Mileage Report Form Free

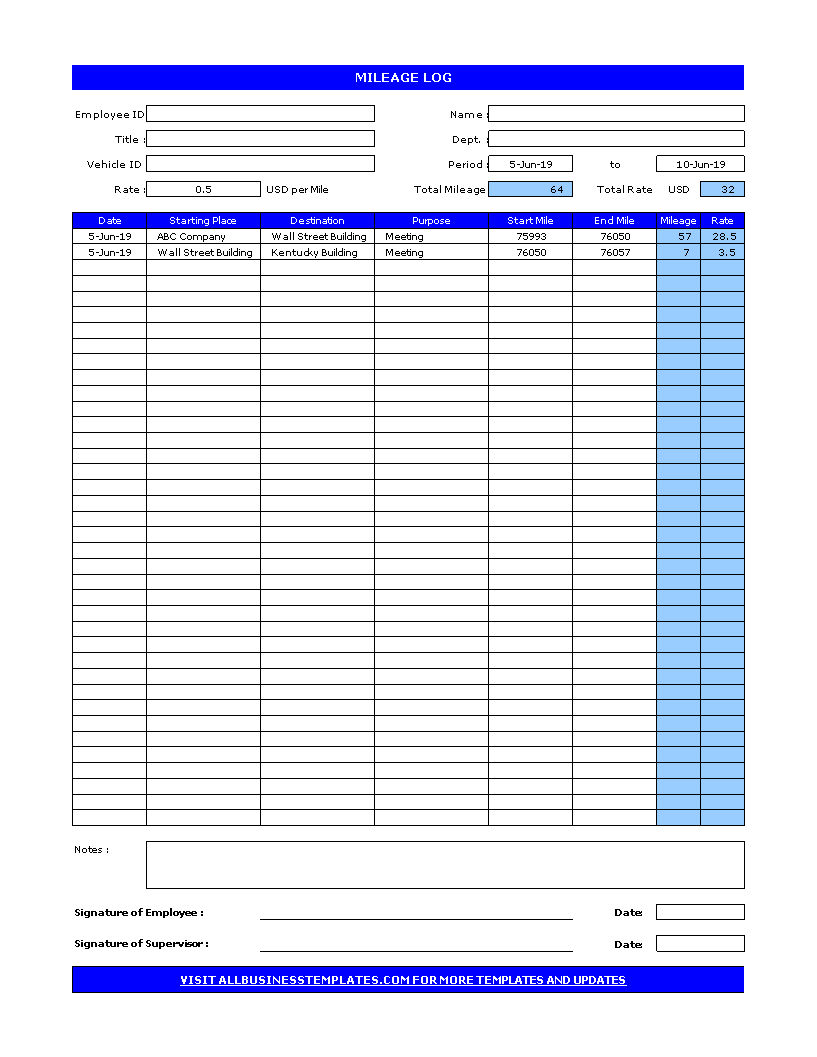

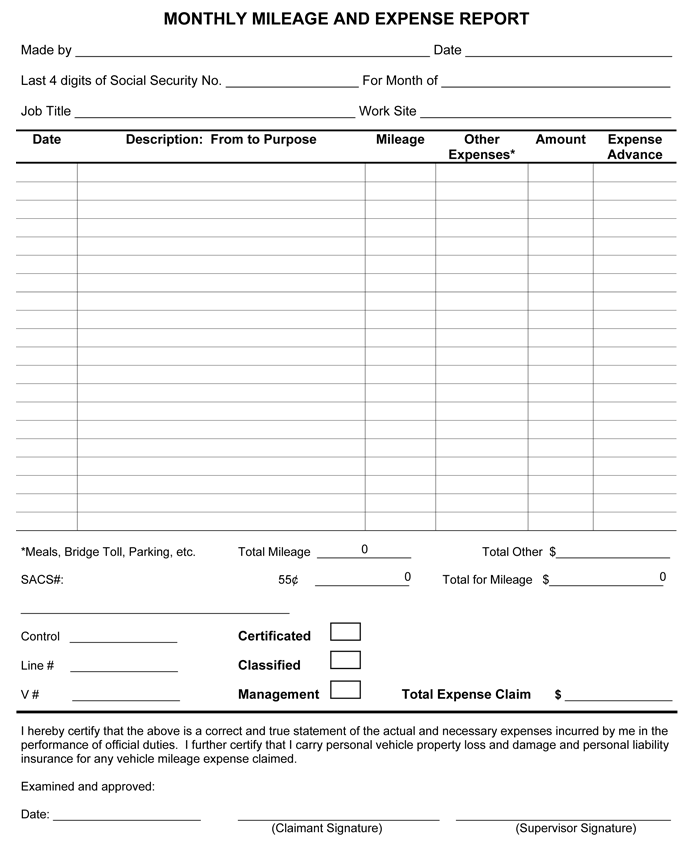

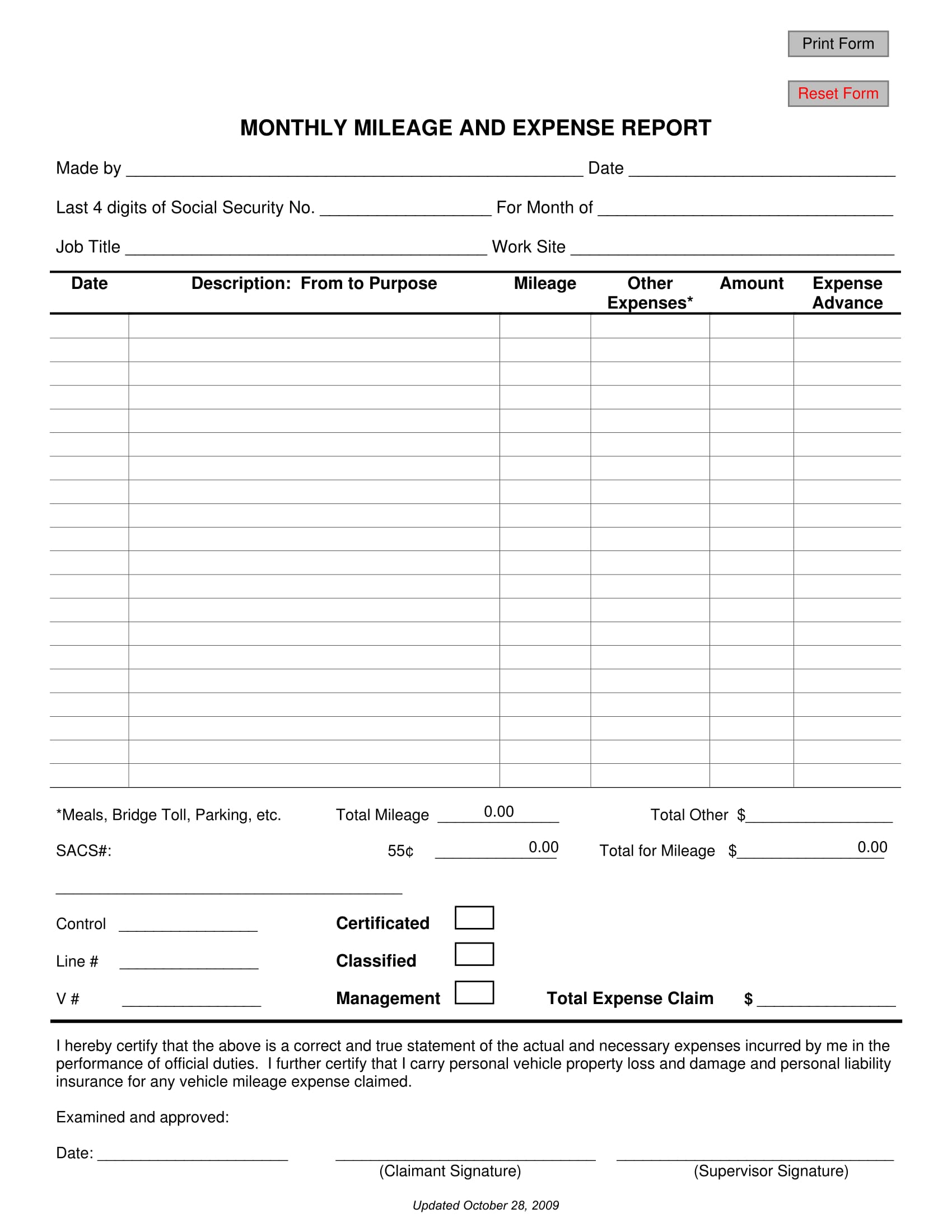

Mileage Report Form Free - You can access the following service: Are you a aaa policyholder but yet not a member? Trusted by over 2 million users. Web november 16, 2018 by sean fitzpatrick mileage report formmileage report form what is a mileage report form? The mileage calculate is using. You can download a pdf version of the mileage report form absolutely free. Web free downloadable and printable mileage expense templates that are compatible with pdf and microsoft word and excel. Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Web monthly mileage report form employee name employee id supervisor name department vehicle id month represented start end employee signature date date You can also customize the forms and templates.

Free irs printable mileage log guss to download. These free printable mileage logs are sufficient to meet the irs’s basic requirements. Web a decision will be made within 90 days from the date you asked for a state fair hearing unless it was an expedited request. Web free downloadable and printable mileage expense templates that are compatible with pdf and microsoft word and excel. Web here is a preview of the mileage report form: You can download a pdf version of the mileage report form absolutely free. Contents 1 what is a mileage report. Web free mileage tracking log & mileage reimbursement form 1. Are you a aaa policyholder but yet not a member? Web november 16, 2018 by sean fitzpatrick mileage report formmileage report form what is a mileage report form?

