Nj Form 1065 Instructions

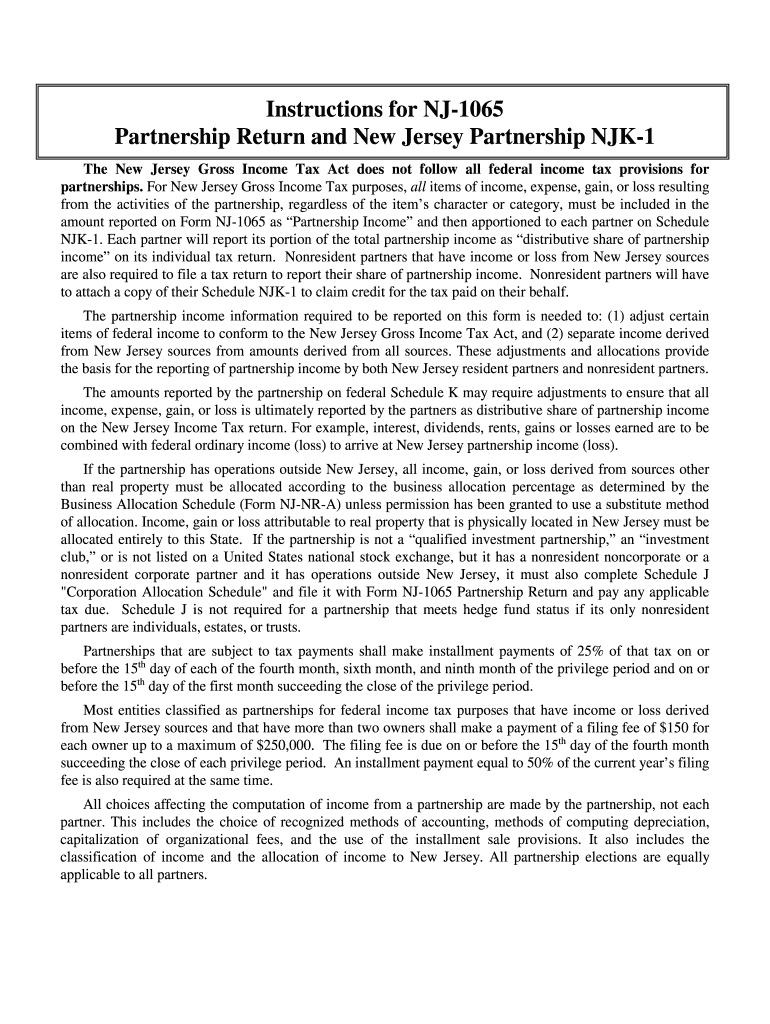

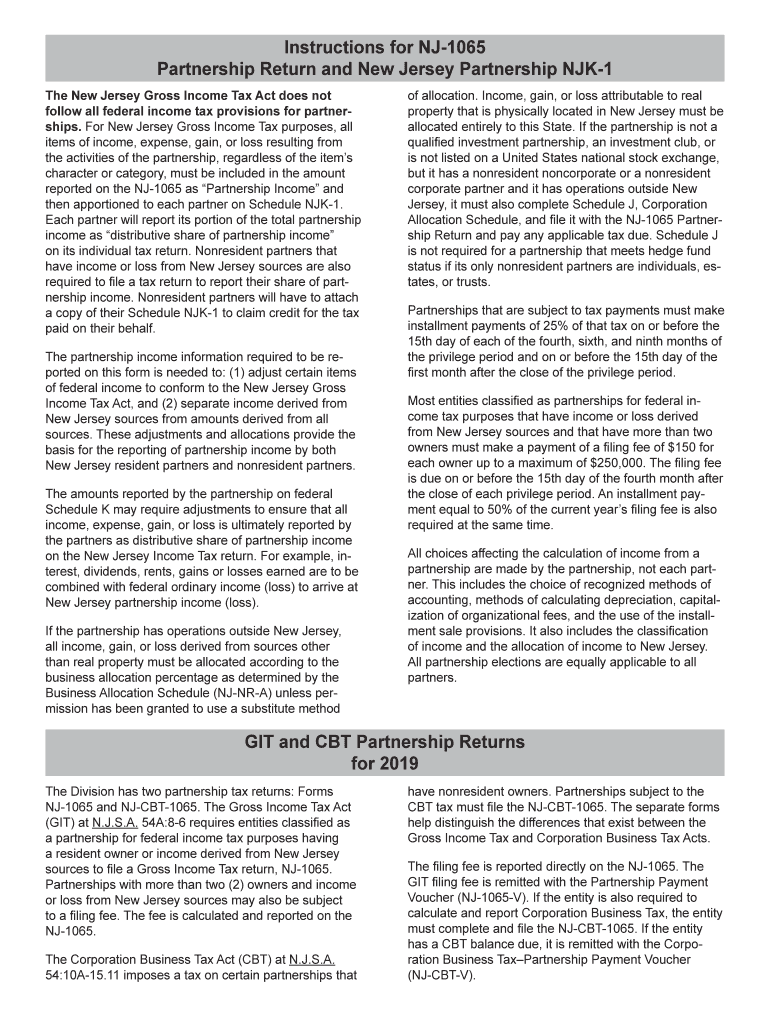

Nj Form 1065 Instructions - Web gross income tax for calendar year 2020, or tax year beginning , 2020 and ending , 20 legal name of taxpayer trade name of business if different from legal name above. Electronic filing and payment options. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Fill, sign, print and send online instantly. Partnerships with more than two owners and income or loss from new jersey sources may also be subject to a. Partners subject to the gross income tax. A partnership must file even if its principal place of business is outside the. Web developments related to form 1065 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form1065. Web up to $40 cash back get the free nj 1065 instructions form. Web edit form nj 1065 instructions.

Web developments related to form 1065 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form1065. Web gross income tax for calendar year 2020, or tax year beginning , 2020 and ending , 20 legal name of taxpayer trade name of business if different from legal name above. Web 17 rows 2022 partnership returns. Partnerships with more than two owners and income or loss from new jersey sources may also be subject to a. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Partners subject to the gross income tax. Web edit form nj 1065 instructions. Web new jersey partnership return gross income tax for calendar year 2022, or tax year beginning , 2022 and ending , 20 legal name of taxpayer trade name of business if. Check the box to indicate. Securely download your document with other editable.

Securely download your document with other editable. Web developments related to form 1065 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form1065. Web new jersey partnership return gross income tax for calendar year 2022, or tax year beginning , 2022 and ending , 20 legal name of taxpayer trade name of business if. A partnership must file even if its principal place of business is outside the. Web gross income tax for calendar year 2020, or tax year beginning , 2020 and ending , 20 legal name of taxpayer trade name of business if different from legal name above. Web up to $40 cash back get the free nj 1065 instructions form. Electronic filing and payment options. Web edit form nj 1065 instructions. A filing fee and tax may be imposed on the partnership. Easily add and underline text, insert images, checkmarks, and signs, drop new fillable fields, and rearrange or delete pages from your document.

990 Instructions 2023

Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Web gross income tax for calendar year 2020, or tax year beginning , 2020 and ending , 20 legal name of taxpayer trade name of business if different from legal name above. Partnerships with more than.

