Montana 2021 Tax Form

Montana 2021 Tax Form - Montana individual income tax return (form 2) Web description montana state income tax rate: 6.9% estimate your mt income taxes now compare other state income tax rates. Taxformfinder provides printable pdf copies of 79 current montana income tax forms. Detailed efile.com service overview start federal and montana tax returns prepare only a mt state return without an irs return. The current tax year is. The current tax year is 2022, and most states will release updated tax forms between january and april of 2023. The state income tax table can be found inside the montana form 2 instructions booklet. Web income tax rates, deductions, and exemptions. Web december 30, 2021 you may use this form to report exempt income earned on tribal land if you are a tribal member.

For your convenience, we have also compiled a list of approved software for filing your corporate income tax return. Web popular forms & instructions; Amending or correcting a return. Web montana has a state income tax that ranges between 1% and 6.9%. If you meet those requirements but paid less than $1,250 in 2021, you should have your entire payment refunded. 6.9% estimate your mt income taxes now compare other state income tax rates. Prepare, efile mt + irs tax return: Web montana has a state income tax that ranges between 1% and 6.9% , which is administered by the montana department of revenue. You do not need to file a montana form 2. Filing information for military personnel and spouses.

You must pay tax as you earn or receive income during the year. Web you may use this form to file your montana individual income tax return. If you meet those requirements but paid less than $1,250 in 2021, you should have your entire payment refunded. Individual tax return form 1040 instructions; Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in montana. Amending or correcting a return. You do not need to file a montana form 2. Web these bills provide rebates to eligible montana taxpayers for 2021 individual income taxes (hb192) and for 2022 and 2023 property taxes paid on a principal residence (hb222). Prepare, efile mt + irs tax return: Retirements income exemptions, deductions, and exclusions.

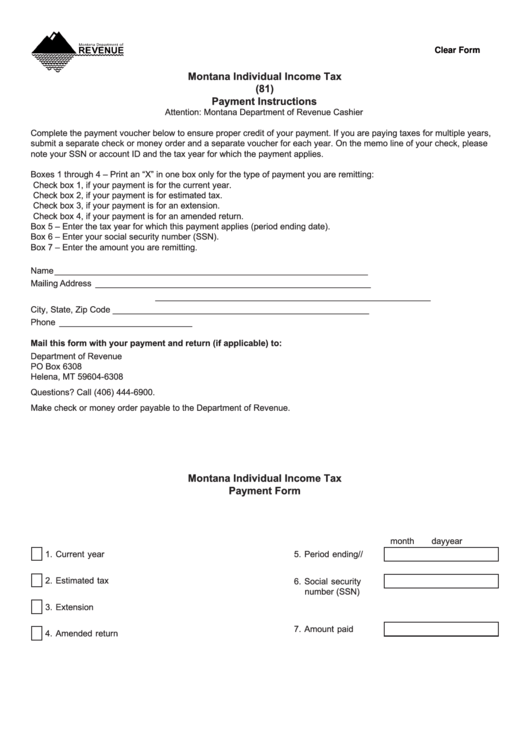

Fillable Montana Individual Tax Payment Form Montana

Web montana has a state income tax that ranges between 1% and 6.9%. Get my payment by irs.gov information on the coronavirus stimulus payments provided by. Keep in mind that some states will not update their tax forms for 2023 until january 2024. Visit the department’s webpage devoted to the rebates to learn more and see if you qualify. Web.