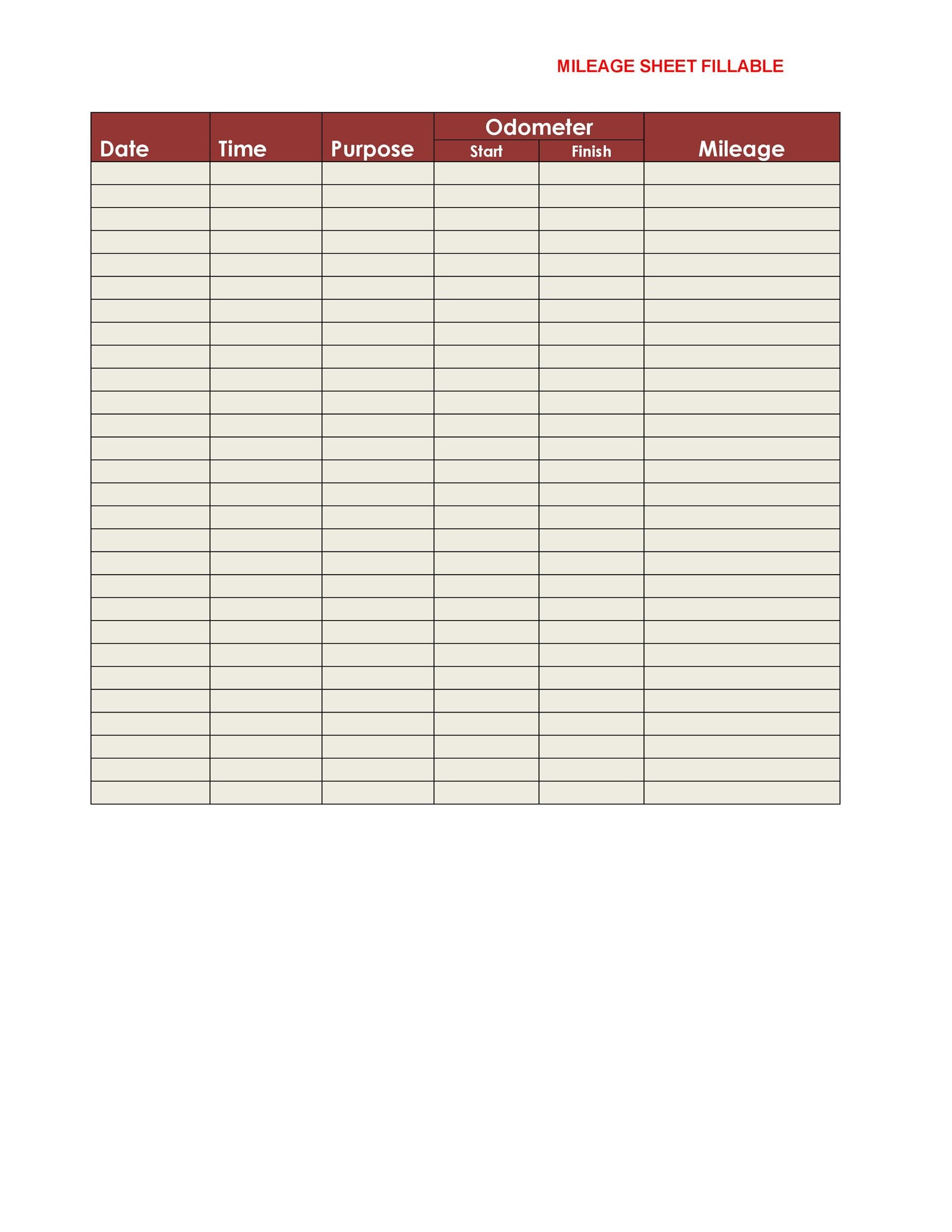

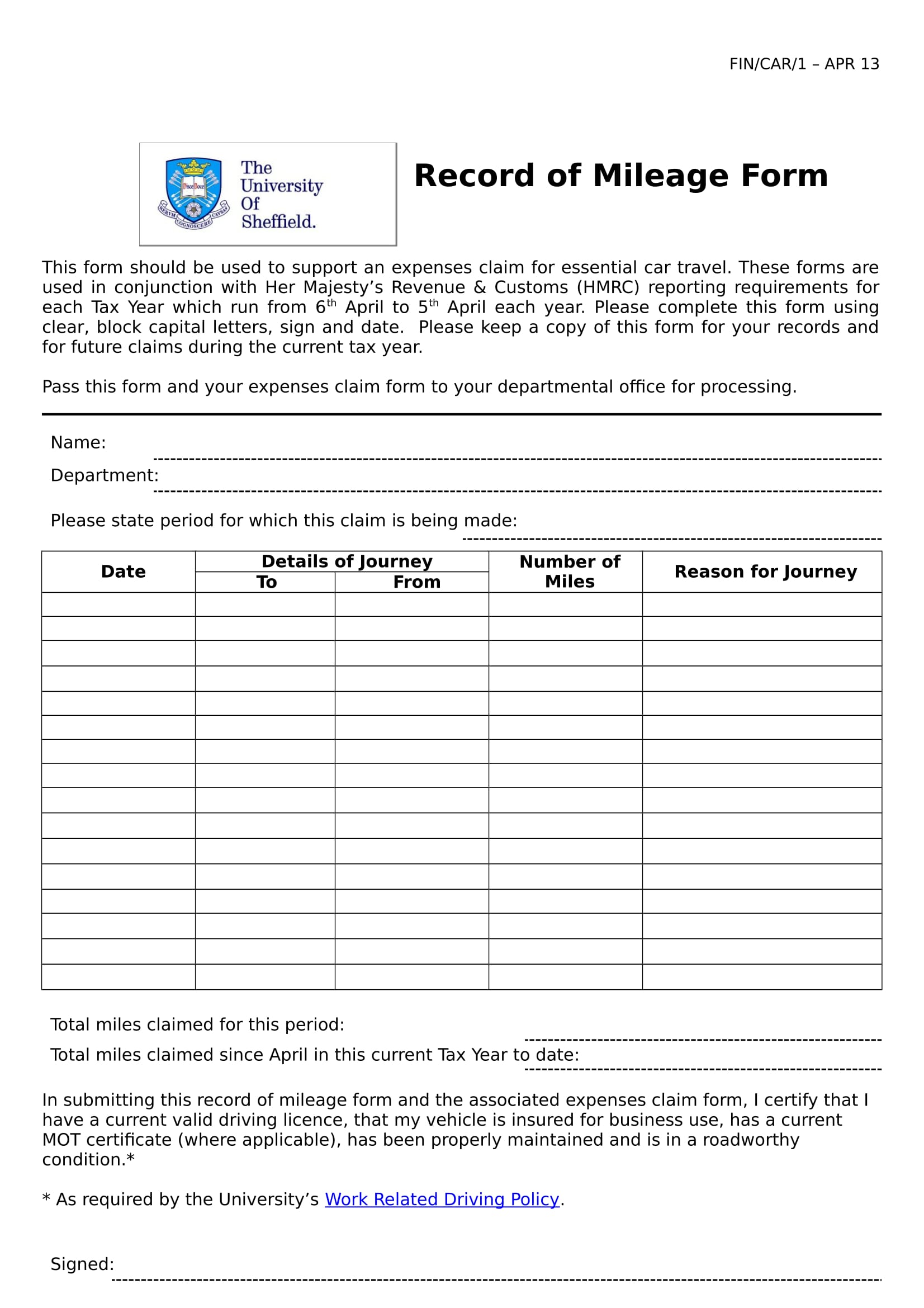

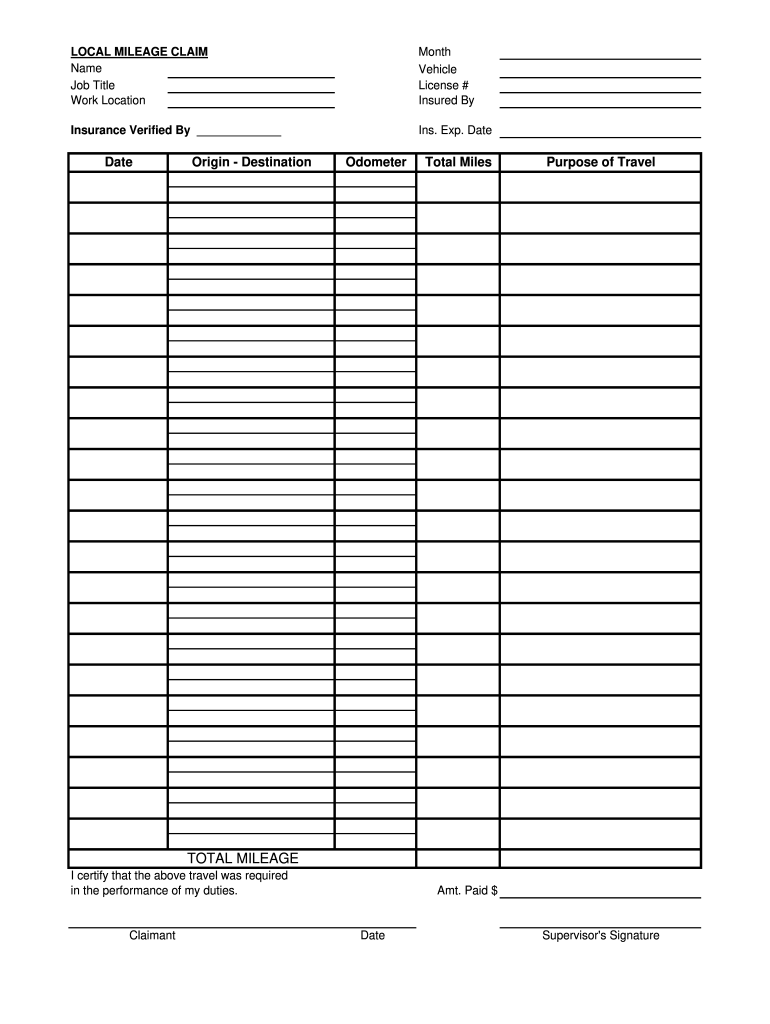

Web here is a preview of the mileage report form: Web free mileage tracking log & mileage reimbursement form 1. Web it’s free to download or print. Powerful tracking that's simple to use and manage. A mileage claim form is designed to help employees request for reimbursement for travelling expenses incurred for business purposes. Customize smart locations, favorite trips, work hours and more. The mileage calculate is using. Download excel template free for personal or commercial use. Web free mileage claim form template. These free printable mileage logs are sufficient to meet the irs’s basic requirements.

Mileage Report Template Excel Excel Templates

You can download a pdf version of the mileage report form absolutely free. © general blue an employee mileage expense report is important to those whose. Web it’s free to download or print. Web free mileage claim form template. Contents 1 what is a mileage report.