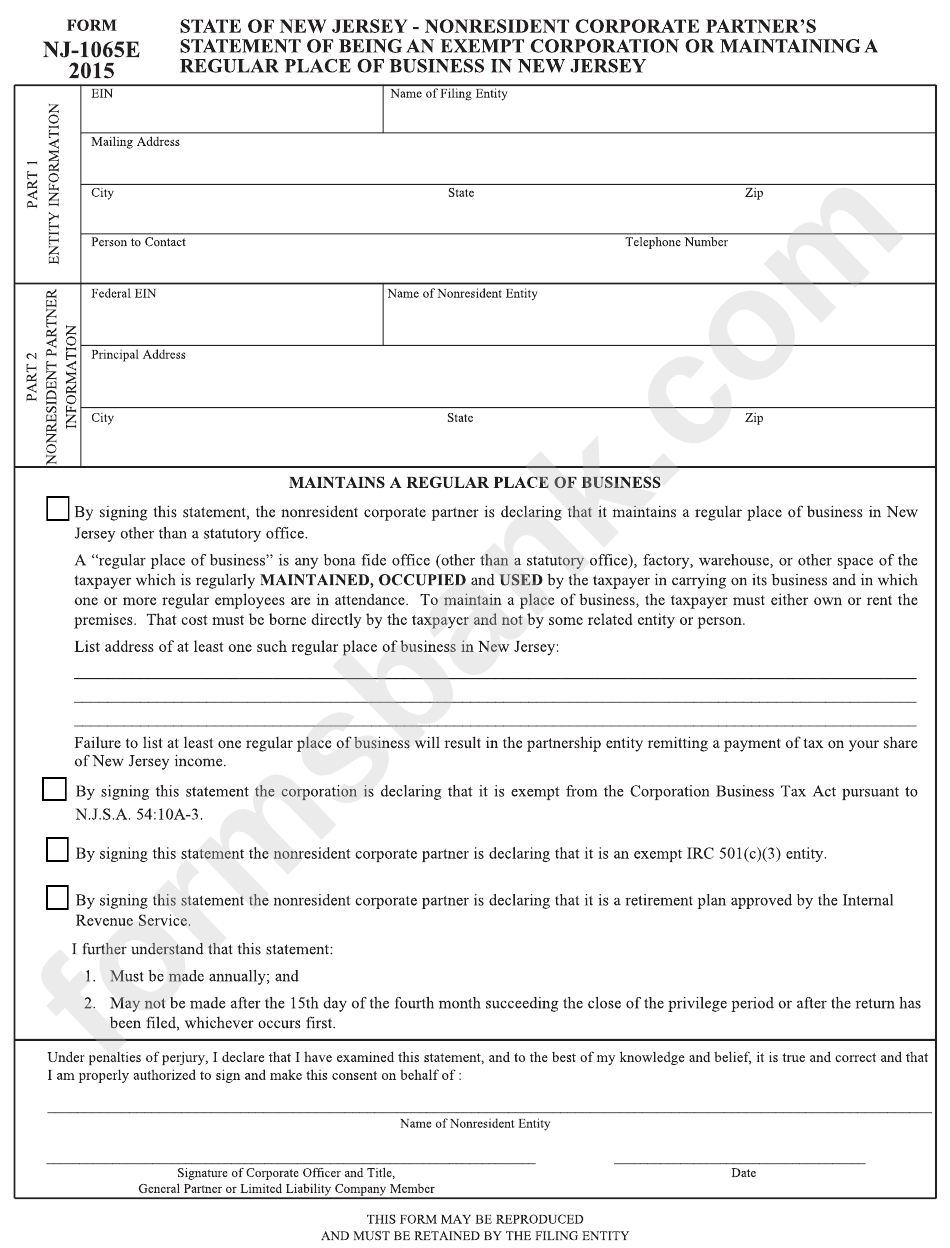

Fillable Form Nj 1065 Nonresident Corporate Partner'S Statement Of

Securely download your document with other editable. For a fiscal year or a short tax year, fill in the tax year. Web 17 rows 2022 partnership returns. Web up to $40 cash back get the free nj 1065 instructions form. Partners subject to the gross income tax.

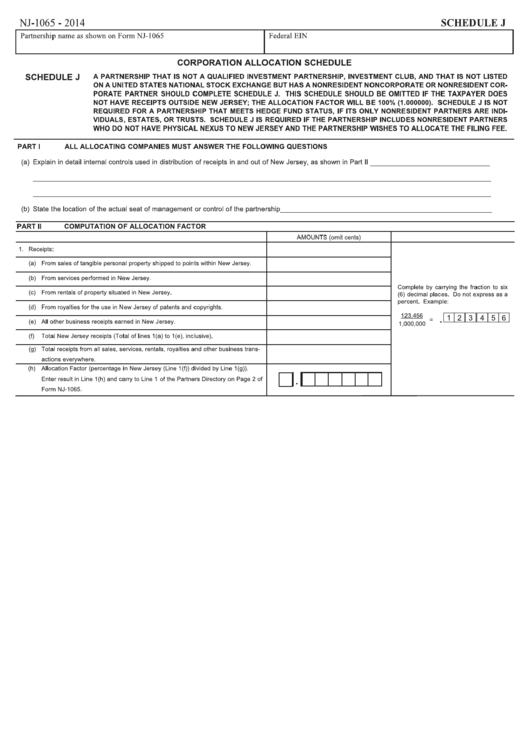

Fillable Form Nj1065 Corporation Allocation Schedule printable pdf

Fill, sign, print and send online instantly. Partnerships with more than two owners and income or loss from new jersey sources may also be subject to a. Web up to $40 cash back get the free nj 1065 instructions form. Web 17 rows 2022 partnership returns. Web the 2022 form 1065 is an information return for calendar year 2022 and.

