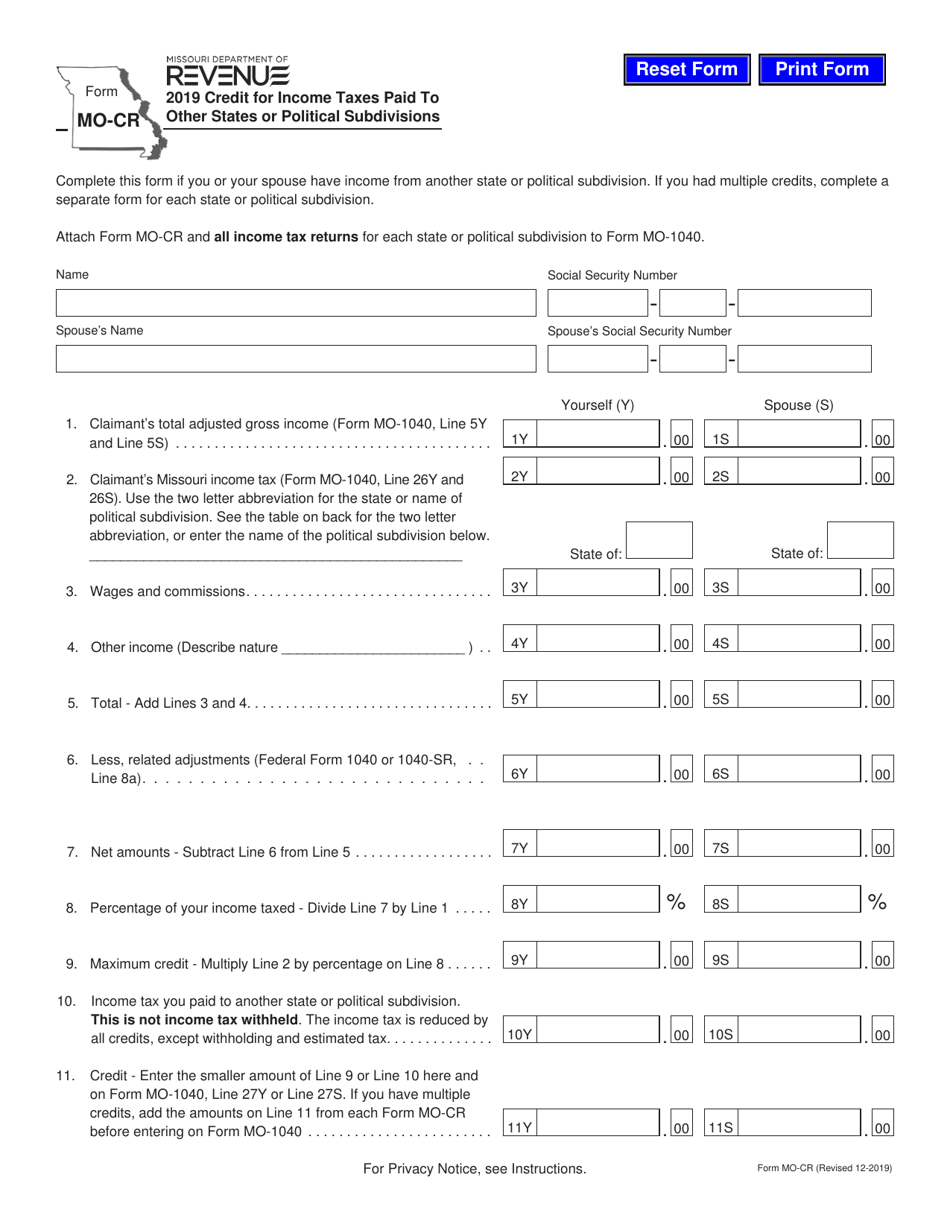

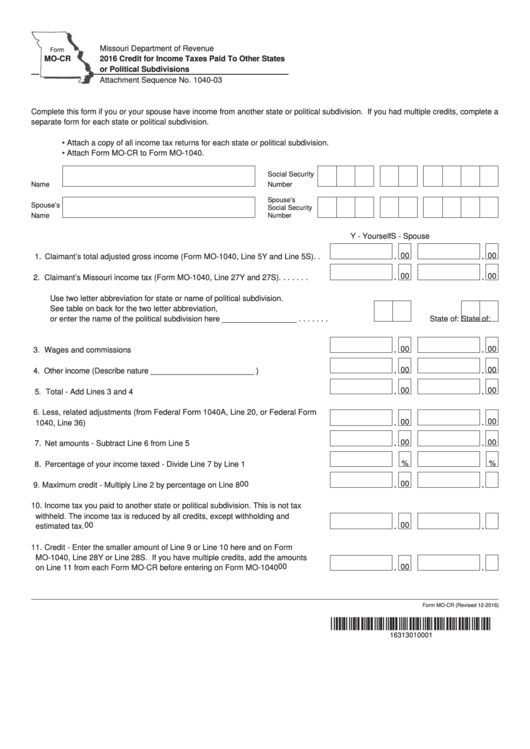

Missouri Form Mo-Cr

Missouri Form Mo-Cr - 2021 miscellaneous income tax credits. Late filing will subject taxpayers to charges for interest and addition to tax. Line 13 — enter total credit from all states on line 13 and on. Fiscal year filers must file. You may file all of your income as if it were taxable in missouri as a resident, and then take a percentage. The missouri property tax credit claim is a program that. This form is for income earned in tax year 2022, with tax returns due in april. Complete this form if you or your spouse have income from another. Web your credit cannot exceed the tax paid to the other state or the percent of tax due missouri on that part of your income. 2015 credit for income taxes paid to other states.

Web use our income tax calculator to find out what your take home pay will be in missouri for the tax year. Late filing will subject taxpayers to charges for interest and addition to tax. You can download or print current or. 2015 credit for income taxes paid to other states. Who is eligible for mo ptc? The missouri property tax credit claim is a program that. Web your credit cannot exceed the tax paid to the other state or the percent of tax due missouri on that part of your income. Enter your details to estimate your salary after tax. You may file all of your income as if it were taxable in missouri as a resident, and then take a percentage. Web missouri department of revenue.

