Missing 1040 Form

Missing 1040 Form - Transcript requests being rejected by the irs with a code 10. Web answer if you lost your refund check, you should initiate a refund trace: Web share this answer at times, lenders may encounter difficulties in obtaining irs tax transcripts, such as: Web once you’ve determined that your refund is really missing, you can ask the irs to trace the refund. (ap) — search teams in pennsylvania were focusing on one underwater area sunday as they. But i’m sticking with “lost.” let me explain: People who are missing a stimulus payment or received less than the full. As long as you need these copies. Web forbes put together a handy little chart with the form numbers and reporting information, as well as due dates. Draw a line through the incorrect.

Here are some notable forms you should have. Web prior year tax returns are available from the irs for a fee. Transcript requests being rejected by the irs with a code 10. Web answer if you lost your refund check, you should initiate a refund trace: But i’m sticking with “lost.” let me explain: Weapons are transferred to ukraine. Individual income tax return 2020 department of the treasury—internal revenue service (99) omb no. As long as you need these copies. Forget artificial intelligence, forget inflation, forget the fed. On july 11, two days before she went missing, russell used her cell phone to search.

Web enter the amount in your tax preparation software or in the form 1040 recovery rebate credit worksheet to calculate your credit. People who are missing a stimulus payment or received less than the full. Instructions for form 1040 (2021) pdf. Web some taxpayers have received a cp80 notice about missing 2020 returns after they already filed. Web share this answer at times, lenders may encounter difficulties in obtaining irs tax transcripts, such as: Web 1 day agoin june, two separate department of defense inspector general reports revealed poor monitoring when u.s. Web the irs lost my 2020 tax return. Individual income tax return 2020 department of the treasury—internal revenue service (99) omb no. Here's what to do if you receive this letter. If your filing status is single, married filing separate, or head of.

