Ky Tax Exempt Form Pdf

Ky Tax Exempt Form Pdf - Web of exemption for materials, machinery and equipment (form 51a159). Residential, farm & commercial property; Sellers accepting certifi cates for such purchases will be held liable for the sales or use tax. Web ensuring it is eligible for the exemption in the state it is claiming the tax exemption from. The purchaser is liable for any tax and interest, and possible civil and criminal penalties imposed by the state, if the purchaser is not eligible to claim this exemption. Web to be used in fulfi lling a contract with an exempt institution. Check with the state for exemption information and requirements. The basis of the residential exemption for utilities shifts from reliance on tariff language filed with the public service commission (psc) to a customer declaration that the services are used at the location as the place of. If any of these links are broken, or you can't find the form you need, please let us know. You can find resale certificates for other states here.

(july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale certificate (form 51a105) to include the services that are now exempt for resale, effective july 1, 2019. Payment of sales and use tax to the vendor. There are no local sales and use taxes in kentucky. Web we have five kentucky sales tax exemption forms available for you to print or save as a pdf file. Check with the state for exemption information and requirements. If any of these links are broken, or you can't find the form you need, please let us know. • if the statutory requirements are met, you will be permitted to make purchases of tangible personal property without. The advanced tools of the editor will lead you through the editable pdf template. The basis of the residential exemption for utilities shifts from reliance on tariff language filed with the public service commission (psc) to a customer declaration that the services are used at the location as the place of. Web how you can fill out the tax exempt form ky on the internet:

Web how you can fill out the tax exempt form ky on the internet: Web agriculture exemption number faqs (05/0 6/22) a griculture exemption number search. To start the form, use the fill camp; Payment of sales and use tax to the vendor. Web of exemption for materials, machinery and equipment (form 51a159). Sellers accepting certifi cates for such purchases will be held liable for the sales or use tax. Web to be used in fulfi lling a contract with an exempt institution. Unmined coal & other natural resources; Web we have five kentucky sales tax exemption forms available for you to print or save as a pdf file. The purchaser is liable for any tax and interest, and possible civil and criminal penalties imposed by the state, if the purchaser is not eligible to claim this exemption.

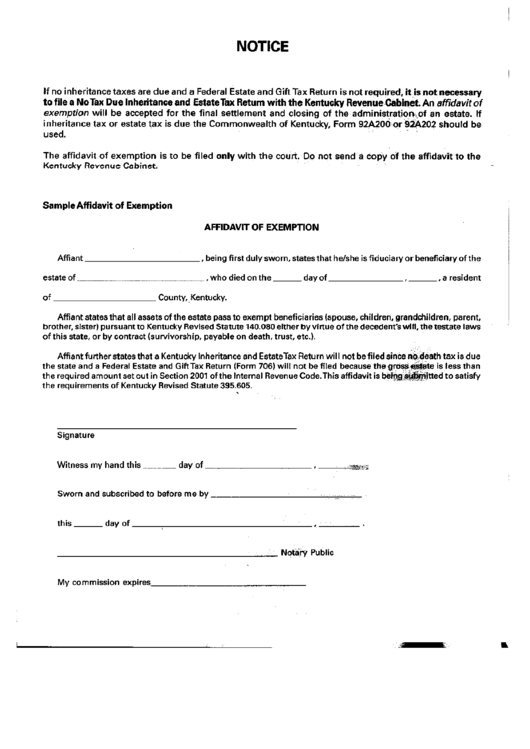

Affidavit Of Exemption Kentucky Tax Exemption printable pdf download

Web we have five kentucky sales tax exemption forms available for you to print or save as a pdf file. Web of exemption for materials, machinery and equipment (form 51a159). Payment of sales and use tax to the vendor. Web ensuring it is eligible for the exemption in the state it is claiming the tax exemption from. __________________________________________________ name of.