Late filing will subject taxpayers to charges for interest and addition to tax. Web use our income tax calculator to find out what your take home pay will be in missouri for the tax year. Web your credit cannot exceed the tax paid to the other state or the percent of tax due missouri on that part of your income. 2015 credit for income taxes paid to other states. Who is eligible for mo ptc? Web 15 rows driver license forms and manuals find your form to search, type a keyword. You can download or print current or. From within your taxact return ( online or desktop), click state, then click. Line 13 — enter total credit from all states on line 13 and on. Web when to file calendar year taxpayers must file no later than april 15, 2014.

Missouri Form 1957 Fill and Sign Printable Template Online US Legal

Web your credit cannot exceed the tax paid to the other state or the percent of tax due missouri on that part of your income. Web 15 rows driver license forms and manuals find your form to search, type a keyword. 2015 credit for income taxes paid to other states. Web missouri department of revenue. From within your taxact return.

2018 Form MO DOR 5049 Fill Online, Printable, Fillable, Blank pdfFiller

2015 credit for income taxes paid to other states. Web missouri department of revenue. Who is eligible for mo ptc? The missouri property tax credit claim is a program that. Late filing will subject taxpayers to charges for interest and addition to tax.

MISSOURI 2021 Tax Forms 1040 Printable

Web your credit cannot exceed the tax paid to the other state or the percent of tax due missouri on that part of your income. Enter your details to estimate your salary after tax. You can download or print current or. Late filing will subject taxpayers to charges for interest and addition to tax. Line 13 — enter total credit.

