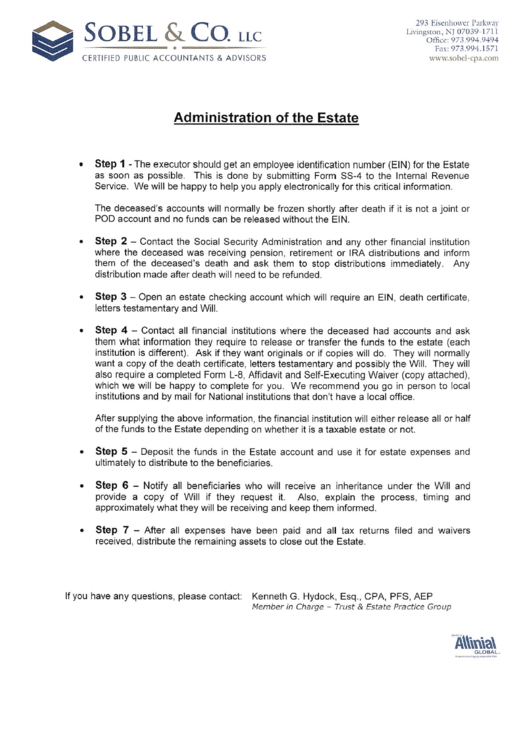

L-8 Form Nj

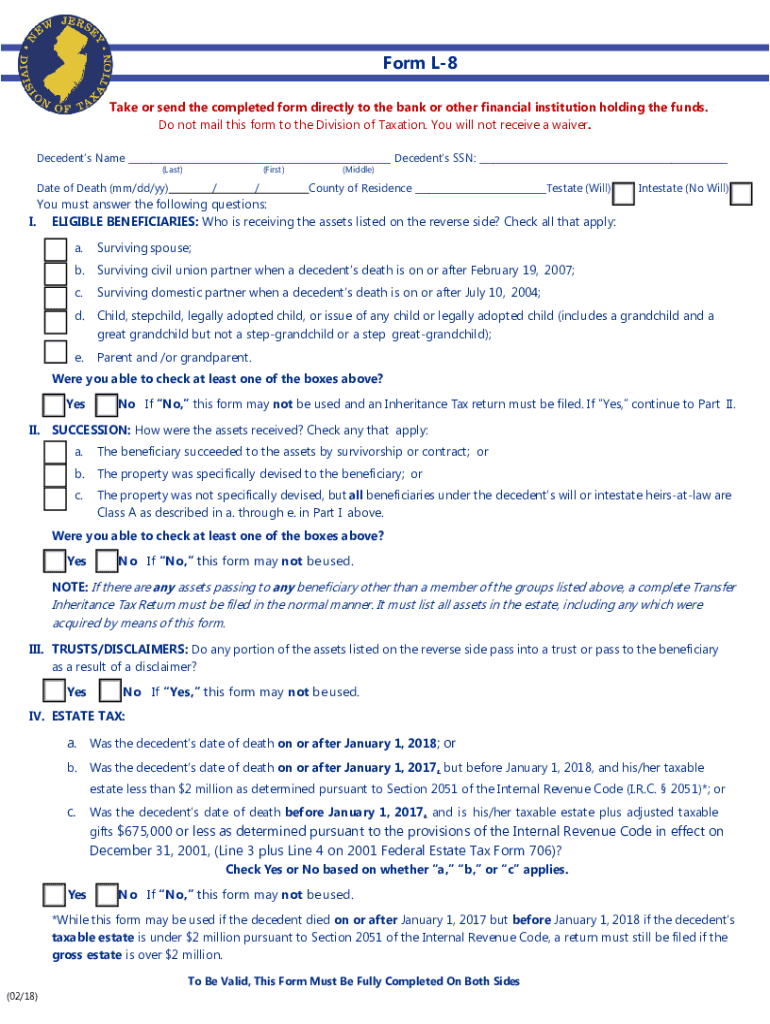

L-8 Form Nj - Use this form for release of: • stock in new jersey corporations; Then they can be sent or brought directly to the bank, transfer agent, or other financial institutions holding the funds. This is new jersey law. You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets. • new jersey bank accounts; And • new jersey investment bonds. This form cannot be used for real estate. No estate tax is ever due when there is a surviving spouse. No inheritance tax is due on inheritances to a surviving spouse, child or grandchild.

• new jersey bank accounts; No estate tax is ever due when there is a surviving spouse. This is new jersey law. For real estate investments, use. However, if other heirs file to claim real estate property, then the value may not exceed $20,000. • stock in new jersey corporations; Use this form for release of: Then they can be sent or brought directly to the bank, transfer agent, or other financial institutions holding the funds. This form cannot be used for real estate. You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets.

Then they can be sent or brought directly to the bank, transfer agent, or other financial institutions holding the funds. For real estate investments, use. And • new jersey investment bonds. This form cannot be used for real estate. This is new jersey law. However, if other heirs file to claim real estate property, then the value may not exceed $20,000. Use this form for release of: • new jersey bank accounts; No inheritance tax is due on inheritances to a surviving spouse, child or grandchild. You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets.

Statement of Assets, Liabilities and Net Worth (SALN) Form 2012

Then they can be sent or brought directly to the bank, transfer agent, or other financial institutions holding the funds. This form cannot be used for real estate. This is new jersey law. No estate tax is ever due when there is a surviving spouse. • stock in new jersey corporations;

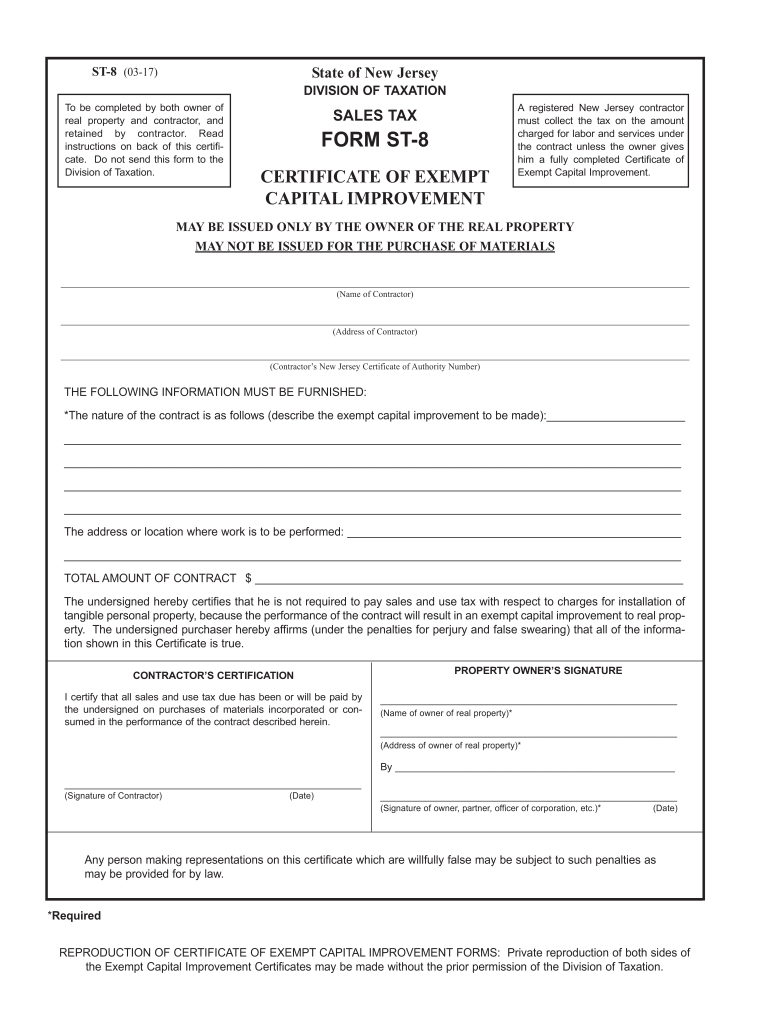

20172023 Form NJ DoT ST8 Fill Online, Printable, Fillable, Blank

You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets. For real estate investments, use. This is new jersey law. This form cannot be used for real estate. However, if other heirs file to claim real estate property, then the value may not exceed $20,000.

