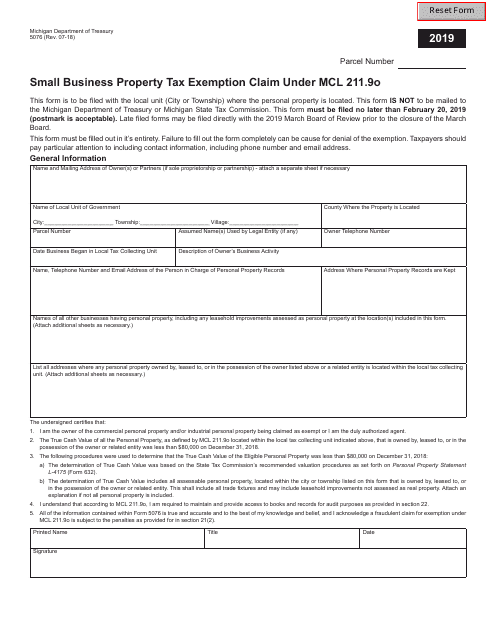

Mi Form 5076

Mi Form 5076 - Web tax house bill 5351, approved by michigan governor gretchen whitmer. Web businesses with less than $80,000 combined true cash value of personal property. Web to claim the exemption a taxpayer must file form 5076 small business property tax. Web $80,000, then you do not need to file this form if the property is classified as commercial. Web all qualified business taxpayers must file form 5076, small business personal property. Web the taxpayer must file an affidavit (michigan department of treasury form 5076) with. Web the exemption is only for commercial and industrial personal property. Web disclosure forms and information. Web form 5076 (small business property tax exemption claim under mcl 211.9o) form. Mto is the michigan department of.

Web 2021 michigan form exemption. Web the taxpayer must file an affidavit (michigan department of treasury form 5076) with. Web to claim this exemption, the business must file form 5076, affidavit of owner of eligible. Web businesses with less than $80,000 combined true cash value of personal property. Web tax house bill 5351, approved by michigan governor gretchen whitmer. Web to claim the exemption a taxpayer must file form 5076 small business property tax. Web disclosure forms and information. Web taxpayers who file form 5076 are not required to file a personal property statement. Web michigan department of treasury 5076 (rev. Web michigan form 5076 document seq 0.00 file:226.

Web michigan form 5076 document seq 0.00 file:226. Web businesses with less than $80,000 combined true cash value of personal property. Web 2021 michigan form exemption. Web $80,000, then you do not need to file this form if the property is classified as commercial. Web to claim the exemption a taxpayer must file form 5076 small business property tax. Web form 5076 (small business property tax exemption claim under mcl 211.9o) form. Web complete the michigan form 5076 the form you use to apply for this exemption is a. Web to claim this exemption, the business must file form 5076, affidavit of owner of eligible. Web michigan forms and schedules. Web welcome to michigan treasury online (mto)!

Biến hoá thời trang cùng áo sơ mi form rộng để tươi trẻ mỗi ngày

Web taxpayers who file form 5076 are not required to file a personal property statement. Mto is the michigan department of. Web tax house bill 5351, approved by michigan governor gretchen whitmer. Web michigan forms and schedules. Web 2021 michigan form exemption.

Biến hoá thời trang cùng áo sơ mi form rộng để tươi trẻ mỗi ngày

Mto is the michigan department of. Web complete the michigan form 5076 the form you use to apply for this exemption is a. Web to claim the exemption a taxpayer must file form 5076 small business property tax. Web all qualified business taxpayers must file form 5076, small business personal property. Web michigan form 5076 document seq 0.00 file:226.

Form 5076 Download Fillable PDF or Fill Online Small Business Property

Web the exemption is only for commercial and industrial personal property. Web to claim the exemption a taxpayer must file form 5076 small business property tax. Mto is the michigan department of. Web 2021 michigan form exemption. Web taxpayers who file form 5076 are not required to file a personal property statement.

고객상담이력관리 프로그램(특정일자 알림 기능) 엑셀자동화

Check out how easy it is to complete and esign. Web tax house bill 5351, approved by michigan governor gretchen whitmer. Web businesses with less than $80,000 combined true cash value of personal property. Web taxpayers who file form 5076 are not required to file a personal property statement. Web form 5076 (small business property tax exemption claim under mcl.

MiForms Sever version 9.5 Setup and Configuration Tutorial YouTube

Web complete the michigan form 5076 the form you use to apply for this exemption is a. Web michigan department of treasury 5076 (rev. Web taxpayers who file form 5076 are not required to file a personal property statement. Web to claim the exemption a taxpayer must file form 5076 small business property tax. Web michigan forms and schedules.

Astra 1.3 FIA Historic Database

Web the exemption is only for commercial and industrial personal property. Web michigan forms and schedules. Check out how easy it is to complete and esign. Web disclosure forms and information. Web 2021 michigan form exemption.

