Louisiana State Tax Exemption Form

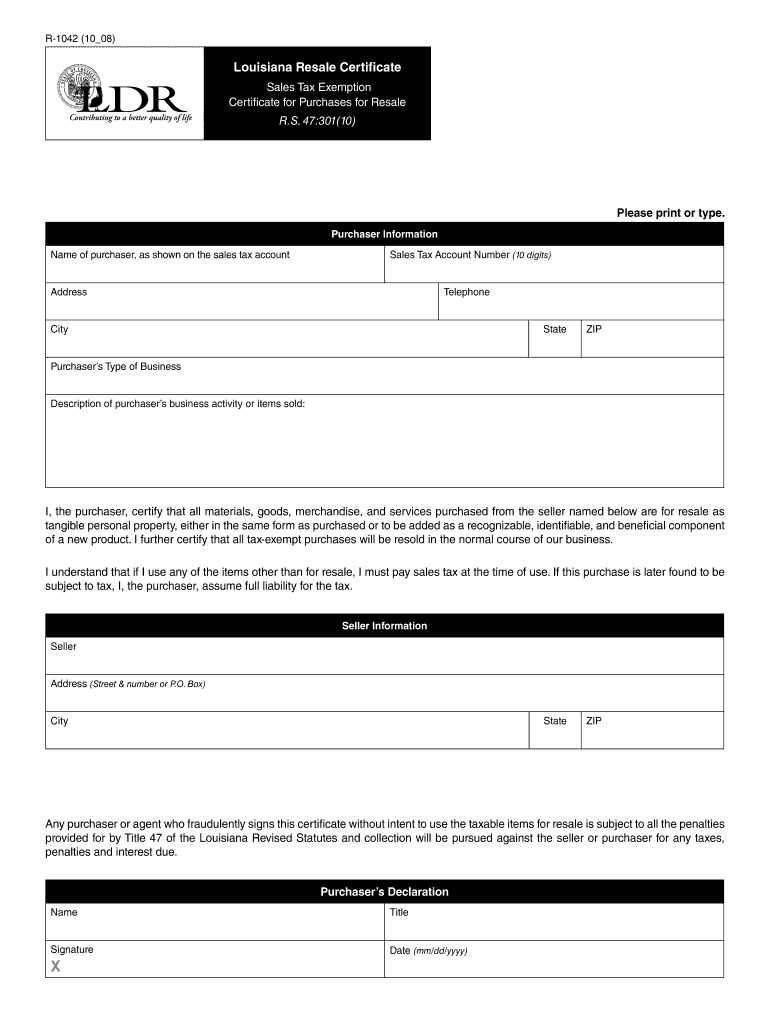

Louisiana State Tax Exemption Form - Address of property to be exempted: For other louisiana sales tax exemption certificates, go. Official louisiana exemption certificate forms for: Web we have four louisiana sales tax exemption forms available for you to print or save as a pdf file. Report these sales under exemption code 5107. Web for your wages to be exempt from louisiana income taxes, (a) you must be a nonresident of louisiana; Individual tax return form 1040 instructions; While the louisiana sales tax of 4.45% applies. It is used to document employee eligibility for. Web popular forms & instructions;

Web we have four louisiana sales tax exemption forms available for you to print or save as a pdf file. Affidavit for homestead exemption affidavit for continuation of. State filing requirements for political organizations. Web this certificate is for use by employees of the state of louisiana. For other louisiana sales tax exemption certificates, go. Address of property to be exempted: (b) you will be paid wages for employment duties performed in louisiana. Web yes do i need a form? Official louisiana exemption certificate forms for: 47:301(8)(c) please print or type.

Web yes do i need a form? Affidavit for homestead exemption affidavit for continuation of. While the louisiana sales tax of 4.45% applies. Report these sales under exemption code 5107. If any of these links are broken, or you can't find the form you need, please let. Individual tax return form 1040 instructions; Web certificate of sales/use tax exemption/exclusion of purchases by political subdivisions of the state of louisiana. Address of property to be exempted: Web for your wages to be exempt from louisiana income taxes, (a) you must be a nonresident of louisiana; Web louisiana tax exempt form forms, tax exempt forms, tax forms / united states this certificate is for use by employees of the united states government and the state of.

