Ma Family Gift Form

Ma Family Gift Form - You can give a vehicle as a gift to a family member, who may be exempt from paying taxes on it. 4/99 massachusetts department of revenue please read the instructions below before completing this form and provide. Have cofidence that our forms are drafted by attorneys and we offer a 100%. Web transferring a title to family members. Fill out the back of the title as if. Web a gift deed, or deed of gift, is a legal document voluntarily transferring title to real property from one party (the grantor or donor) to another (the grantee or donee). Receipt of gift unrelated to official position disclosure instructions: You may be exempt from paying sales tax on a vehicle transferred to you as a gift from another person. Web meals, entertainment event tickets, golf, gift baskets, and payment of travel expenses can all be illegal gifts if given in connection with official action or position, as can anything. Web a borrower of a mortgage loan secured by a principal residence or second home may use funds received as a personal gift from an acceptable donor.

The person transferring the vehicle. Web a gift deed, or deed of gift, is a legal document voluntarily transferring title to real property from one party (the grantor or donor) to another (the grantee or donee). Have cofidence that our forms are drafted by attorneys and we offer a 100%. Fill out the back of the title as if. If you have any questions. Complete, edit or print tax forms instantly. You can give a vehicle as a gift to a family member, who may be exempt from paying taxes on it. Receipt of gift valued at less than $50. Web a borrower of a mortgage loan secured by a principal residence or second home may use funds received as a personal gift from an acceptable donor. Web transferring a title to family members.

Fill out the back of the title as if. Web to gift a car in massachusetts without paying taxes on it, you’ll need to submit a bill of sale, an affidavit for tax exemption, and a $25 gift fee with the $75 title. Have cofidence that our forms are drafted by attorneys and we offer a 100%. 4/99 massachusetts department of revenue please read the instructions below before completing this form and provide. Receipt of gift unrelated to official position disclosure instructions: Web under massachusetts general laws, chapter 62c, section 73, or chapter 268, section 1a. Web can you gift a car to a family member in massachusetts? Web a gift deed, or deed of gift, is a legal document voluntarily transferring title to real property from one party (the grantor or donor) to another (the grantee or donee). Web meals, entertainment event tickets, golf, gift baskets, and payment of travel expenses can all be illegal gifts if given in connection with official action or position, as can anything. Web a borrower of a mortgage loan secured by a principal residence or second home may use funds received as a personal gift from an acceptable donor.

