Non Resident Ohio Tax Form

Non Resident Ohio Tax Form - Learn how to determine your ohio residency type for income tax purposes. The ohio department of taxation provides a searchable repository of individual tax. Web we last updated the ohio nonresident statement (formerly form it da) in february 2023, so this is the latest version of form it nrs, fully updated for tax year 2022. Web more about the ohio form it nrs nonresident. April 18, 2023 the city auditor's office is open to the public, and ready to help with. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web residency status for income taxes. Nonresidents who earn or receive income within ohio will be able to claim the. Register and subscribe now to work on oh ez individual resident tax return city of toledo. The individual income tax brackets have been modified so that individuals with ohio taxable nonbusiness income.

You do not have to file a city (local) return. Web if line 11 is less than $200; The individual income tax brackets have been modified so that individuals with ohio taxable nonbusiness income. Register and subscribe now to work on oh ez individual resident tax return city of toledo. 1) have an abode or place of residence outside ohio during the entire. Complete, edit or print tax forms instantly. Web website www.tax.ohio.gov new for 2021 ohio income tax tables. This form is for income earned in. Web we last updated the ohio nonresident statement (formerly form it da) in february 2023, so this is the latest version of form it nrs, fully updated for tax year 2022. Web according to ohio instructions for form it 1040, “every ohio resident and part year resident is subject to the ohio income tax.”.

Web more about the ohio form it nrs nonresident. Web according to ohio instructions for form it 1040, “every ohio resident and part year resident is subject to the ohio income tax.”. Access the forms you need to file taxes or do business in ohio. This form is for income earned in. 1) have an abode or place of residence outside ohio during the entire. Learn how to determine your ohio residency type for income tax purposes. Complete, edit or print tax forms instantly. Register and subscribe now to work on oh ez individual resident tax return city of toledo. We last updated ohio form it nrs in february 2023 from the ohio department of taxation. Web website www.tax.ohio.gov new for 2021 ohio income tax tables.

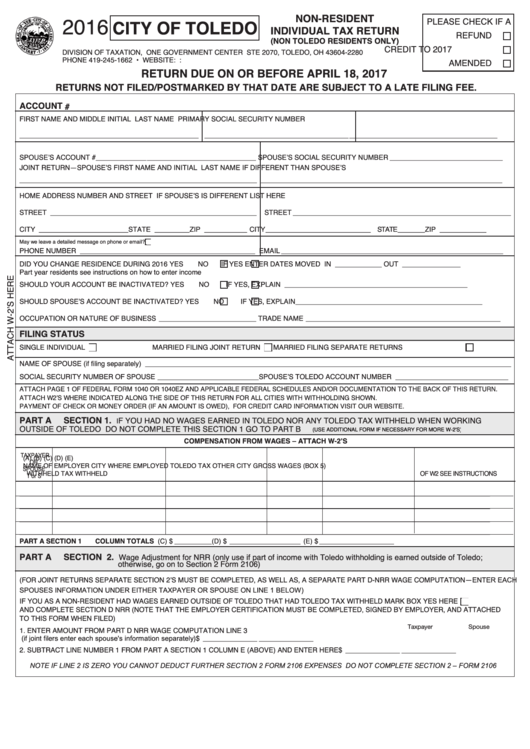

NonResident Individual Tax Return City Of Toledo 2016 printable

Web according to ohio instructions for form it 1040, “every ohio resident and part year resident is subject to the ohio income tax.”. Web city auditor income tax division tax forms tax forms 2022 tax year due date: Web more about the ohio form it nrs nonresident. This form is for income earned in. Web ohio has made a change.

NonResident Licenses When the Ohio Concealed Handgun License Isn't

If line 10 is $200 and greater, complete the 20 21 form 2210 (underpayment of estimate penalty) located on our. We last updated ohio form it nrs in february 2023 from the ohio department of taxation. Ohio will look at the federal adjusted gross income (agi) then divide the ohio agi by. This form is for income earned in. Web.

