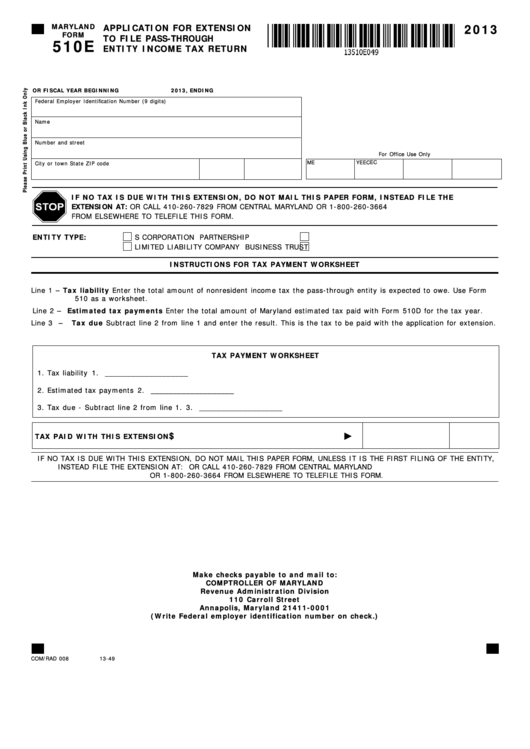

Maryland Form 510E

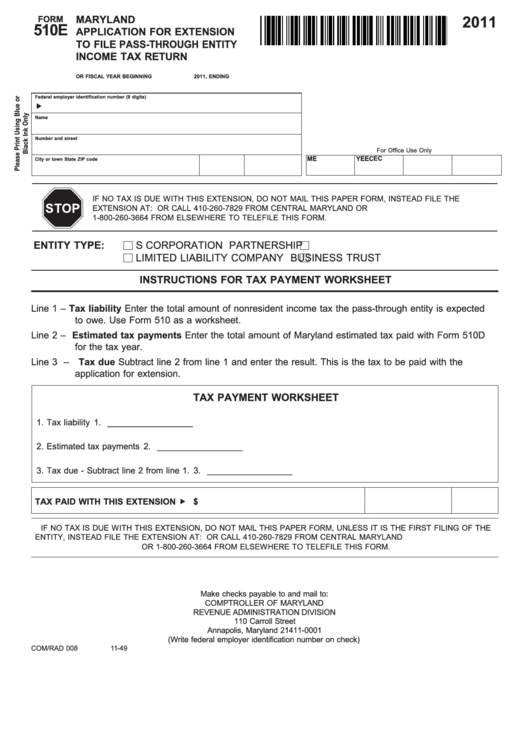

Maryland Form 510E - Web we last updated maryland form 510e in november 2022 from the maryland comptroller of maryland. If line 3 is zero, file in one of the following ways: Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. Use form 510e to remit. Use form 510e to remit. You can download or print current. How to file complete the tax payment worksheet. When and where to filefile form 510e by the 15th day of the 3rd month Businesses can file the 500e or 510e online if they have previously filed form. A 7 month extension can be granted for.

This form is for income earned in tax year 2022, with tax returns due in april. Web corporations can make a maryland extension payment with form 500e. Web the extension request filing system allows businesses to instantly file for an extension online. An automatic extension will be granted if filed by the due date. Web submitted with form 510e; Web maryland law provides for accrual of interest and imposition of penalty for failure to pay any tax when due. Web file maryland form 510 electronically to pass on business tax credits from maryland form 500cr and/or maryland form 502s to your members. Web this system allows instant online electronic filing of the 500e/510e forms. Use form 510e to remit. 1) telefile request an automatic extension by calling 1.

Web this system allows instant online electronic filing of the 500e/510e forms. When and where to filefile form 510e by the 15th day of the 3rd month 1) telefile request an automatic extension by calling 1. A 7 month extension can be granted for. Use form 510e to remit. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. Web corporations can make a maryland extension payment with form 500e. Web maryland law provides for accrual of interest and imposition of penalty for failure to pay any tax when due. Use form 510e to remit any tax that may be due.