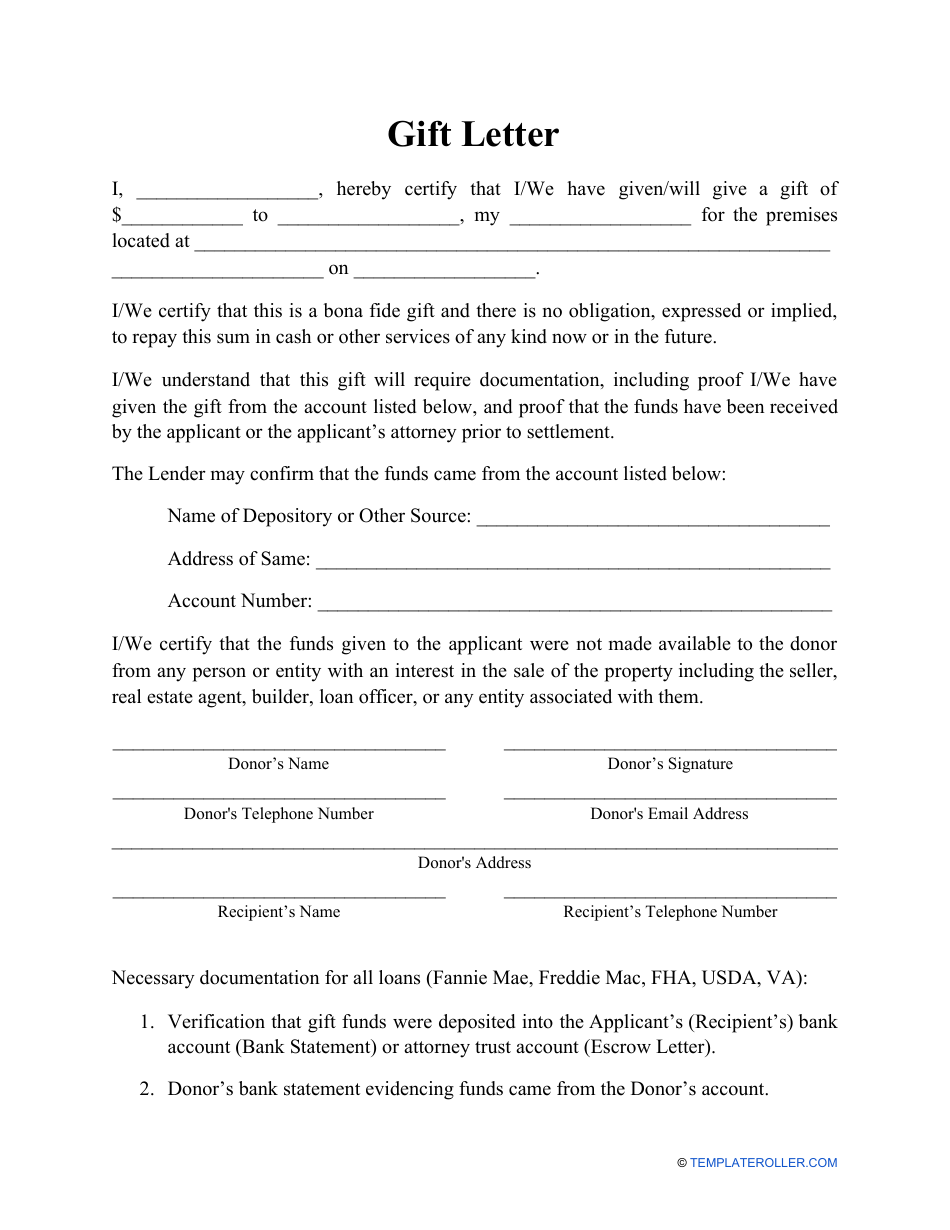

Gift Letter Mortgage Template Awesome forms Lettering, Letter gifts

You can give a vehicle as a gift to a family member, who may be exempt from paying taxes on it. Web a gift deed, or deed of gift, is a legal document voluntarily transferring title to real property from one party (the grantor or donor) to another (the grantee or donee). Have cofidence that our forms are drafted by.

MA Family Photo by HavFos on DeviantArt

Web motor vehicle sales and use (mvu) tax forms. Receipt of gift unrelated to official position disclosure instructions: The person transferring the vehicle. Web transferring a title to family members. Receipt of gift valued at less than $50.

