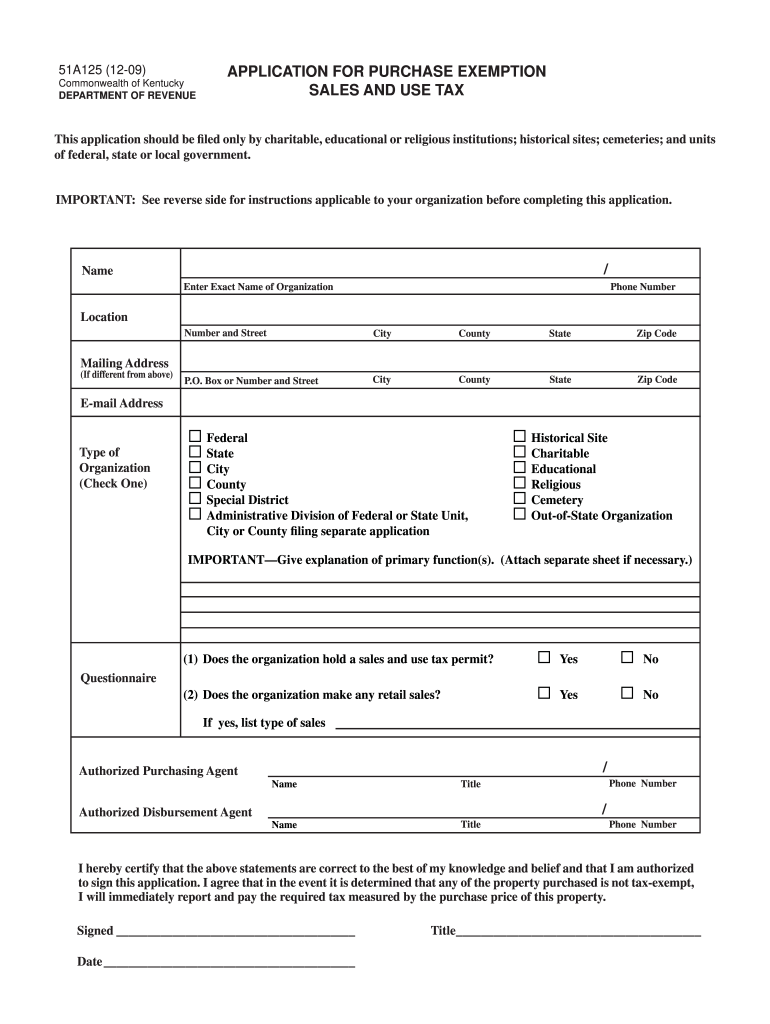

Kentucky tax registration application Fill out & sign online DocHub

Visit our individual income tax page for more information. Be sure to verify that the form you are downloading is for the correct year. Income tax liability thresholds— the 2022 filingthreshold amount based upon federal poverty level is expected to be $13,590 for a family The new individual income tax rate for 2023 has also been established to be 4.5%,.

2021 year planner calendar download for a4 or a3 print infozio your

Web • for 2023, you expect a refund of all your kentucky income tax withheld. Be sure to verify that the form you are downloading is for the correct year. Kentucky revised statute chapter 141 requires employers to withhold income tax for both residents and nonresidents employees (unless exempted by law). Motor vehicle rental/ride share excise tax; Web current individual.