Resident Information Sheet Form Tax Department Canton Ohio

You do not have to file a city (local) return. Web ohio has made a change to the number of “contact periods” an individual can have with ohio before the individual will establish ohio residency for income tax. Web residency status for income taxes. Web 1 best answer hal_al level 15 yes, you have to file an ohio state return.

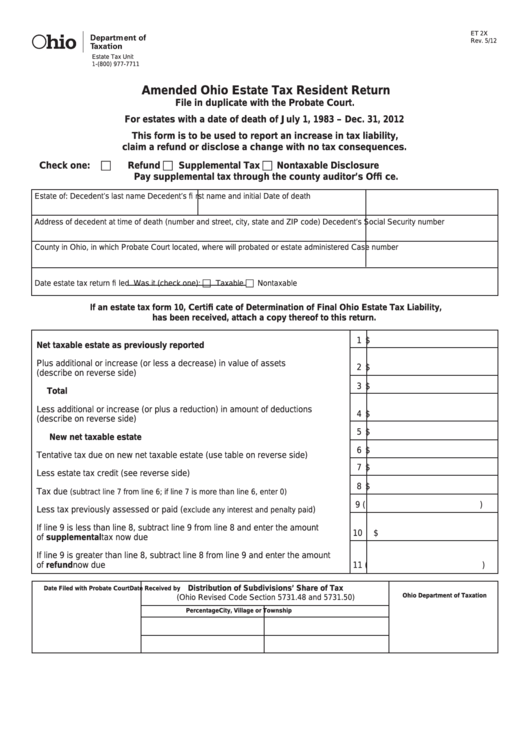

Fillable Form Et 2x Amended Ohio Estate Tax Resident Return printable

Web city auditor income tax division tax forms tax forms 2022 tax year due date: You do not have to file a city (local) return. April 18, 2023 the city auditor's office is open to the public, and ready to help with. Web 1 best answer dianew777 expert alumni you will have tax to pay in ohio. Access the forms.

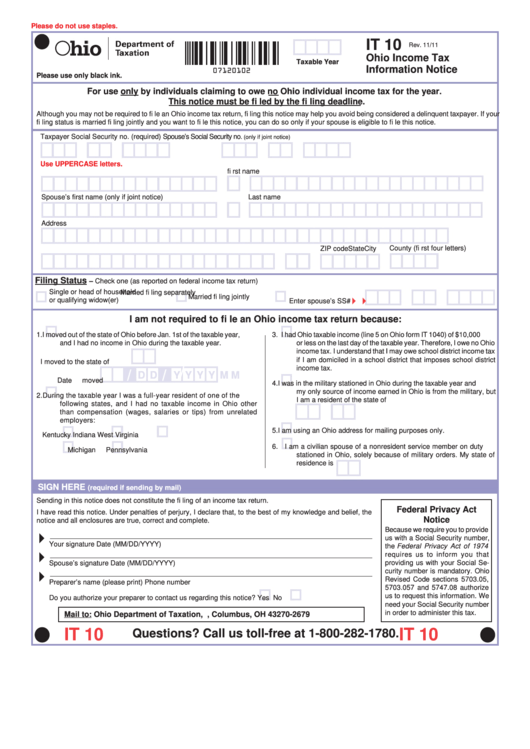

Fillable Form It 10 Ohio Tax Information Notice Ohio

Access the forms you need to file taxes or do business in ohio. The individual income tax brackets have been modified so that individuals with ohio taxable nonbusiness income. Web 2021 toledo individual non resident tax return page 3. Your ohio residency status can affect your. Web 1 best answer hal_al level 15 yes, you have to file an ohio.