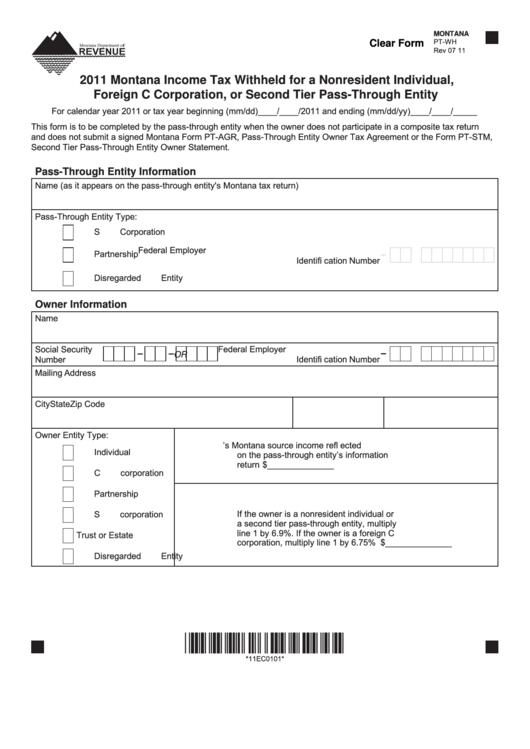

Fillable Montana Form PtWh 2011 Montana Tax Withheld For A

Montana individual income tax return (form 2) 2021. Fully exempt income if you are a tribal member and all your income is exempt from montana income tax, this form will serve as your return. Retirements income exemptions, deductions, and exclusions. Web montana has a state income tax that ranges between 1% and 6.9%. Be sure to verify that the form.

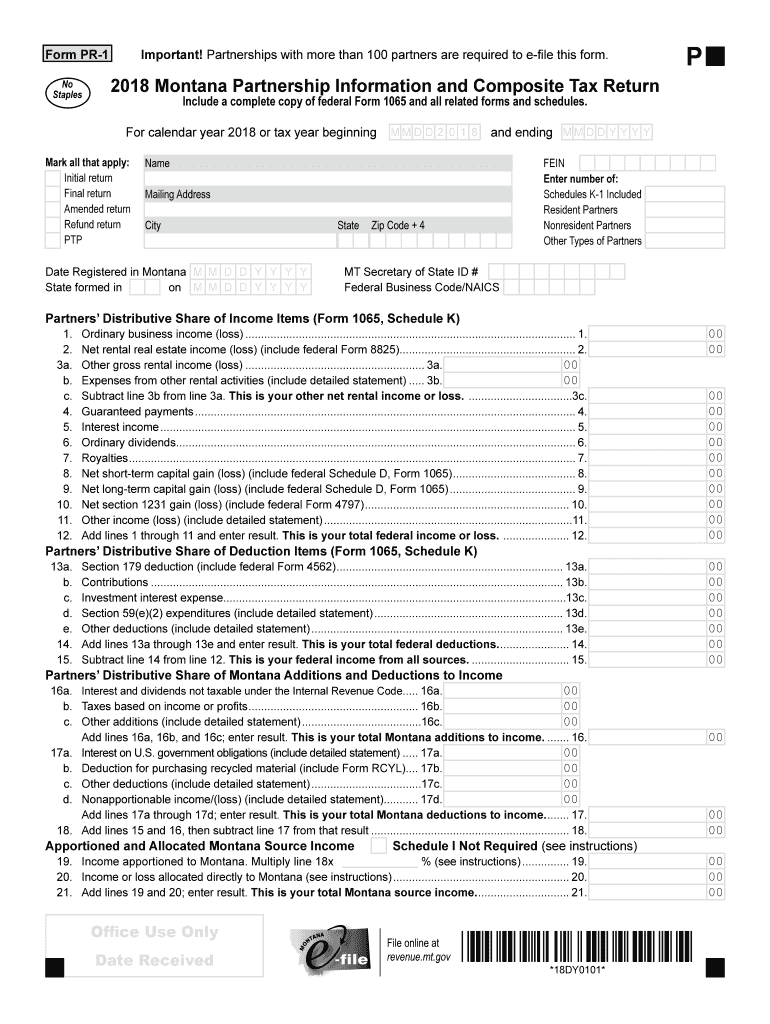

20182022 Form MT PR1 Fill Online, Printable, Fillable, Blank pdfFiller

Montana individual income tax return (form 2) 2021. If you meet those requirements but paid less than $1,250 in 2021, you should have your entire payment refunded. Retirements income exemptions, deductions, and exclusions. The current tax year is 2022, and most states will release updated tax forms between january and april of 2023. Irs coronavirus tax relief the official irs.