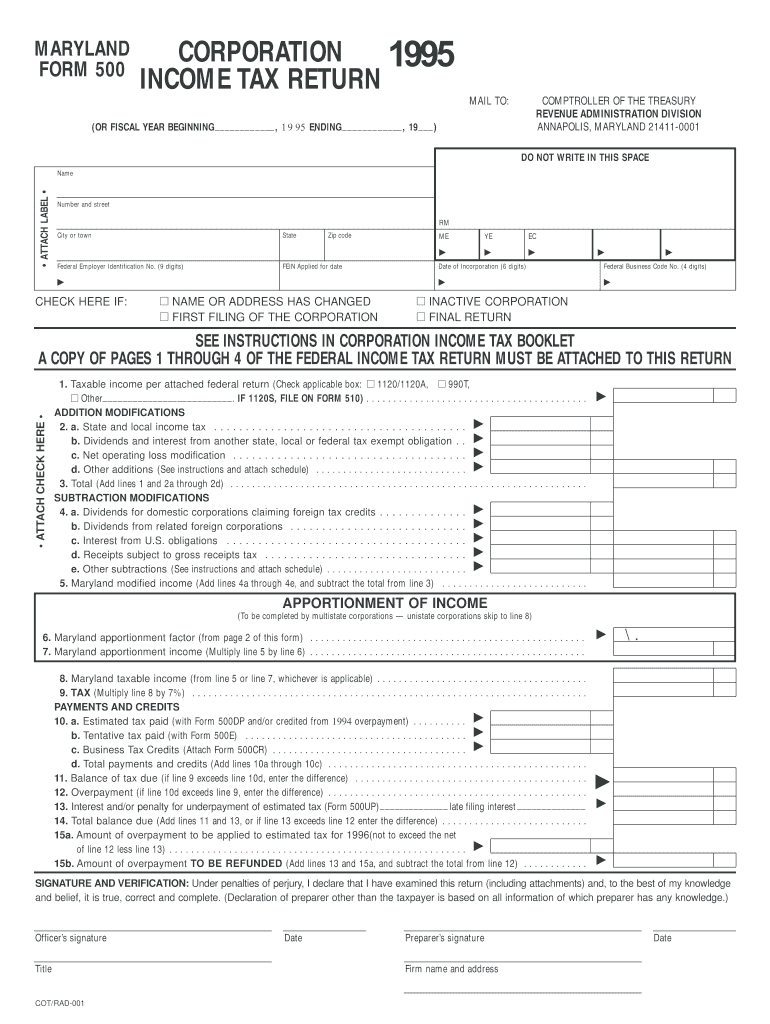

Maryland Form 500 Fill Online, Printable, Fillable, Blank PDFfiller

Web we last updated maryland form 510e in november 2022 from the maryland comptroller of maryland. Web the extension request filing system allows businesses to instantly file for an extension online. Web corporations can make a maryland extension payment with form 500e. Use form 510e to remit any tax that may be due. Web maryland law provides for accrual of.

Maryland Form 502d Fill Online, Printable, Fillable, Blank pdfFiller

An automatic extension will be granted if filed by the due date. Web corporations can make a maryland extension payment with form 500e. When and where to filefile form 510e by the 15th day of the 3rd month Web be used for form 510e. I certify that i am a legal resident of thestate of and am not subject to.

Fillable Maryland Form 510e Application For Extension To File Pass

This form is for income earned in tax year 2022, with tax returns due in april. Web file maryland form 510 electronically to pass on business tax credits from maryland form 500cr and/or maryland form 502s to your members. Web be used for form 510e. 1) telefile request an automatic extension by calling 1. When and where to filefile form.

PROFORM 510E MANUAL Pdf Download ManualsLib

When and where to filefile form 510e by the 15th day of the 3rd month 1) telefile request an automatic extension by calling 1. Use form 510e to remit. Web submitted with form 510e; A 7 month extension can be granted for.

