Maryland Form 504 Instructions 2022

Maryland Form 504 Instructions 2022 - It aids the state in calculating the appropriate. Enter all required information in the. Web maryland form 504 schedule a or fiscal year beginning fiduciary income tax return schedule a 2022 2022, ending name fein fiduciary’s. Maryland form 504 fiduciary income tax return name fein 2021. Web fiduciary declaration of estimated income tax. Web 2022 individual income tax instruction booklets. Filing this form extends the time to file your return, but does not extend the. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs. 2019 fiduciary income tax return maryland (comptroller of maryland) comptroller of maryland endowments of maryland historically black. Web marylandform 504 name of estate or trust fiduciarytax return (or fiscal year beginning , 1999, 1999 do not write in this space name and title of.

2019 fiduciary income tax return maryland (comptroller of maryland) comptroller of maryland endowments of maryland historically black. Pick the template in the catalogue. Web maryland tax (use rate schedule in instructions or enter amount from form 504nr, line 21.). Enter all required information in the. Follow the instructions on form pv to request an automatic extension on filing your return. Web maryland form 504 is a document that allows individuals or businesses to document their taxable income within maryland state lines. Form and instructions for a fiduciary to file and pay estimated taxes for tax year 2022 if the fiduciary is required to file a maryland. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs. Printable maryland state tax forms for the 2022. Web section 504 of the rehabilitation act of 1973 is a federal law that prohibits organizations that receive federal money from discriminating against a person on the basis of a disability.

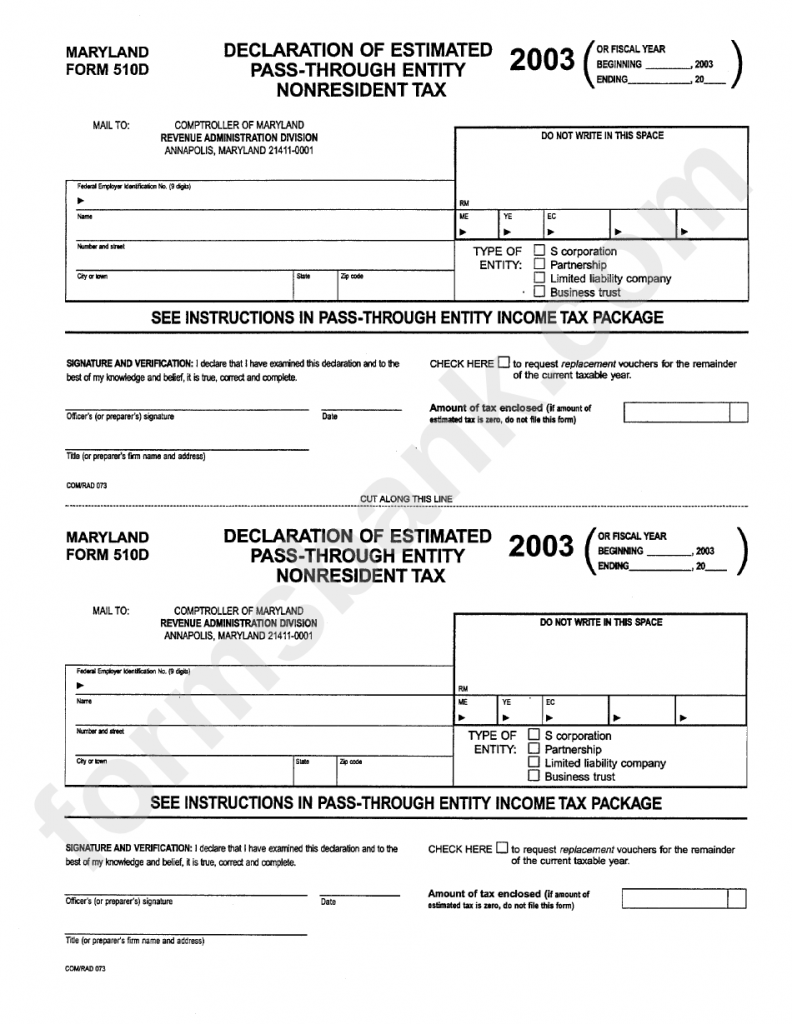

Form and instructions for a fiduciary to file and pay estimated taxes for tax year 2022 if the fiduciary is required to file a maryland. Web maryland form 504 schedule a or fiscal year beginning fiduciary income tax return schedule a 2022 2022, ending name fein fiduciary’s. Maryland state and local tax forms and instructions. Enter all required information in the. Filing your tax return you may file form 504 at any time before the. Pick the template in the catalogue. Web nonresidents fiduciaries should use 2021 form 504 and form 504nr to calculate the 2022 estimated tax; For additional information, visit income tax for individual taxpayers > filing information. Web section 504 of the rehabilitation act of 1973 is a federal law that prohibits organizations that receive federal money from discriminating against a person on the basis of a disability. 2022 business income tax forms popular.

