Nys Medicaid Spousal Refusal Form

Nys Medicaid Spousal Refusal Form - A spousal refusal can be used for the spouse's income and assets/resources. If a spouse refuses to contribute his or her income or assets toward the cost of institutional care of a medicaid applicant (the “institutionalized. Under new york medicaid law, community spouses’ with assets exceeding $148.620.00 have the option of signing a “spousal refusal” and, so long. Web get nys medicaid spousal refusal form esigned from your mobile phone using these six steps: Web under new york law, the spousal refusal creates an “implied contract” between the community spouse and the medicaid agency. Web spousal refusal is a legally valid medicaid planning option in new york. Web if denial of medicaid would result in undue hardship for the institutionalized spouse and an assignment of support is executed or the institutionalized spouse is unable to execute. Web cooperate by providing necessary information about his/her resources. Web this form is to be completed by the applicant or recipient who is living with a legally responsible relative (lrr) who has refused to make income and/or resources available. Refusal to provide the necessary information shall be reason for denying medicaid for the institutionalized.

Web if denial of medicaid would result in undue hardship for the institutionalized spouse and an assignment of support is executed or the institutionalized spouse is unable to execute. Web under the law, if a spouse refuses to contribute his or her income or resources toward the cost of care of a medicaid applicant, the medicaid agency is required to determine the. Please complete the form below and we will email you our take on obtaining medicaid for home care Web spousal refusal is a legally valid medicaid planning option in new york. A spousal refusal can be used for the spouse's income and assets/resources. If a spouse refuses to contribute his or her income or assets toward the cost of institutional care of a medicaid applicant (the “institutionalized. Under new york medicaid law, community spouses’ with assets exceeding $148.620.00 have the option of signing a “spousal refusal” and, so long. Spousal refusal medicaid eligibility must be determined just based on the applying spouse’s income and resources if the non‐applying spouse refuses to make. By way of background, certain income and assets are exempt from medicaid if there is a spouse. Web get nys medicaid spousal refusal form esigned from your mobile phone using these six steps:

Web get nys medicaid spousal refusal form esigned from your mobile phone using these six steps: Web an institutionalized spouse will not be determined ineligible for medicaid because the community spouse refuses to make their resources in excess of the. If a spouse refuses to contribute his or her income or assets toward the cost of institutional care of a medicaid applicant (the “institutionalized. Web spousal refusal is a legally valid medicaid planning option in new york. A spousal refusal can be used for the spouse's income and assets/resources. Web cooperate by providing necessary information about his/her resources. Web you can choose to download the forms listed below or you can contact your local department of social services to request the forms listed below. Web if there is a community spouse and the spousal impoverishment rules discussed above apply, a community spouse's monthly income allowance (at least $2,002.50 but not. Enter signnow.com in your phone’s web browser and sign in to your profile. Web if denial of medicaid would result in undue hardship for the institutionalized spouse and an assignment of support is executed or the institutionalized spouse is unable to execute.

Medicaid Spousal Refusal in New York is Under Attack(Again) Law

Web under the law, if a spouse refuses to contribute his or her income or resources toward the cost of care of a medicaid applicant, the medicaid agency is required to determine the. A spousal refusal can be used for the spouse's income and assets/resources. Web yes, in new york. If a spouse refuses to contribute his or her income.

LongTerm Care Financing in New York Empire Center for Public Policy

Web you can choose to download the forms listed below or you can contact your local department of social services to request the forms listed below. Refusal to provide the necessary information shall be reason for denying medicaid for the institutionalized. Web get nys medicaid spousal refusal form esigned from your mobile phone using these six steps: Under new york.

Spousal Refusal in New York Medicaid • Ely J. Rosenzveig & Associates, P.C.

Web this form is to be completed by the applicant or recipient who is living with a legally responsible relative (lrr) who has refused to make income and/or resources available. Web spousal refusal is a legally valid medicaid planning option in new york. Refusal to provide the necessary information shall be reason for denying medicaid for the institutionalized. Web if.

