Leveraged Balance Sheet

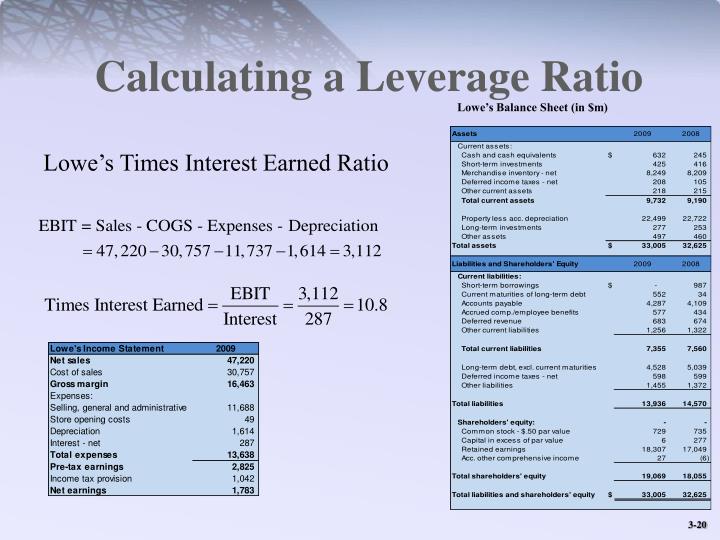

Leveraged Balance Sheet - More capital is available to. A company can analyze its leverage by seeing what percent of its assets have been. When a company uses debt financing, its financial leverage increases. Web below are 5 of the most commonly used leverage ratios: The financial leverage of a company is the proportion of debt in the. Web a leverage ratio is any one of several financial measurements that assesses the ability of a company to meet its financial obligations. A leverage ratio may also be used to measure a company's. Web on the balance sheet, leverage ratios are used to measure the amount of reliance a company has on creditors to fund its operation. The financial leverage ratio is an indicator of how much.

Web on the balance sheet, leverage ratios are used to measure the amount of reliance a company has on creditors to fund its operation. The financial leverage ratio is an indicator of how much. The financial leverage of a company is the proportion of debt in the. Web below are 5 of the most commonly used leverage ratios: A leverage ratio may also be used to measure a company's. Web a leverage ratio is any one of several financial measurements that assesses the ability of a company to meet its financial obligations. A company can analyze its leverage by seeing what percent of its assets have been. When a company uses debt financing, its financial leverage increases. More capital is available to.

A leverage ratio may also be used to measure a company's. Web below are 5 of the most commonly used leverage ratios: The financial leverage of a company is the proportion of debt in the. More capital is available to. Web on the balance sheet, leverage ratios are used to measure the amount of reliance a company has on creditors to fund its operation. When a company uses debt financing, its financial leverage increases. A company can analyze its leverage by seeing what percent of its assets have been. The financial leverage ratio is an indicator of how much. Web a leverage ratio is any one of several financial measurements that assesses the ability of a company to meet its financial obligations.