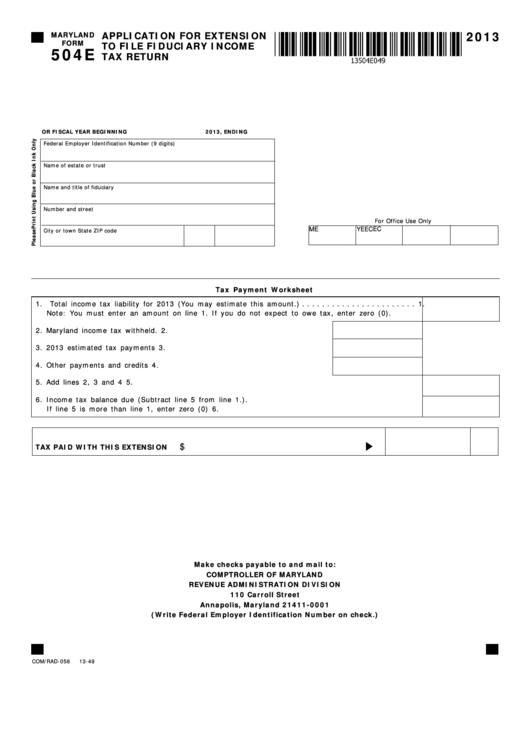

Fillable Maryland Form 504e Application For Extension To File

Web maryland form 504e application for extension to file fiduciary income tax return instructions 2022 general instructions purpose of form use. Web we last updated the maryland instructions for fiduciaries in january 2023, so this is the latest version of fiduciary booklet, fully updated for tax year 2022. Web maryland form 504 schedule a or fiscal year beginning fiduciary income.

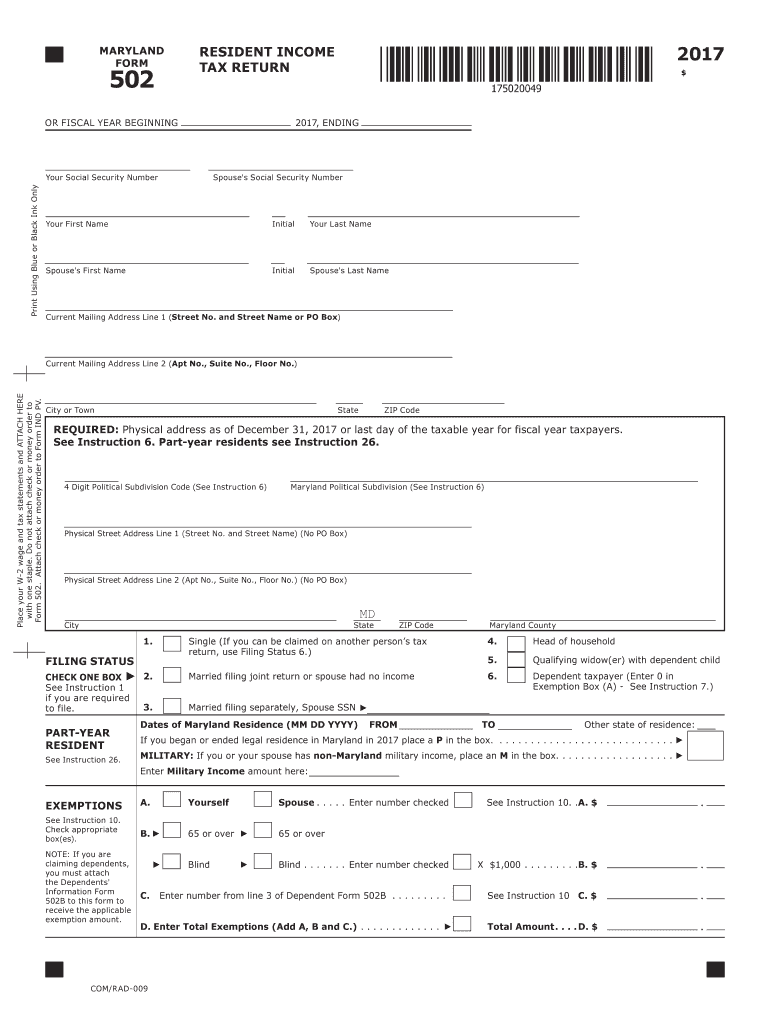

Maryland 502 Instructions 2017 Fill Out and Sign Printable PDF

Web 2023 individual income tax forms. Web peter franchot, comptroller table of contents instructions for electronic filing introduction the maryland modernized electronic filing (mef) program is part of the internal. Web nonresidents fiduciaries should use 2021 form 504 and form 504nr to calculate the 2022 estimated tax; Web maryland tax (use rate schedule in instructions or enter amount from form.