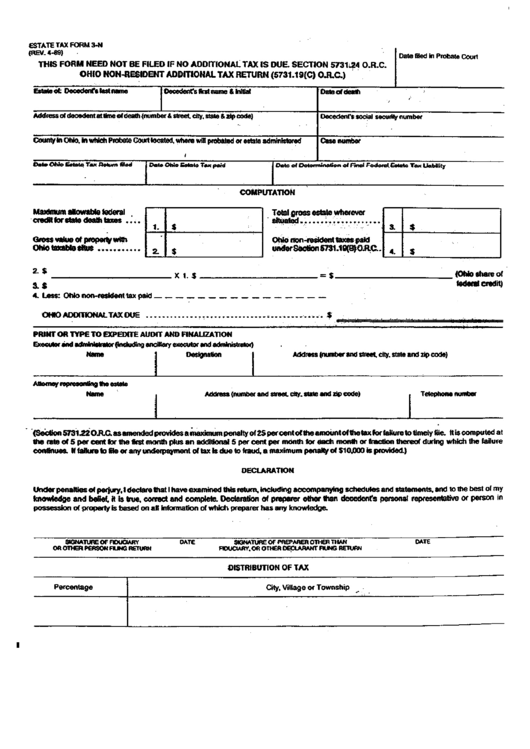

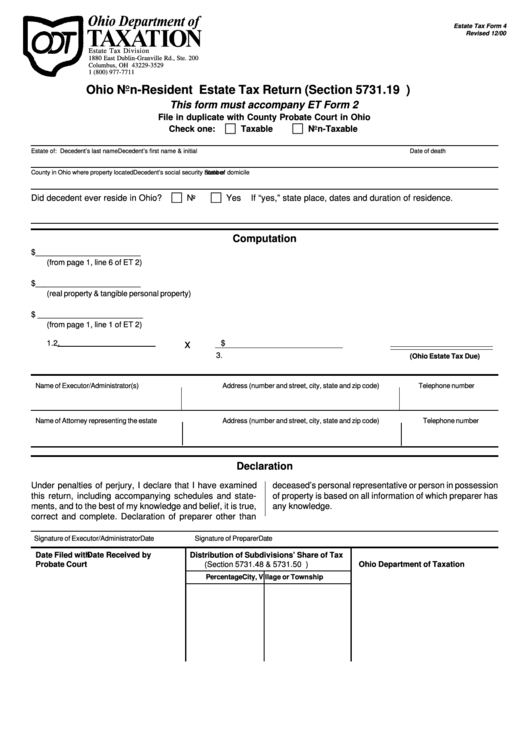

Form 3N Ohio NonResident Additional Tax Return (5731.19(C) O.r.c

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Register and subscribe now to work on oh ez individual resident tax return city of toledo. Web ohio has made a change to the number of “contact periods” an individual can have with ohio before the individual will establish ohio residency for income tax. Web.

Estate Tax Form 4 Ohio NonResident Estate Tax Return 2000

Access the forms you need to file taxes or do business in ohio. 1) have an abode or place of residence outside ohio during the entire. Your ohio residency status can affect your. Web ohio has made a change to the number of “contact periods” an individual can have with ohio before the individual will establish ohio residency for income.

English Form Sa700 Tax Return for a Nonresident Company or Other

Ohio will look at the federal adjusted gross income (agi) then divide the ohio agi by. You do not have to file a city (local) return. Web 1 best answer dianew777 expert alumni you will have tax to pay in ohio. If line 10 is $200 and greater, complete the 20 21 form 2210 (underpayment of estimate penalty) located on.