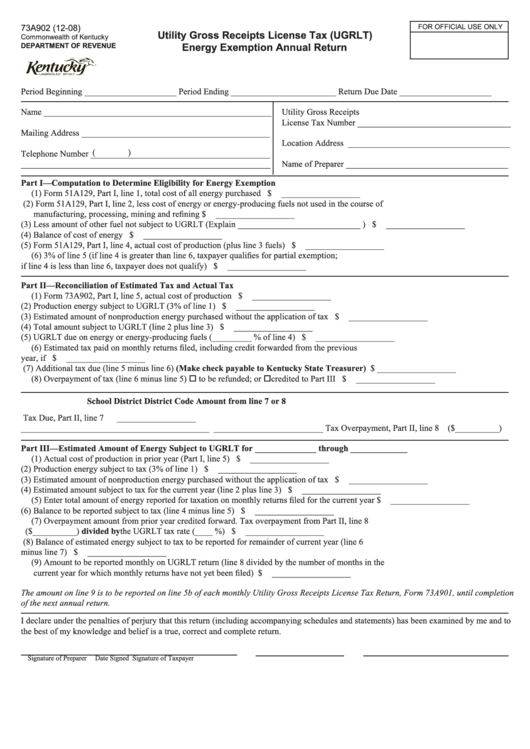

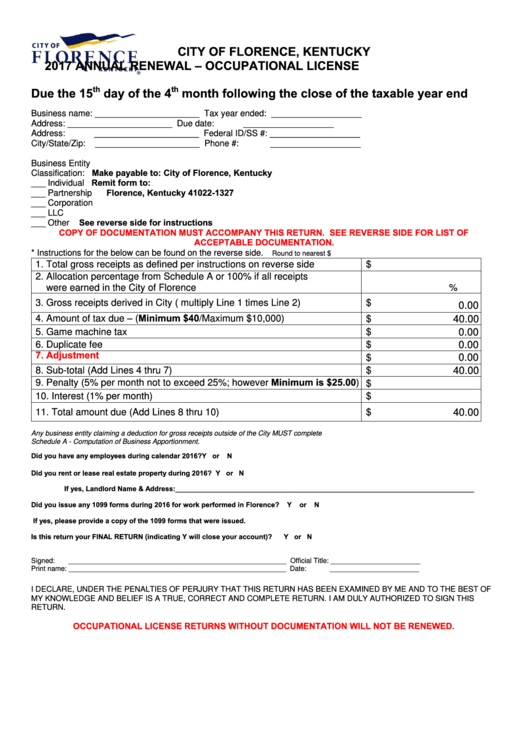

Form 73a902 Utility Gross Receipts License Tax (Ugrlt) Energy

The basis of the residential exemption for utilities shifts from reliance on tariff language filed with the public service commission (psc) to a customer declaration that the services are used at the location as the place of. If any of these links are broken, or you can't find the form you need, please let us know. Web to be used.

