Long At The Money Calendar Spread Greeks Measured

Long At The Money Calendar Spread Greeks Measured - Web a move lower would be beneficial. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same underlying asset and strike. This strategy can be done with either calls. How to create a calendar spread. Web a long calendar spread profits from a directionless market, i.e., one that is range bound. Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take advantage of near term time decay. The key component to the trade being successful is where the underlying ends up at the. Web take your understanding of the calendar spreads to the next level. Ideal market conditions include low implied volatility and a. In a calendar spread, the delta for the long leg (the option with the later expiration date) will generally be closer to 1, meaning it closely mirrors the price movement of the.

This strategy can be done with either calls. Ideal market conditions include low implied volatility and a. Web delta measures how sensitive an option's price is to changes in the underlying asset's price. Web a long calendar spread involves selling the option with the closer expiration date and buying the option with the later expiration date. Web in this chapter, we will learn an option trading strategy called ‘calendar spread.’ as the name suggests, it spreads over the calendar month, hence is known as calendar. A short calendar spread profits from either a bull or a bear market, but will lose in a. In a calendar spread, the delta for the long leg (the option with the later expiration date) will generally be closer to 1, meaning it closely mirrors the price movement of the. Web a move lower would be beneficial. Web a long calendar spread profits from a directionless market, i.e., one that is range bound. Web this tutorial shall cover what calendar spreads are, the nature and role of calendar spreads as well as the different categories of calendar spreads and a detailed listing of.

Explore the impact greeks have, specifically theta (time decay) and vega (volatility), on the calendar. Web a long calendar spread profits from a directionless market, i.e., one that is range bound. This strategy can be done with either calls. A short calendar spread profits from either a bull or a bear market, but will lose in a. Web delta measures how sensitive an option's price is to changes in the underlying asset's price. The key component to the trade being successful is where the underlying ends up at the. In a calendar spread, the delta for the long leg (the option with the later expiration date) will generally be closer to 1, meaning it closely mirrors the price movement of the. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with. Option a if you are lon. Web a calendar spread (time spread) refers to selling a near term expiry option and buying a longer term expiry option, at the same strike.

Long Calendar Spreads Unofficed

Ideal market conditions include low implied volatility and a. Web a move lower would be beneficial. A short calendar spread profits from either a bull or a bear market, but will lose in a. A calendar spread, sometimes called a time spread or a horizontal spread, is an option strategy that involves buying one option and selling another option with.

Calendar Spread PDF Greeks (Finance) Option (Finance)

Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take advantage of near term time decay. Web take your understanding of the calendar spreads to the next level. Web a move lower would be beneficial. Web this tutorial shall cover what calendar spreads are,.

Calendars Greeks When to use calendar Spread YouTube

Explore the impact greeks have, specifically theta (time decay) and vega (volatility), on the calendar. A calendar spread, sometimes called a time spread or a horizontal spread, is an option strategy that involves buying one option and selling another option with the same. Ideal market conditions include low implied volatility and a. This strategy can be done with either calls..

