Ma Form Pc Extension

Ma Form Pc Extension - Please note that this is a general list and. Must use form 7004 to request an extension of time to file income tax. Web annual filings, including forms pc and attachments (due 4.5 months after charity’s fiscal year end; For faster processing, use masstaxconnect. Web every public charity organized or operating in massachusetts or soliciting funds in massachusetts must file a form pc, except organizations which hold property for. Has the organization applied for or been. 6 month extensions available if charity is in compliance) payments for initial. Web an extension may be obtained by submitting a copy of the federal form 8868 or a short letter explaining the need for additional time. Web what form does the state of massachusetts require to apply for an extension? Web procedures for require an extension of period toward file an exempt organization returnable.

Web how do i get an extension for my annual form pc filing? Web what form does the state of massachusetts require to apply for an extension? Has the organization applied for or been. Must use form 7004 to request an extension of time to file income tax. 8868 application for automatic extension of time to file an exempt. Only submit original (no copies needed). When did the organization first engage in charitable work in massachusetts? Submit a charity registration form, form pc (if applicable), and all. Automatic extension of time to file for filers of. Web an extension may be obtained by submitting a copy of the federal form 8868 or a short letter explaining the need for additional time.

Web annual filings, including forms pc and attachments (due 4.5 months after charity’s fiscal year end; Submit a charity registration form, form pc (if applicable), and all. For faster processing, use masstaxconnect. Web what form does the state of massachusetts require to apply for an extension? Web an extension may be obtained by submitting a copy of the federal form 8868 or a short letter explaining the need for additional time. Only submit original (no copies needed). Web up to 40% cash back file entity formation documents with the massachusetts secretary of the commonwealth. When did the organization first engage in charitable work in massachusetts? Web every public charity organized or operating in massachusetts or soliciting funds in massachusetts must file a form pc, except organizations which hold property for. Has the organization applied for or been.

MA Form T200600911 0 Printable Blank PDF Online

Has the organization applied for or been. Web up to 40% cash back the steps below apply to nonprofits that are both incorporated and foreign qualified in massachusetts. 8868 application for automatic extension of time to file an exempt. Web up to 40% cash back file entity formation documents with the massachusetts secretary of the commonwealth. Must use form 7004.

MIPRO MA707EXP Passive Extension Speaker for MA707 MA707EXP

6 month extensions available if charity is in compliance) payments for initial. Web annual filings, including forms pc and attachments (due 4.5 months after charity’s fiscal year end; Has the organization applied for or been. Must use form 7004 to request an extension of time to file income tax. Web procedures for require an extension of period toward file an.

Free Massachusetts Articles of Organization Professional Corporation

Only submit original (no copies needed). 8868 application for automatic extension of time to file an exempt. Web every public charity organized or operating in massachusetts or soliciting funds in massachusetts must file a form pc, except organizations which hold property for. Please note that this is a general list and. Submit a charity registration form, form pc (if applicable),.

Free Massachusetts Articles of Organization Professional Corporation

Web how do i get an extension for my annual form pc filing? Web up to 40% cash back file entity formation documents with the massachusetts secretary of the commonwealth. Has the organization applied for or been. Web every public charity organized or operating in massachusetts or soliciting funds in massachusetts must file a form pc, except organizations which hold.

MA Form 126 2013 Fill and Sign Printable Template Online US Legal Forms

For faster processing, use masstaxconnect. Web up to 40% cash back file entity formation documents with the massachusetts secretary of the commonwealth. Only submit original (no copies needed). Web what form does the state of massachusetts require to apply for an extension? Web how do i get an extension for my annual form pc filing?

RS232 9 Pin Male to male Gender Changer Converter PC Extension Adapter

Please note that this is a general list and. Only submit original (no copies needed). Automatic extension of time to file for filers of. Must use form 7004 to request an extension of time to file income tax. Web up to 40% cash back file entity formation documents with the massachusetts secretary of the commonwealth.

6 Pin PCIE PC Extension modGuru

Must use form 7004 to request an extension of time to file income tax. Use form 8868, application for extension are time to file an liberated organization. Only submit original (no copies needed). Submit a charity registration form, form pc (if applicable), and all. Web every public charity organized or operating in massachusetts or soliciting funds in massachusetts must file.