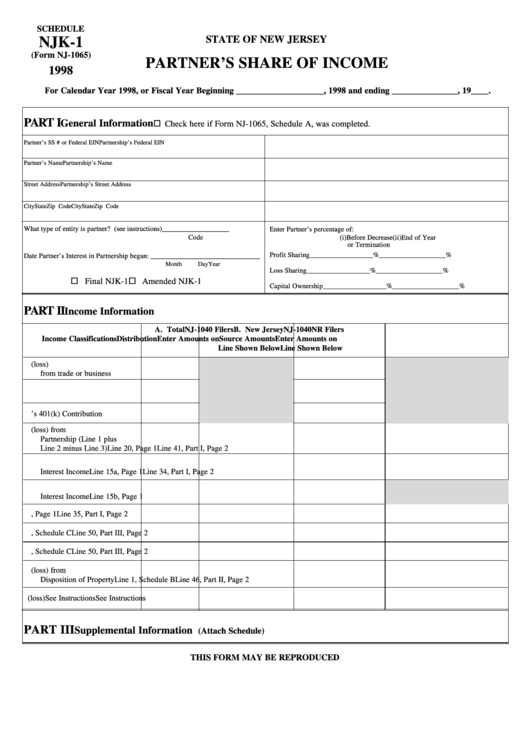

Fillable Form Nj1065 Schedule Njk1 Partner'S Share Of

(1) adjust certain items of federal income to conform to the new jersey gross income tax. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Electronic filing and payment options. Check the box to indicate. Partnerships with more than two owners and income or loss.

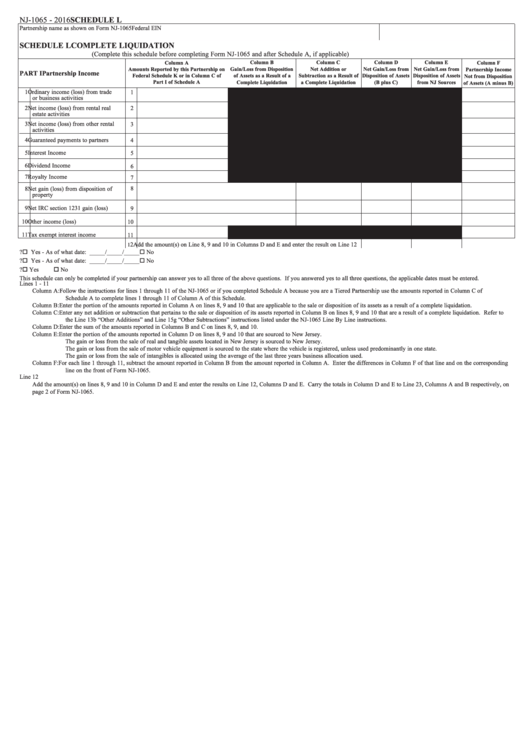

Fillable Form Nj1065 Schedule L Complete Liquidation 2016

Web edit form nj 1065 instructions. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. (1) adjust certain items of federal income to conform to the new jersey gross income tax. Fill, sign, print and send online instantly. Partners subject to the gross income tax.

2018 Form NJ NJ1065 Instructions Fill Online, Printable, Fillable

Electronic filing and payment options. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Web 17 rows 2022 partnership returns. Partnerships with more than two owners and income or loss from new jersey sources may also be subject to a. Partners subject to the gross.

NJ NJ1065 Instructions 20192022 Fill and Sign Printable Template

Electronic filing and payment options. Partners subject to the gross income tax. Web new jersey partnership return gross income tax for calendar year 2022, or tax year beginning , 2022 and ending , 20 legal name of taxpayer trade name of business if. You can download or print. A partnership must file even if its principal place of business is.

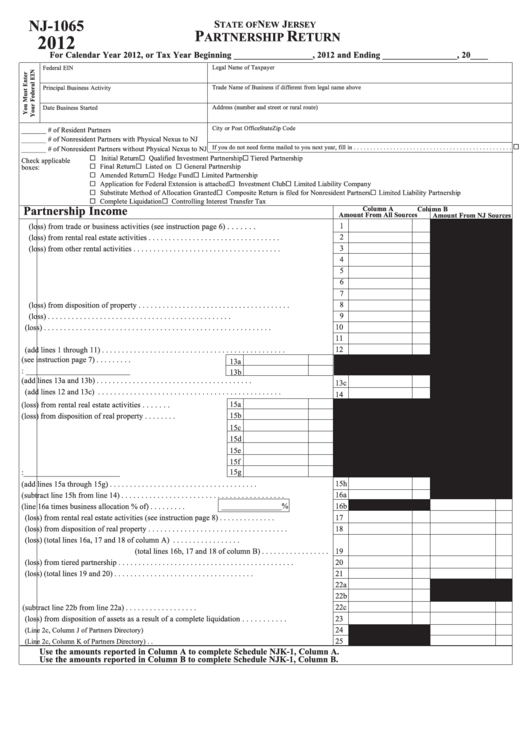

Fillable Form Nj1065 New Jersey Partnership Return 2012 printable

Electronic filing and payment options. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Web developments related to form 1065 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form1065. Partners subject to the gross income tax. Easily add and.