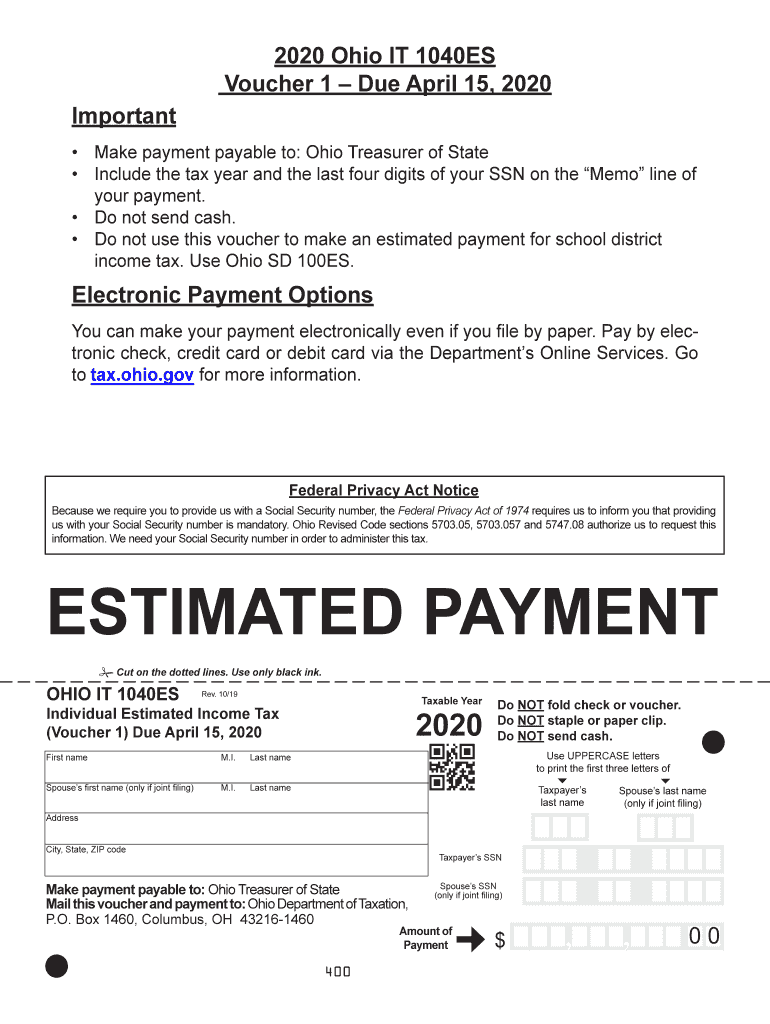

ESTIMATED PAYMENT Ohio Department Of Taxation Fill Out and Sign

If line 10 is $200 and greater, complete the 20 21 form 2210 (underpayment of estimate penalty) located on our. The ohio department of taxation provides a searchable repository of individual tax. Web more about the ohio form it nrs nonresident. Learn how to determine your ohio residency type for income tax purposes. 1) have an abode or place of.

US NonResident Tax Return 2019 Delaware Company Formation LLC

Nonresidents who earn or receive income within ohio will be able to claim the. If line 10 is $200 and greater, complete the 20 21 form 2210 (underpayment of estimate penalty) located on our. We last updated ohio form it nrs in february 2023 from the ohio department of taxation. Web according to ohio instructions for form it 1040, “every.

Register And Subscribe Now To Work On Oh Ez Individual Resident Tax Return City Of Toledo.

Web ohio has made a change to the number of “contact periods” an individual can have with ohio before the individual will establish ohio residency for income tax. You do not have to file a city (local) return. Web more about the ohio form it nrs nonresident. We last updated ohio form it nrs in february 2023 from the ohio department of taxation.

Web If Line 11 Is Less Than $200;

Web city auditor income tax division tax forms tax forms 2022 tax year due date: April 18, 2023 the city auditor's office is open to the public, and ready to help with. Web according to ohio instructions for form it 1040, “every ohio resident and part year resident is subject to the ohio income tax.”. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023)

Web We Last Updated The Ohio Nonresident Statement (Formerly Form It Da) In February 2023, So This Is The Latest Version Of Form It Nrs, Fully Updated For Tax Year 2022.

Web website www.tax.ohio.gov new for 2021 ohio income tax tables. Your ohio residency status can affect your. You are a nonresident if you were a resident of another state for the entire tax year. The individual income tax brackets have been modified so that individuals with ohio taxable nonbusiness income.

Learn How To Determine Your Ohio Residency Type For Income Tax Purposes.

1) have an abode or place of residence outside ohio during the entire. Web 1 best answer hal_al level 15 yes, you have to file an ohio state return because you have ohio source income. The ohio department of taxation provides a searchable repository of individual tax. Complete, edit or print tax forms instantly.