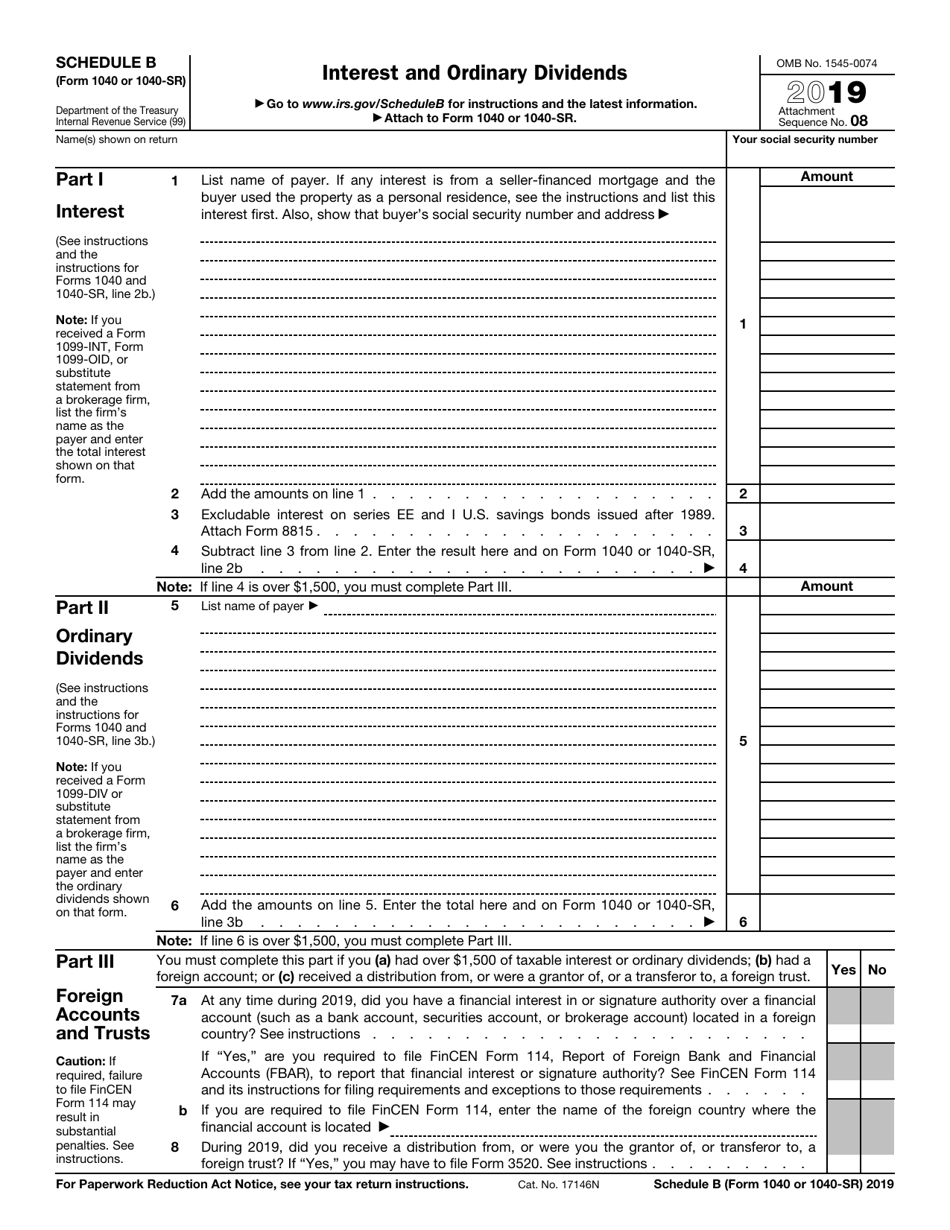

IRS Form 1040 (1040SR) Schedule B Download Fillable PDF or Fill Online

Web once you’ve determined that your refund is really missing, you can ask the irs to trace the refund. As long as you need these copies. Web as this irs tip sheet says, you can call the irs, who will then contact your employer or other financial entity to get the information you need. It indicates the ability to send.

Printable Tax Form 1040ez Printable Form, Templates and Letter

Individual income tax return 2020 department of the treasury—internal revenue service (99) omb no. As long as you need these copies. Web as this irs tip sheet says, you can call the irs, who will then contact your employer or other financial entity to get the information you need. Here are some notable forms you should have. Web some taxpayers.

Irs Form 1040 Line 79 Instructions Form Resume Examples

A new force drove stocks higher in. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web prior year tax returns are available from the irs for a fee. Web forbes put together a handy little chart with the form numbers and reporting information, as well as due dates. Here's what to.