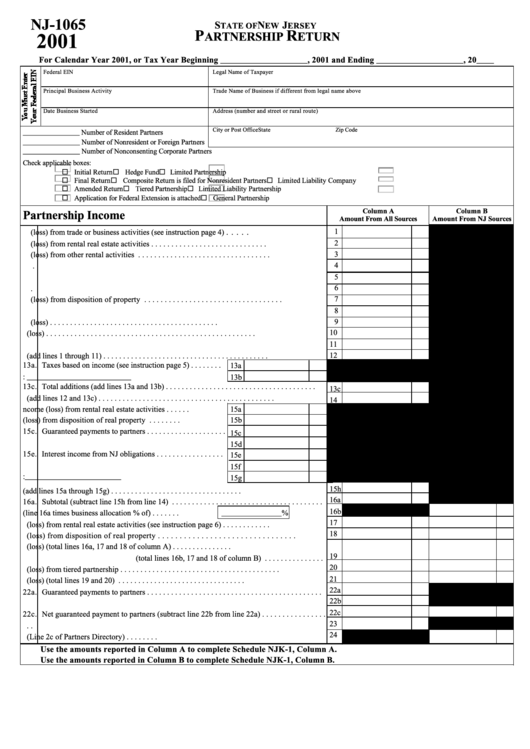

Form Nj1065 New Jersey Partnership Return 2001 printable pdf download

Electronic filing and payment options. Check the box to indicate. Easily add and underline text, insert images, checkmarks, and signs, drop new fillable fields, and rearrange or delete pages from your document. Web edit form nj 1065 instructions. A partnership must file even if its principal place of business is outside the.

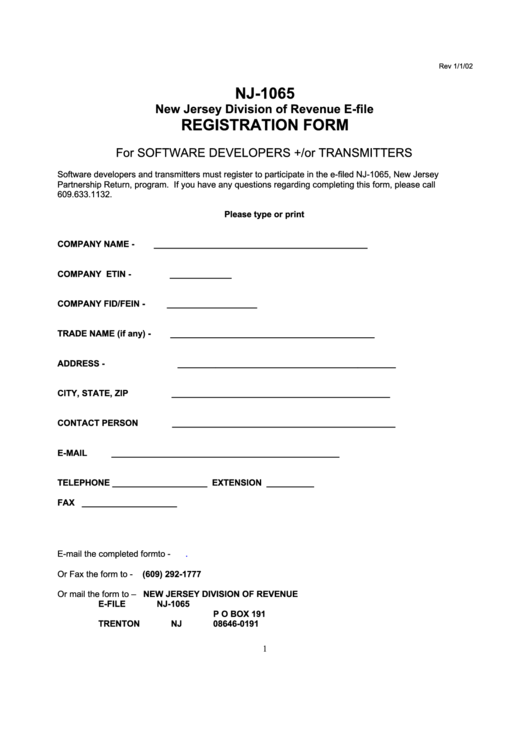

Fillable Form Nj1065 New Jersey Division Of Revenue EFile

Web 17 rows 2022 partnership returns. Web developments related to form 1065 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form1065. Easily add and underline text, insert images, checkmarks, and signs, drop new fillable fields, and rearrange or delete pages from your document. Electronic filing and payment options. Partners subject to the gross income.

A Partnership Must File Even If Its Principal Place Of Business Is Outside The.

Partnerships with more than two owners and income or loss from new jersey sources may also be subject to a. Fill, sign, print and send online instantly. You can download or print. Web 17 rows 2022 partnership returns.

Web Up To $40 Cash Back Get The Free Nj 1065 Instructions Form.

Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Partners subject to the gross income tax. Web new jersey partnership return gross income tax for calendar year 2022, or tax year beginning , 2022 and ending , 20 legal name of taxpayer trade name of business if. Securely download your document with other editable.

A Filing Fee And Tax May Be Imposed On The Partnership.

Easily add and underline text, insert images, checkmarks, and signs, drop new fillable fields, and rearrange or delete pages from your document. (1) adjust certain items of federal income to conform to the new jersey gross income tax. Web edit form nj 1065 instructions. Check the box to indicate.

Electronic Filing And Payment Options.

Web developments related to form 1065 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form1065. For a fiscal year or a short tax year, fill in the tax year. Web gross income tax for calendar year 2020, or tax year beginning , 2020 and ending , 20 legal name of taxpayer trade name of business if different from legal name above.