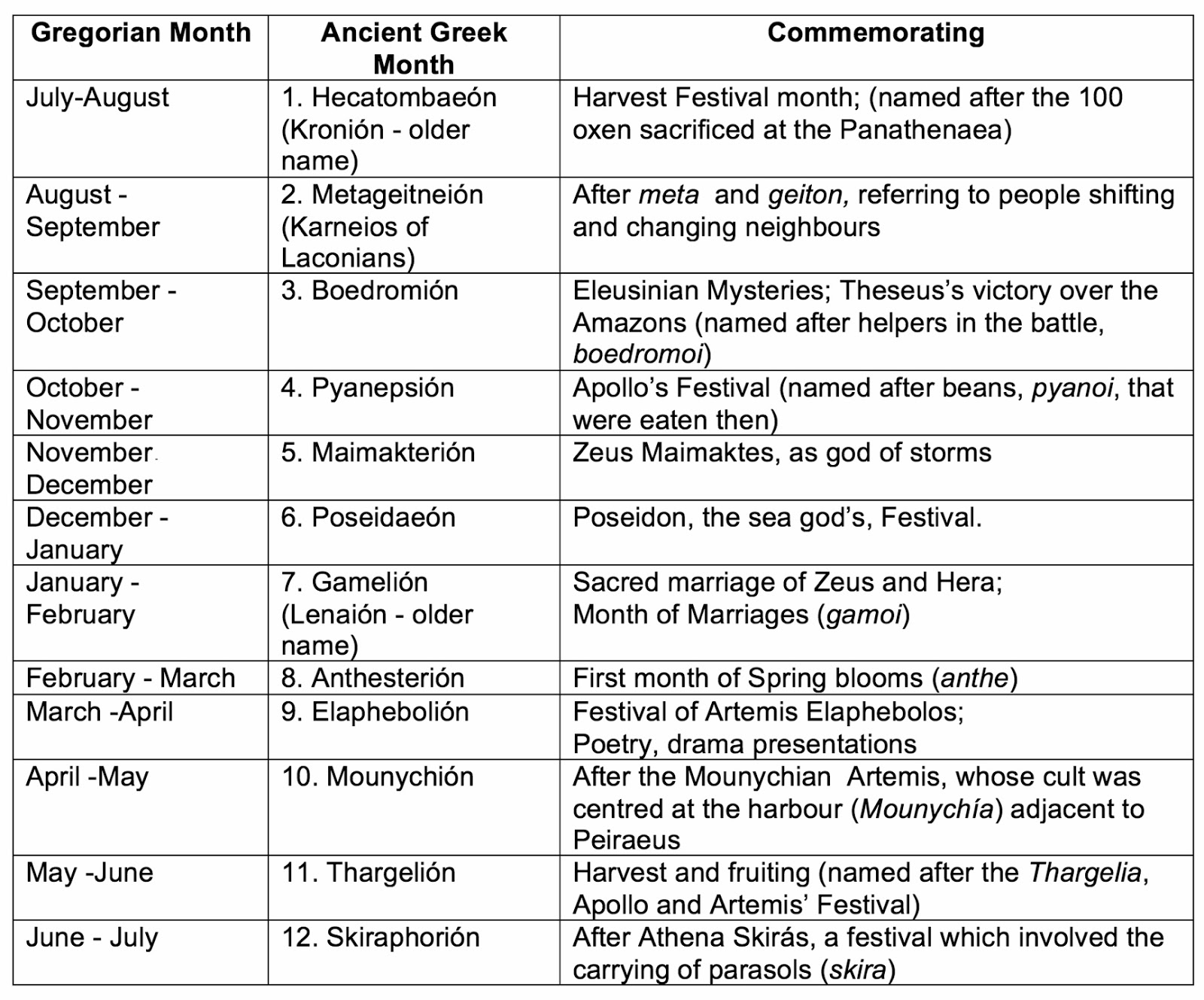

Intelliblog THE ANCIENT GREEK CALENDAR

The key component to the trade being successful is where the underlying ends up at the. In a calendar spread, the delta for the long leg (the option with the later expiration date) will generally be closer to 1, meaning it closely mirrors the price movement of the. Web a calendar spread, also known as a horizontal spread, is created.

Long Calendar Spreads for Beginner Options Traders projectfinance

Web delta measures how sensitive an option's price is to changes in the underlying asset's price. The key component to the trade being successful is where the underlying ends up at the. A short calendar spread profits from either a bull or a bear market, but will lose in a. Option a if you are lon. Web recognize that the.

Calendar Spreads PDF Greeks (Finance) Option (Finance)

Web recognize that the question is asking you to understand the greeks associated with a long 'at the money' calendar spread. A short calendar spread profits from either a bull or a bear market, but will lose in a. Ideal market conditions include low implied volatility and a. Web a long calendar spread profits from a directionless market, i.e., one.

8 Big Reasons to Get the Greeks Come True Calendar

Web this tutorial shall cover what calendar spreads are, the nature and role of calendar spreads as well as the different categories of calendar spreads and a detailed listing of. A calendar spread, sometimes called a time spread or a horizontal spread, is an option strategy that involves buying one option and selling another option with the same. A short.

How Calendar Spreads Work (Best Explanation) projectoption

A calendar spread, sometimes called a time spread or a horizontal spread, is an option strategy that involves buying one option and selling another option with the same. Web delta measures how sensitive an option's price is to changes in the underlying asset's price. Web a move lower would be beneficial. In a calendar spread, the delta for the long.

Long Put Calendar Spread PDF Greeks (Finance) Option (Finance)

Web in this chapter, we will learn an option trading strategy called ‘calendar spread.’ as the name suggests, it spreads over the calendar month, hence is known as calendar. Web delta measures how sensitive an option's price is to changes in the underlying asset's price. Web a calendar spread is an options or futures strategy where an investor simultaneously enters.

How to use OPTION GREEKS to calculate calendar call spreads profit/risk

This strategy can be done with either calls. Web a calendar spread (time spread) refers to selling a near term expiry option and buying a longer term expiry option, at the same strike. Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take advantage.

Web A Long Calendar Spread Involves Selling The Option With The Closer Expiration Date And Buying The Option With The Later Expiration Date.

Web take your understanding of the calendar spreads to the next level. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same underlying asset and strike. Web delta measures how sensitive an option's price is to changes in the underlying asset's price. A calendar spread, sometimes called a time spread or a horizontal spread, is an option strategy that involves buying one option and selling another option with the same.

Web A Move Lower Would Be Beneficial.

Web in this chapter, we will learn an option trading strategy called ‘calendar spread.’ as the name suggests, it spreads over the calendar month, hence is known as calendar. Web recognize that the question is asking you to understand the greeks associated with a long 'at the money' calendar spread. Web a long calendar spread profits from a directionless market, i.e., one that is range bound. Ideal market conditions include low implied volatility and a.

Web The Objective For A Long Call Calendar Spread Is For The Underlying Stock To Be At Or Near, Nearest Strike Price At Expiration And Take Advantage Of Near Term Time Decay.

In a calendar spread, the delta for the long leg (the option with the later expiration date) will generally be closer to 1, meaning it closely mirrors the price movement of the. A short calendar spread profits from either a bull or a bear market, but will lose in a. How to create a calendar spread. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with.

This Strategy Can Be Done With Either Calls.

Option a if you are lon. Web this tutorial shall cover what calendar spreads are, the nature and role of calendar spreads as well as the different categories of calendar spreads and a detailed listing of. Explore the impact greeks have, specifically theta (time decay) and vega (volatility), on the calendar. Web a calendar spread (time spread) refers to selling a near term expiry option and buying a longer term expiry option, at the same strike.