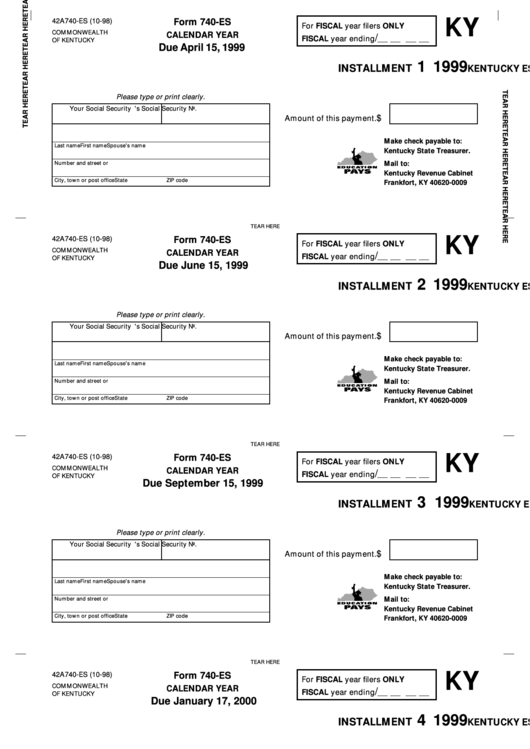

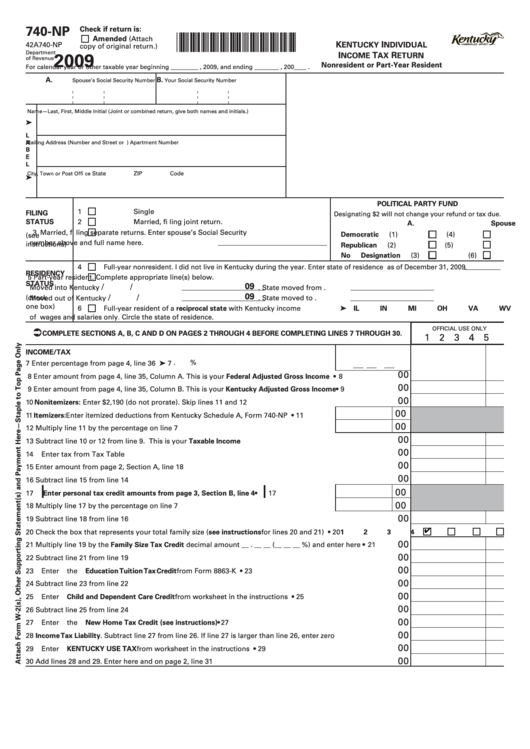

dipitdesign Kentucky Tax Form 740

Income tax liability thresholds— the 2022 filingthreshold amount based upon federal poverty level is expected to be $13,590 for a family Tobacco and vapor products taxes; Web • for 2023, you expect a refund of all your kentucky income tax withheld. Kentucky revised statute chapter 141 requires employers to withhold income tax for both residents and nonresidents employees (unless exempted.