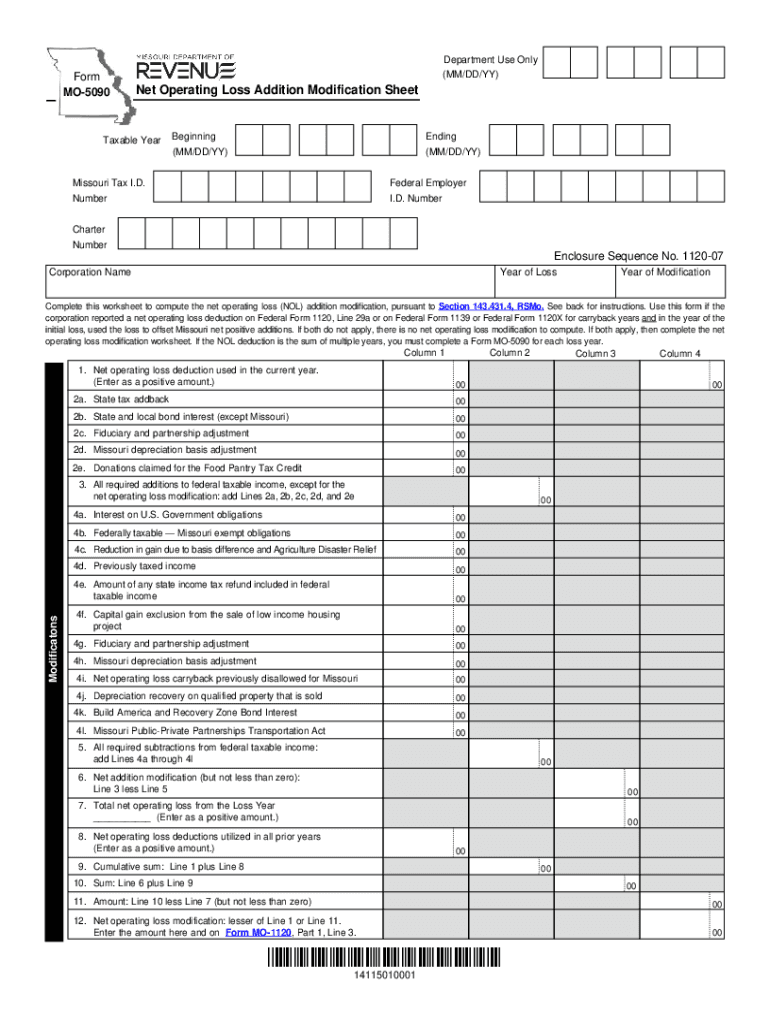

MO MO5090 20202021 Fill out Tax Template Online US Legal Forms

Web use our income tax calculator to find out what your take home pay will be in missouri for the tax year. Web your credit cannot exceed the tax paid to the other state or the percent of tax due missouri on that part of your income. Web 15 rows driver license forms and manuals find your form to search,.

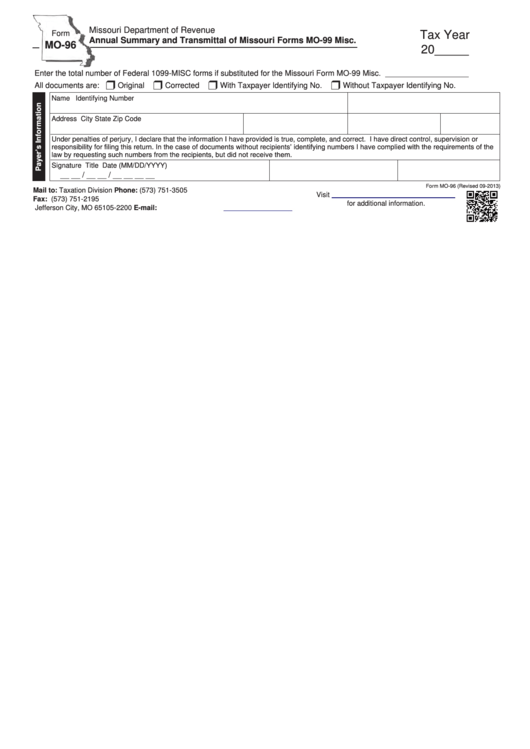

Fillable Form Mo96 Annual Summary And Transmittal Of Missouri Forms

Web missouri department of revenue. 2021 miscellaneous income tax credits. From within your taxact return ( online or desktop), click state, then click. You can download or print current or. This form is for income earned in tax year 2022, with tax returns due in april.