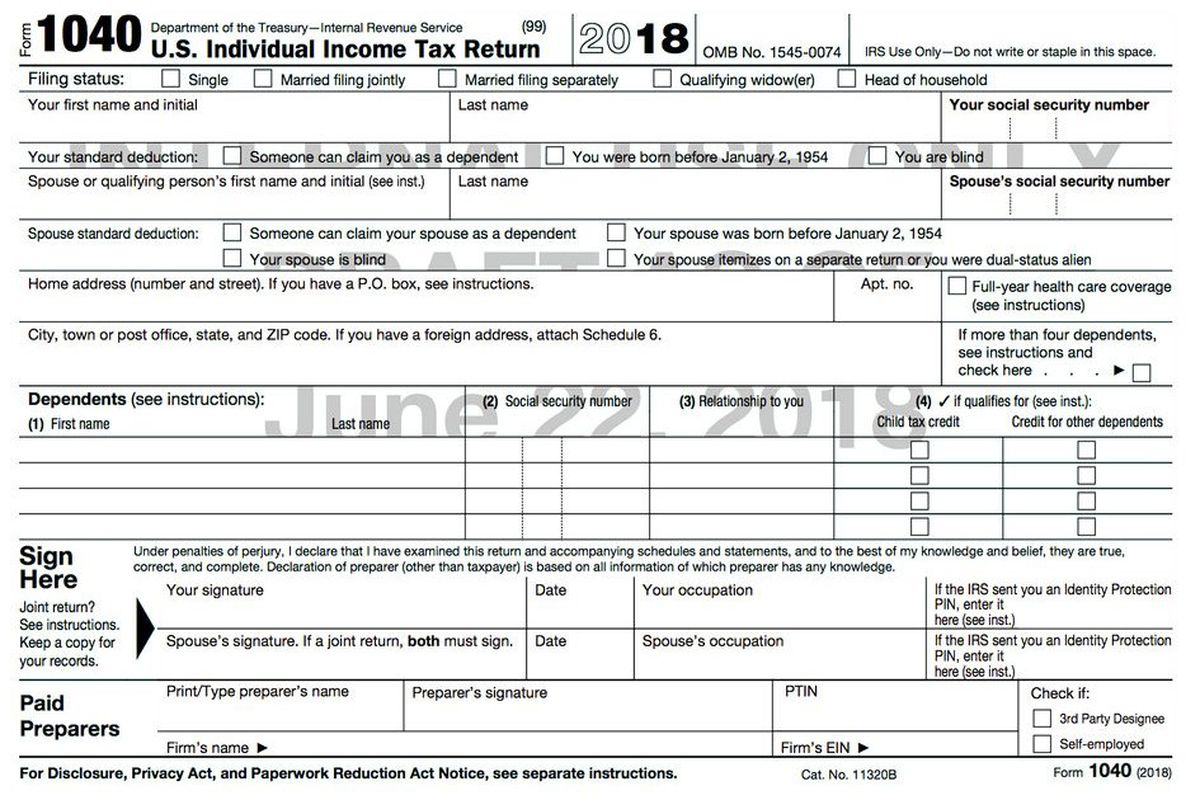

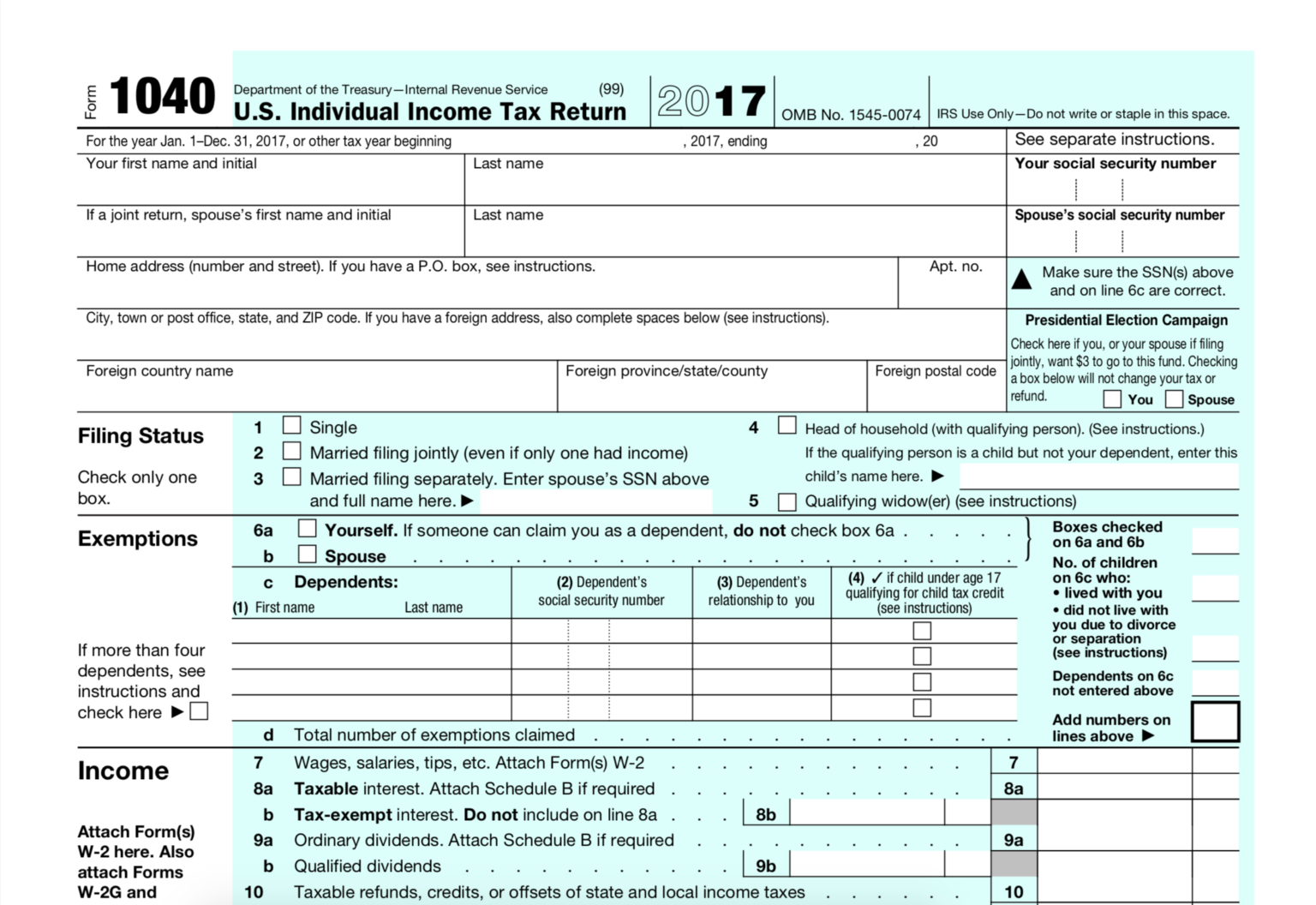

The IRS Shrinks The 1040 Tax Form But The Workload Stays 1040 Form

Web some taxpayers have received a cp80 notice about missing 2020 returns after they already filed. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web however, if you did not file a tax return at all for that year, you will need to use the correct year form 1040, u. Web.

7 Common Missing Tax Return Items taxhelp tax 1040 Byron L. Riley, CPA

Web forbes put together a handy little chart with the form numbers and reporting information, as well as due dates. As long as you need these copies. Web get federal tax return forms and file by mail. People who are missing a stimulus payment or received less than the full. Individual income tax return 2020 department of the treasury—internal revenue.

Downlodable Shareware IRS FORM 1040 DOWNLOAD

Web the irs lost my 2020 tax return. Individual income tax return 2020 department of the treasury—internal revenue service (99) omb no. Web only employees, or their preparer and/or translator, may correct errors or omissions made in section 1. Forget artificial intelligence, forget inflation, forget the fed. If your filing status is single, married filing separate, or head of.