Nj State Tax Form Pdf Fill Online, Printable, Fillable, Blank pdfFiller

• stock in new jersey corporations; You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets. No estate tax is ever due when there is a surviving spouse. No inheritance tax is due on inheritances to a surviving spouse, child or grandchild. For real estate investments, use.

Nj L8 Form 2018 Fill Out and Sign Printable PDF Template signNow

Then they can be sent or brought directly to the bank, transfer agent, or other financial institutions holding the funds. No estate tax is ever due when there is a surviving spouse. And • new jersey investment bonds. However, if other heirs file to claim real estate property, then the value may not exceed $20,000. • new jersey bank accounts;

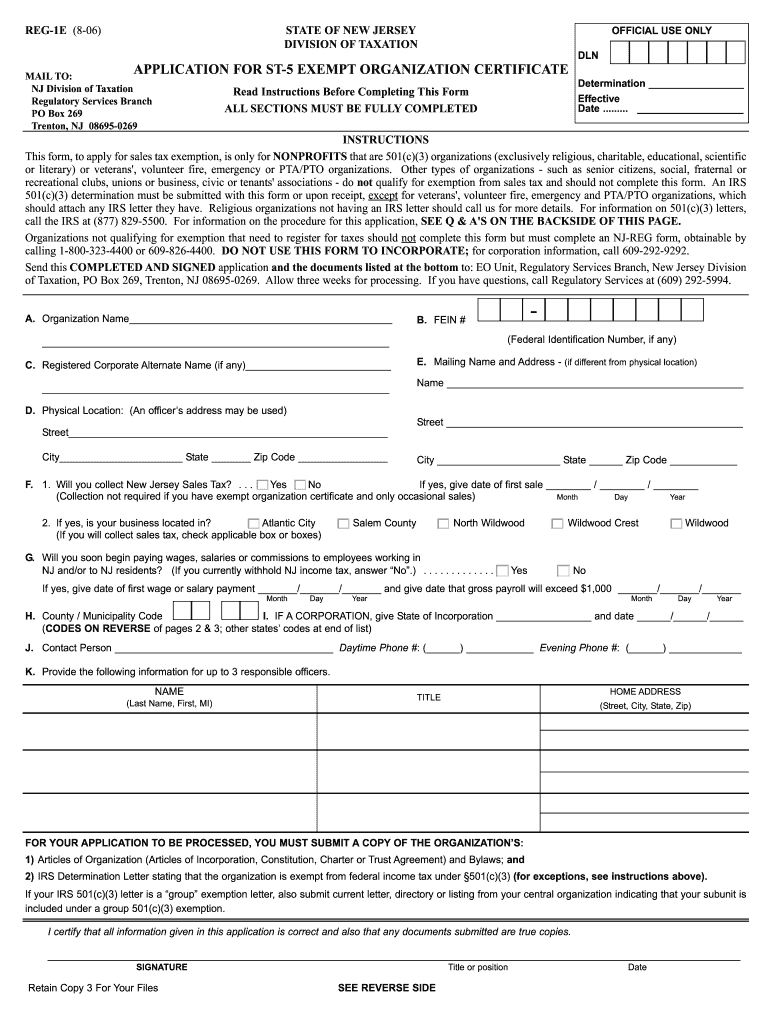

Reg 1e application 2006 form Fill out & sign online DocHub

This is new jersey law. Then they can be sent or brought directly to the bank, transfer agent, or other financial institutions holding the funds. This form cannot be used for real estate. However, if other heirs file to claim real estate property, then the value may not exceed $20,000. • new jersey bank accounts;