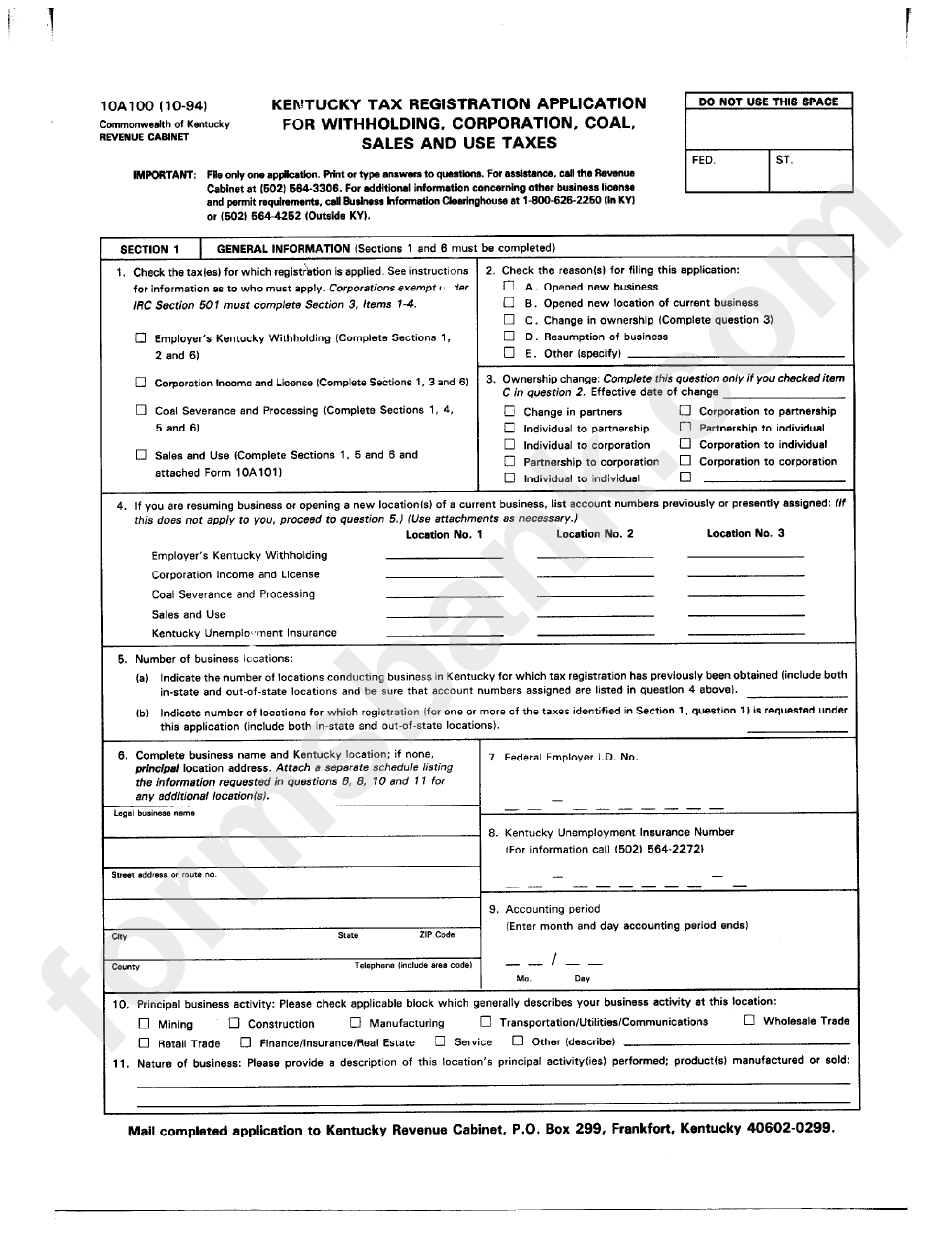

Fillable Form 10a100 Kentucky Tax Registration Application For

Web current individual income tax forms schedule p, kentucky pension income exclusion for all individuals who are retired from the federal government, the commonwealth of kentucky, or a kentucky local government with service performed prior to january 1, 1998, you may be able to exclude more than $31,110*. Web • for 2023, you expect a refund of all your kentucky.