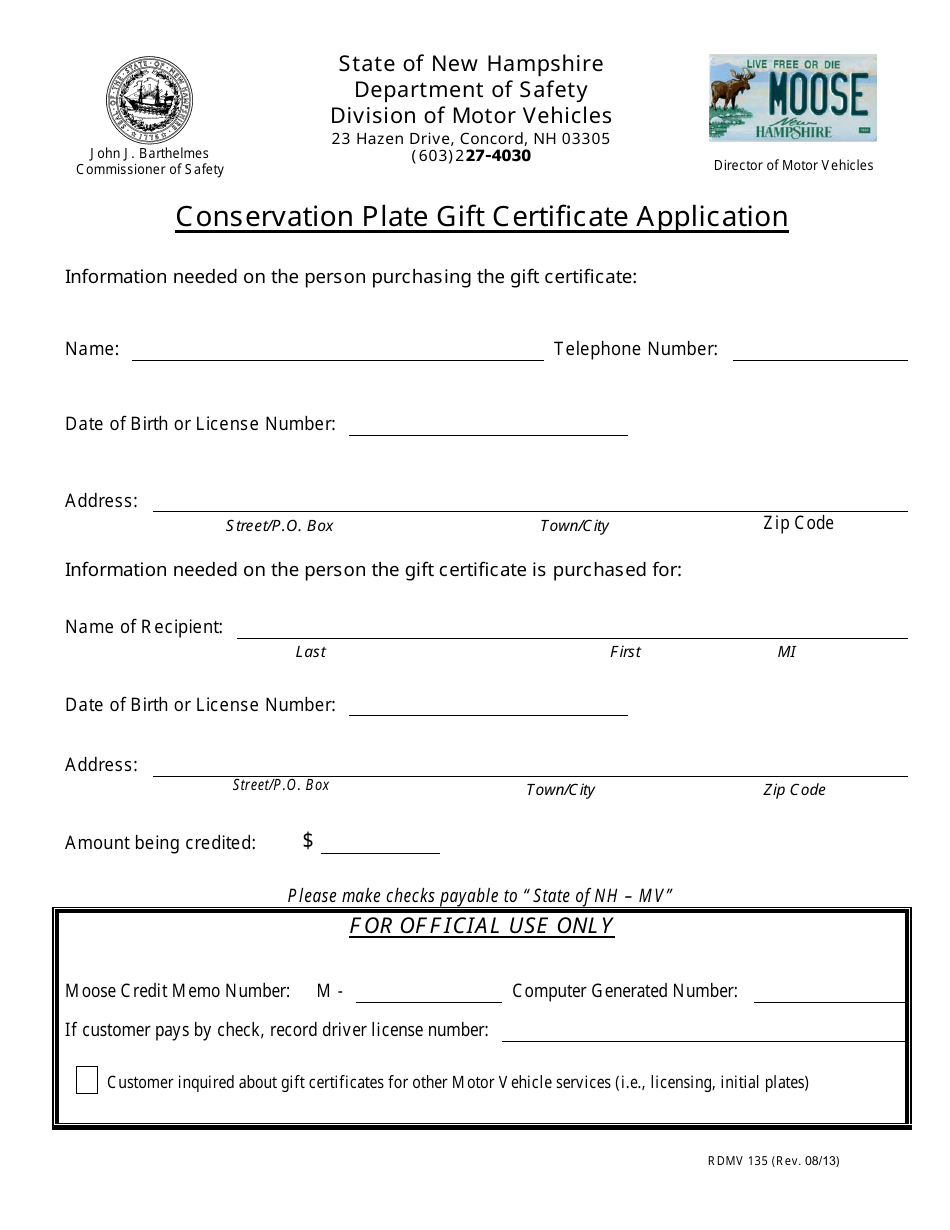

Form RDMV135 Download Fillable PDF or Fill Online Conservation Plate

Web motor vehicle sales and use (mvu) tax forms. Have cofidence that our forms are drafted by attorneys and we offer a 100%. Web vehicles transferred as a gift. The following are the most current versions of massachusetts department of revenue motor vehicle sales and use tax. The person transferring the vehicle.

Top 10 Family Gift Ideas

If you have any questions. Web motor vehicle sales and use (mvu) tax forms. You can give a vehicle as a gift to a family member, who may be exempt from paying taxes on it. Receipt of gift valued at less than $50. Web a borrower of a mortgage loan secured by a principal residence or second home may use.

MA Family Room Addition Contractor Cape Cod, MA & RI

If you have any questions. Web can you gift a car to a family member in massachusetts? The following are the most current versions of massachusetts department of revenue motor vehicle sales and use tax. Web a gift deed, or deed of gift, is a legal document voluntarily transferring title to real property from one party (the grantor or donor).

Printable Family Member Gift Letter Template Printable Templates

If you have any questions. Web a borrower of a mortgage loan secured by a principal residence or second home may use funds received as a personal gift from an acceptable donor. Massachusetts does allow you to transfer a car between immediate family members. Web a gift deed, or deed of gift, is a legal document voluntarily transferring title to.