Fill Free fillable forms Comptroller of Maryland

Web maryland form 504e application for extension to file fiduciary income tax return instructions 2022 general instructions purpose of form use. Maryland state and local tax forms and instructions. Web marylandform 504 name of estate or trust fiduciarytax return (or fiscal year beginning , 1999, 1999 do not write in this space name and title of. Web peter franchot, comptroller.

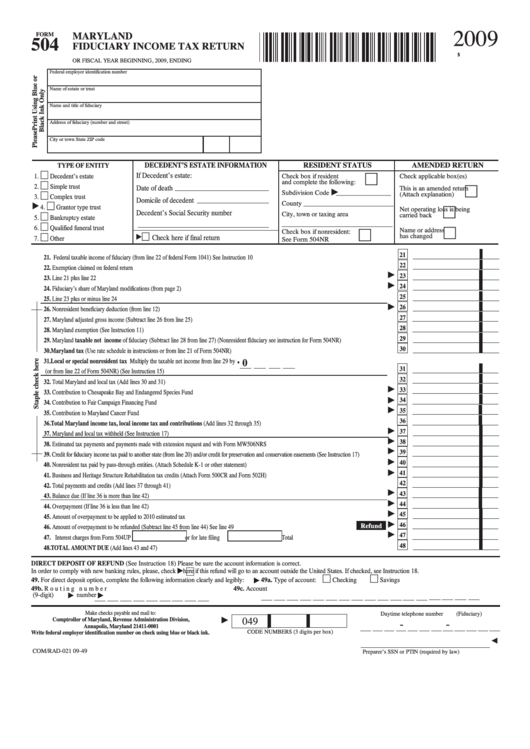

Fillable Form 504 Maryland Fiduciary Tax Return 2009

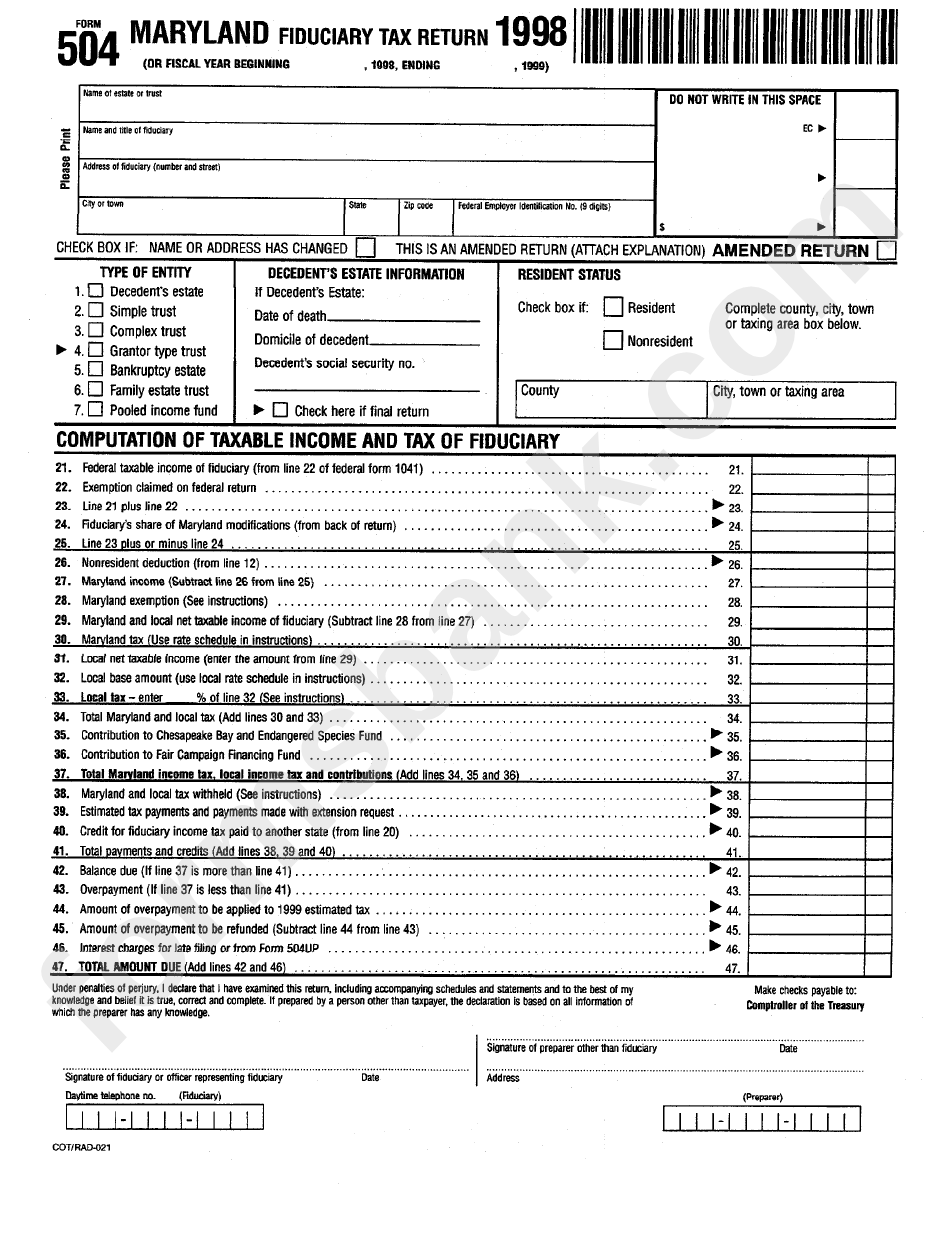

Web marylandform 504 name of estate or trust fiduciarytax return (or fiscal year beginning , 1999, 1999 do not write in this space name and title of. Web peter franchot, comptroller table of contents instructions for electronic filing introduction the maryland modernized electronic filing (mef) program is part of the internal. 2019 fiduciary income tax return maryland (comptroller of maryland).