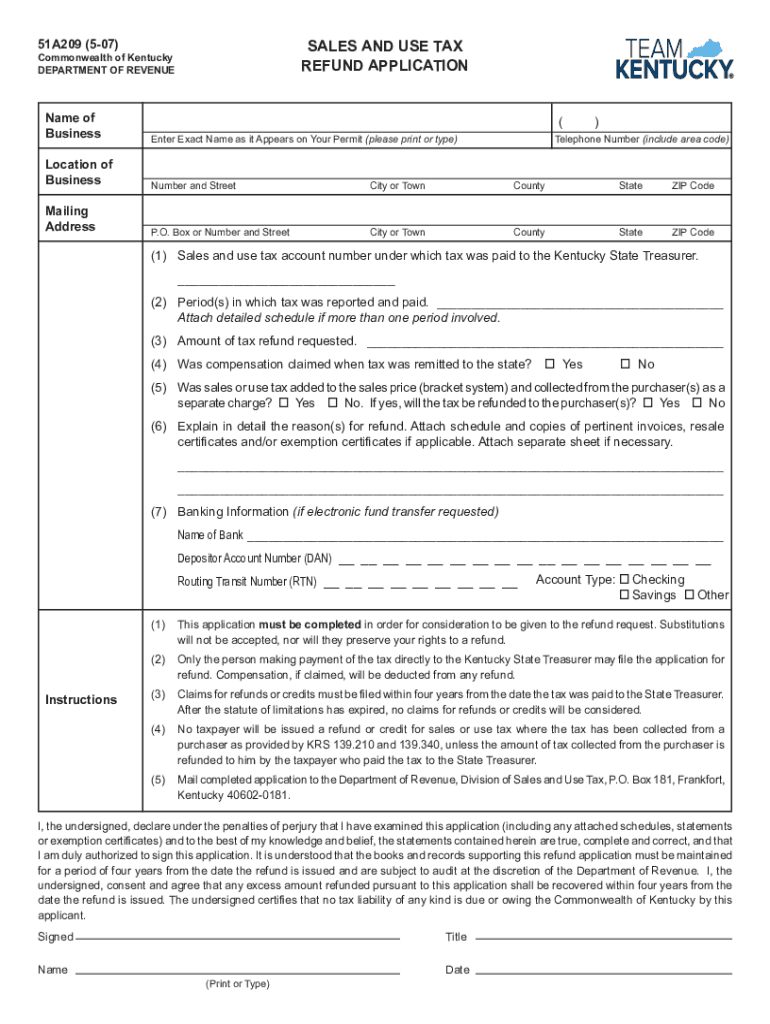

Refund Kentucky Form Fill Out and Sign Printable PDF Template signNow

The kentucky general assembly's 2023 session kicks off next week. Income tax liability thresholds— the 2022 filingthreshold amount based upon federal poverty level is expected to be $13,590 for a family Web • for 2023, you expect a refund of all your kentucky income tax withheld. Utility gross receipts license tax; Web current individual income tax forms schedule p, kentucky.