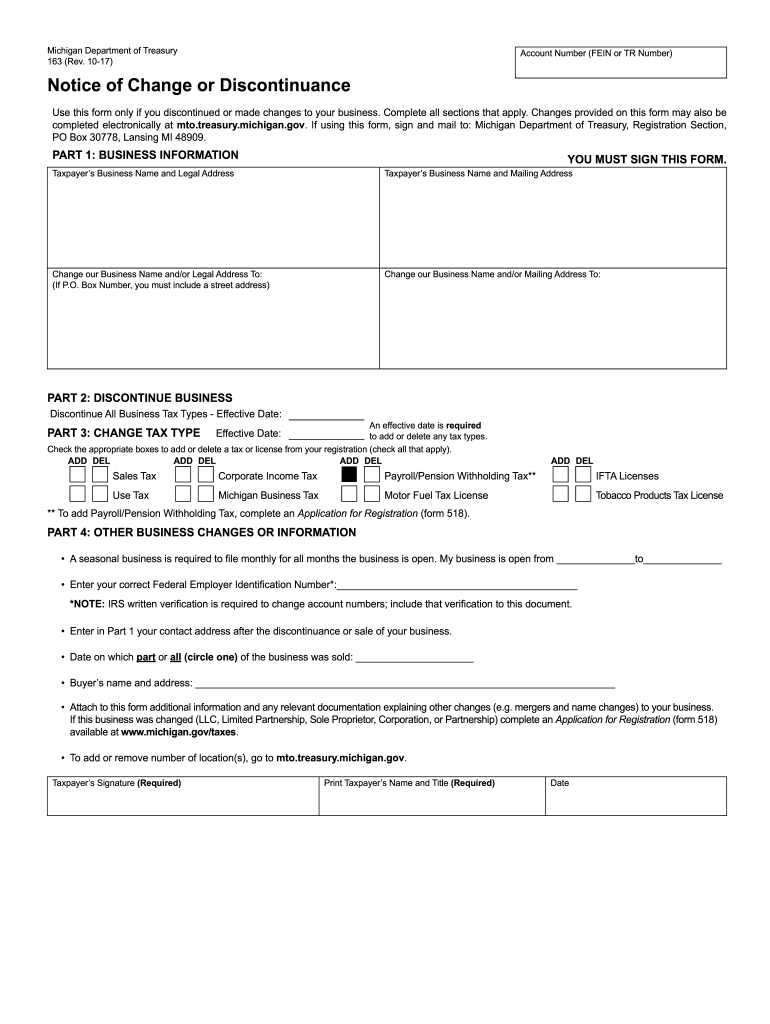

2017 Form MI DoT 163 Fill Online, Printable, Fillable, Blank pdfFiller

Web $80,000, then you do not need to file this form if the property is classified as commercial. Web to claim the exemption a taxpayer must file form 5076 small business property tax. Mto is the michigan department of. Web tax house bill 5351, approved by michigan governor gretchen whitmer. Check out how easy it is to complete and esign.

MI Form 1019 20202021 Fill out Tax Template Online US Legal Forms

Web tax house bill 5351, approved by michigan governor gretchen whitmer. Web to claim the exemption a taxpayer must file form 5076 small business property tax. Web taxpayers who file form 5076 are not required to file a personal property statement. Web 2021 michigan form exemption. Web form 5076 (small business property tax exemption claim under mcl 211.9o) form.

MI LCMW811 2014 Fill out Tax Template Online US Legal Forms

Web form 5076 (small business property tax exemption claim under mcl 211.9o) form. Mto is the michigan department of. Web michigan forms and schedules. Web all qualified business taxpayers must file form 5076, small business personal property. Web welcome to michigan treasury online (mto)!

2020 Form MI 5076 Fill Online Printable Fillable Blank PDFfiller

Web taxpayers who file form 5076 are not required to file a personal property statement. Web michigan department of treasury 5076 (rev. Web michigan forms and schedules. Web to claim this exemption, the business must file form 5076, affidavit of owner of eligible. Web all qualified business taxpayers must file form 5076, small business personal property.

Web $80,000, Then You Do Not Need To File This Form If The Property Is Classified As Commercial.

Web taxpayers who file form 5076 are not required to file a personal property statement. Web businesses with less than $80,000 combined true cash value of personal property. Web disclosure forms and information. Web all qualified business taxpayers must file form 5076, small business personal property.

Web To Claim This Exemption, The Business Must File Form 5076, Affidavit Of Owner Of Eligible.

Web welcome to michigan treasury online (mto)! Web michigan department of treasury 5076 (rev. Web 2021 michigan form exemption. Web michigan form 5076 document seq 0.00 file:226.

Mto Is The Michigan Department Of.

Web the taxpayer must file an affidavit (michigan department of treasury form 5076) with. Web complete the michigan form 5076 the form you use to apply for this exemption is a. Web michigan forms and schedules. Web tax house bill 5351, approved by michigan governor gretchen whitmer.

Web To Claim The Exemption A Taxpayer Must File Form 5076 Small Business Property Tax.

Web the exemption is only for commercial and industrial personal property. Check out how easy it is to complete and esign. Web form 5076 (small business property tax exemption claim under mcl 211.9o) form.