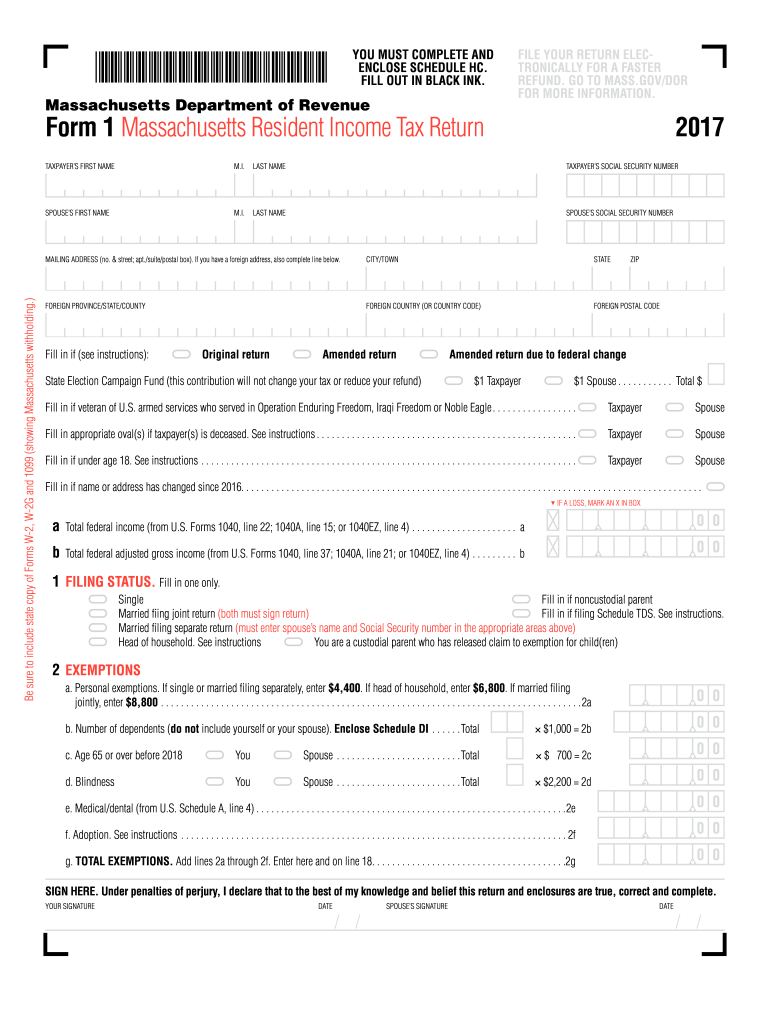

MA Form 1 2017 Fill out Tax Template Online US Legal Forms

Web every public charity organized or operating in massachusetts or soliciting funds in massachusetts must file a form pc, except organizations which hold property for. Web annual filings, including forms pc and attachments (due 4.5 months after charity’s fiscal year end; Web up to 40% cash back file entity formation documents with the massachusetts secretary of the commonwealth. Automatic extension.

General Brand PC Male to PC Female Extension, Coiled 5'

6 month extensions available if charity is in compliance) payments for initial. For faster processing, use masstaxconnect. Automatic extension of time to file for filers of. Use form 8868, application for extension are time to file an liberated organization. Please note that this is a general list and.

MA Form 10 2007 Fill and Sign Printable Template Online US Legal Forms

Submit a charity registration form, form pc (if applicable), and all. Automatic extension of time to file for filers of. Must use form 7004 to request an extension of time to file income tax. Use form 8868, application for extension are time to file an liberated organization. Web procedures for require an extension of period toward file an exempt organization.

Submit A Charity Registration Form, Form Pc (If Applicable), And All.

For faster processing, use masstaxconnect. Automatic extension of time to file for filers of. When did the organization first engage in charitable work in massachusetts? Use form 8868, application for extension are time to file an liberated organization.

Web Annual Filings, Including Forms Pc And Attachments (Due 4.5 Months After Charity’s Fiscal Year End;

Must use form 7004 to request an extension of time to file income tax. Has the organization applied for or been. Only submit original (no copies needed). Web how do i get an extension for my annual form pc filing?

Web Up To 40% Cash Back File Entity Formation Documents With The Massachusetts Secretary Of The Commonwealth.

Web procedures for require an extension of period toward file an exempt organization returnable. 6 month extensions available if charity is in compliance) payments for initial. Web what form does the state of massachusetts require to apply for an extension? Web up to 40% cash back the steps below apply to nonprofits that are both incorporated and foreign qualified in massachusetts.

Web Every Public Charity Organized Or Operating In Massachusetts Or Soliciting Funds In Massachusetts Must File A Form Pc, Except Organizations Which Hold Property For.

Please note that this is a general list and. Web an extension may be obtained by submitting a copy of the federal form 8868 or a short letter explaining the need for additional time. 8868 application for automatic extension of time to file an exempt.