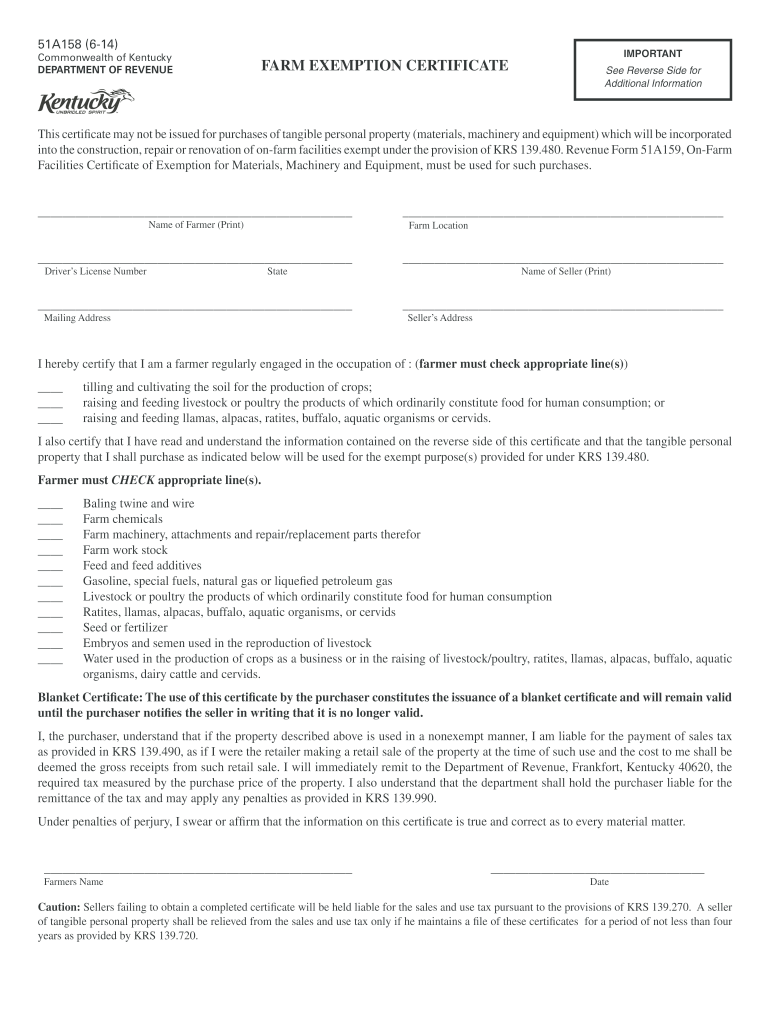

Farm Tax Exemption Kentucky Fill Online, Printable, Fillable, Blank

The advanced tools of the editor will lead you through the editable pdf template. __________________________________________________ name of farmer (print) ___________________________________________________ farm location. Payment of sales and use tax to the vendor. Web ensuring it is eligible for the exemption in the state it is claiming the tax exemption from. Unmined coal & other natural resources;

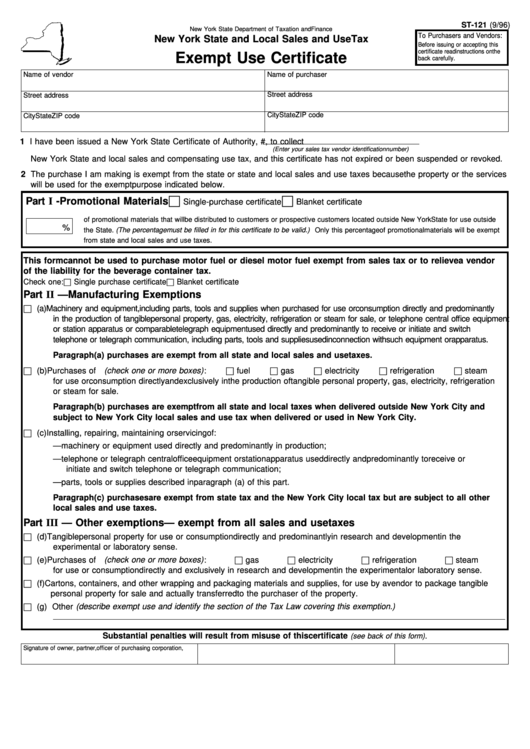

Fillable Form St121 Exempt Use Certificate printable pdf download

Unmined coal & other natural resources; Check with the state for exemption information and requirements. The advanced tools of the editor will lead you through the editable pdf template. You can find resale certificates for other states here. The basis of the residential exemption for utilities shifts from reliance on tariff language filed with the public service commission (psc) to.

Tax Exempt Forms San Patricio Electric Cooperative

Web how you can fill out the tax exempt form ky on the internet: Web we have five kentucky sales tax exemption forms available for you to print or save as a pdf file. The basis of the residential exemption for utilities shifts from reliance on tariff language filed with the public service commission (psc) to a customer declaration that.

Co Resale Certificate Master of Documents

The basis of the residential exemption for utilities shifts from reliance on tariff language filed with the public service commission (psc) to a customer declaration that the services are used at the location as the place of. Check with the state for exemption information and requirements. Sign online button or tick the preview image of the form. To start the.

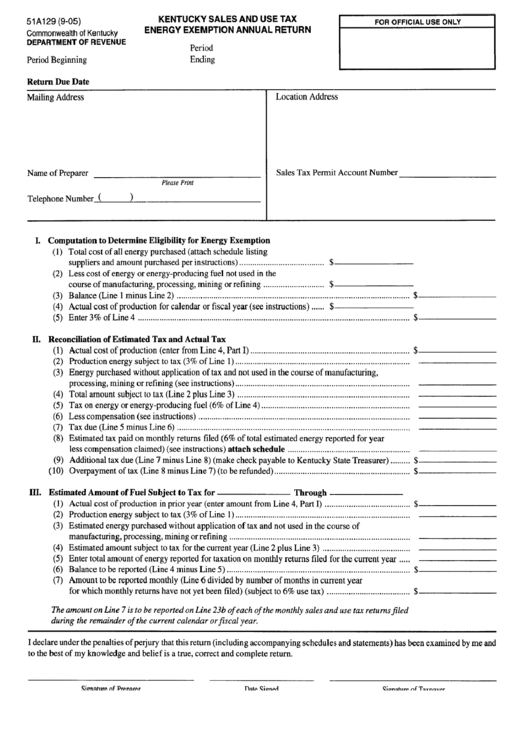

Kentucky Sales And Use Tax Energy Exemption Annual Return Form

Sign online button or tick the preview image of the form. Unmined coal & other natural resources; There are no local sales and use taxes in kentucky. Sales and use tax faqs (09/06 /22) kentucky sales and use tax is imposed at the rate of 6 percent of gross receipts or purchase price. To start the form, use the fill.