ProForm 510E Elliptical Machine with iFit for Sale in Biscayne Park

Use form 510e to remit. Businesses can file the 500e or 510e online if they have previously filed form. If line 3 is zero, file in one of the following ways: Use form 510e to remit. Web the extension request filing system allows businesses to instantly file for an extension online.

elliemeyersdesigns Maryland Form 510

How to file complete the tax payment worksheet. Web be used for form 510e. This form is for income earned in tax year 2022, with tax returns due in april. 1) telefile request an automatic extension by calling 1. Use form 510e to remit any tax that may be due.

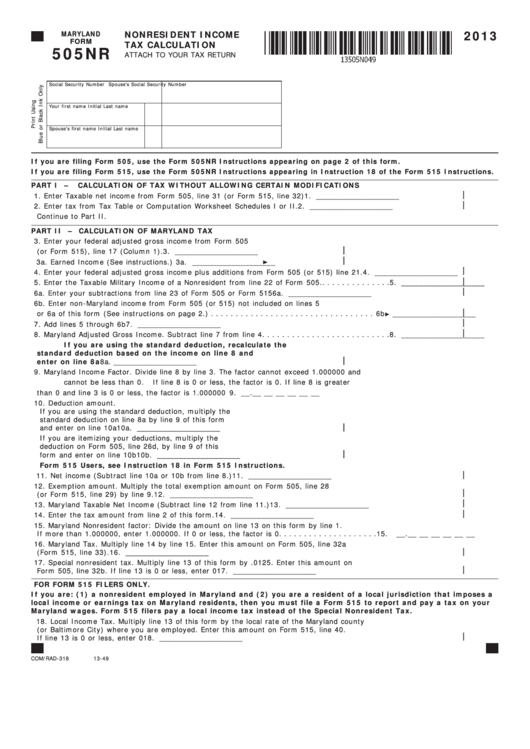

Fillable Maryland Form 505nr Nonresident Tax Calculation

Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. Use form 510e to remit. Also use form 510e if this is the first. Web file maryland form 510 electronically to pass on business tax credits from maryland form 500cr and/or maryland form 502s to your members. If line 3 is zero, file in.

