Monthly Payment Form

Monthly Payment Form - Web select the reason you are submitting this form (check only one): B) 90% (66 2/3% in the case of a farmer) of the total amount due for the current year. Web benefits avoid accruing additional interest and penalties avoid offset of your future refunds avoid issues obtaining loans if you can't pay the full amount due, pay as much as you can and visit irs.gov/payments to consider our online payment options. Web now you’re ready to accept monthly payments of any kind or amount! Go to billing > bills & payments > payment methods. Current revision form 9465 pdf instructions for form 9465 ( print version pdf) recent developments updates to the instructions for form 9465 (rev. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. August social security checks are getting disbursed this week for recipients who've received social security payments since. We will update this page with a new version of the form for 2024 as soon as it is made available by the missouri. Pay now with direct pay pay by debit card, credit card or digital wallet (e.g., paypal) for individuals and businesses (not for payroll tax deposits).

The payment calculator can determine the monthly payment amount or loan term for a fixed interest loan. Web benefits avoid accruing additional interest and penalties avoid offset of your future refunds avoid issues obtaining loans if you can't pay the full amount due, pay as much as you can and visit irs.gov/payments to consider our online payment options. Collecting payment online is incredibly simple using a jotform payment form. A) the tax shown on the preceding year’s return if that return was for a 12 month period and showed a tax liability; You can also create and print a loan amortization schedule to see how your monthly payment will pay. All delinquencies on your account. B) 90% (66 2/3% in the case of a farmer) of the total amount due for the current year. Each template is fully customizable and designed to look professional while saving you time. Web payments of estimated tax made on or before the last date prescribed for payment of such installment equals or exceeds: No matter the size or type of business you have.

