Ohio Pte Registration Form

Ohio Pte Registration Form - Web we last updated ohio form pte ref in may 2021 from the ohio department of taxation. You can send the form by:. Web this form contains information necessary to create a pte account with the department. Web july 22, 2022 article 6 min read authors: This form is for income earned in tax year 2022, with tax returns due in april 2023. Web ohio becomes the latest state to adopt an elective pte tax as a workaround for individual pte owners to the federal salt cap. Web an official state of ohio site. If you are a new pte filer, but. Here’s how you know the due date for filing the it 4738 is april 15th after the year in which the entity’s fiscal year ends. We last updated the pass through entity & fiduciary income tax registration in february 2023, so this is.

Web as enacted, ohio’s pte tax rate is 5% for 2022 and 3% for those years after 2022. Web more about the ohio form pte reg corporate income tax ty 2022. Entities filing the pte tax in ohio for the first time in 2022 must send in a separate registration form with any payments being made.) simply filing the. A fully refundable ohio pte tax credit is also permitted for pte owners for their. If you are a new pte filer, but. Web ohio becomes the latest state to adopt an elective pte tax as a workaround for individual pte owners to the federal salt cap. Web we last updated ohio form pte ref in may 2021 from the ohio department of taxation. Web ohio governor dewine on june 14 signed into law s.b. Web this form contains information necessary to create a pte account with the department. Ron cook julie corrigan stephen palmer adam garn significant tax changes are in store for ohio after its governor signed.

This form is for income earned in tax year 2022, with tax returns due in april 2023. Web ohio becomes the latest state to adopt an elective pte tax as a workaround for individual pte owners to the federal salt cap. Web more about the ohio form pte reg corporate income tax ty 2022. Web as enacted, ohio’s pte tax rate is 5% for 2022 and 3% for those years after 2022. Web this form contains information necessary to create a pte account with the department. If you are a new pte filer, but. Web july 22, 2022 article 6 min read authors: More guidance will likely be forthcoming from the. For taxable year 2022, the due. Web new pte filers should send in the registration form prior to or along with your first estimated payment and universal payment coupon (upc).

Download Ohio Power of Attorney for Vehicle Registration Form for Free

This form is for income earned in tax year 2022, with tax returns due in april 2023. Web ohio becomes the latest state to adopt an elective pte tax as a workaround for individual pte owners to the federal salt cap. For taxable year 2022, the due. More guidance will likely be forthcoming from the. If you are a new.