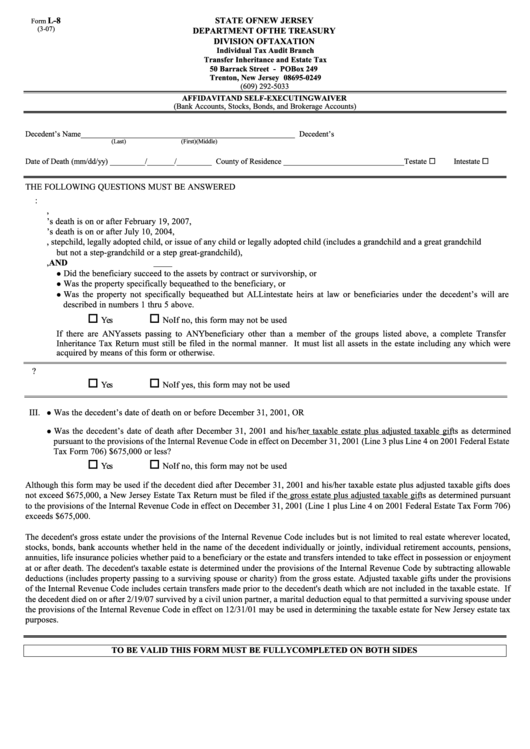

Fillable Form L8 Individual Tax Audit Branch Transfer Inheritance And

Use this form for release of: • stock in new jersey corporations; And • new jersey investment bonds. You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets. No estate tax is ever due when there is a surviving spouse.

Form L8 Affidavit And SelfExecuting Waiver New Jersey Department

However, if other heirs file to claim real estate property, then the value may not exceed $20,000. This form cannot be used for real estate. No inheritance tax is due on inheritances to a surviving spouse, child or grandchild. Use this form for release of: • stock in new jersey corporations;

