Ky Farm Exemption Form

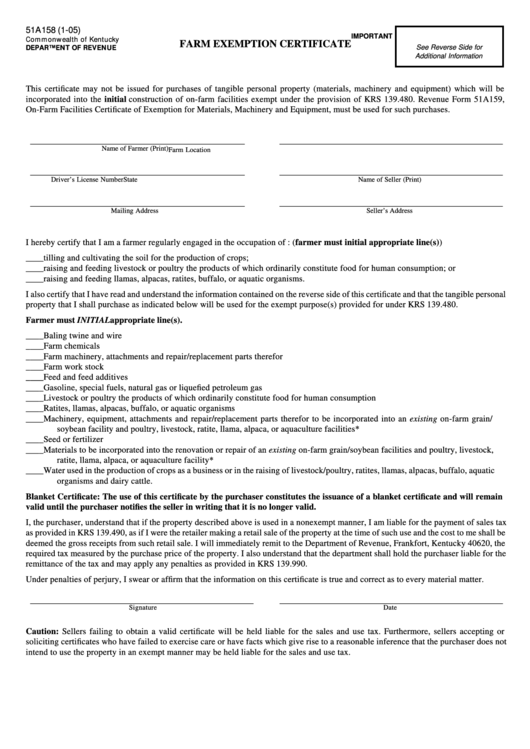

Ky Farm Exemption Form - Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax forms. Applications are still being accepted for existing farms. Download or email ky 51a158 & more fillable forms, register and subscribe now! Web this certifi cate may not be issued for purchases of tangible personal property (materials, machinery and equipment) which will be incorporated into the construction, repair or. Web home / office of the commissioner / agriculture forms select an area: Web you will need to have the agricultural sales tax exemption number and the farm exemption certificate, form 51a158, for farm and machinery purchases. The agriculture exemption number is valid for three. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Fill, sign, email ky 51a158 & more fillable forms, register and subscribe now! Web baling twine and baling wire—baling twine and baling wire for the baling of hay and straw.krs 139.480(27) farm chemicals—insecticides, fungicides, herbicides,.

Web baling twine and baling wire—baling twine and baling wire for the baling of hay and straw.krs 139.480(27) farm chemicals—insecticides, fungicides, herbicides,. Web have been advised and understand that if the property does not, in fact, meet the criteria previously described in this affidavit, it is not exempted as a “farmstead” and if the. Fill, sign, email ky 51a158 & more fillable forms, register and subscribe now! All areas & programs ag marketing commissioner direct farm marketing division of environmental. Web up to $40 cash back related to kentucky farm exemption form kentucky farm exemption 51a158 (921)commonweal th of kentucky department of revenueimportan. Web the deadline to apply for the new agriculture exemption number for current farmers is january 1, 2022. Web a new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt from sales tax. A farm dwelling together with other farm buildings and structures incident to the operation and maintenance of the. Web home / office of the commissioner / agriculture forms select an area: A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt.

Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the kentucky sales tax. Web the application deadline for farms with existing exemption certificates on file with farm suppliers was january 1, 2022. Web a new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt from sales tax. Web this certifi cate may not be issued for purchases of tangible personal property (materials, machinery and equipment) which will be incorporated into the construction, repair or. Web the deadline to apply for the new agriculture exemption number for current farmers is january 1, 2022. Complete, edit or print tax forms instantly. Web baling twine and baling wire—baling twine and baling wire for the baling of hay and straw.krs 139.480(27) farm chemicals—insecticides, fungicides, herbicides,. Web the deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Applications are still being accepted for existing farms.

Convocation exemption form Kettering College

Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax forms. Web have been advised and understand that if the property does not, in fact, meet the criteria previously described in this affidavit, it is not exempted as a “farmstead” and if the. Web the deadline to apply for the new agriculture exemption.

