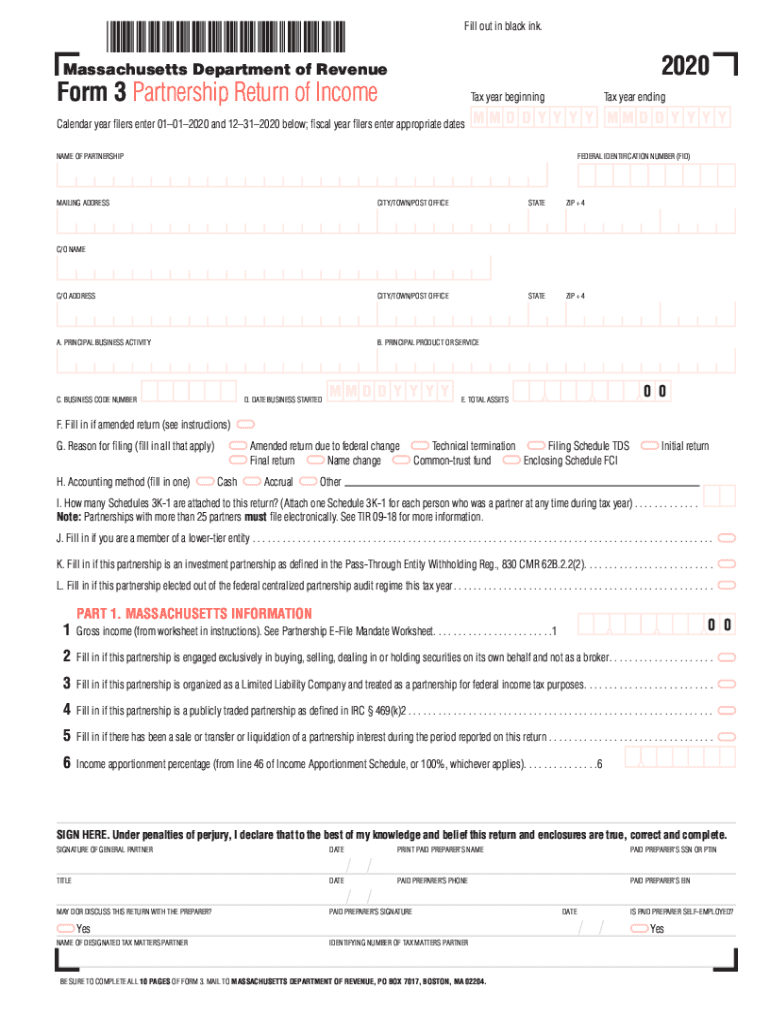

Ma Form 3 Instructions

Ma Form 3 Instructions - Combine lines 24 and 25. The instructions are divided into two sections designed to lead you Enter the applicable line number from u.s. 2021 form 3, page 2 Web massachusetts fiduciary and partnership tax forms and instructions. Web 25 adjustments (if any) to line 24. 26 adjusted massachusetts net income or loss from other rental activities. Form 1065 and the amount of the adjustment. Web more about the massachusetts form 3 corporate income tax tax credit ty 2022. Web for calendar year filers form 3 is due on or before march 15, 2023.

February 17, 2023 all massachusetts tax forms are in pdf format. Web massachusetts fiduciary and partnership tax forms and instructions. Enter the applicable line number from u.s. Combine lines 24 and 25. Dor has released its 2022 massachusetts fiduciary and partnership tax forms. 26 adjusted massachusetts net income or loss from other rental activities. Web follow the simple instructions below: Our service provides you with a wide library of templates available for filling out on the internet. Web here you will find an updated listing of all massachusetts department of revenue (dor) tax forms and instructions. Are you still trying to find a quick and efficient solution to fill in ma form 3 at a reasonable price?