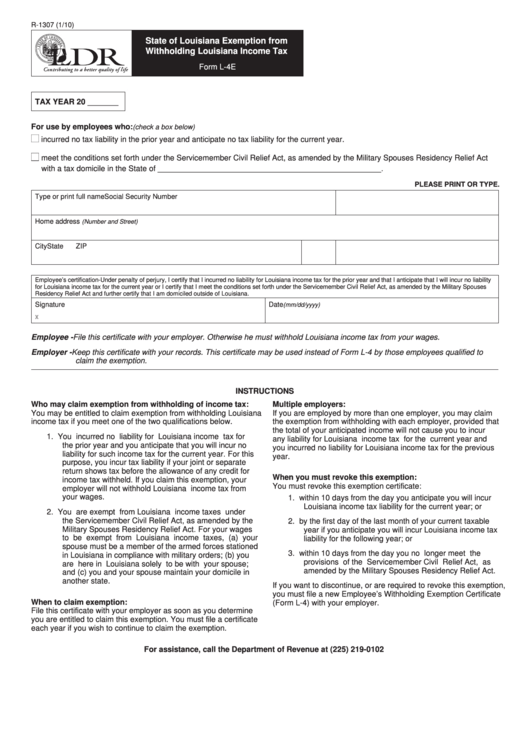

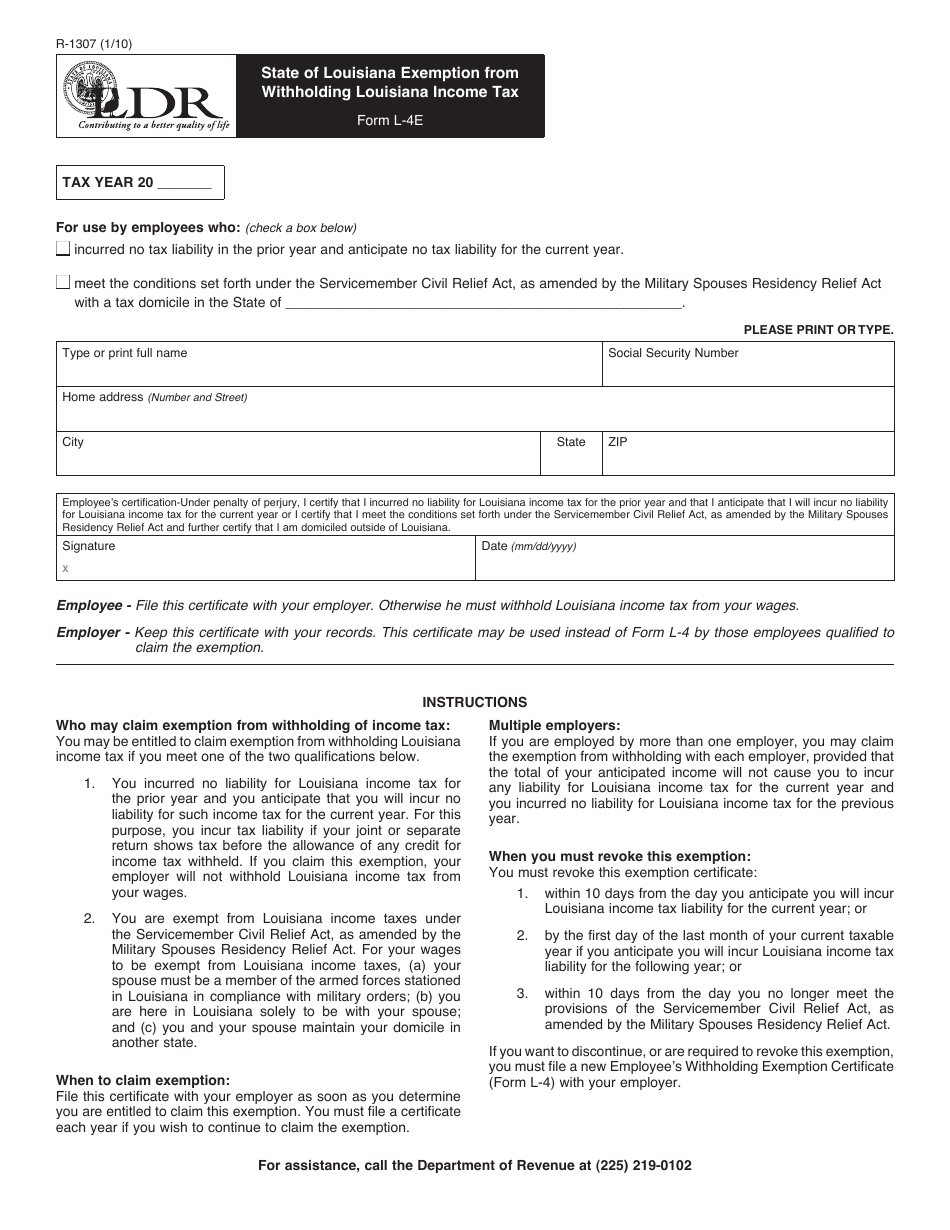

Form R1307 State Of Louisiana Exemption From Withholding Louisiana

Affidavit for homestead exemption affidavit for continuation of. Web if a certificate of sales/use tax exemption/exclusion is requested or needed by a seller for southeastern purchases, please complete the tax exempt request form. It is used to document employee eligibility for exemption from payment of state sales taxes on authorized. Web this certificate is for use by employees of the.

W9 Blank Form For Louisiana 2020 Example Calendar Printable

Web if a certificate of sales/use tax exemption/exclusion is requested or needed by a seller for southeastern purchases, please complete the tax exempt request form. Web purchases of tangible personal property and taxable services, and/or leases and rentals of tangible personal property by this political body are totally exempted from the 4 percent. It is used to document employee eligibility.

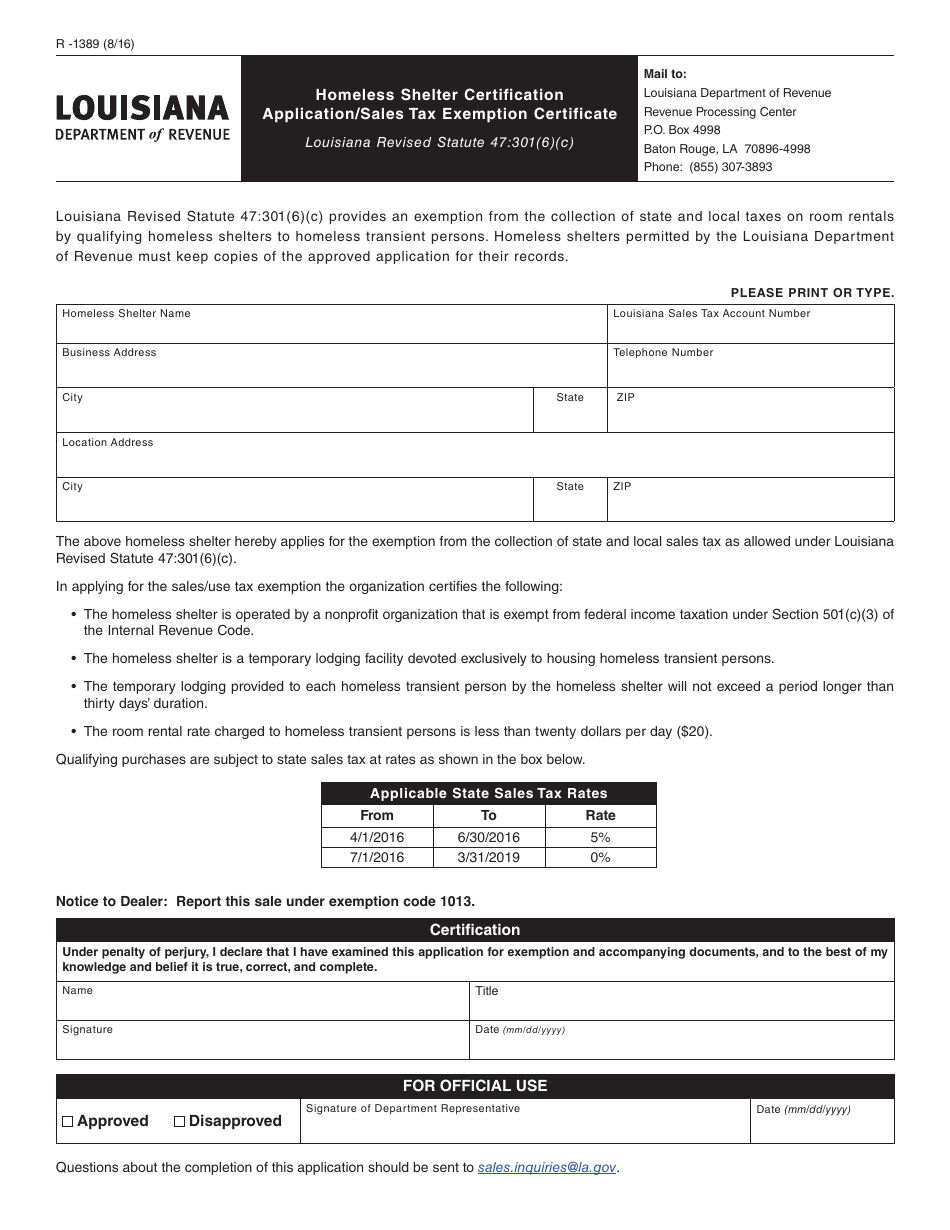

Form R1389 Download Fillable PDF or Fill Online Homeless Shelter

While the louisiana sales tax of 4.45% applies. 47:301(8)(c) please print or type. Web certifi cate of sales/use tax exemption/ exclusion of purchases by political subdivisions of the state of louisiana louisiana r.s. (b) you will be paid wages for employment duties performed in louisiana. Individual tax return form 1040 instructions;

√ Military Spouse Residency Relief Act Tax Form Navy Docs

Web certificate of sales/use tax exemption/exclusion of purchases by political subdivisions of the state of louisiana. Web exemption certificates for businesses taxability vehicles more what purchases are exempt from the louisiana sales tax? Web click on the state below where you will be traveling to or purchasing from to find out if that state exempts state taxes and what the.

California Tax Exempt Certificate Fill Online, Printable, Fillable

Web for your wages to be exempt from louisiana income taxes, (a) you must be a nonresident of louisiana; Web certificate of sales/use tax exemption/exclusion of purchases by political subdivisions of the state of louisiana. Address of property to be exempted: Web amount incurred.the government agency named above claims exemption from the payment of state and local sales taxes. Web.

Top 46 Louisiana Tax Exempt Form Templates free to download in PDF format

Individual tax return form 1040 instructions; Affidavit for homestead exemption affidavit for continuation of. For hotel room rental charges (hotel/lodging. 47:301(8)(c) please print or type. Address of property to be exempted:

Louisiana Hotel Tax Exempt Form Fill Online, Printable, Fillable

Web this certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions. Web purchases of tangible personal property and taxable services, and/or leases and rentals of tangible personal property by this political body are totally exempted from the 4 percent. Web yes do i need a form? Yes, a form.