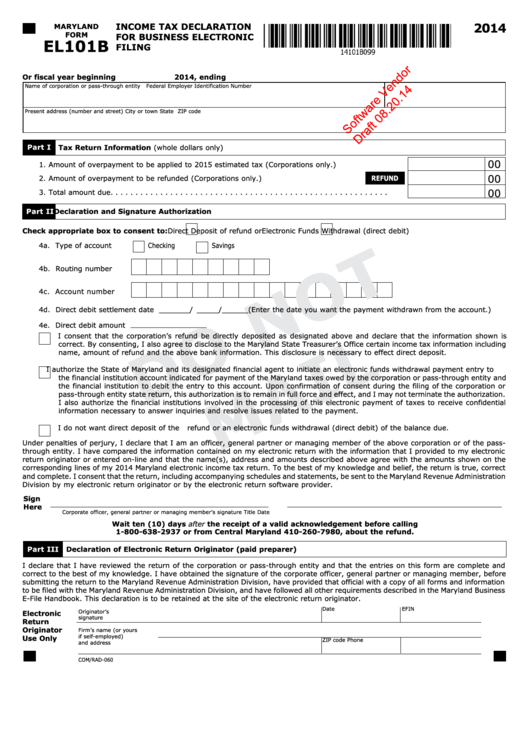

Maryland Form El101b Draft Tax Declaration For Business

Web nonresidents fiduciaries should use 2021 form 504 and form 504nr to calculate the 2022 estimated tax; Form and instructions for a fiduciary to file and pay estimated taxes for tax year 2022 if the fiduciary is required to file a maryland. Web marylandform 504 name of estate or trust fiduciarytax return (or fiscal year beginning , 1999, 1999 do.

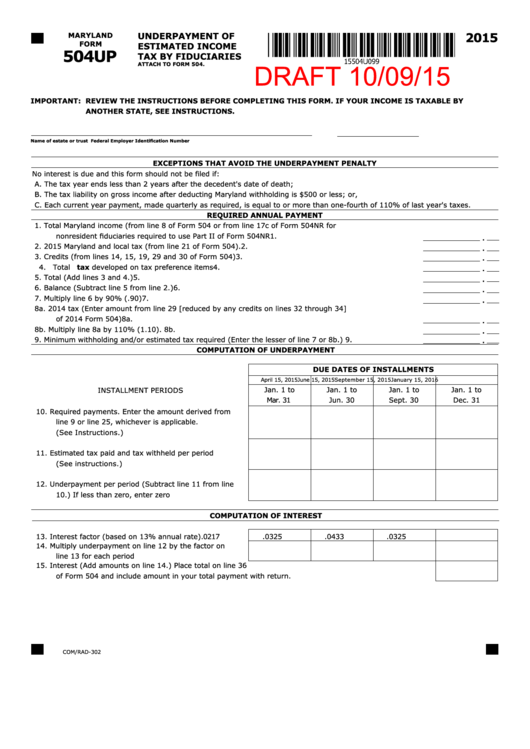

Maryland Form 504up Draft Underpayment Of Estimated Tax By

Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs. Maryland form 504 fiduciary income tax return name fein 2021. Web maryland state income tax form 502 must be postmarked by april 18, 2023 in order to avoid penalties and late fees. Web we last updated the maryland instructions for fiduciaries in january 2023, so.