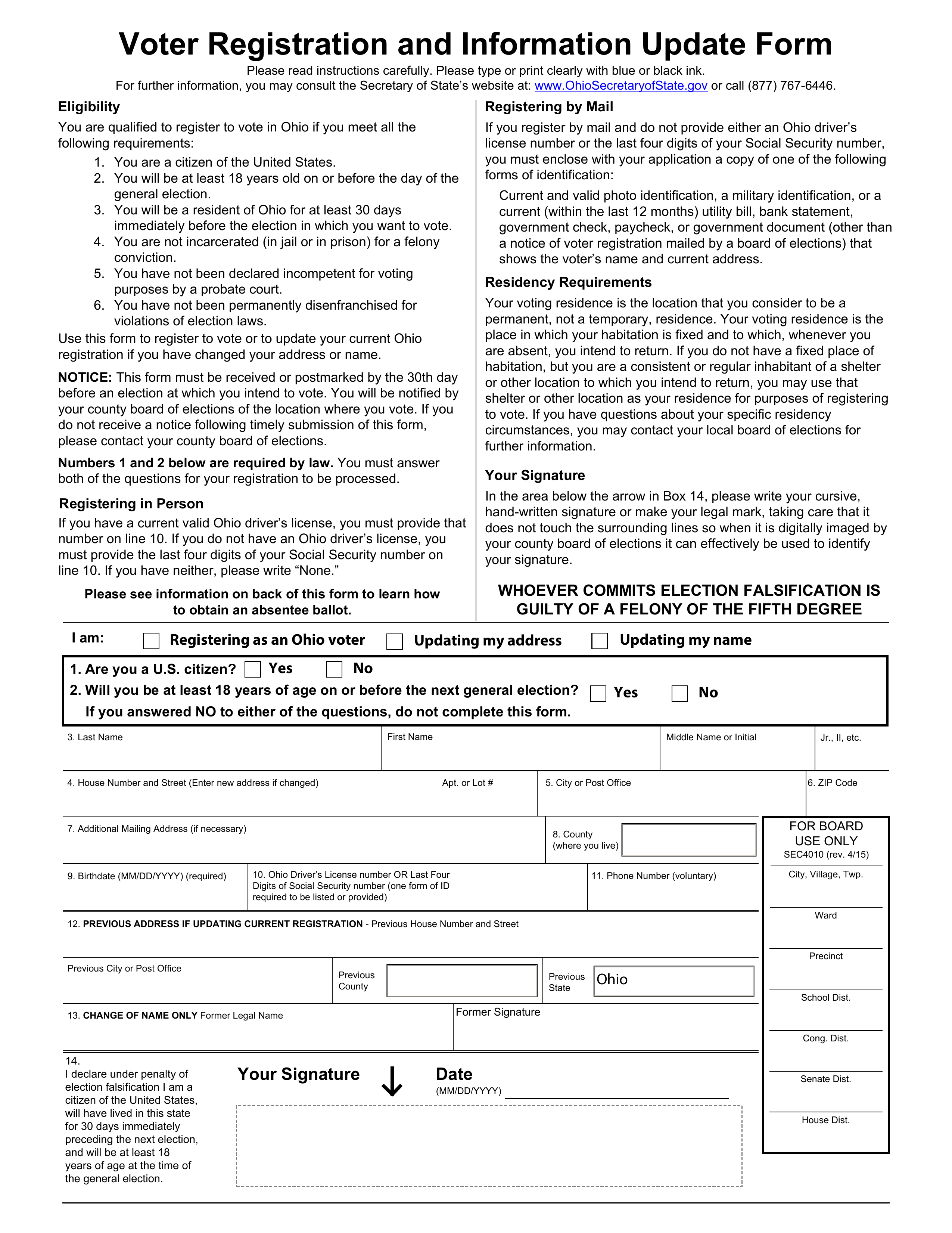

Free Ohio Voter Registration Form Register to Vote in OH PDF eForms

Entities filing the pte tax in ohio for the first time in 2022 must send in a separate registration form with any payments being made.) simply filing the. Web ohio governor dewine on june 14 signed into law s.b. Web this form contains information necessary to create a pte account with the department. Web more about the ohio form pte.