2021 form 3, page 2 Are you still trying to find a quick and efficient solution to fill in ma form 3 at a reasonable price? Web here you will find an updated listing of all massachusetts department of revenue (dor) tax forms and instructions. Web more about the massachusetts form 3 corporate income tax tax credit ty 2022. More about the massachusetts form 3 tax credit we last updated massachusetts form 3 in january 2023 from the massachusetts department of revenue. This form is for income earned in tax year 2022, with tax returns due in april. Web 25 adjustments (if any) to line 24. February 17, 2023 all massachusetts tax forms are in pdf format. Web massachusetts fiduciary and partnership tax forms and instructions. Web follow the simple instructions below:

MA Form 272 Fill and Sign Printable Template Online US Legal Forms

Web follow the simple instructions below: 26 adjusted massachusetts net income or loss from other rental activities. 2021 form 3, page 2 Dor has released its 2022 massachusetts fiduciary and partnership tax forms. More about the massachusetts form 3 tax credit we last updated massachusetts form 3 in january 2023 from the massachusetts department of revenue.

20202022 MA Form 3 Fill Online, Printable, Fillable, Blank pdfFiller

2021 form 3, page 2 Web massachusetts fiduciary and partnership tax forms and instructions. Our service provides you with a wide library of templates available for filling out on the internet. Web for calendar year filers form 3 is due on or before march 15, 2023. Web here you will find an updated listing of all massachusetts department of revenue.

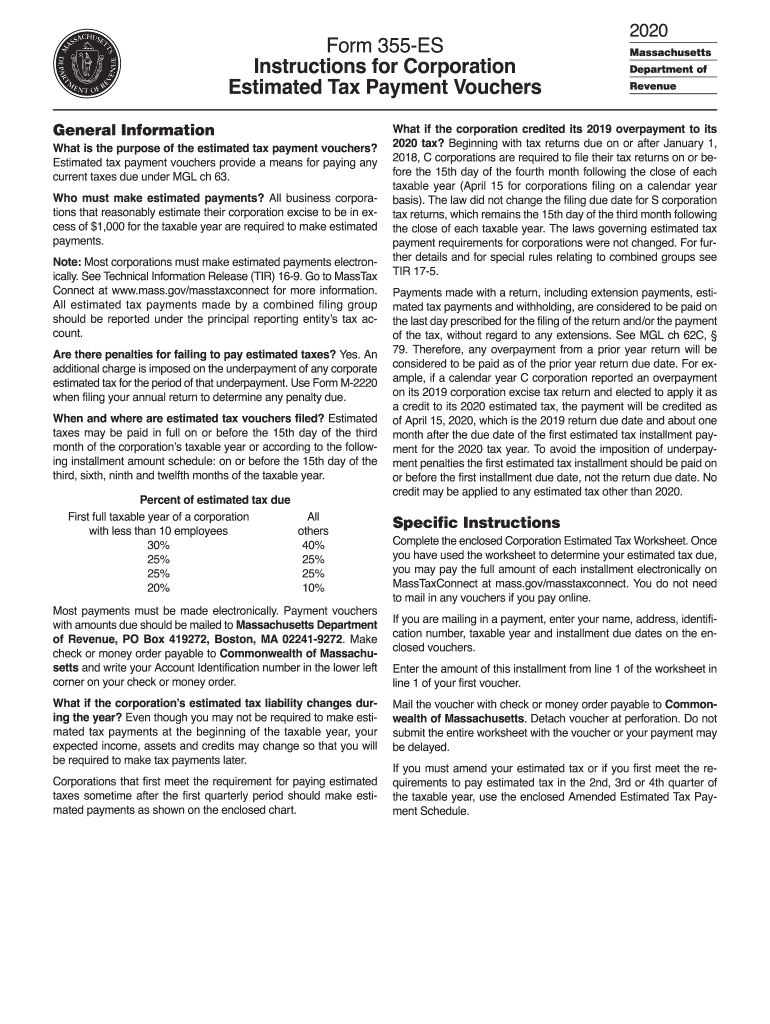

MA 355ES 20202022 Fill out Tax Template Online US Legal Forms

We last updated the partnership return in january 2023, so this is the latest version of form 3, fully updated for tax year 2022. This form is for income earned in tax year 2022, with tax returns due in april. The instructions are divided into two sections designed to lead you Combine lines 24 and 25. Web massachusetts fiduciary and.