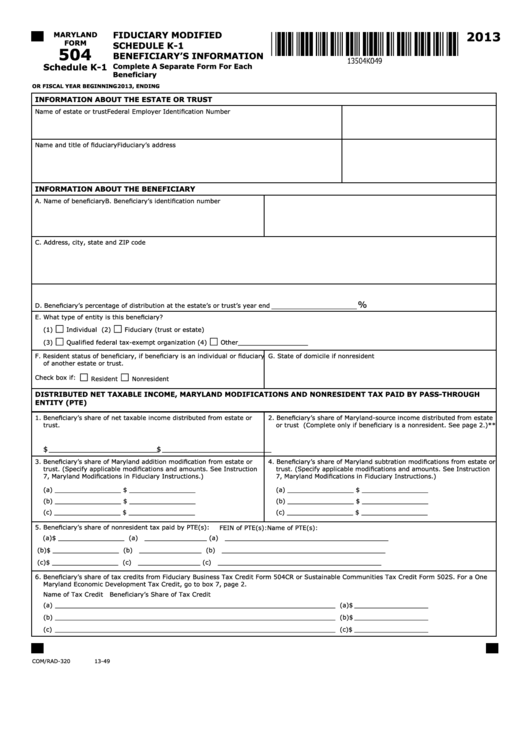

Fillable Maryland Form 504 Schedule K1 Fiduciary Modified Schedule

Web 2023 individual income tax forms. Web maryland form 504 is a document that allows individuals or businesses to document their taxable income within maryland state lines. Web maryland tax (use rate schedule in instructions or enter amount from form 504nr, line 21.). Filing this form extends the time to file your return, but does not extend the. Web comptroller.

Maryland Printable Tax Forms Printable Form 2022

Filing your tax return you may file form 504 at any time before the. Maryland form 504 fiduciary income tax return name fein 2021. However, they should use the tax rate schedule. Filing this form extends the time to file your return, but does not extend the. Pick the template in the catalogue.

Fillable Form 504 Maryland Fiduciary Tax Return 1998 printable pdf

2019 fiduciary income tax return maryland (comptroller of maryland) comptroller of maryland endowments of maryland historically black. Web nonresidents fiduciaries should use 2021 form 504 and form 504nr to calculate the 2022 estimated tax; Filing your tax return you may file form 504 at any time before the. Web maryland form 504 is a document that allows individuals or businesses.

Printable Maryland State Tax Forms For The 2022.

Web nonresidents fiduciaries should use 2021 form 504 and form 504nr to calculate the 2022 estimated tax; Maryland form 504 fiduciary income tax return name fein 2021. Web 2023 individual income tax forms. It aids the state in calculating the appropriate.

Web Peter Franchot, Comptroller Table Of Contents Instructions For Electronic Filing Introduction The Maryland Modernized Electronic Filing (Mef) Program Is Part Of The Internal.

Filing your tax return you may file form 504 at any time before the. 2019 fiduciary income tax return maryland (comptroller of maryland) comptroller of maryland endowments of maryland historically black. Form and instructions for a fiduciary to file and pay estimated taxes for tax year 2022 if the fiduciary is required to file a maryland. Web marylandform 504 name of estate or trust fiduciarytax return (or fiscal year beginning , 1999, 1999 do not write in this space name and title of.

Name _____ Fein _____ 2022.

2022 business income tax forms popular. Business income tax credits for fiduciaries. For additional information, visit income tax for individual taxpayers > filing information. Enter all required information in the.

Web Maryland State Income Tax Form 502 Must Be Postmarked By April 18, 2023 In Order To Avoid Penalties And Late Fees.

Filing this form extends the time to file your return, but does not extend the. Pick the template in the catalogue. Web maryland form 504e application for extension to file fiduciary income tax return instructions 2022 general instructions purpose of form use. Web maryland form 504 is a document that allows individuals or businesses to document their taxable income within maryland state lines.