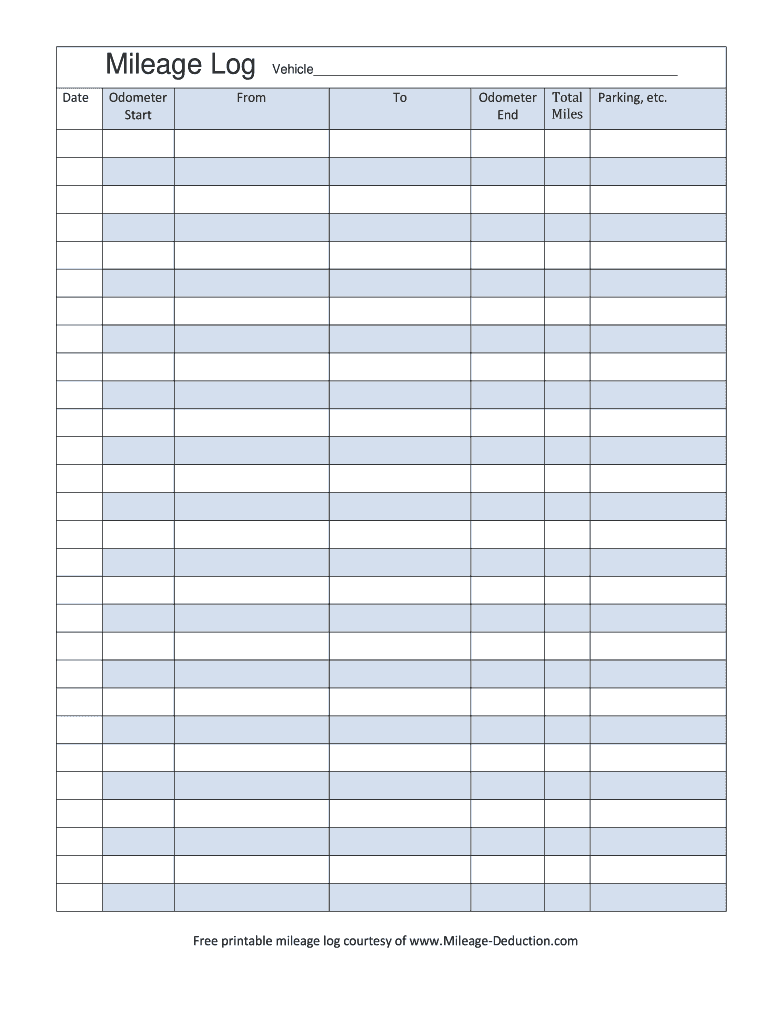

Free PDF Mileage Logs Printable IRS Mileage Rate 2021

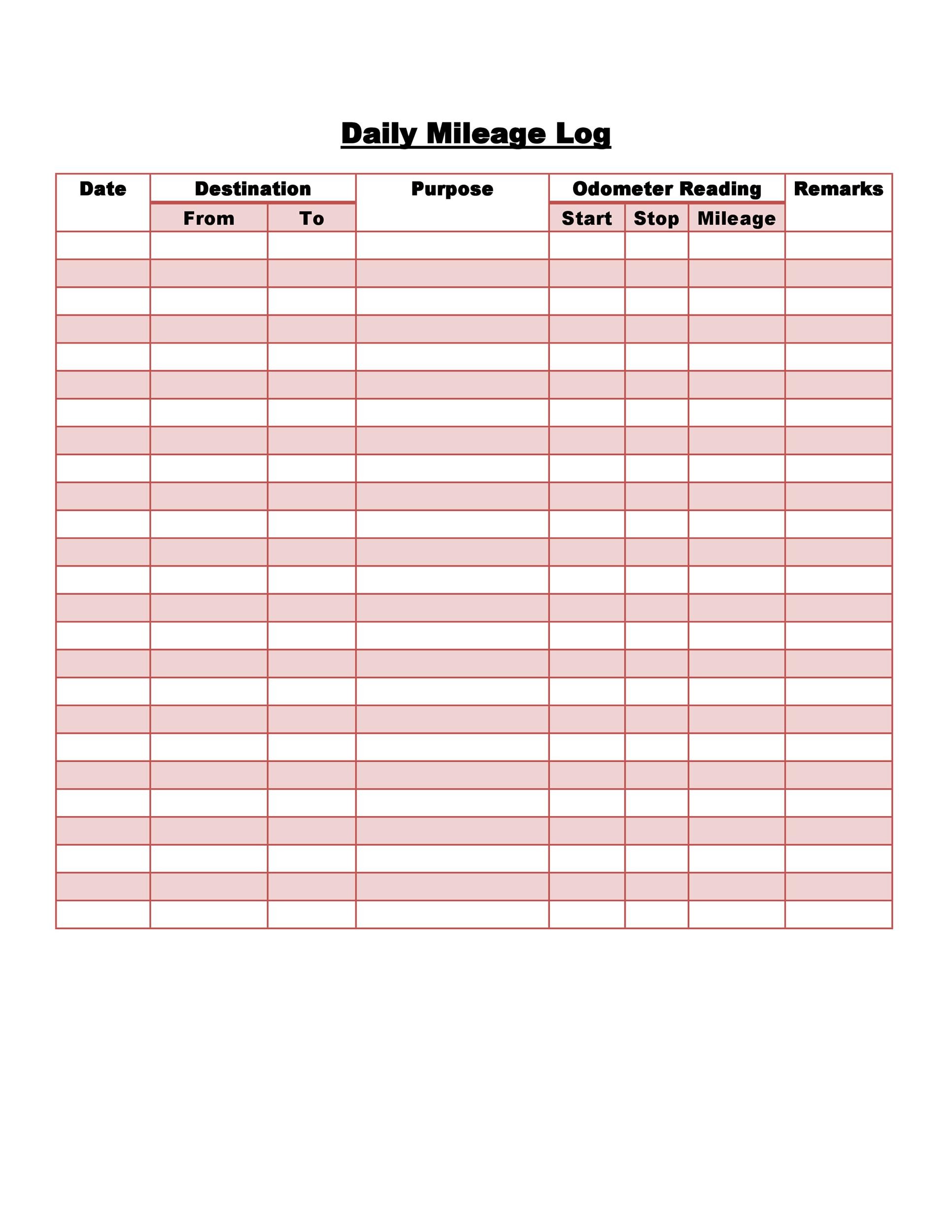

Download excel template free for personal or commercial use. Free irs printable mileage log guss to download. Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. A mileage claim form is designed to help employees request for reimbursement for travelling expenses incurred for business purposes. Powerful tracking that's simple to use.