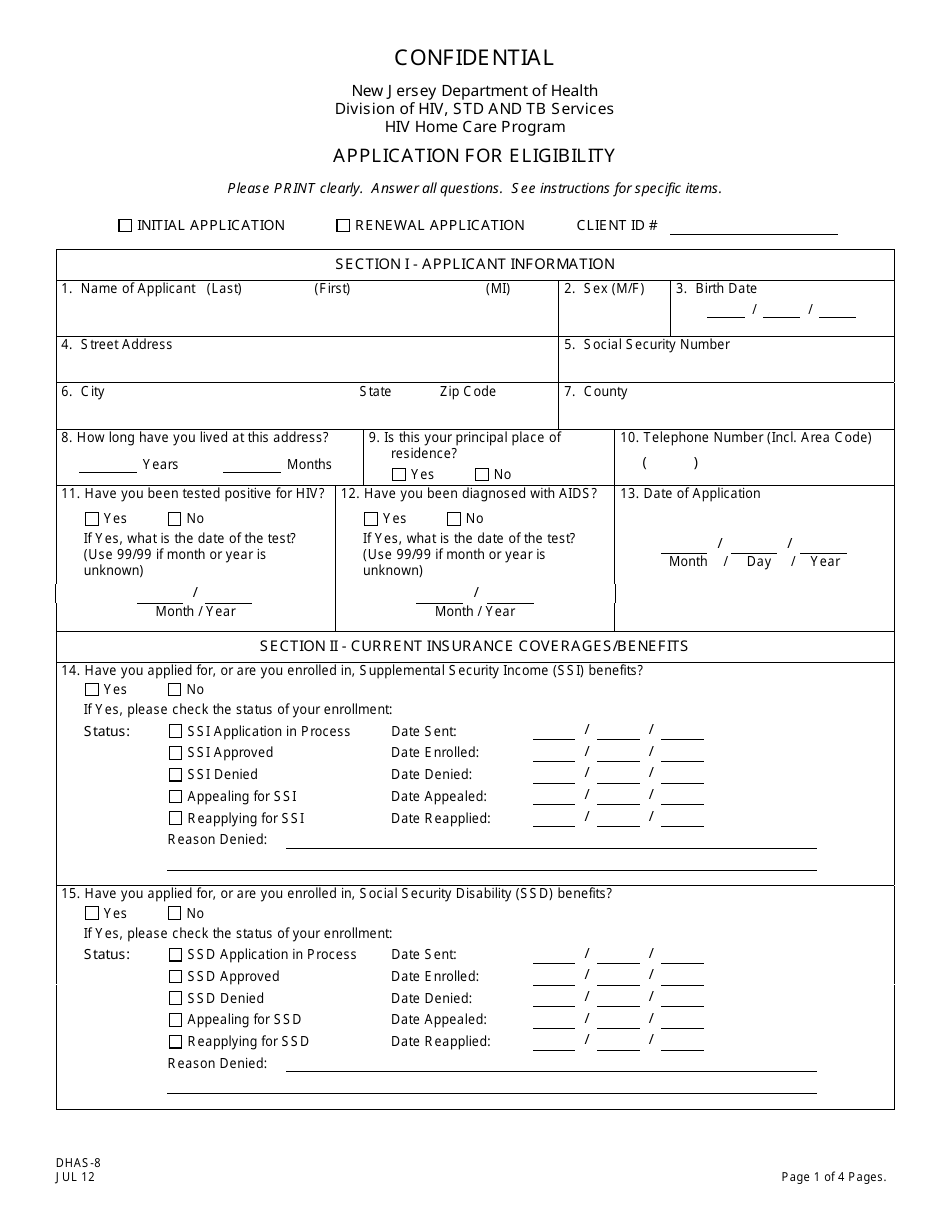

Form DHAS8 Download Printable PDF or Fill Online Application for

• stock in new jersey corporations; Use this form for release of: This is new jersey law. And • new jersey investment bonds. This form cannot be used for real estate.