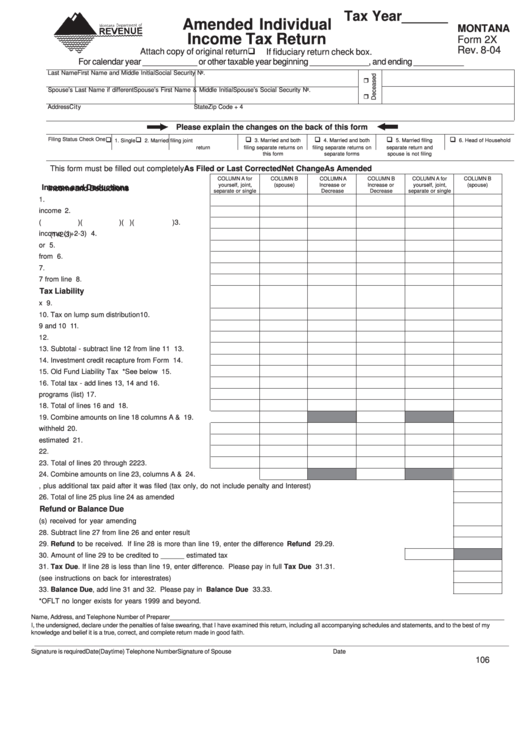

Fillable Montana Form 2x Amended Individual Tax Return

Montana individual income tax return (form 2) 2020. Montana individual income tax return (form 2) Web description montana state income tax rate: Visit the department’s webpage devoted to the rebates to learn more and see if you qualify. You can print other montana tax forms here.

Montana State Taxes Tax Types in Montana Property, Corporate

Web we last updated the individual income tax instructional booklet in february 2023, so this is the latest version of form 2 instructions, fully updated for tax year 2022. Web these bills provide rebates to eligible montana taxpayers for 2021 individual income taxes (hb192) and for 2022 and 2023 property taxes paid on a principal residence (hb222). You must pay.

Montana Real Estate Transfer Tax Montana Realty Transfer Certificate

Web we last updated the individual income tax instructional booklet in february 2023, so this is the latest version of form 2 instructions, fully updated for tax year 2022. Detailed efile.com service overview start federal and montana tax returns prepare only a mt state return without an irs return. Web you may use this form to file your montana individual.