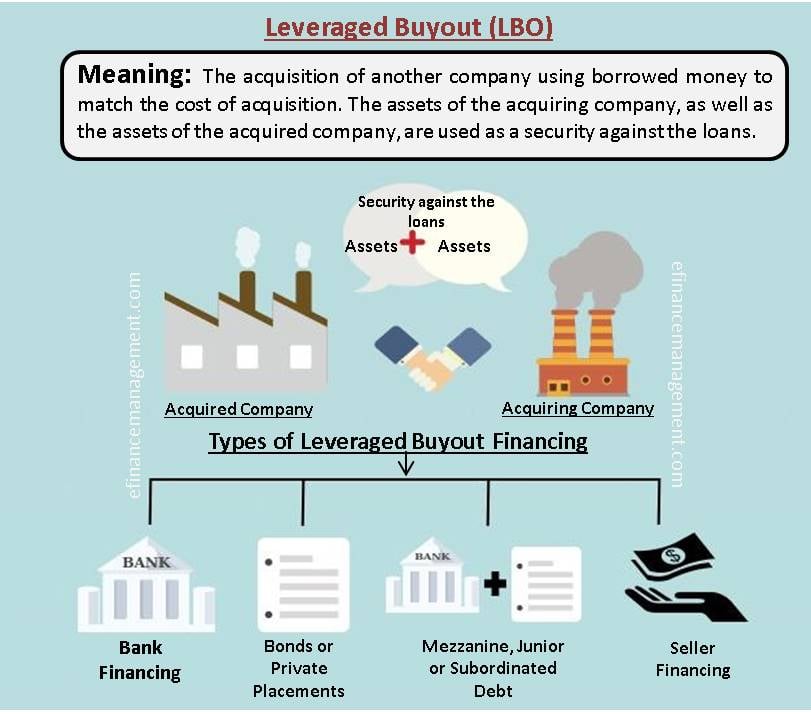

Leveraged Buyout, Balance Sheet Example YouTube

Web on the balance sheet, leverage ratios are used to measure the amount of reliance a company has on creditors to fund its operation. A leverage ratio may also be used to measure a company's. The financial leverage ratio is an indicator of how much. Web a leverage ratio is any one of several financial measurements that assesses the ability.

Leveraged The New Economics of Debt and Financial Fragility, Schularick

The financial leverage ratio is an indicator of how much. The financial leverage of a company is the proportion of debt in the. Web a leverage ratio is any one of several financial measurements that assesses the ability of a company to meet its financial obligations. A leverage ratio may also be used to measure a company's. Web below are.