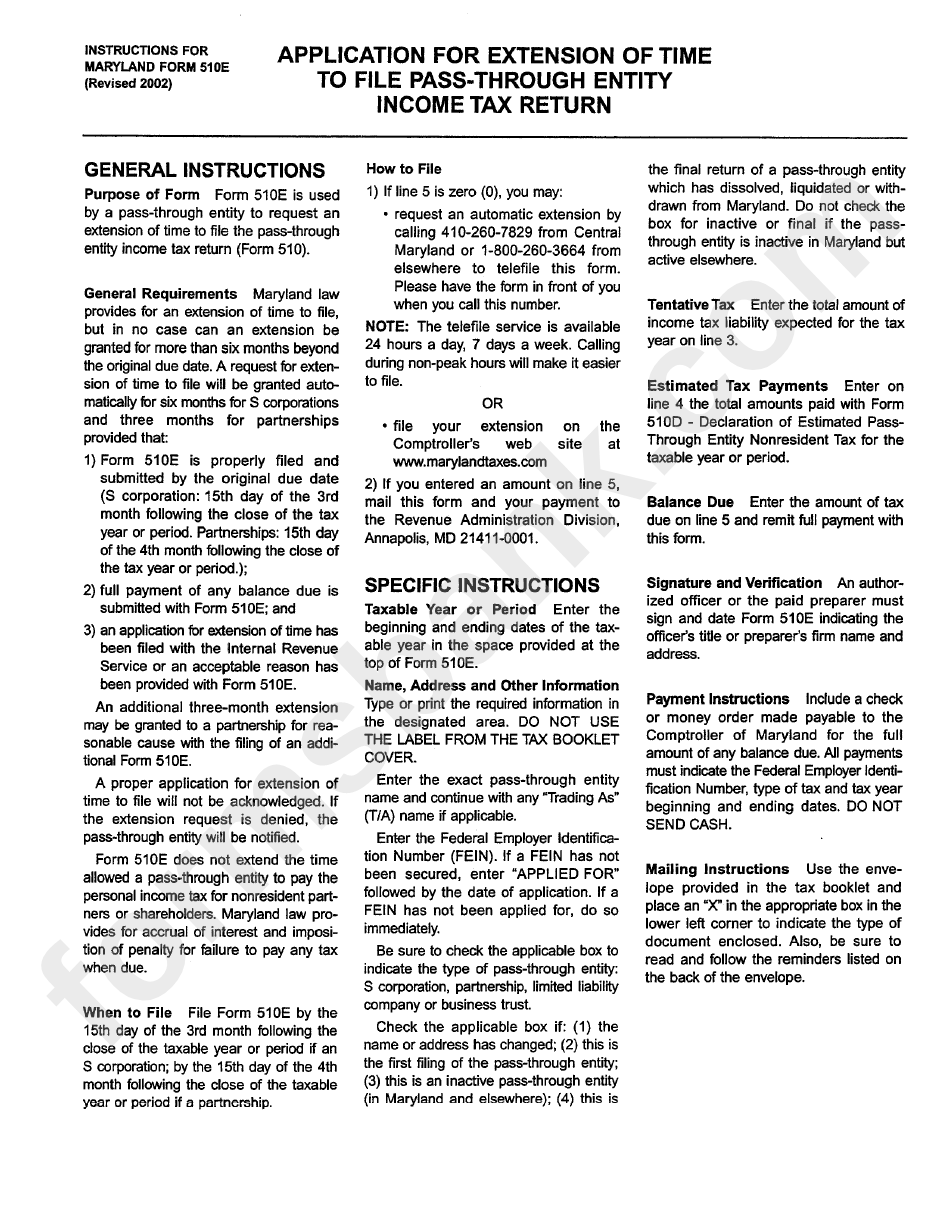

Instructions For Maryland Form 510e Application For Extension Oftime

Web file maryland form 510 electronically to pass on business tax credits from maryland form 500cr and/or maryland form 502s to your members. And 3) an application for extension of time has been filed with the internal revenue service or an acceptable reason has been provided with form. Businesses can file the 500e or 510e online if they have previously.

Fillable Form 510e Maryland Application For Extension To File Pass

How to file complete the tax payment worksheet. A 7 month extension can be granted for. Web submitted with form 510e; Businesses can file the 500e or 510e online if they have previously filed form. An automatic extension will be granted if filed by the due date.

[ベスト] mw 507 495852Mw 507 Gambarsaeo4p

Use form 510e to remit. Web corporations can make a maryland extension payment with form 500e. Web the extension request filing system allows businesses to instantly file for an extension online. This form is for income earned in tax year 2022, with tax returns due in april. How to file complete the tax payment worksheet.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

A 7 month extension can be granted for. An automatic extension will be granted if filed by the due date. Use form 510e to remit. 1) telefile request an automatic extension by calling 1.

How To File Complete The Tax Payment Worksheet.

Web we last updated maryland form 510e in november 2022 from the maryland comptroller of maryland. And 3) an application for extension of time has been filed with the internal revenue service or an acceptable reason has been provided with form. Web maryland law provides for accrual of interest and imposition of penalty for failure to pay any tax when due. When and where to filefile form 510e by the 15th day of the 3rd month

I Certify That I Am A Legal Resident Of Thestate Of And Am Not Subject To Maryland Withholding Because I Meet The Requirements Set Forth Under The Servicemembers Civil.

You can download or print current. Web the extension request filing system allows businesses to instantly file for an extension online. Web corporations can make a maryland extension payment with form 500e. Businesses can file the 500e or 510e online if they have previously filed form.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Web file maryland form 510 electronically to pass on business tax credits from maryland form 500cr and/or maryland form 502s to your members. Use form 510e to remit. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. Web be used for form 510e.

![[ベスト] mw 507 495852Mw 507 Gambarsaeo4p](https://www.speedytemplate.com/maryland-form-mw-507_000002.png)