Upton MA Family Photography FrameWorthy Family!

You can give a vehicle as a gift to a family member, who may be exempt from paying taxes on it. Web to gift a car in massachusetts without paying taxes on it, you’ll need to submit a bill of sale, an affidavit for tax exemption, and a $25 gift fee with the $75 title. The person transferring the vehicle..

Gift Letter Template Uk FREE 13+ Sample Gift Letter Templates in PDF

Have cofidence that our forms are drafted by attorneys and we offer a 100%. Complete, edit or print tax forms instantly. Web vehicles transferred as a gift. Web can you gift a car to a family member in massachusetts? Receipt of gift unrelated to official position disclosure instructions:

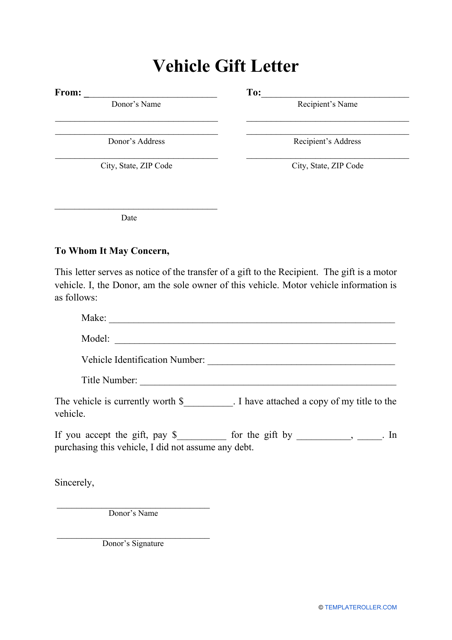

Explore Our Image of Car Gift Letter Template Letter gifts, Letter

Massachusetts does allow you to transfer a car between immediate family members. If you have any questions. Receipt of gift valued at less than $50. Web to gift a car in massachusetts without paying taxes on it, you’ll need to submit a bill of sale, an affidavit for tax exemption, and a $25 gift fee with the $75 title. 4/99.

Vehicle Gift Letter Template Download Printable PDF Templateroller

The following are the most current versions of massachusetts department of revenue motor vehicle sales and use tax. Receipt of gift unrelated to official position disclosure instructions: You may be exempt from paying sales tax on a vehicle transferred to you as a gift from another person. Receipt of gift valued at less than $50. Web transferring a title to.

Massachusetts Does Allow You To Transfer A Car Between Immediate Family Members.

Web under massachusetts general laws, chapter 62c, section 73, or chapter 268, section 1a. The following are the most current versions of massachusetts department of revenue motor vehicle sales and use tax. You can give a vehicle as a gift to a family member, who may be exempt from paying taxes on it. Web a borrower of a mortgage loan secured by a principal residence or second home may use funds received as a personal gift from an acceptable donor.

Web To Gift A Car In Massachusetts Without Paying Taxes On It, You’ll Need To Submit A Bill Of Sale, An Affidavit For Tax Exemption, And A $25 Gift Fee With The $75 Title.

Have cofidence that our forms are drafted by attorneys and we offer a 100%. Web meals, entertainment event tickets, golf, gift baskets, and payment of travel expenses can all be illegal gifts if given in connection with official action or position, as can anything. Web a gift deed, or deed of gift, is a legal document voluntarily transferring title to real property from one party (the grantor or donor) to another (the grantee or donee). Complete, edit or print tax forms instantly.

Fill Out The Back Of The Title As If.

Receipt of gift valued at less than $50. Web transferring a title to family members. Web can you gift a car to a family member in massachusetts? 4/99 massachusetts department of revenue please read the instructions below before completing this form and provide.

You May Be Exempt From Paying Sales Tax On A Vehicle Transferred To You As A Gift From Another Person.

The person transferring the vehicle. Web motor vehicle sales and use (mvu) tax forms. Web vehicles transferred as a gift. Receipt of gift unrelated to official position disclosure instructions:

.jpg)