2014 Form MA DoR 1 Instructions Fill Online, Printable, Fillable, Blank

We last updated the partnership return in january 2023, so this is the latest version of form 3, fully updated for tax year 2022. Web here you will find an updated listing of all massachusetts department of revenue (dor) tax forms and instructions. Are you still trying to find a quick and efficient solution to fill in ma form 3.

Ma Form 3 Instructions Fill Online, Printable, Fillable, Blank

Web more about the massachusetts form 3 corporate income tax tax credit ty 2022. Dor has released its 2022 massachusetts fiduciary and partnership tax forms. Web 25 adjustments (if any) to line 24. February 17, 2023 all massachusetts tax forms are in pdf format. This form is for income earned in tax year 2022, with tax returns due in april.

Ma Form Fill Out and Sign Printable PDF Template signNow

More about the massachusetts form 3 tax credit we last updated massachusetts form 3 in january 2023 from the massachusetts department of revenue. We last updated the partnership return in january 2023, so this is the latest version of form 3, fully updated for tax year 2022. Combine lines 24 and 25. 26 adjusted massachusetts net income or loss from.

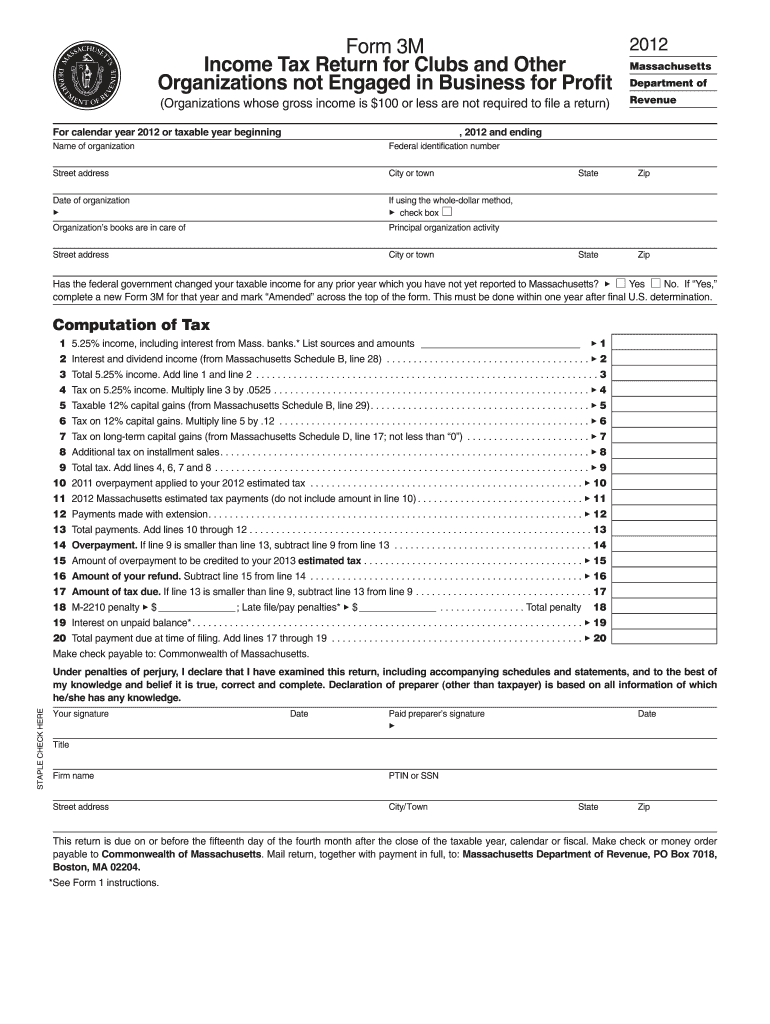

2012 Form MA DoR 3M Fill Online, Printable, Fillable, Blank pdfFiller

The instructions are divided into two sections designed to lead you Web here you will find an updated listing of all massachusetts department of revenue (dor) tax forms and instructions. Web 25 adjustments (if any) to line 24. Our service provides you with a wide library of templates available for filling out on the internet. Are you still trying to.