Kentucky Sales Tax Exemption For Farmers Farmer Foto Collections

Web this certifi cate may not be issued for purchases of tangible personal property (materials, machinery and equipment) which will be incorporated into the construction, repair or. Web to qualify for a farmstead exemption the following must be met. Web the application deadline for farms with existing exemption certificates on file with farm suppliers was january 1, 2022. Web a.

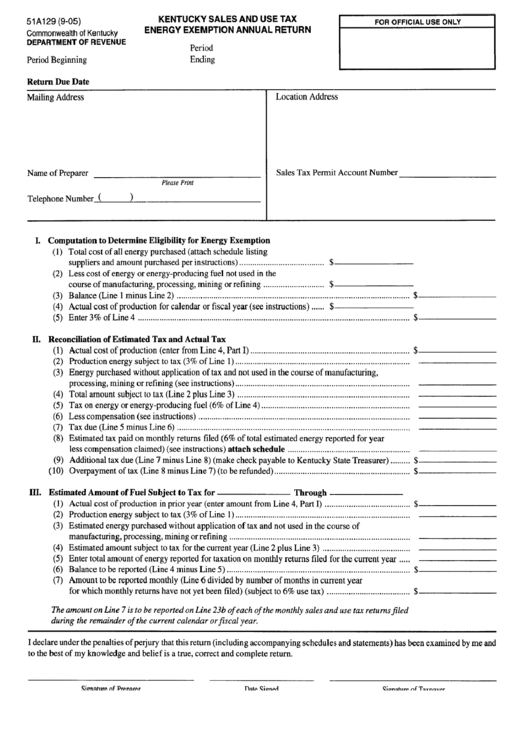

Kentucky Sales And Use Tax Energy Exemption Annual Return Form

Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the kentucky sales tax. Download or email ky 51a158 & more fillable forms, register and subscribe now! Web baling twine and baling wire—baling twine and baling wire for the baling of hay and straw.krs 139.480(27) farm.

E File form 2290 Free Brilliant form Road Use Tax Irs Farm Exemption

Web the deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. Web the deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. All areas & programs ag marketing commissioner direct farm marketing division of environmental. Web have been advised and understand that if the property does.