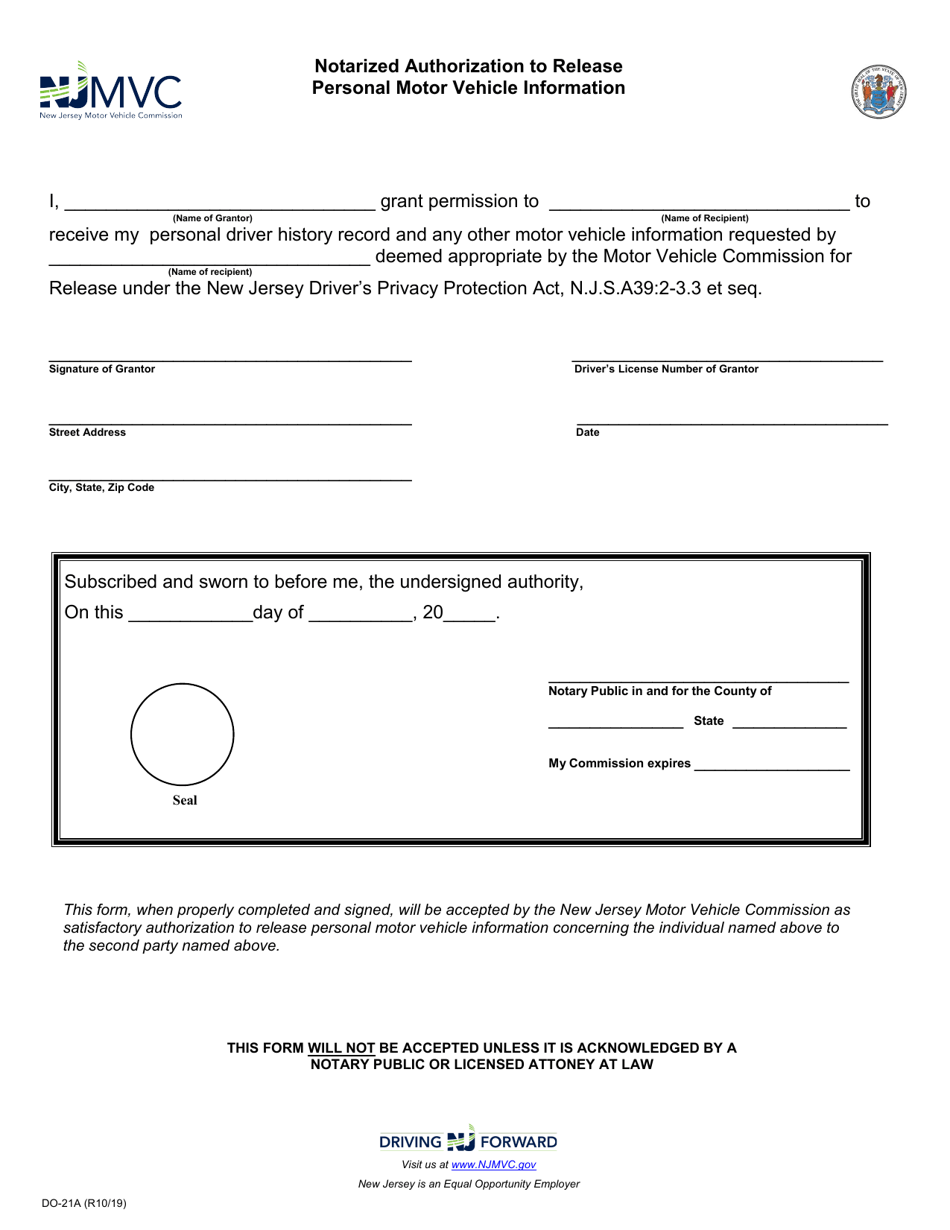

Form DO21A Download Fillable PDF or Fill Online Notarized

No estate tax is ever due when there is a surviving spouse. No inheritance tax is due on inheritances to a surviving spouse, child or grandchild. For real estate investments, use. You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets. • stock in new jersey corporations;

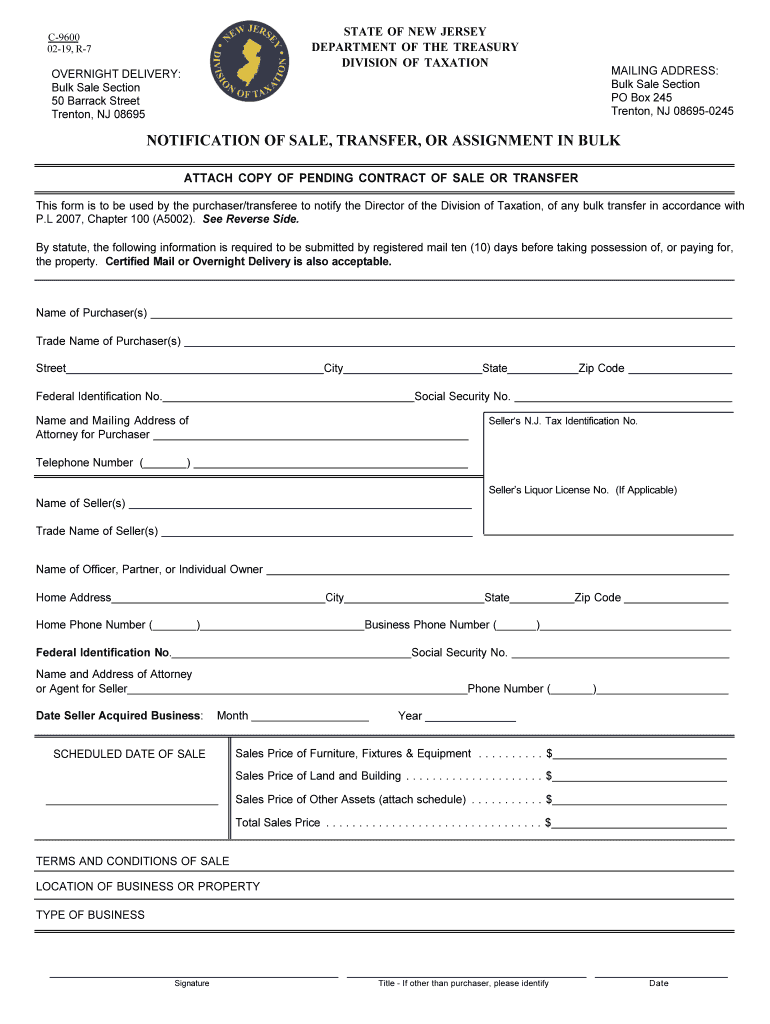

20192021 Form NJ DoT C9600 Fill Online, Printable, Fillable, Blank

• new jersey bank accounts; And • new jersey investment bonds. Use this form for release of: This form cannot be used for real estate. You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets.

However, If Other Heirs File To Claim Real Estate Property, Then The Value May Not Exceed $20,000.

No inheritance tax is due on inheritances to a surviving spouse, child or grandchild. And • new jersey investment bonds. This is new jersey law. You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets.

This Form Cannot Be Used For Real Estate.

No estate tax is ever due when there is a surviving spouse. Use this form for release of: Then they can be sent or brought directly to the bank, transfer agent, or other financial institutions holding the funds. For real estate investments, use.

• Stock In New Jersey Corporations;

• new jersey bank accounts;