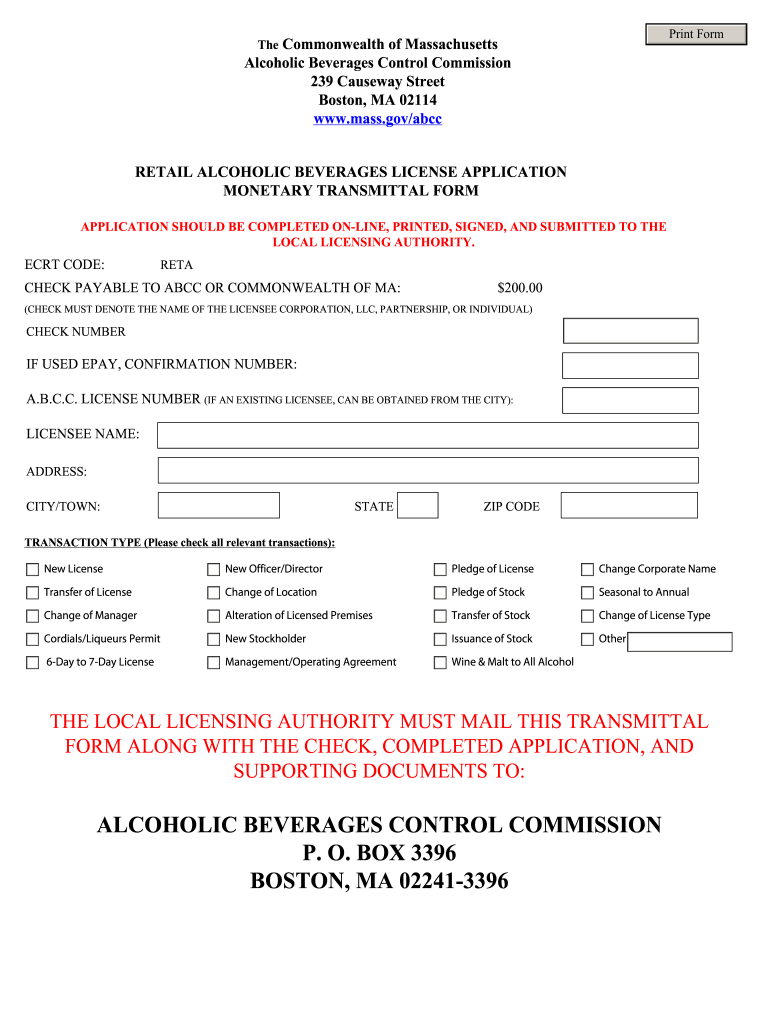

Abcc Ma Form Fill Out and Sign Printable PDF Template signNow

Dor has released its 2022 massachusetts fiduciary and partnership tax forms. Form 1065 and the amount of the adjustment. More about the massachusetts form 3 tax credit we last updated massachusetts form 3 in january 2023 from the massachusetts department of revenue. We last updated the partnership return in january 2023, so this is the latest version of form 3,.

Mass Form 1 Instructions For 2019 Fill Out and Sign Printable PDF

We last updated the partnership return in january 2023, so this is the latest version of form 3, fully updated for tax year 2022. Web for calendar year filers form 3 is due on or before march 15, 2023. 2021 form 3, page 2 Web massachusetts fiduciary and partnership tax forms and instructions. Dor has released its 2022 massachusetts fiduciary.