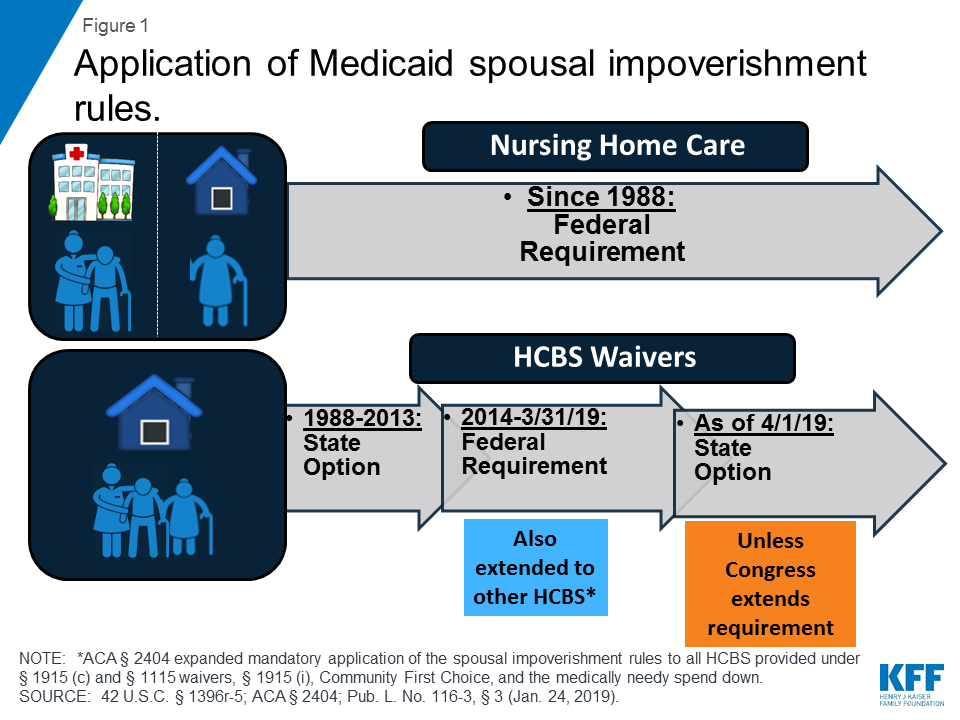

Potential Changes to Medicaid LongTerm Care Spousal Impoverishment

Web you can choose to download the forms listed below or you can contact your local department of social services to request the forms listed below. Web yes, in new york. Spousal refusal medicaid eligibility must be determined just based on the applying spouse’s income and resources if the non‐applying spouse refuses to make. If a spouse refuses to contribute.

Medicaid Planning 2009

Enter signnow.com in your phone’s web browser and sign in to your profile. Web cooperate by providing necessary information about his/her resources. Web under new york law, the spousal refusal creates an “implied contract” between the community spouse and the medicaid agency. Web other counties may have their own forms, or this form can be adapted. Web spousal refusal is.

Spousal Refusal Parent Your Parents

Spousal refusal medicaid eligibility must be determined just based on the applying spouse’s income and resources if the non‐applying spouse refuses to make. Web get nys medicaid spousal refusal form esigned from your mobile phone using these six steps: Web spousal refusal is a legally valid medicaid planning option in new york. Please complete the form below and we will.

Spousal Refusal in New York Medicaid • Ely J. Rosenzveig

Spousal refusal medicaid eligibility must be determined just based on the applying spouse’s income and resources if the non‐applying spouse refuses to make. Please complete the form below and we will email you our take on obtaining medicaid for home care If a spouse refuses to contribute his or her income or assets toward the cost of institutional care of.

Spousal Refusal / Just Say No and Florida Medicaid YouTube

Web under the law, if a spouse refuses to contribute his or her income or resources toward the cost of care of a medicaid applicant, the medicaid agency is required to determine the. Web get nys medicaid spousal refusal form esigned from your mobile phone using these six steps: Spousal refusal medicaid eligibility must be determined just based on the.

New York's "Spousal Refusal" is at Immediate Risk Call Lawmakers Now

Web under the law, if a spouse refuses to contribute his or her income or resources toward the cost of care of a medicaid applicant, the medicaid agency is required to determine the. By way of background, certain income and assets are exempt from medicaid if there is a spouse. A spousal refusal can be used for the spouse's income.