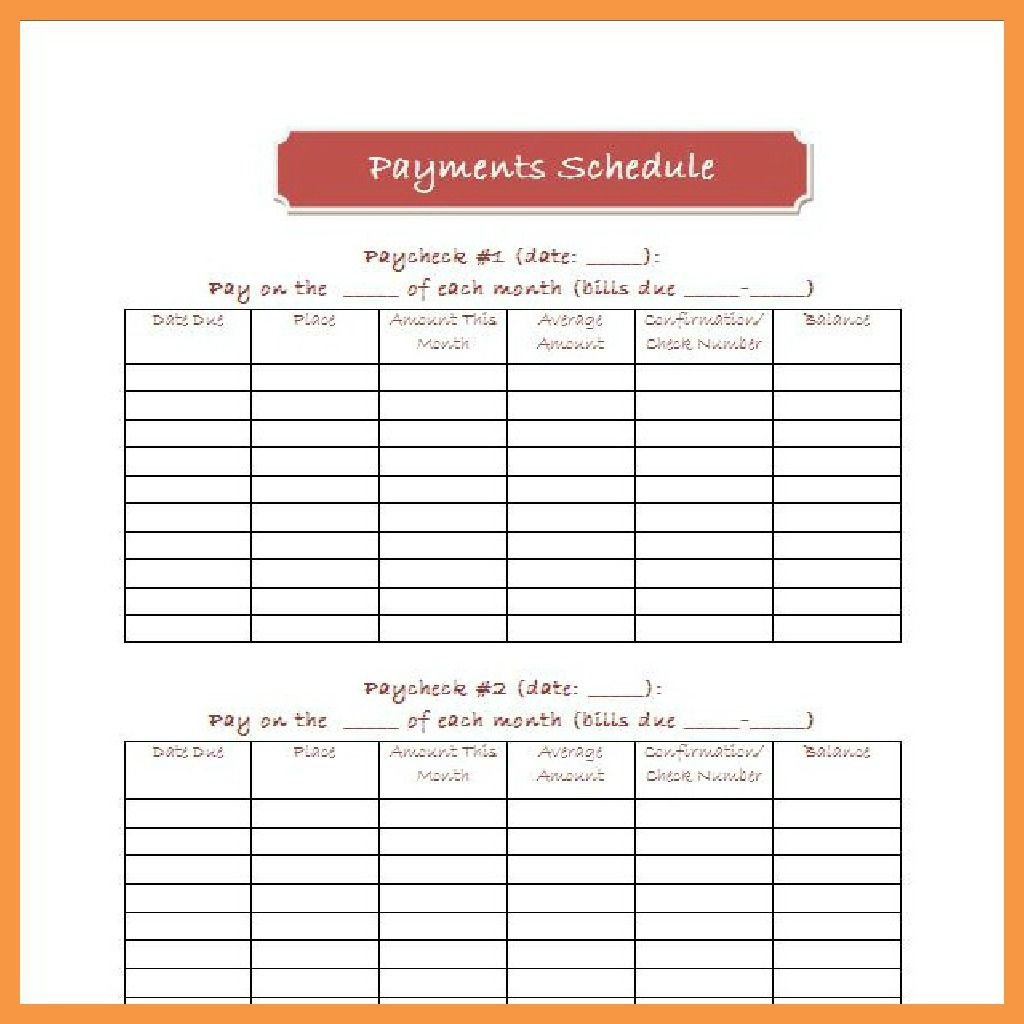

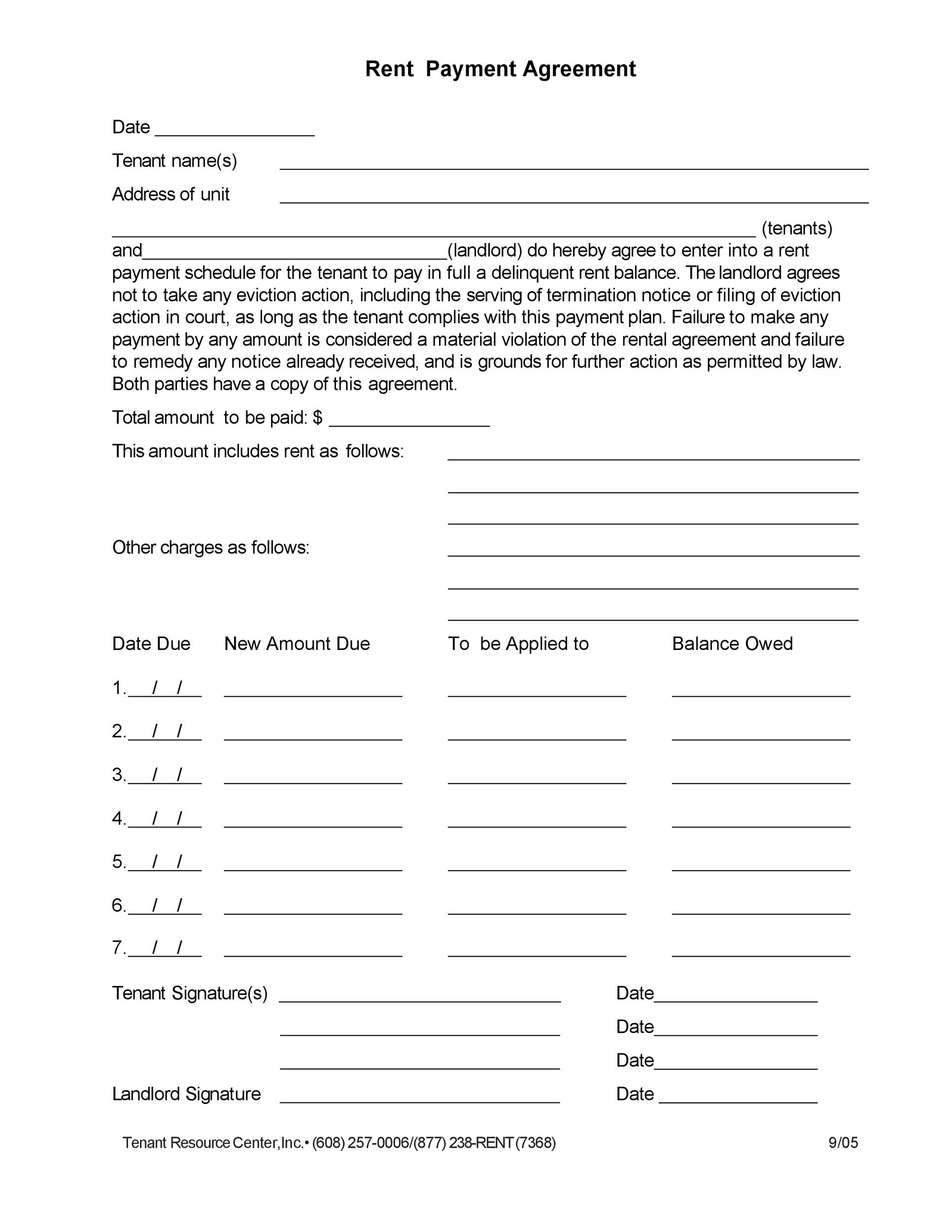

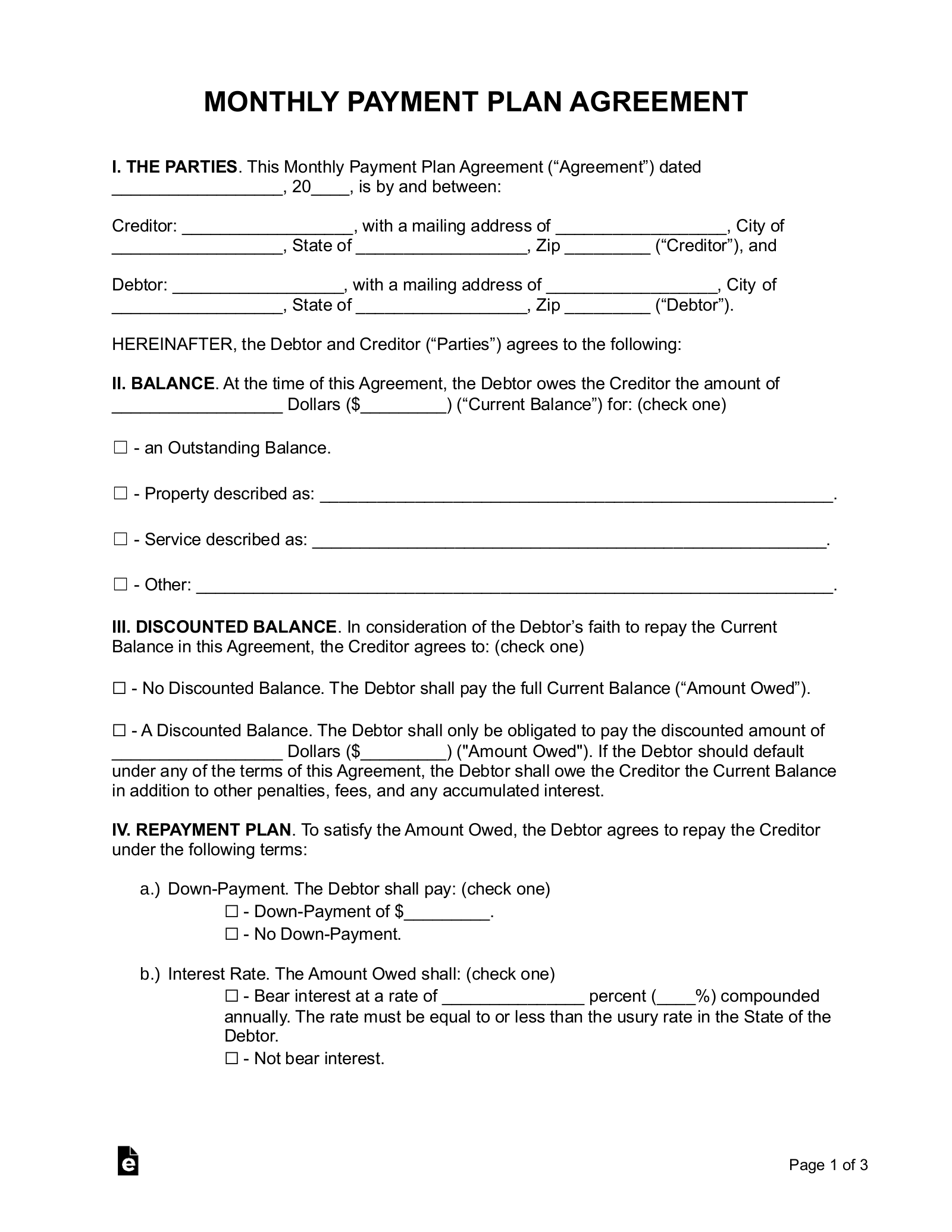

Schedule payments up to a year in advance. The template is available in pdf format that's printable and fully compatible with any printer. Web for creating a payment plan, templates can be used to schedule installment payments, keep track of due