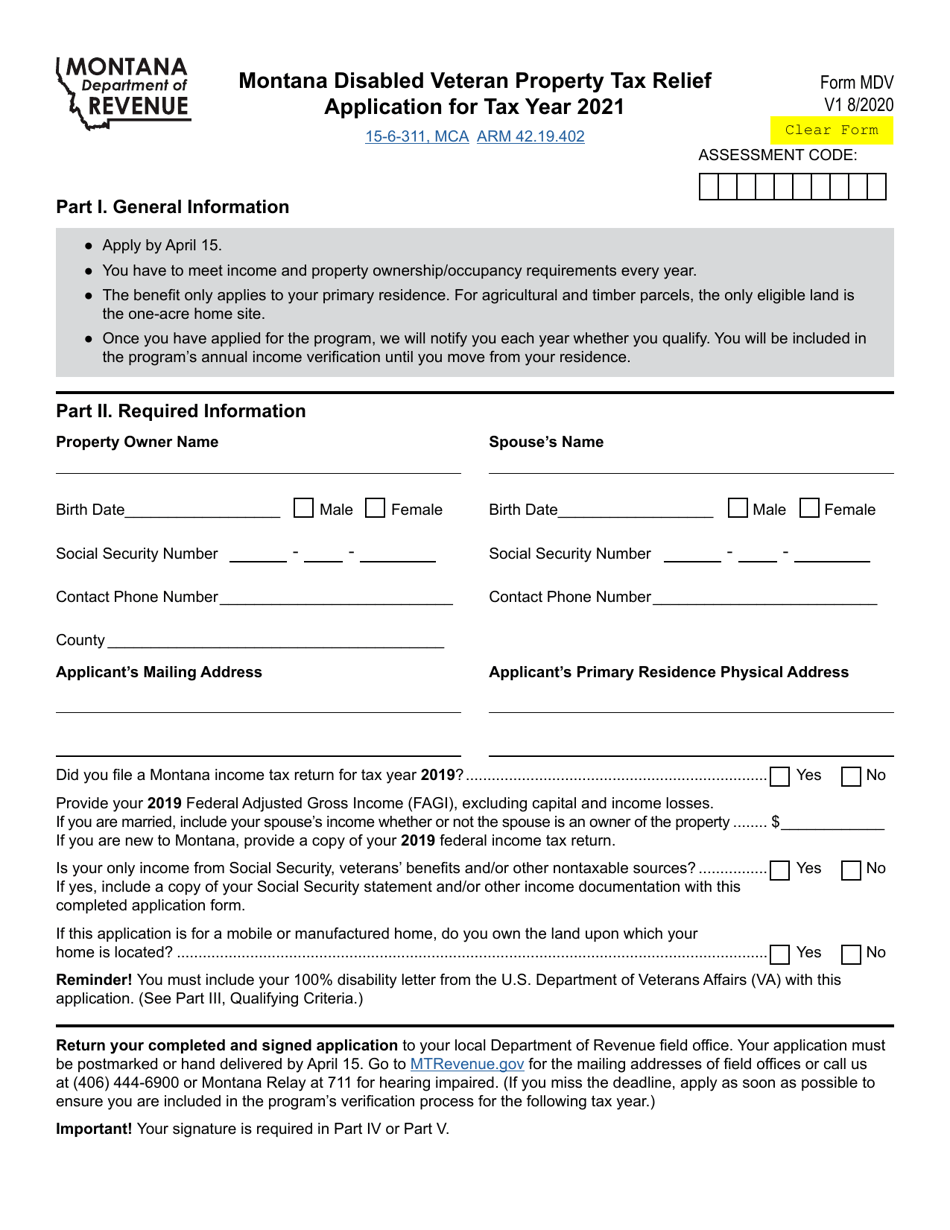

Form MDV Download Fillable PDF or Fill Online Montana Disabled Veteran

Web montana has a state income tax that ranges between 1% and 6.9%. Web income tax rates, deductions, and exemptions. You must pay tax as you earn or receive income during the year. Taxformfinder provides printable pdf copies of 79 current montana income tax forms. Prepare, efile mt + irs tax return:

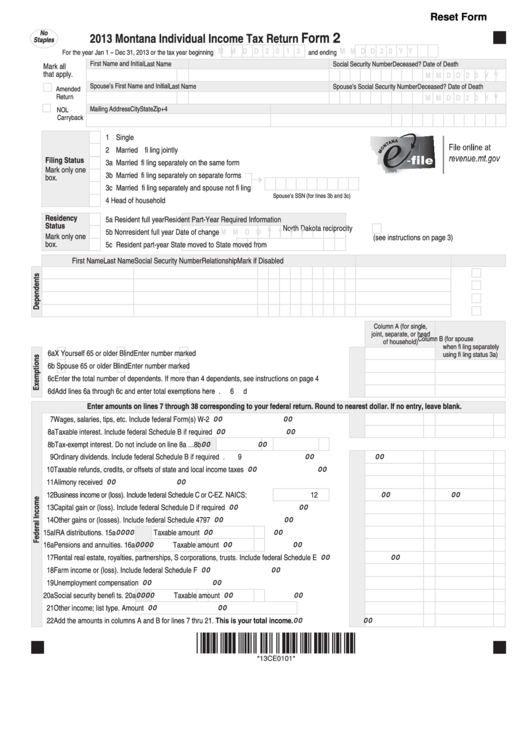

Fillable Form 2 Montana Individual Tax Return 2013 printable

Web these bills provide rebates to eligible montana taxpayers for 2021 individual income taxes (hb192) and for 2022 and 2023 property taxes paid on a principal residence (hb222). Web you may use this form to file your montana individual income tax return. There are two ways to pay as you go: Irs coronavirus tax relief the official irs updates on.