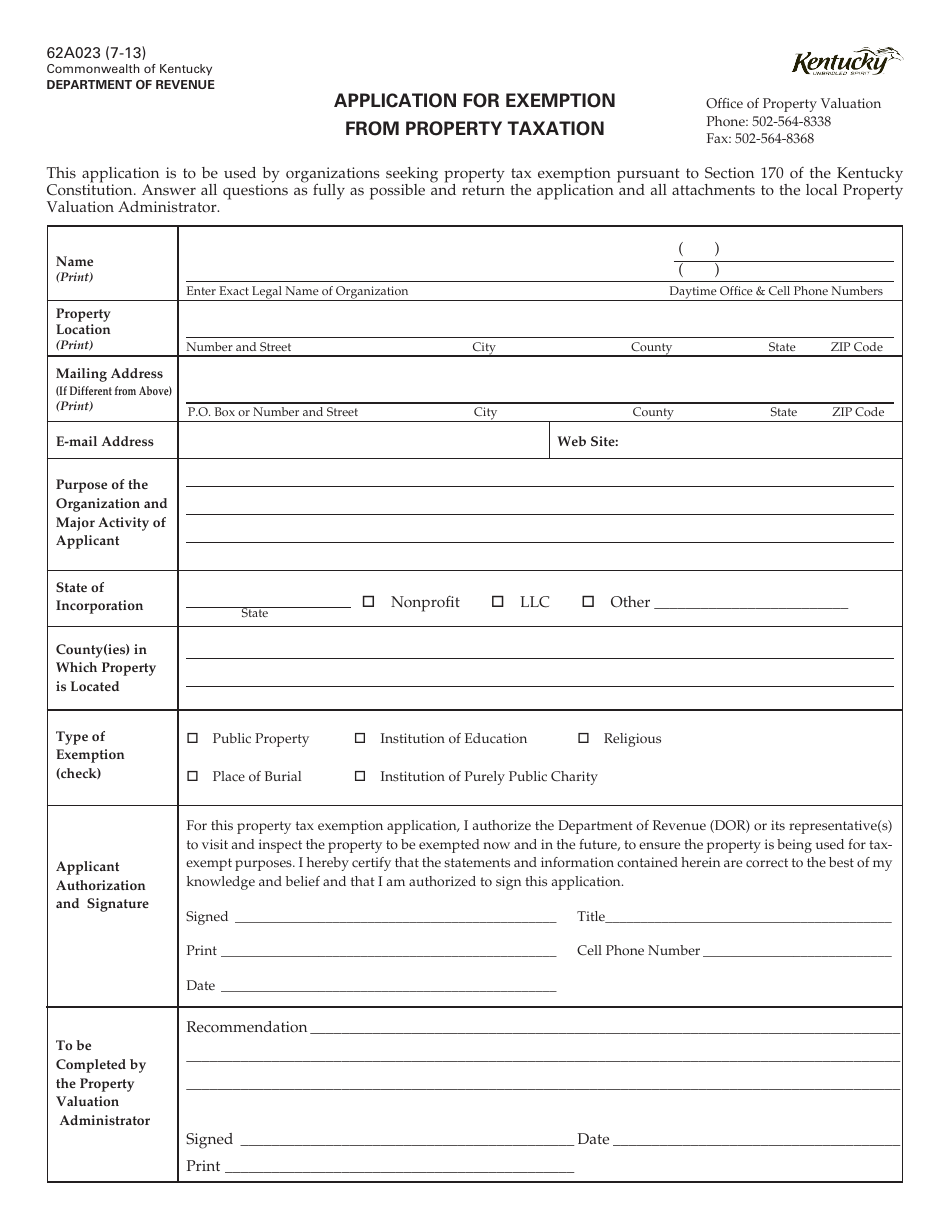

Form 62A023 Download Fillable PDF or Fill Online Application for

Fill, sign, email ky 51a158 & more fillable forms, register and subscribe now! Applications are still being accepted for existing farms. The application form 51a800 is currently available. Web home / office of the commissioner / agriculture forms select an area: Download or email ky 51a158 & more fillable forms, register and subscribe now!