dates, and manage payments over time. By means of the agreements forms.app has reliable payment applications such as stripe and paypal, and the payment processes are easier and safer. Find your ideal payment by changing loan amount, interest rate and term and seeing the effect on payment amount. Web no fees from irs. The debtor agrees to repay the creditor on the [day] of each week until the end date of [date]. Create a payment form and collect payments, sell your products, and do many more transactions with forms.app easily. Each template is fully customizable and designed to look professional while saving you time. Choose from a selection of free payment templates below, in excel, word, and pdf formats.

Payment Plan Agreement Templates Word Excel Samples

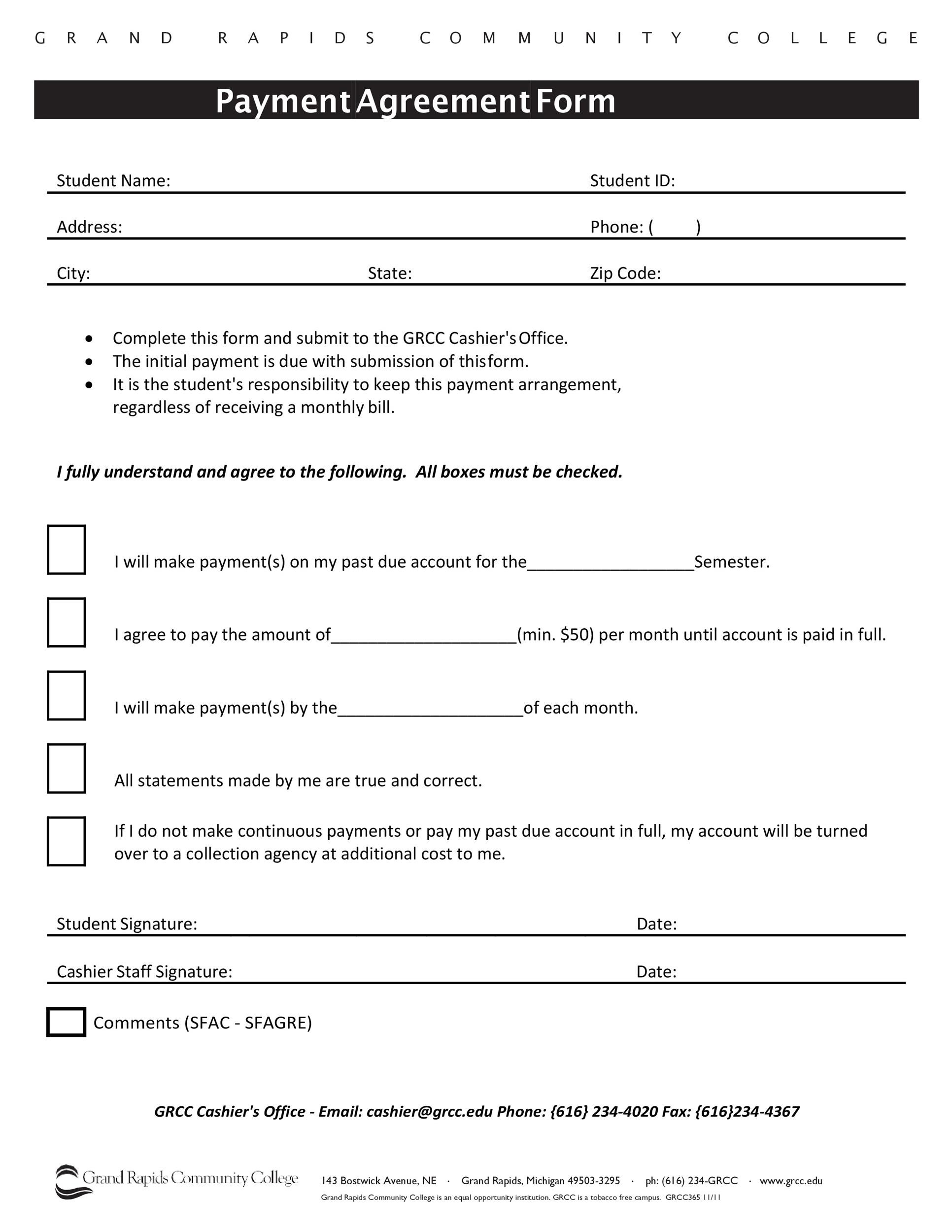

Web a payment plan can be established for no longer than 36 months and the monthly amount cannot be less than $50. B) 90% (66 2/3% in the case of a farmer) of the total amount due for the current year. Get started by either selecting a payment form template below or start your own form, then choose which payment.

Payment Agreement 40 Templates & Contracts ᐅ TemplateLab

Sign in to the microsoft 365 admin center with your admin credentials. Our forms can be customized to fit your needs. This form is for income earned in tax year 2022, with tax returns due in april 2023. Must be included in the installment agreement. Web now you’re ready to accept monthly payments of any kind or amount!

Monthly Payment Schedule Template Luxury Free Printable Bill Pay

Web benefits avoid accruing additional interest and penalties avoid offset of your future refunds avoid issues obtaining loans if you can't pay the full amount due, pay as much as you can and visit irs.gov/payments to consider our online payment options. Whether you're looking to collect customer information, order type and quantity; Select add a payment method. Amount paid with.

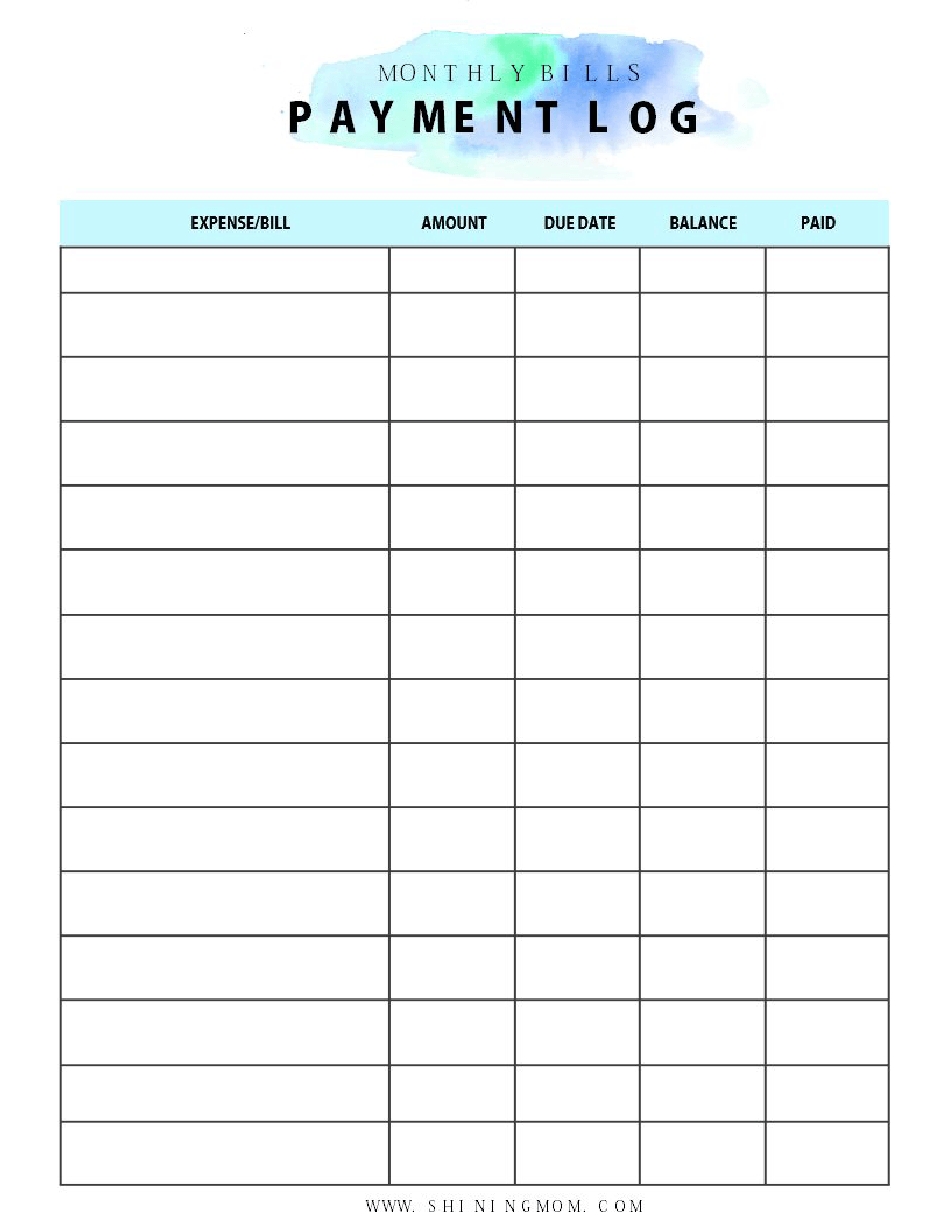

Monthly Bill Payment Log Best Calendar Example

Try one of our free online payment form templates today! Get started with wpforms today to create and customize your own form. Pay now with direct pay pay by debit card, credit card or digital wallet (e.g., paypal) for individuals and businesses (not for payroll tax deposits). The template is available in pdf format that's printable and fully compatible with.