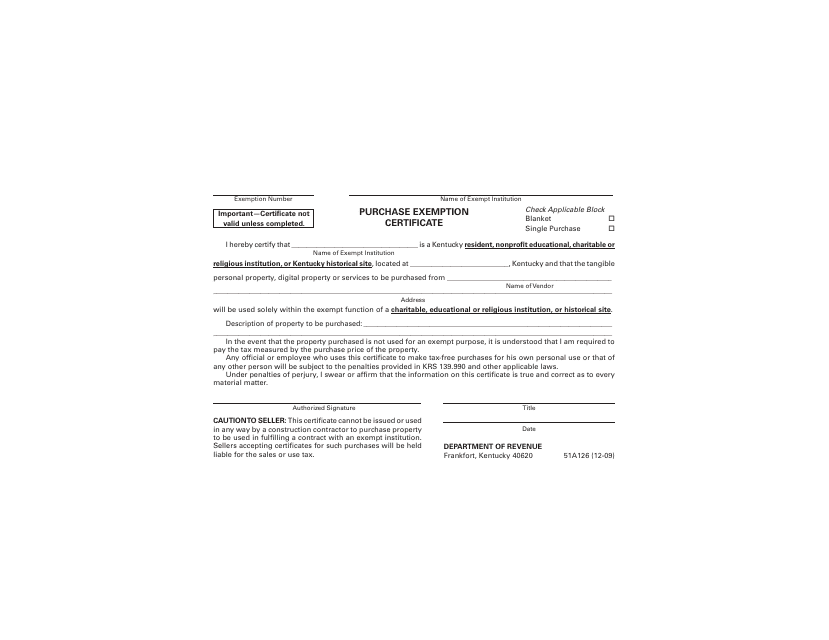

Ky Revenue Form 51a126

• if the statutory requirements are met, you will be permitted to make purchases of tangible personal property without. If any of these links are broken, or you can't find the form you need, please let us know. There are no local sales and use taxes in kentucky. You can find resale certificates for other states here. Sales and use.

Ky Revenue Form 51a126

(july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale certificate (form 51a105) to include the services that are now exempt for resale, effective july 1, 2019. If any of these links are broken, or you can't find the form you need, please let us know. You can find resale certificates for other.

Kentucky Sales Tax Exemption For Farmers Farmer Foto Collections

Web agriculture exemption number faqs (05/0 6/22) a griculture exemption number search. __________________________________________________ name of farmer (print) ___________________________________________________ farm location. Sellers accepting certifi cates for such purchases will be held liable for the sales or use tax. The basis of the residential exemption for utilities shifts from reliance on tariff language filed with the public service commission (psc) to a.

Sign Online Button Or Tick The Preview Image Of The Form.

Web agriculture exemption number faqs (05/0 6/22) a griculture exemption number search. There are no local sales and use taxes in kentucky. Check with the state for exemption information and requirements. You can find resale certificates for other states here.

(July 15, 2019)— Due To Recent Legislative Changes, The Department Of Revenue (Dor) Has Updated The Resale Certificate (Form 51A105) To Include The Services That Are Now Exempt For Resale, Effective July 1, 2019.

Web how you can fill out the tax exempt form ky on the internet: Web we have five kentucky sales tax exemption forms available for you to print or save as a pdf file. The advanced tools of the editor will lead you through the editable pdf template. __________________________________________________ name of farmer (print) ___________________________________________________ farm location.

Sales And Use Tax Faqs (09/06 /22) Kentucky Sales And Use Tax Is Imposed At The Rate Of 6 Percent Of Gross Receipts Or Purchase Price.

The basis of the residential exemption for utilities shifts from reliance on tariff language filed with the public service commission (psc) to a customer declaration that the services are used at the location as the place of. Web ensuring it is eligible for the exemption in the state it is claiming the tax exemption from. To start the form, use the fill camp; If any of these links are broken, or you can't find the form you need, please let us know.

Web To Be Used In Fulfi Lling A Contract With An Exempt Institution.

Residential, farm & commercial property; • if the statutory requirements are met, you will be permitted to make purchases of tangible personal property without. Payment of sales and use tax to the vendor. Unmined coal & other natural resources;