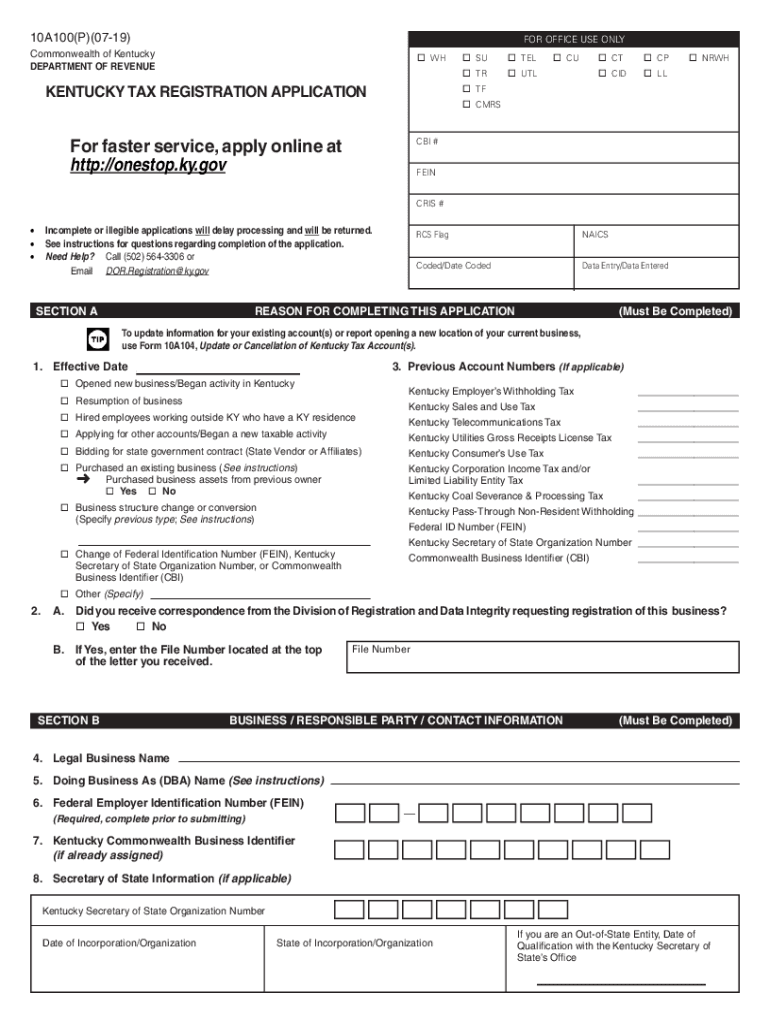

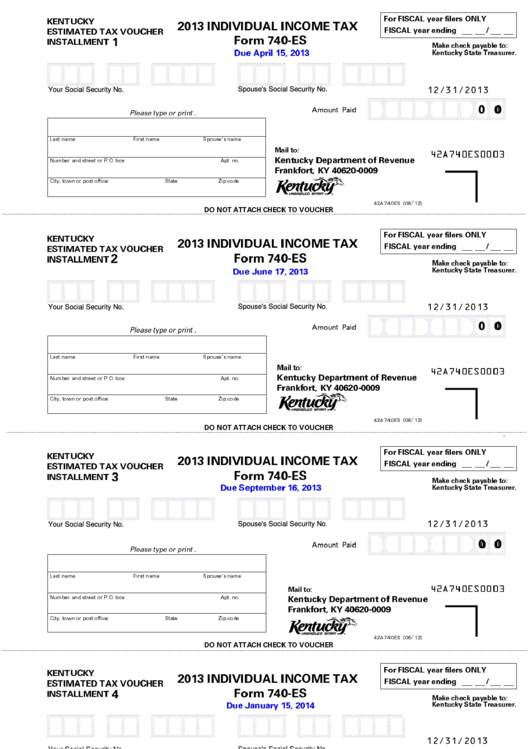

Fillable Form 740Es Individual Tax Kentucky Estimated Tax

Web • for 2023, you expect a refund of all your kentucky income tax withheld. Tobacco and vapor products taxes; Visit our individual income tax page for more information. The kentucky general assembly's 2023 session kicks off next week. Be sure to verify that the form you are downloading is for the correct year.

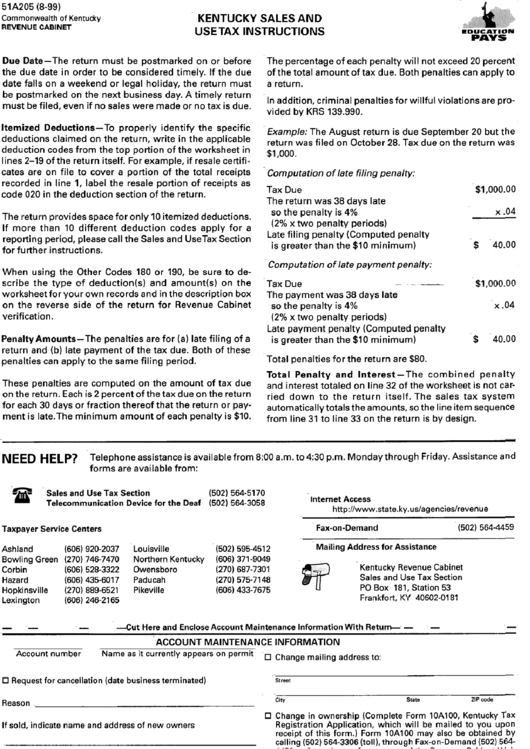

Form 51a205 Kentucky Sales And Use Tax Instructions printable pdf

Keep in mind that some states will not update their tax forms for 2023 until january 2024. Web the kentucky withholding tax rate will be 4.5% for tax year 2023. Web • for 2023, you expect a refund of all your kentucky income tax withheld. The kentucky general assembly's 2023 session kicks off next week. Visit our individual income tax.

Keep In Mind That Some States Will Not Update Their Tax Forms For 2023 Until January 2024.

Tobacco and vapor products taxes; Web current individual income tax forms schedule p, kentucky pension income exclusion for all individuals who are retired from the federal government, the commonwealth of kentucky, or a kentucky local government with service performed prior to january 1, 1998, you may be able to exclude more than $31,110*. Visit our individual income tax page for more information. Web the kentucky withholding tax rate will be 4.5% for tax year 2023.

Motor Vehicle Rental/Ride Share Excise Tax;

Be sure to verify that the form you are downloading is for the correct year. The kentucky general assembly's 2023 session kicks off next week. Web this amount will be incorporated into 2023 tax forms and should be used for tax planning in the new year. Income tax liability thresholds— the 2022 filingthreshold amount based upon federal poverty level is expected to be $13,590 for a family

Utility Gross Receipts License Tax;

Web • for 2023, you expect a refund of all your kentucky income tax withheld. Kentucky revised statute chapter 141 requires employers to withhold income tax for both residents and nonresidents employees (unless exempted by law). The new individual income tax rate for 2023 has also been established to be 4.5%, a reduction by.5% from the 2022 tax rate.