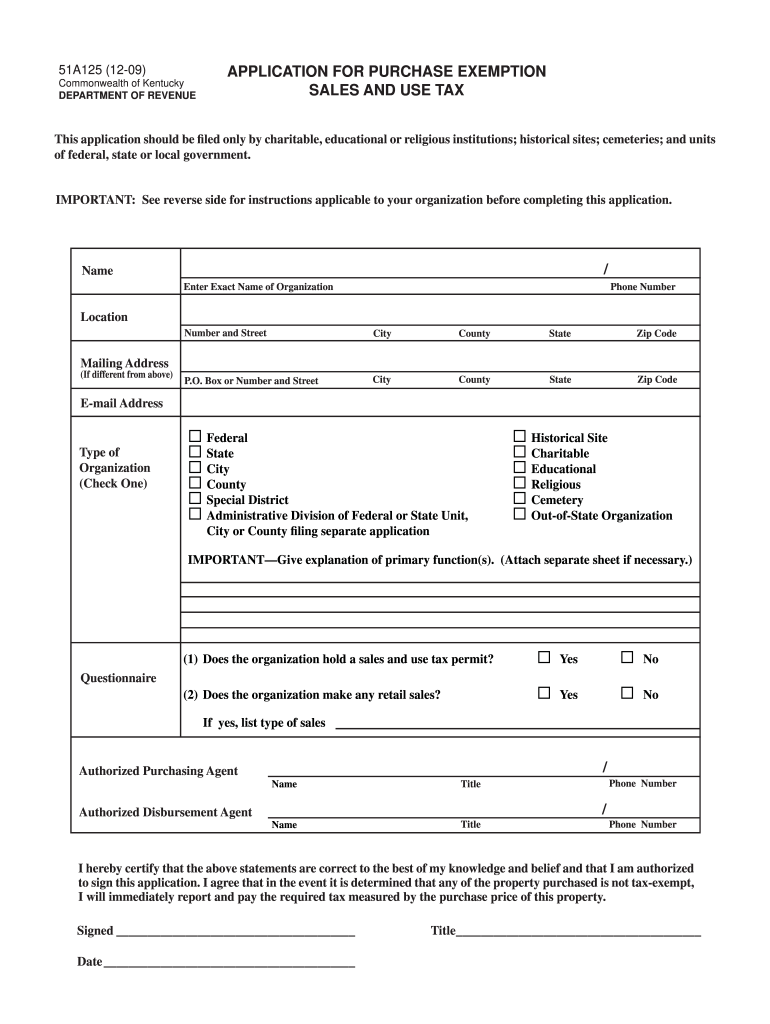

Ky Exemption Tax Form Fill Out and Sign Printable PDF Template signNow

Web home / office of the commissioner / agriculture forms select an area: A farm dwelling together with other farm buildings and structures incident to the operation and maintenance of the. Fill, sign, email ky 51a158 & more fillable forms, register and subscribe now! The application for the agriculture exemption number, form 51a800, is. Web the application deadline for farms.

California Farm Tax Exemption Form Fill Online, Printable, Fillable

The application for the agriculture exemption number, form 51a800, is. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax forms. Web baling twine and baling wire—baling twine and baling wire for the baling of hay and straw.krs 139.480(27) farm chemicals—insecticides, fungicides, herbicides,. Web the deadline for applying for the new agriculture exemption.

Form 51a158 Farm Exemption Certificate printable pdf download

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. All areas & programs ag marketing commissioner direct farm marketing division of environmental. Complete, edit or print tax forms instantly. Web a new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases.