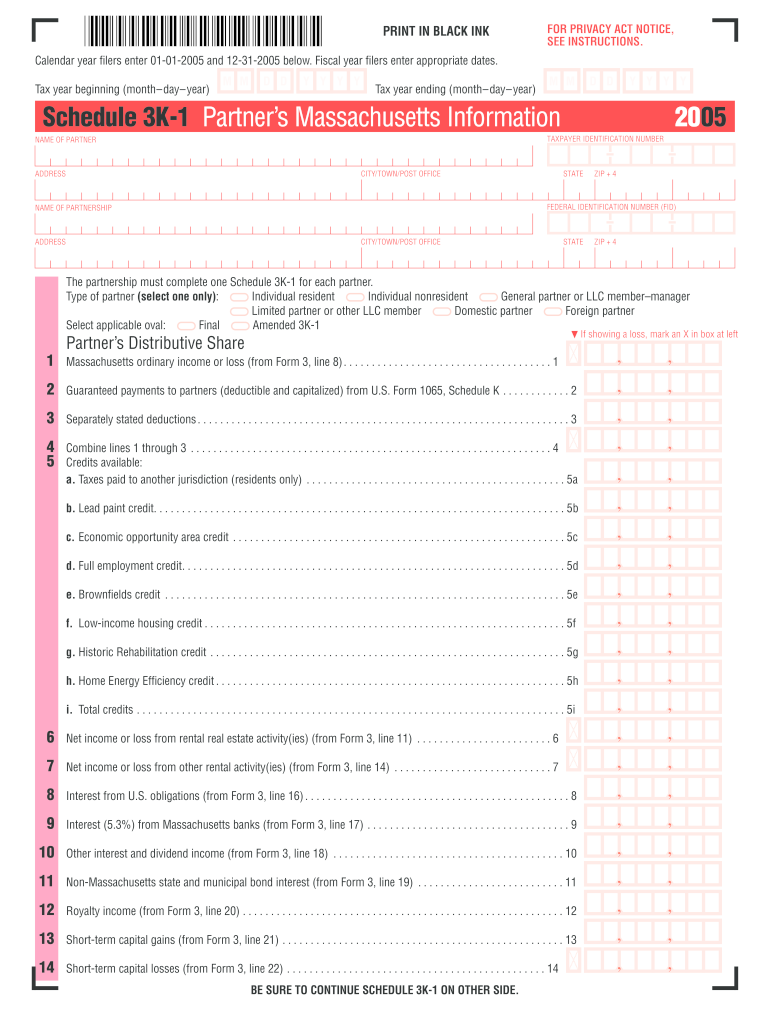

2005 Form MA DoR Schedule 3K1 Fill Online, Printable, Fillable, Blank

Are you still trying to find a quick and efficient solution to fill in ma form 3 at a reasonable price? Web massachusetts fiduciary and partnership tax forms and instructions. This form is for income earned in tax year 2022, with tax returns due in april. Web follow the simple instructions below: The instructions are divided into two sections designed.

Are You Still Trying To Find A Quick And Efficient Solution To Fill In Ma Form 3 At A Reasonable Price?

More about the massachusetts form 3 tax credit we last updated massachusetts form 3 in january 2023 from the massachusetts department of revenue. Combine lines 24 and 25. The instructions are divided into two sections designed to lead you 2021 form 3, page 2

February 17, 2023 All Massachusetts Tax Forms Are In Pdf Format.

Web for calendar year filers form 3 is due on or before march 15, 2023. Enter the applicable line number from u.s. Our service provides you with a wide library of templates available for filling out on the internet. Web 25 adjustments (if any) to line 24.

Dor Has Released Its 2022 Massachusetts Fiduciary And Partnership Tax Forms.

Web here you will find an updated listing of all massachusetts department of revenue (dor) tax forms and instructions. Web more about the massachusetts form 3 corporate income tax tax credit ty 2022. We last updated the partnership return in january 2023, so this is the latest version of form 3, fully updated for tax year 2022. 26 adjusted massachusetts net income or loss from other rental activities.

Web Follow The Simple Instructions Below:

Form 1065 and the amount of the adjustment. Web massachusetts fiduciary and partnership tax forms and instructions. This form is for income earned in tax year 2022, with tax returns due in april.