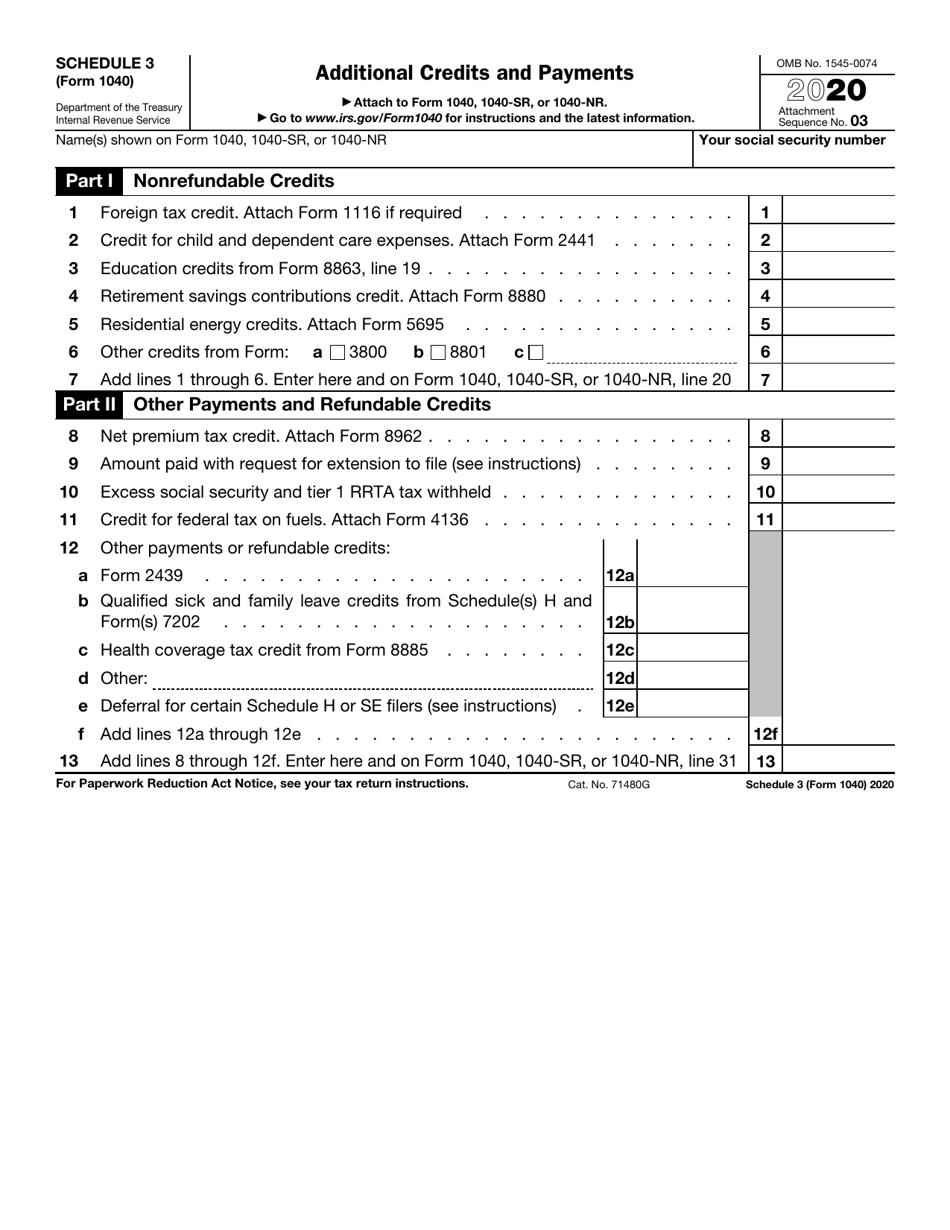

IRS Form 1040 Schedule 3 Download Fillable PDF or Fill Online

Forget artificial intelligence, forget inflation, forget the fed. If your filing status is single, married filing separate, or head of. Go to prior year forms and. Here are some notable forms you should have. Weapons are transferred to ukraine.

What Does A 1040 Form Look Like Seven Questions To Ask At 2021 Tax

Web the irs lost my 2020 tax return. Web enter the amount in your tax preparation software or in the form 1040 recovery rebate credit worksheet to calculate your credit. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. On july.

Printable Tax Forms 1040 Universal Network

An curved arrow pointing right. As long as you need these copies. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. On july 11, two days before she went missing, russell used her cell phone to search. But i’m sticking with.

Tax Season Is a Time to Keep Cool A Writer's Guide to Missing 1099

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. If your filing status is single, married filing separate, or head of. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Transcript requests being.

If Your Filing Status Is Single, Married Filing Separate, Or Head Of.

Web once you’ve determined that your refund is really missing, you can ask the irs to trace the refund. Web however, if you did not file a tax return at all for that year, you will need to use the correct year form 1040, u. Web annual income tax return filed by citizens or residents of the united states. Here are some notable forms you should have.

Web Get Federal Tax Return Forms And File By Mail.

(ap) — search teams in pennsylvania were focusing on one underwater area sunday as they. On july 11, two days before she went missing, russell used her cell phone to search. Web answer if you lost your refund check, you should initiate a refund trace: As long as you need these copies.

Web Published 8:31 Am Pdt, July 23, 2023.

Well, according to the notice i got yesterday, the irs says it “never received” the return. Web only employees, or their preparer and/or translator, may correct errors or omissions made in section 1. Instructions for form 1040 (2021) pdf. Web 1 day agoin june, two separate department of defense inspector general reports revealed poor monitoring when u.s.

Forget Artificial Intelligence, Forget Inflation, Forget The Fed.

People who are missing a stimulus payment or received less than the full. An curved arrow pointing right. Web enter the amount in your tax preparation software or in the form 1040 recovery rebate credit worksheet to calculate your credit. But i’m sticking with “lost.” let me explain: