Nc W2 Form

Nc W2 Form - Sales and use electronic data interchange (edi) step by step instructions for efile; Log into fiori and select the my online selections tile. A copy of this form is given to the employee, the irs and the state taxing authority (if applicable) each january for the prior calendar (tax) year. However, the hr/payroll portal will be closed to all users from thursday, january 6th at 12:00pm until. If you want to download a tax form, use the navigation above, search the site, or choose a link below: As an employer in the state of north carolina, you must file. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Web north carolina state filing requirements. How do i get a copy? You must file the 1099 forms only if there is state tax withholding.

Log into fiori and select the my online selections tile. You must file the 1099 forms only if there is state tax withholding. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. If you want to download a tax form, use the navigation above, search the site, or choose a link below: How do i get a copy? Use the following link for instructions: However, the hr/payroll portal will be closed to all users from thursday, january 6th at 12:00pm until. Find a tax type search for a form Even if you do not receive your. Select the create button in the upper right.

Sales and use electronic data interchange (edi) step by step instructions for efile; How do i get a copy? Use the following link for instructions: If too much is withheld, you will generally be due a refund. Electronic filing options and requirements; If you want to download a tax form, use the navigation above, search the site, or choose a link below: Select the create button in the upper right. Even if you do not receive your. You must file the 1099 forms only if there is state tax withholding. Web home page | ncdor

W2 Form Copy C or Copy 2 (LW2CLW22)

Select the create button in the upper right. Log into fiori and select the my online selections tile. Web north carolina state filing requirements. However, the hr/payroll portal will be closed to all users from thursday, january 6th at 12:00pm until. Find a tax type search for a form

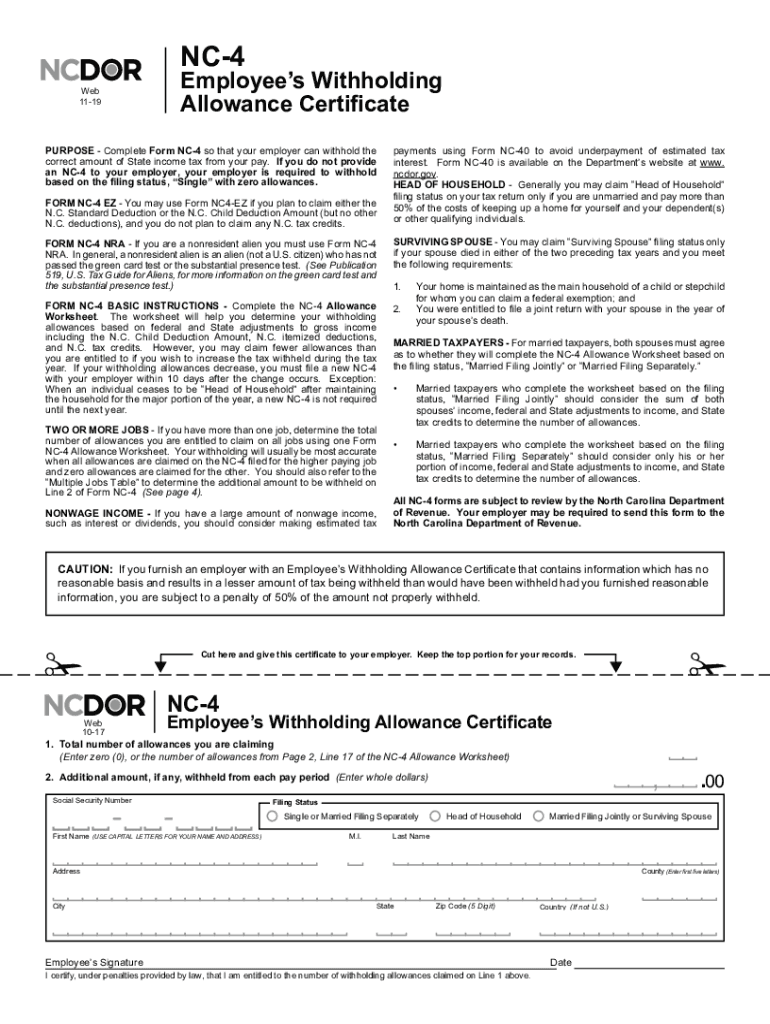

Download North Carolina Form NC4 for Free Page 2 FormTemplate

You must file the 1099 forms only if there is state tax withholding. Web north carolina state filing requirements. Web download tax forms and instructions ncdor has recently redesigned its website. Web home page | ncdor Even if you do not receive your.

W2 Mate 2021 2022 W2 Forms Zrivo

Web north carolina state filing requirements. Find a tax type search for a form Select the create button in the upper right. Web download tax forms and instructions ncdor has recently redesigned its website. As an employer in the state of north carolina, you must file.

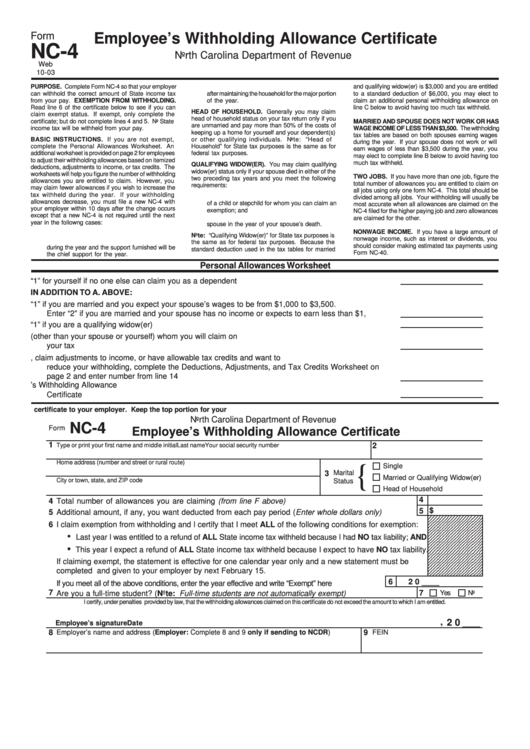

NC DoR NC4 2000 Fill out Tax Template Online US Legal Forms

Use the following link for instructions: Web download tax forms and instructions ncdor has recently redesigned its website. If too much is withheld, you will generally be due a refund. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. As an employer in the state of north carolina,.

Blank W2c Form 20202021 Fill and Sign Printable Template Online US

A copy of this form is given to the employee, the irs and the state taxing authority (if applicable) each january for the prior calendar (tax) year. If you want to download a tax form, use the navigation above, search the site, or choose a link below: Use the following link for instructions: Find a tax type search for a.

W2 Form 2023

Select the create button in the upper right. Web home page | ncdor Web download tax forms and instructions ncdor has recently redesigned its website. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Use the following link for instructions:

New Employee Nc Tax Forms 2023

How do i get a copy? Web north carolina state filing requirements. Select the create button in the upper right. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Sales and use electronic data interchange (edi) step by step instructions for efile;

NC4 Employee's Withholding Allowance Certificate (North Carolina State

Web download tax forms and instructions ncdor has recently redesigned its website. You must file the 1099 forms only if there is state tax withholding. Electronic filing options and requirements; As an employer in the state of north carolina, you must file. If you want to download a tax form, use the navigation above, search the site, or choose a.

2019 Form NC DoR NC4 Fill Online, Printable, Fillable, Blank pdfFiller

Sales and use electronic data interchange (edi) step by step instructions for efile; Web home page | ncdor Find a tax type search for a form However, the hr/payroll portal will be closed to all users from thursday, january 6th at 12:00pm until. A copy of this form is given to the employee, the irs and the state taxing authority.

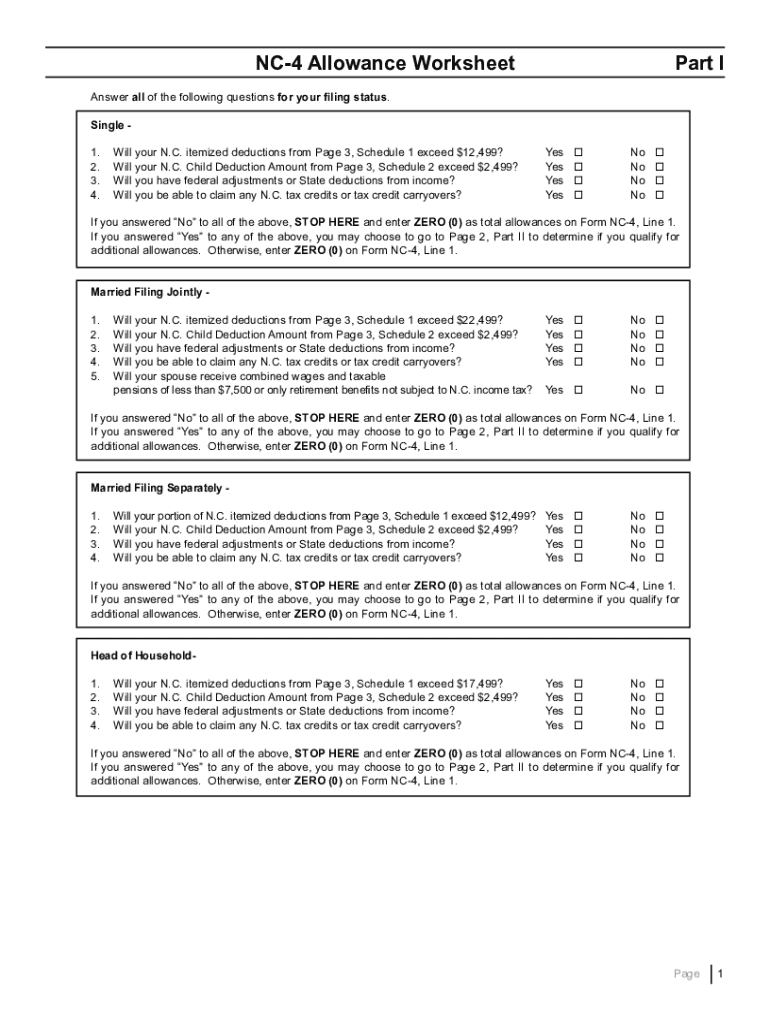

Nc 4 Allowance Worksheet Form Fill Out and Sign Printable PDF

However, the hr/payroll portal will be closed to all users from thursday, january 6th at 12:00pm until. How do i get a copy? If you want to download a tax form, use the navigation above, search the site, or choose a link below: Web download tax forms and instructions ncdor has recently redesigned its website. Web home page | ncdor

If Too Much Is Withheld, You Will Generally Be Due A Refund.

Select the create button in the upper right. However, the hr/payroll portal will be closed to all users from thursday, january 6th at 12:00pm until. Web north carolina state filing requirements. Log into fiori and select the my online selections tile.

You Must File The 1099 Forms Only If There Is State Tax Withholding.

How do i get a copy? Web download tax forms and instructions ncdor has recently redesigned its website. Use the following link for instructions: As an employer in the state of north carolina, you must file.

Even If You Do Not Receive Your.

If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Sales and use electronic data interchange (edi) step by step instructions for efile; Find a tax type search for a form Web home page | ncdor

A Copy Of This Form Is Given To The Employee, The Irs And The State Taxing Authority (If Applicable) Each January For The Prior Calendar (Tax) Year.

If you want to download a tax form, use the navigation above, search the site, or choose a link below: Electronic filing options and requirements;