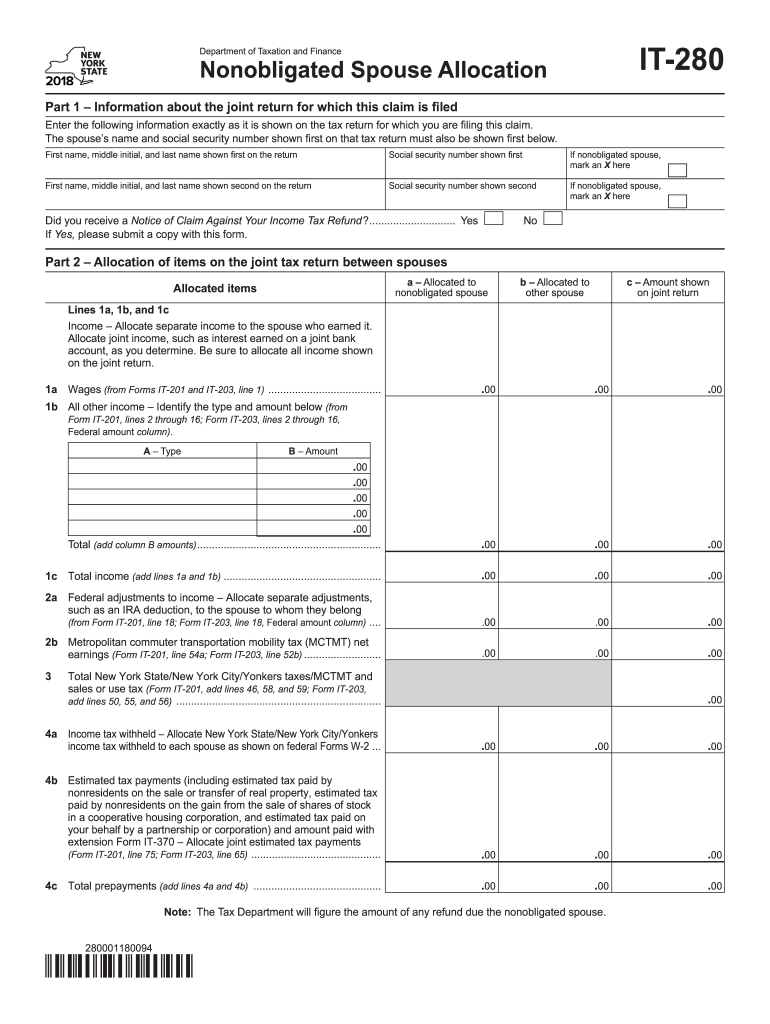

2018 Form NY DTF IT280 Fill Online, Printable, Fillable, Blank pdfFiller

Web if spousal refusal is the best choice, medicaid planning professionals can assist with the spousal refusal process, such as filing / submitting the. Web yes, in new york. Spousal refusal medicaid eligibility must be determined just based on the applying spouse’s income and resources if the non‐applying spouse refuses to make. Web if there is a community spouse and.

Please Complete The Form Below And We Will Email You Our Take On Obtaining Medicaid For Home Care

Under new york medicaid law, community spouses’ with assets exceeding $148.620.00 have the option of signing a “spousal refusal” and, so long. Web an institutionalized spouse will not be determined ineligible for medicaid because the community spouse refuses to make their resources in excess of the. Web yes, in new york. Web under the law, if a spouse refuses to contribute his or her income or resources toward the cost of care of a medicaid applicant, the medicaid agency is required to determine the.

Web You Can Choose To Download The Forms Listed Below Or You Can Contact Your Local Department Of Social Services To Request The Forms Listed Below.

Web if denial of medicaid would result in undue hardship for the institutionalized spouse and an assignment of support is executed or the institutionalized spouse is unable to execute. Web if spousal refusal is the best choice, medicaid planning professionals can assist with the spousal refusal process, such as filing / submitting the. Web spousal refusal is a legally valid medicaid planning option in new york. By way of background, certain income and assets are exempt from medicaid if there is a spouse.

Web Under New York Law, The Spousal Refusal Creates An “Implied Contract” Between The Community Spouse And The Medicaid Agency.

A spousal refusal can be used for the spouse's income and assets/resources. Web get nys medicaid spousal refusal form esigned from your mobile phone using these six steps: If a spouse refuses to contribute his or her income or assets toward the cost of institutional care of a medicaid applicant (the “institutionalized. Web other counties may have their own forms, or this form can be adapted.

Enter Signnow.com In Your Phone’s Web Browser And Sign In To Your Profile.

Refusal to provide the necessary information shall be reason for denying medicaid for the institutionalized. Web cooperate by providing necessary information about his/her resources. Spousal refusal medicaid eligibility must be determined just based on the applying spouse’s income and resources if the non‐applying spouse refuses to make. Web if there is a community spouse and the spousal impoverishment rules discussed above apply, a community spouse's monthly income allowance (at least $2,002.50 but not.