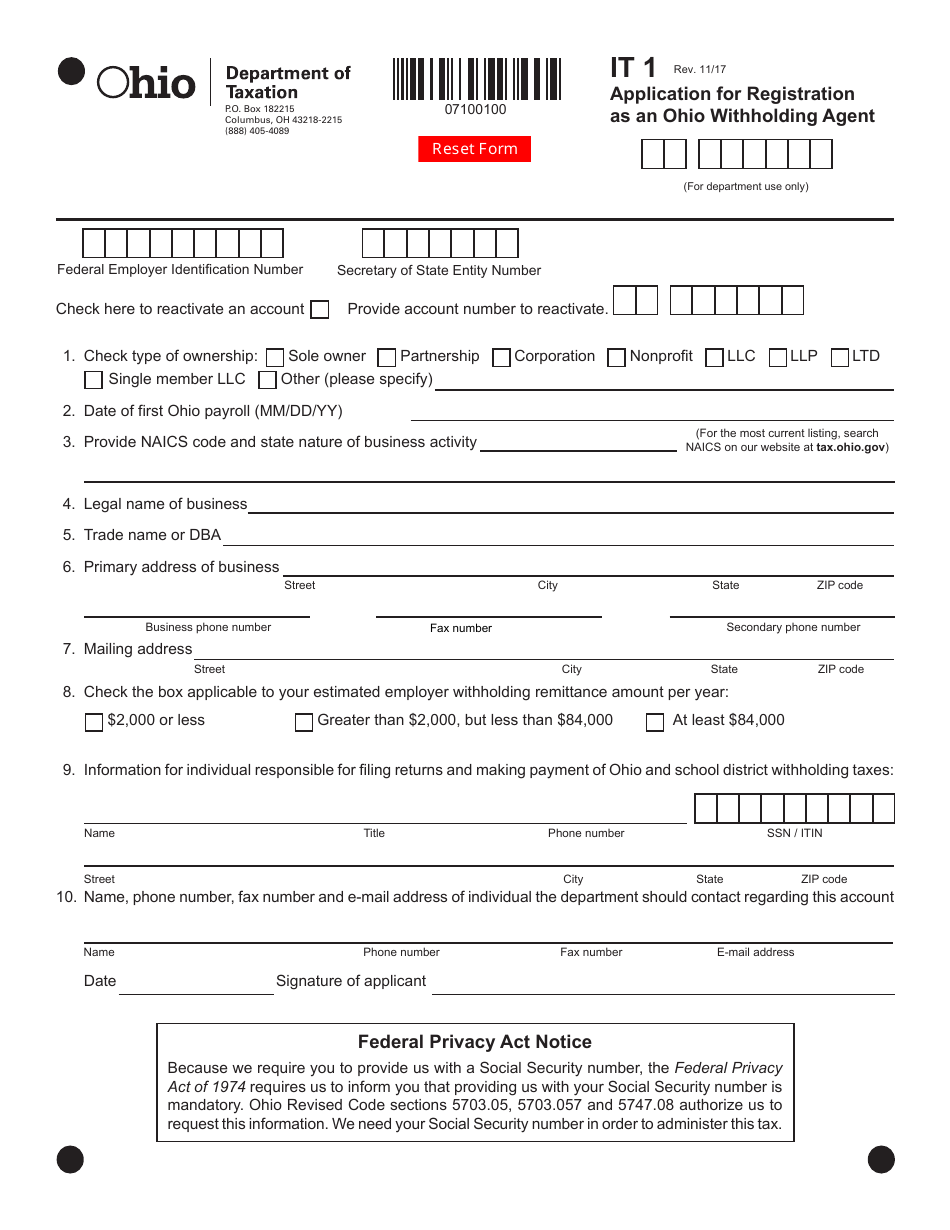

Ohio Withholding Business Registration Subisness

Web new pte filers should send in the registration form prior to or along with your first estimated payment and universal payment coupon (upc). Web an official state of ohio site. Web we last updated ohio form pte ref in may 2021 from the ohio department of taxation. Web ohio becomes the latest state to adopt an elective pte tax.

Ohio LLC and Corporation Registration and Formation IncParadise

Web ohio becomes the latest state to adopt an elective pte tax as a workaround for individual pte owners to the federal salt cap. Web as enacted, ohio’s pte tax rate is 5% for 2022 and 3% for those years after 2022. Here’s how you know the due date for filing the it 4738 is april 15th after the year.

How to Register a Car in Ohio BMV Registration Guide DMV Connect

Web more about the ohio form pte reg corporate income tax ty 2022. Entities filing the pte tax in ohio for the first time in 2022 must send in a separate registration form with any payments being made.) simply filing the. Ron cook julie corrigan stephen palmer adam garn significant tax changes are in store for ohio after its governor.

Ohio Voter Registration Information Update Form Edit, Fill, Sign

Web new ohio pte registration process (pdf) 08/05/2019: Web we last updated ohio form pte ref in may 2021 from the ohio department of taxation. Here’s how you know the due date for filing the it 4738 is april 15th after the year in which the entity’s fiscal year ends. You can send the form by:. Web ohio becomes the.

PTE Registration 2021 Check Registration Process & Test Centers

Web we last updated ohio form pte ref in may 2021 from the ohio department of taxation. Web july 22, 2022 article 6 min read authors: Web this form contains information necessary to create a pte account with the department. A fully refundable ohio pte tax credit is also permitted for pte owners for their. Web an official state of.