Free Printable Bill Payment Schedule Free Printable

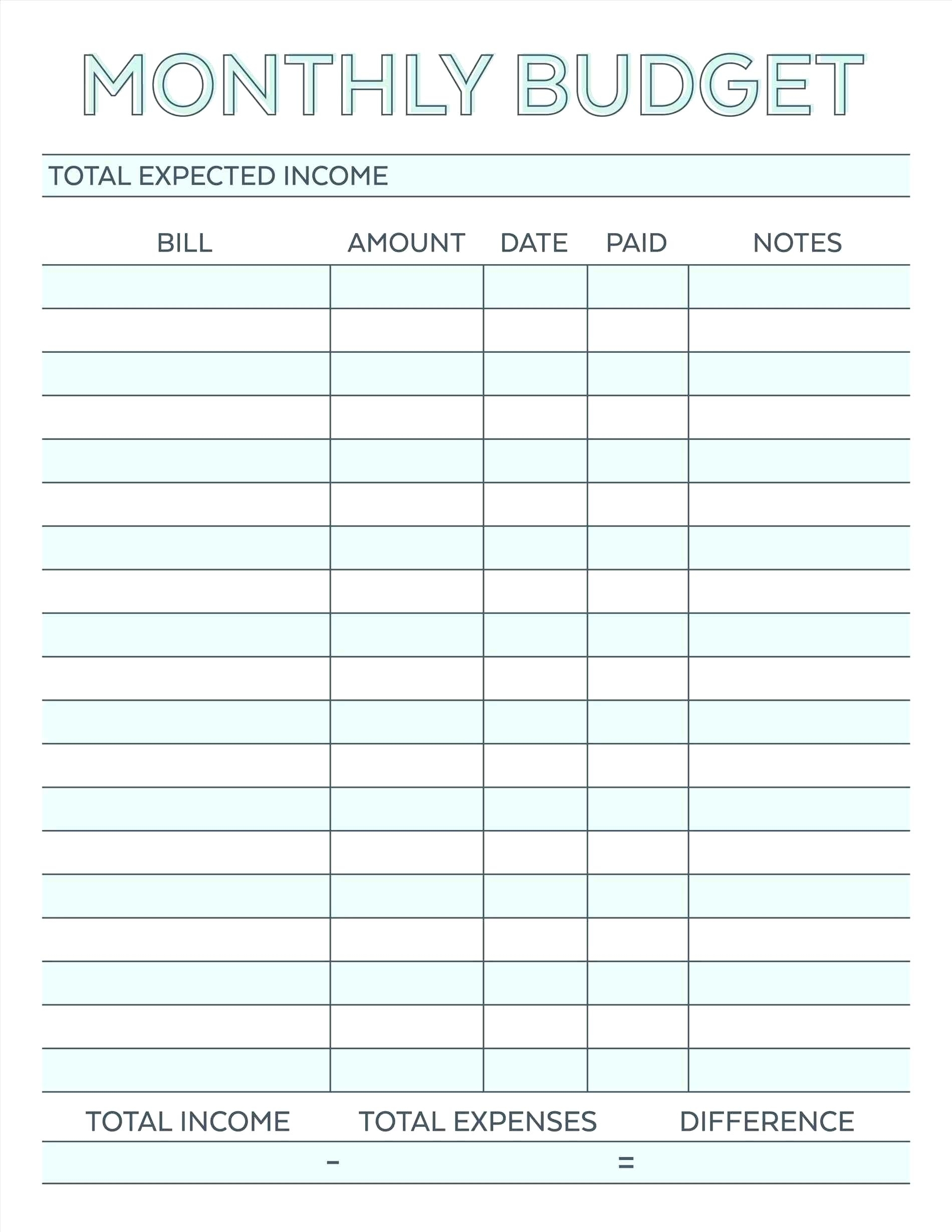

Go to billing > bills & payments > payment methods. Web use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Web track what for and how much you pay for it during a month with this simple monthly bill.

Payment Agreement 40 Templates & Contracts ᐅ TemplateLab

Choose from a selection of free payment templates below, in excel, word, and pdf formats. The template is available in pdf format that's printable and fully compatible with any printer. Get started with wpforms today to create and customize your own form. Schedule payments up to a year in advance. Find your ideal payment by changing loan amount, interest rate.

Free Monthly (Recurring) Payment Plan Agreement PDF Word eForms

Web free online payment form templates. Our forms can be customized to fit your needs. The debtor agrees to repay the creditor on the [day] of each month until the end date of [date]. Web with a variety of payment form options, including invoice forms, order forms or purchase forms. Easily fill out pdf blank, edit, and sign them.

Payment Record Template charlotte clergy coalition

The payment calculator can determine the monthly payment amount or loan term for a fixed interest loan. Web select the reason you are submitting this form (check only one): Web printable bill pay checklist template pay to date due payment jan feb mar apr may jun jul aug sep oct nov dec comments Use the fixed payments tab to calculate.

Contract Schedule Template Payment Agreement 40 Templates Contracts á

Pay now by card or digital wallet sign in to pay Use the fixed payments tab to calculate the time to pay off a loan with a fixed monthly payment. Enter the amount paid with form 941. Sign in to the microsoft 365 admin center with your admin credentials. Find your ideal payment by changing loan amount, interest rate and.

Printable Bills To Pay List

Control all bills, make a budget for the next month, plan spendings, note the amount of debt and appropriate payments, and effectively accumulate capital to improve the financial situation. Amount paid with missouri extension of time to file Web select the reason you are submitting this form (check only one): Must be included in the installment agreement. Web payments of.

Get Started By Either Selecting A Payment Form Template Below Or Start Your Own Form, Then Choose Which Payment Gateway You'd Like To Use Such As Paypal And Square.

Web printable bill pay checklist template pay to date due payment jan feb mar apr may jun jul aug sep oct nov dec comments Web use this loan calculator to determine your monthly payment, interest rate, number of months or principal amount on a loan. Web with a variety of payment form options, including invoice forms, order forms or purchase forms. Web payments of estimated tax made on or before the last date prescribed for payment of such installment equals or exceeds:

We Will Update This Page With A New Version Of The Form For 2024 As Soon As It Is Made Available By The Missouri.

The debtor agrees to repay the creditor on the [day] of each week until the end date of [date]. No matter the size or type of business you have. Web a payment plan can be established for no longer than 36 months and the monthly amount cannot be less than $50. You can also create and print a loan amortization schedule to see how your monthly payment will pay.

The Debtor Agrees To Repay The Creditor On The [Day] Of Each Month Until The End Date Of [Date].

August social security checks are getting disbursed this week for recipients who've received social security payments since. Whether you're looking to collect customer information, order type and quantity; This form is for income earned in tax year 2022, with tax returns due in april 2023. Use this helpful template for bill tracking, create your managing money system, and make the right financial decisions.

The Debtor Agrees To Repay The Creditor, In Full, On The Date Of [Date.

Pay now with direct pay pay by debit card, credit card or digital wallet (e.g., paypal) for individuals and businesses (not for payroll tax deposits). Web no fees from irs. Web add a payment method. Go to billing > bills & payments > payment methods.