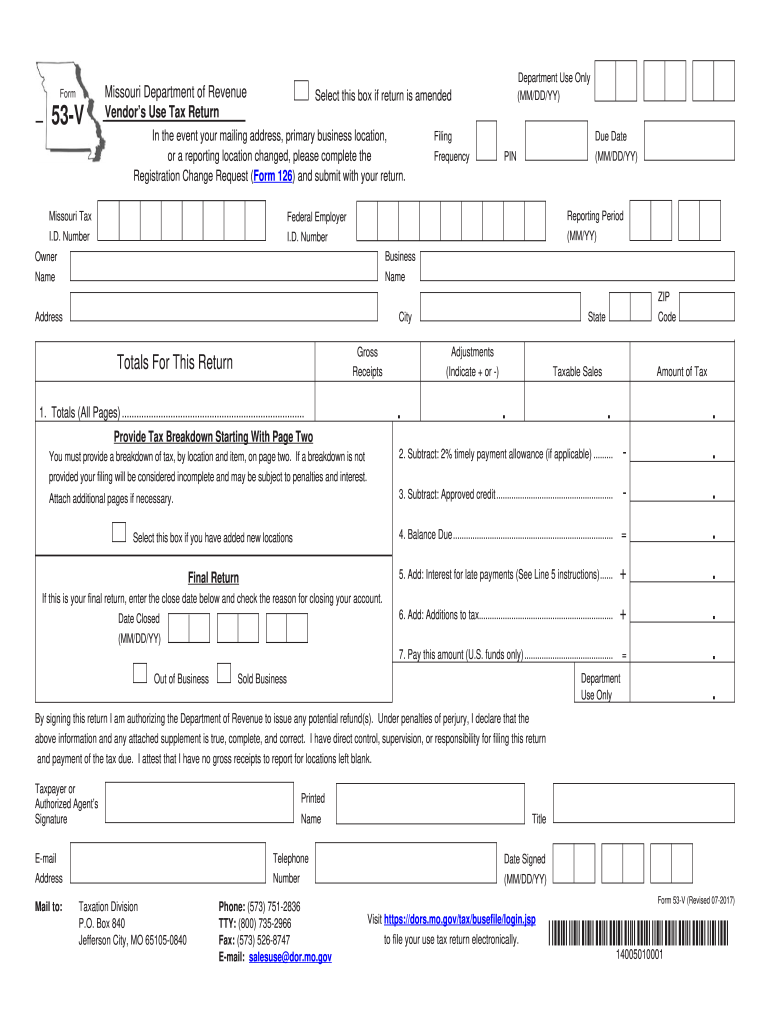

2014 Form MO 53V Fill Online, Printable, Fillable, Blank PDFfiller

Web missouri department of revenue. This form is for income earned in tax year 2022, with tax returns due in april. Web use our income tax calculator to find out what your take home pay will be in missouri for the tax year. 2021 miscellaneous income tax credits. Web your credit cannot exceed the tax paid to the other state.

Form MOCR Download Fillable PDF or Fill Online Credit for Taxes

Fiscal year filers must file. The missouri property tax credit claim is a program that. Web missouri department of revenue. Enter your details to estimate your salary after tax. Web your credit cannot exceed the tax paid to the other state or the percent of tax due missouri on that part of your income.

Fillable Form MoCr Credit For Taxes Paid To Other States Or

The missouri property tax credit claim is a program that. You may file all of your income as if it were taxable in missouri as a resident, and then take a percentage. From within your taxact return ( online or desktop), click state, then click. Enter your details to estimate your salary after tax. Web your credit cannot exceed the.

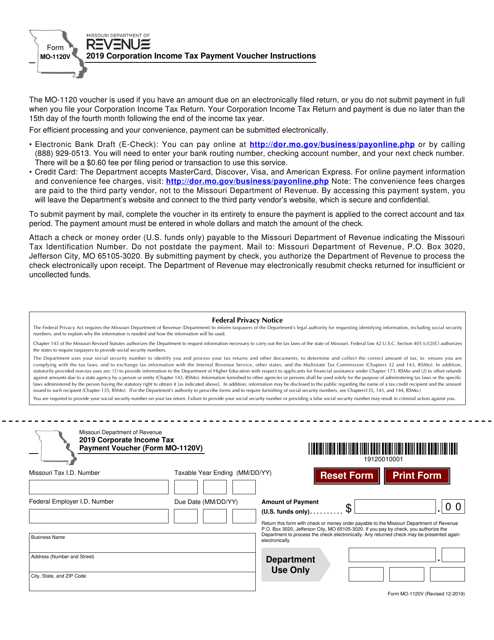

Form MO1120V Download Fillable PDF or Fill Online Corporation

Line 13 — enter total credit from all states on line 13 and on. Web use our income tax calculator to find out what your take home pay will be in missouri for the tax year. 2015 credit for income taxes paid to other states. Late filing will subject taxpayers to charges for interest and addition to tax. Web missouri.

Fill Free fillable forms for the state of Missouri

From within your taxact return ( online or desktop), click state, then click. The missouri property tax credit claim is a program that. Enter your details to estimate your salary after tax. Web use our income tax calculator to find out what your take home pay will be in missouri for the tax year. 2021 miscellaneous income tax credits.

Enter Your Details To Estimate Your Salary After Tax.

Complete this form if you or your spouse have income from another. You can download or print current or. Web use our income tax calculator to find out what your take home pay will be in missouri for the tax year. Line 13 — enter total credit from all states on line 13 and on.

Who Is Eligible For Mo Ptc?

Fiscal year filers must file. Web 15 rows driver license forms and manuals find your form to search, type a keyword. 2015 credit for income taxes paid to other states. Late filing will subject taxpayers to charges for interest and addition to tax.

Web When To File Calendar Year Taxpayers Must File No Later Than April 15, 2014.

From within your taxact return ( online or desktop), click state, then click. The missouri property tax credit claim is a program that. You may file all of your income as if it were taxable in missouri as a resident, and then take a percentage. 2021 miscellaneous income tax credits.

Web Missouri Department Of Revenue.

Web your credit cannot exceed the tax paid to the other state or the percent of tax due missouri on that part of your income. This form is for income earned in tax year 2022, with tax returns due in april.