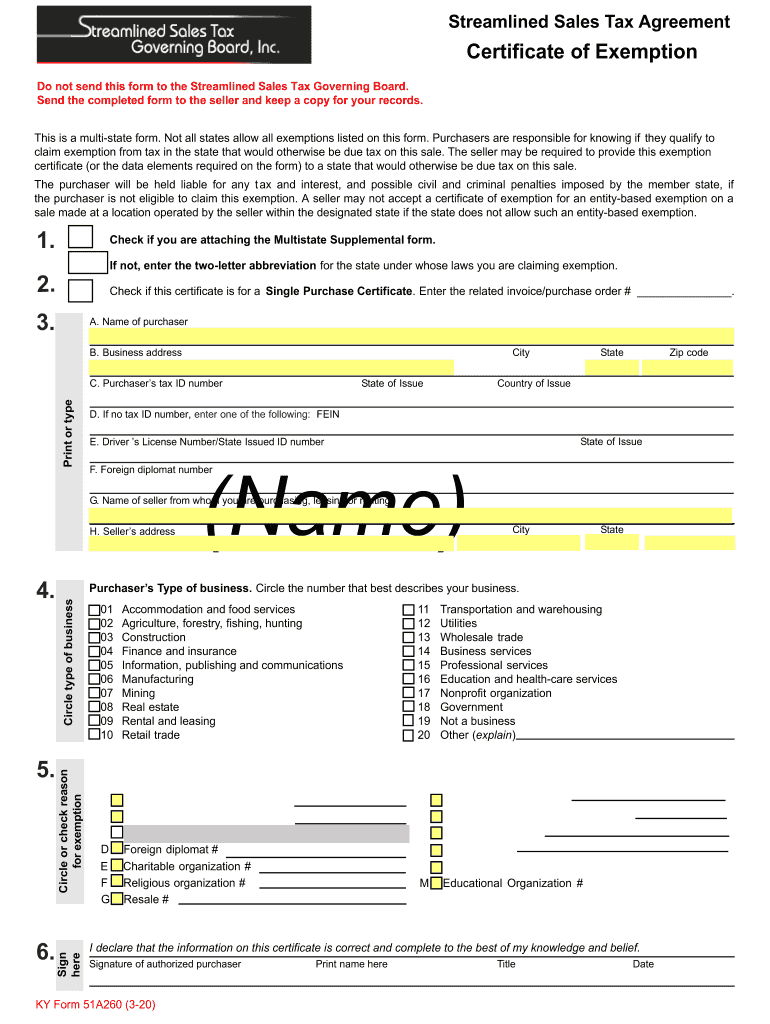

2020 Form KY 51A260 Fill Online, Printable, Fillable, Blank pdfFiller

The application form 51a800 is currently available. The agriculture exemption number is valid for three. Web up to $40 cash back related to kentucky farm exemption form kentucky farm exemption 51a158 (921)commonweal th of kentucky department of revenueimportan. Fill, sign, email ky 51a158 & more fillable forms, register and subscribe now! A sales tax exemption certificate can be used by.

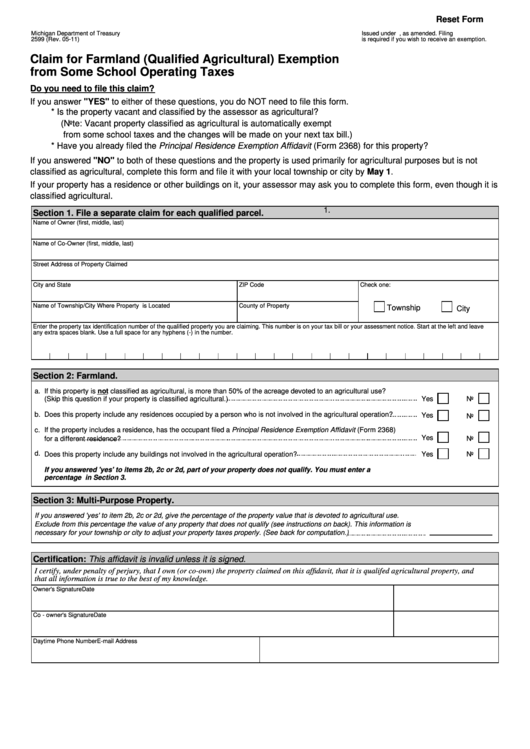

Fillable Form 2599 Claim For Farmland (Qualified Agricultural

Web home / office of the commissioner / agriculture forms select an area: Fill, sign, email ky 51a158 & more fillable forms, register and subscribe now! All areas & programs ag marketing commissioner direct farm marketing division of environmental. Web the deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. The agriculture exemption.

A Farm Dwelling Together With Other Farm Buildings And Structures Incident To The Operation And Maintenance Of The.

Web the application deadline for farms with existing exemption certificates on file with farm suppliers was january 1, 2022. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the kentucky sales tax. Web to qualify for a farmstead exemption the following must be met. The application for the agriculture exemption number, form 51a800, is.

Web The Application For The Agriculture Exemption Number, Form 51A800, Is Available At Www.revenue.ky.gov Under Sales Tax Forms.

Complete, edit or print tax forms instantly. Web the deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. Web the deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. Web up to $40 cash back related to kentucky farm exemption form kentucky farm exemption 51a158 (921)commonweal th of kentucky department of revenueimportan.

Applications Are Still Being Accepted For Existing Farms.

All areas & programs ag marketing commissioner direct farm marketing division of environmental. The application form 51a800 is currently available. Complete, edit or print tax forms instantly. Fill, sign, email ky 51a158 & more fillable forms, register and subscribe now!

Web A New Kentucky Law Requires That Farmers Apply For An Agriculture Exemption Number To Make Qualified Purchases For The Farm Exempt From Sales Tax.

Web home / office of the commissioner / agriculture forms select an area: Web the deadline to apply for the new agriculture exemption number for current farmers is january 1, 2022. Web have been advised and understand that if the property does not, in fact, meet the criteria previously described in this affidavit, it is not exempted as a “farmstead” and if the. The agriculture exemption number is valid for three.