Mileage Expense Report Template Collection

These free printable mileage logs are sufficient to meet the irs’s basic requirements. A mileage claim form is designed to help employees request for reimbursement for travelling expenses incurred for business purposes. Web free downloadable and printable mileage expense templates that are compatible with pdf and microsoft word and excel. Contents 1 what is a mileage report. Customize smart locations,.

8 Travel Expense Report with Mileage Log Excel Templates Excel

Web it’s free to download or print. Web november 16, 2018 by sean fitzpatrick mileage report formmileage report form what is a mileage report form? Web download the free 2023 mileage log template as a pdf, pages or excel version and keep track of your trips. 125,000 but only 25,000 is shown on the odometer, the seller must insert 25,000.

FREE 5+ Mileage Report Forms in MS Word PDF Excel

125,000 but only 25,000 is shown on the odometer, the seller must insert 25,000 in the odometer. Download excel template free for personal or commercial use. You can access the following service: Web feel free to download our excel mileage log template. Contents 1 what is a mileage report.

8+ Free Mileage Log Templates to Keep your Mileage on Track

Web here is a preview of the mileage report form: Trusted by over 2 million users. Web mileage in excess of mechanical limits — if the actual mileage of the vehicle is. © general blue an employee mileage expense report is important to those whose. Contents 1 what is a mileage report.

8+ Mileage Log Template Free Download

You can also, for a small payment, download a. Web a decision will be made within 90 days from the date you asked for a state fair hearing unless it was an expedited request. Web download the free 2023 mileage log template as a pdf, pages or excel version and keep track of your trips. Web it’s free to download.

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

You can also customize the forms and templates. Web free mileage tracking log & mileage reimbursement form 1. Web monthly mileage report form employee name employee id supervisor name department vehicle id month represented start end employee signature date date Rich text instant download buy now description mileage report printable this form documents the daily mileage report for. Web odometer.

FREE 5+ Mileage Report Forms in MS Word PDF Excel

Rich text instant download buy now description mileage report printable this form documents the daily mileage report for. Download excel template free for personal or commercial use. Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Contents 1 what is a mileage report. A mileage claim form is designed to help.

Mileage Form PDF IRS Mileage Rate 2021

Web free mileage tracking log & mileage reimbursement form 1. Rich text instant download buy now description mileage report printable this form documents the daily mileage report for. For 2021, 2022, or 2023. You can access the following service: Web feel free to download our excel mileage log template.

You Can Access The Following Service:

Web odometer disclosure statement (form 3019) effective january 1, 2021 motor vehicles beginning with model year 2011 will be required to have mileage disclosed at the time of. Web free mileage tracking log & mileage reimbursement form 1. The mileage calculate is using. Web november 16, 2018 by sean fitzpatrick mileage report formmileage report form what is a mileage report form?

Free Irs Printable Mileage Log Guss To Download.

Trusted by over 2 million users. 125,000 but only 25,000 is shown on the odometer, the seller must insert 25,000 in the odometer. Rich text instant download buy now description mileage report printable this form documents the daily mileage report for. A mileage claim form is designed to help employees request for reimbursement for travelling expenses incurred for business purposes.

Web Feel Free To Download Our Excel Mileage Log Template.

Are you a aaa policyholder but yet not a member? You can download a pdf version of the mileage report form absolutely free. You can also, for a small payment, download a. © general blue an employee mileage expense report is important to those whose.

Web Here Is A Preview Of The Mileage Report Form:

Contents 1 what is a mileage report. For 2021, 2022, or 2023. You can also customize the forms and templates. These free printable mileage logs are sufficient to meet the irs’s basic requirements.