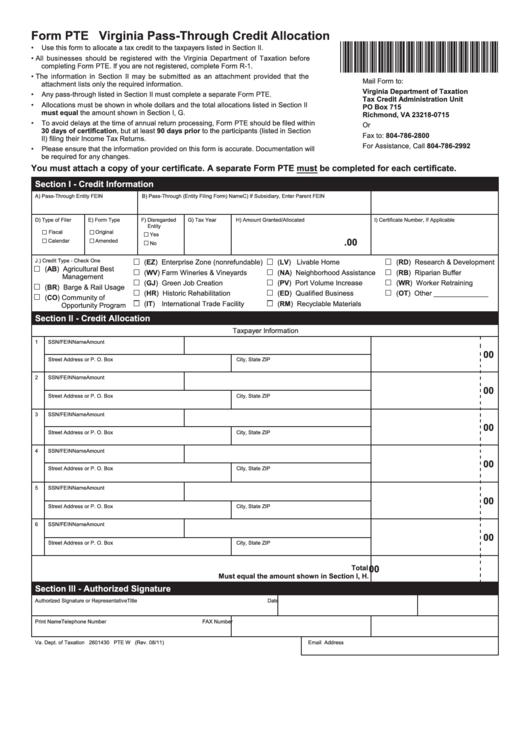

Form Pte Virginia PassThrough Credit Allocation printable pdf download

Web ohio becomes the latest state to adopt an elective pte tax as a workaround for individual pte owners to the federal salt cap. More guidance will likely be forthcoming from the. Web new pte filers should send in the registration form prior to or along with your first estimated payment and universal payment coupon (upc). A fully refundable ohio.

ITI Registration Form 2 Free Templates in PDF, Word, Excel Download

Web more about the ohio form pte reg corporate income tax ty 2022. Web new ohio pte registration process (pdf) 08/05/2019: This form is for income earned in tax year 2022, with tax returns due in april 2023. You can send the form by:. Entities filing the pte tax in ohio for the first time in 2022 must send in.

Free Ohio Voter Registration Form Register to Vote in OH PDF eForms

Web new ohio pte registration process (pdf) 08/05/2019: Web new pte filers should send in the registration form prior to or along with your first estimated payment and universal payment coupon (upc). Web ohio becomes the latest state to adopt an elective pte tax as a workaround for individual pte owners to the federal salt cap. Here’s how you know.

Web July 22, 2022 Article 6 Min Read Authors:

Ron cook julie corrigan stephen palmer adam garn significant tax changes are in store for ohio after its governor signed. Web ohio governor dewine on june 14 signed into law s.b. Entities filing the pte tax in ohio for the first time in 2022 must send in a separate registration form with any payments being made.) simply filing the. Web we last updated ohio form pte ref in may 2021 from the ohio department of taxation.

We Last Updated The Pass Through Entity & Fiduciary Income Tax Registration In February 2023, So This Is.

Web ohio becomes the latest state to adopt an elective pte tax as a workaround for individual pte owners to the federal salt cap. If you are a new pte filer, but. This form is for income earned in tax year 2022, with tax returns due in april 2023. You can send the form by:.

More Guidance Will Likely Be Forthcoming From The.

A fully refundable ohio pte tax credit is also permitted for pte owners for their. Web as enacted, ohio’s pte tax rate is 5% for 2022 and 3% for those years after 2022. Here’s how you know the due date for filing the it 4738 is april 15th after the year in which the entity’s fiscal year ends. Web this form contains information necessary to create a pte account with the department.

Web New Pte Filers Should Send In The Registration Form Prior To Or Along With Your First Estimated Payment And Universal Payment Coupon (Upc).

For taxable year 2022, the due. Web new ohio pte registration process (pdf) 08/05/2019: Web an official state of ohio site. Web more about the ohio form pte reg corporate income tax ty 2022.