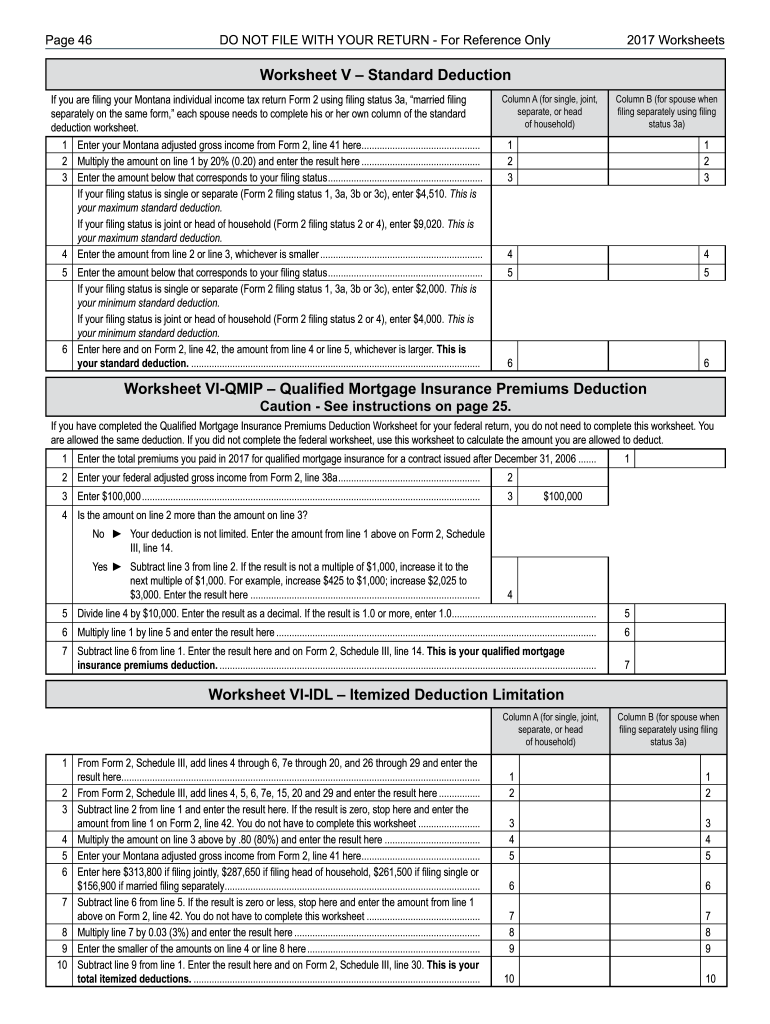

Montana Deduction Fill Out and Sign Printable PDF Template signNow

Get my payment by irs.gov information on the coronavirus stimulus payments provided by. Visit the department’s webpage devoted to the rebates to learn more and see if you qualify. You can print other montana tax forms here. Fully exempt income if you are a tribal member and all your income is exempt from montana income tax, this form will serve.

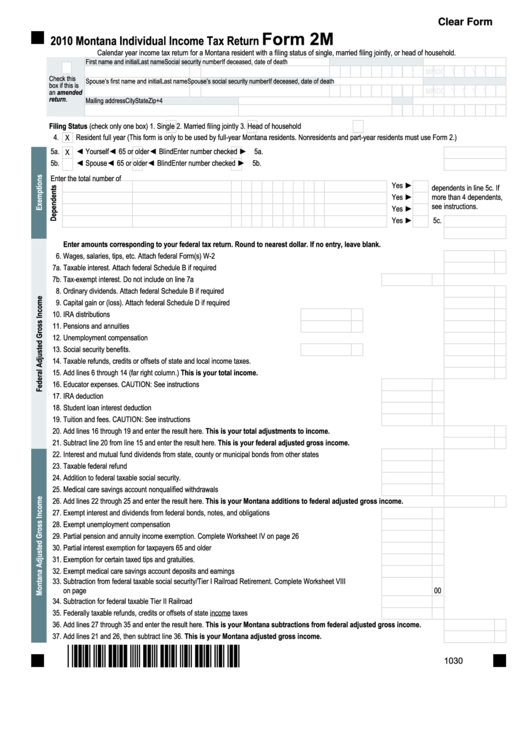

Fillable Form 2m 2010 Montana Individual Tax Return printable

Web corporate income tax return (form cit) december 30, 2021. Web these bills provide rebates to eligible montana taxpayers for 2021 individual income taxes (hb192) and for 2022 and 2023 property taxes paid on a principal residence (hb222). You may use this form to file your montana corporate income tax return. If you meet those requirements but paid less than.

Filing Information For Military Personnel And Spouses.

Montana individual income tax return (form 2) Amending or correcting a return. The current tax year is. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayer's entire liability.

Web Description Montana State Income Tax Rate:

Irs coronavirus tax relief the official irs updates on coronavirus impacts, tax relief, and stimulus checks. The current tax year is 2022, and most states will release updated tax forms between january and april of 2023. 6.9% estimate your mt income taxes now compare other state income tax rates. Web instructions montana state income tax forms for current and previous tax years.

There Are Two Ways To Pay As You Go:

Montana individual income tax return (form 2) 2020. Web corporate income tax return (form cit) december 30, 2021. The montana form 2 instructions and the most commonly filed individual income tax forms are listed below on this page. The state income tax table can be found inside the montana form 2 instructions booklet.

Employees Who Already Claimed Allowances In Previous Years Do Not Have To Submit This Form Unless They Are Claiming An Exemption From Withholding In Section 2.

You do not need to file a montana form 2. Individual tax return form 1040 instructions; Web we last updated the individual income tax instructional booklet in february 2023, so this is the latest version of form 2 instructions, fully updated for tax year 2022. Filing information for native americans.