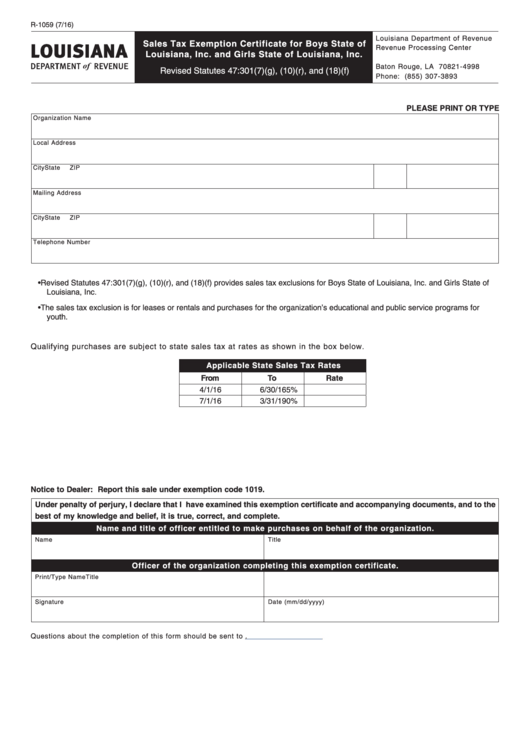

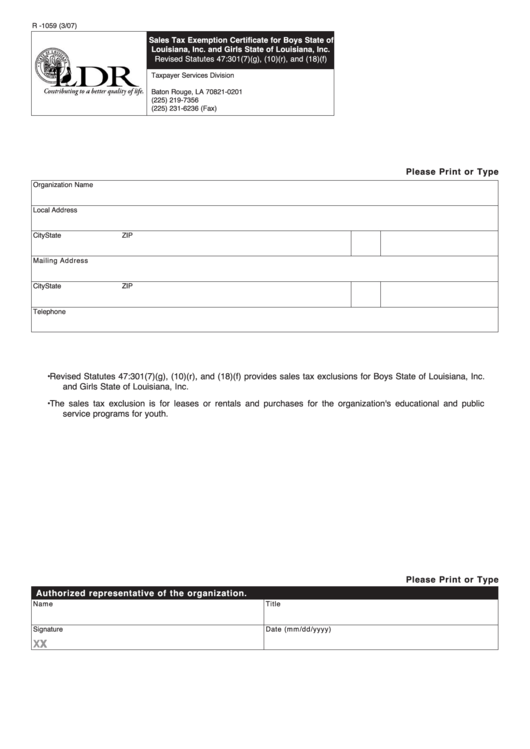

Fillable Form R1059 Sales Tax Exemption Certificate For Boys State

Web yes do i need a form? Address of property to be exempted: Individual tax return form 1040 instructions; For hotel room rental charges (hotel/lodging. If any of these links are broken, or you can't find the form you need, please let.

Tax Return Louisiana State Tax Return

(b) you will be paid wages for employment duties performed in louisiana. Employees who are subject to state. Web for your wages to be exempt from louisiana income taxes, (a) you must be a nonresident of louisiana; 47:301(8)(c) please print or type. Web purchases of tangible personal property and taxable services, and/or leases and rentals of tangible personal property by.

Louisiana state tax filing begins today

Web this certificate is for use by employees of the state of louisiana. (check a box below) incurred no tax liability in the prior year and anticipate no tax liability for the current year. Official louisiana exemption certificate forms for: Web this certificate is for use by employees of the united states government and the state of louisiana and its.

Web Certifi Cate Of Sales/Use Tax Exemption/ Exclusion Of Purchases By Political Subdivisions Of The State Of Louisiana Louisiana R.s.

(check a box below) incurred no tax liability in the prior year and anticipate no tax liability for the current year. Employees who are subject to state. Web this certificate is for use by employees of the state of louisiana. Web for your wages to be exempt from louisiana income taxes, (a) you must be a nonresident of louisiana;

Web Louisiana Tax Exempt Form Forms, Tax Exempt Forms, Tax Forms / United States This Certificate Is For Use By Employees Of The United States Government And The State Of.

Web yes do i need a form? Yes, a form is required. (b) you will be paid wages for employment duties performed in louisiana. Web we have four louisiana sales tax exemption forms available for you to print or save as a pdf file.

Web If A Certificate Of Sales/Use Tax Exemption/Exclusion Is Requested Or Needed By A Seller For Southeastern Purchases, Please Complete The Tax Exempt Request Form.

It is used to document employee eligibility for exemption from payment of state sales taxes on authorized. Web popular forms & instructions; For other louisiana sales tax exemption certificates, go. Affidavit for homestead exemption affidavit for continuation of.

While The Louisiana Sales Tax Of 4.45% Applies.

State filing requirements for political organizations. Web click on the state below where you will be traveling to or purchasing from to find out if that state exempts state taxes and what the requirements are (for example, many states. Web amount incurred.the government agency named above claims exemption from the payment of state and local sales taxes. Web purchases of tangible personal property and taxable services, and/or leases and rentals of tangible personal property by this political body are totally exempted from the 4 percent.