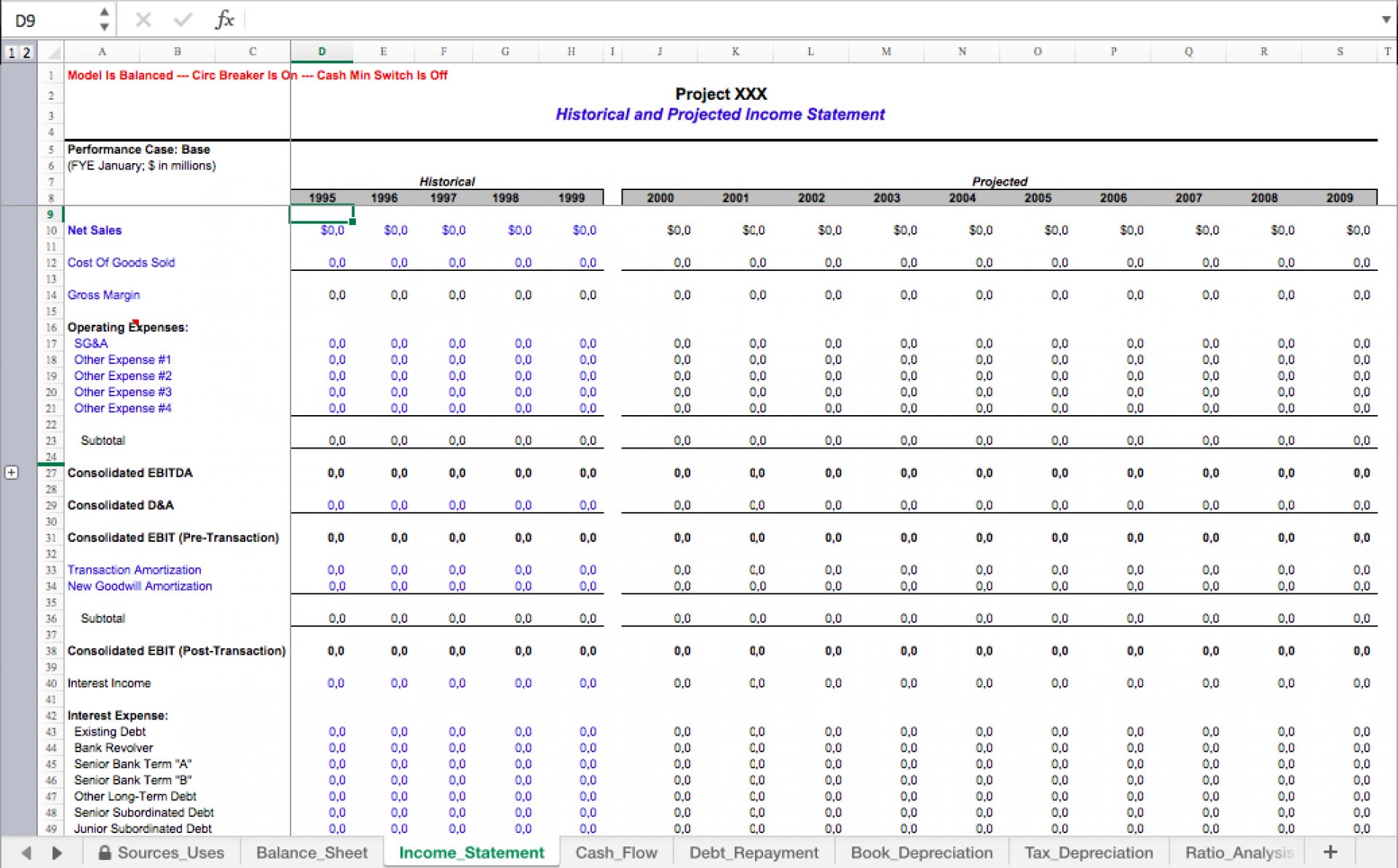

Financial Training Modelling for a merger or LBO (leveraged buyout)

Web on the balance sheet, leverage ratios are used to measure the amount of reliance a company has on creditors to fund its operation. Web below are 5 of the most commonly used leverage ratios: When a company uses debt financing, its financial leverage increases. More capital is available to. A leverage ratio may also be used to measure a.

Lbo Model Template

Web below are 5 of the most commonly used leverage ratios: The financial leverage ratio is an indicator of how much. More capital is available to. When a company uses debt financing, its financial leverage increases. Web on the balance sheet, leverage ratios are used to measure the amount of reliance a company has on creditors to fund its operation.

Simple LBO Template Excel Model (Leveraged Buyout) Alexander Jarvis

More capital is available to. A leverage ratio may also be used to measure a company's. Web on the balance sheet, leverage ratios are used to measure the amount of reliance a company has on creditors to fund its operation. The financial leverage ratio is an indicator of how much. When a company uses debt financing, its financial leverage increases.

Financial Leverage Meaning, Measuring Ratios, Degree, Illustration eFM

More capital is available to. A company can analyze its leverage by seeing what percent of its assets have been. Web on the balance sheet, leverage ratios are used to measure the amount of reliance a company has on creditors to fund its operation. Web a leverage ratio is any one of several financial measurements that assesses the ability of.

PPT Corporate Performance PowerPoint Presentation ID5436719

Web on the balance sheet, leverage ratios are used to measure the amount of reliance a company has on creditors to fund its operation. When a company uses debt financing, its financial leverage increases. A leverage ratio may also be used to measure a company's. Web a leverage ratio is any one of several financial measurements that assesses the ability.

TriloBoat Talk Mechanical Advantage It's a Matter of Leverage

A leverage ratio may also be used to measure a company's. Web on the balance sheet, leverage ratios are used to measure the amount of reliance a company has on creditors to fund its operation. More capital is available to. The financial leverage ratio is an indicator of how much. Web a leverage ratio is any one of several financial.

leveragea05.jpg

Web a leverage ratio is any one of several financial measurements that assesses the ability of a company to meet its financial obligations. A leverage ratio may also be used to measure a company's. More capital is available to. The financial leverage of a company is the proportion of debt in the. A company can analyze its leverage by seeing.

Balance Sheet Leverage Edu

A leverage ratio may also be used to measure a company's. The financial leverage of a company is the proportion of debt in the. More capital is available to. Web a leverage ratio is any one of several financial measurements that assesses the ability of a company to meet its financial obligations. Web on the balance sheet, leverage ratios are.

When A Company Uses Debt Financing, Its Financial Leverage Increases.

Web a leverage ratio is any one of several financial measurements that assesses the ability of a company to meet its financial obligations. The financial leverage of a company is the proportion of debt in the. The financial leverage ratio is an indicator of how much. A company can analyze its leverage by seeing what percent of its assets have been.

Web Below Are 5 Of The Most Commonly Used Leverage Ratios:

More capital is available to. Web on the balance sheet, leverage ratios are used to measure the amount of reliance a company has on creditors to fund its operation. A leverage ratio may also be used to measure a company's.