Oklahoma Form 561

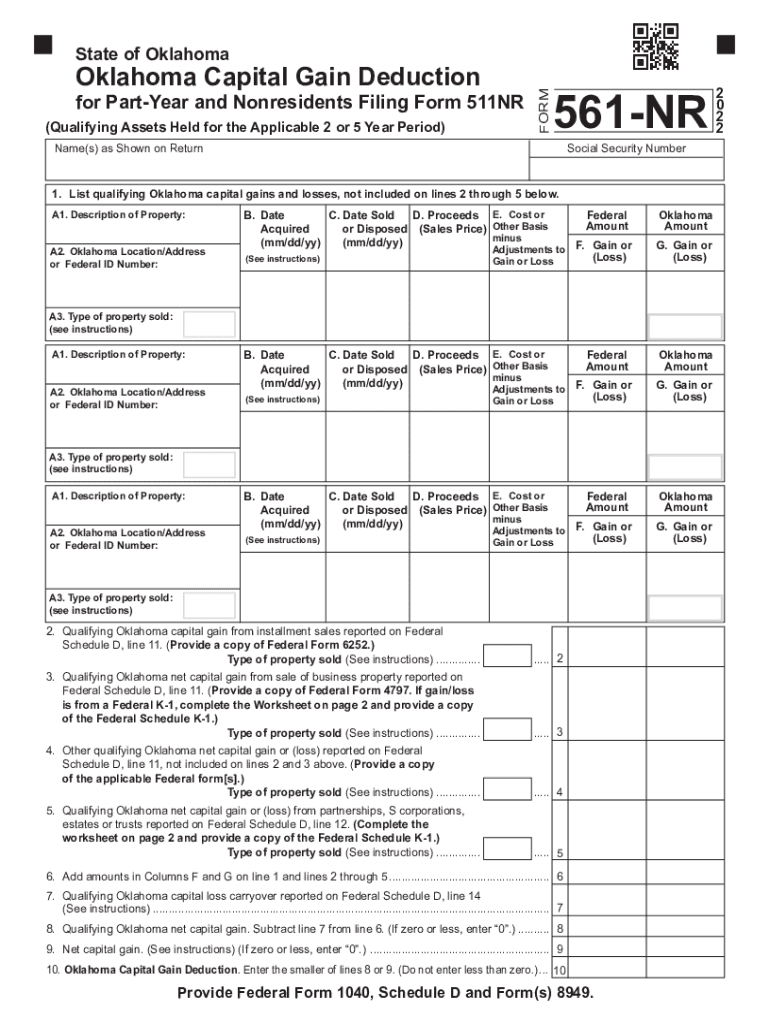

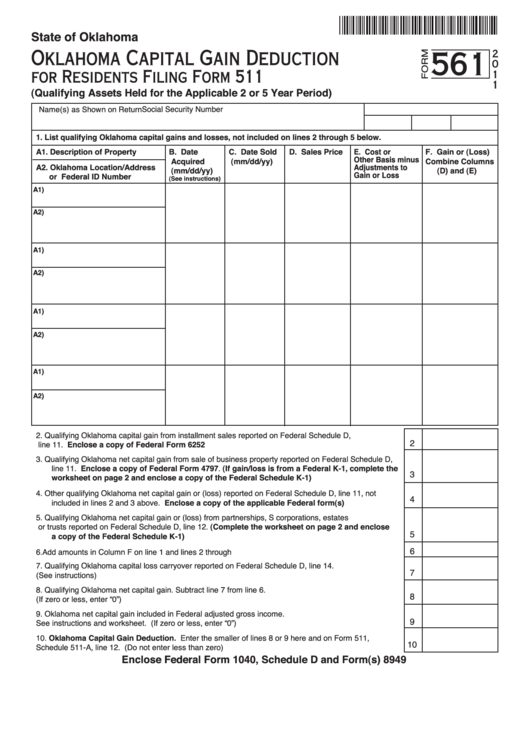

Oklahoma Form 561 - Web state of oklahoma form 561 a2. Line 3 or line 5 oklahoma capital gain deduction for residents filing form 511 68 oklahoma statutes (os) sec. If federal form 6252 was used to report the installment method for gain on the sale of eligible. Web list the nonresident partner’s share of the qualifying oklahoma capital gains and losses from federal form 8949, part ii or from federal schedule d, line 8a. All of your schedule d. List qualifying oklahoma capital gains and losses, not. If you owned and lived in your. Web do not include gains and losses reported on form 561 lines 2 through 5. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web on this form to compute your oklahoma capital gain deduction.

“qualifying gains receiving capital treatment”. Web list the nonresident partner’s share of the qualifying oklahoma capital gains and losses from federal form 8949, part ii or from federal schedule d, line 8a. Web form 561 worksheet for (check one): This form is for income earned in tax year 2022, with tax returns due in april 2023. Web corporate taxpayers can deduct qualifying gains receiving capital gain treatment that are included in federal taxable income. All of your schedule d. Web 2022 form 561 oklahoma capital gain deduction for residents filing form 511. Qualifying gains included in federal distributable income. Web state of oklahoma form 561 a2. Web form 561 allows you to report qualifying sales of oklahoma assets to get a break on oklahoma state tax on a resulting capital gain.

Web 2022 form 561 oklahoma capital gain deduction for residents filing form 511. 1040 oklahoma frequently asked questions overview. Use this screen to calculate the oklahoma forms 561 and 561nr. Web state of oklahoma form 561 a2. Web corporate taxpayers can deduct qualifying gains receiving capital gain treatment that are included in federal taxable income. List qualifying oklahoma capital gains and losses, not. Web a 2021 report prepared for oklahoma’s incentive evaluation commission estimated that the capital gains tax deduction led to an estimated $716.3 million in. “qualifying gains receiving capital treatment”. Web form 561 allows you to report qualifying sales of oklahoma assets to get a break on oklahoma state tax on a resulting capital gain. Web we last updated the capital gain deduction in january 2023, so this is the latest version of form 561s, fully updated for tax year 2022.

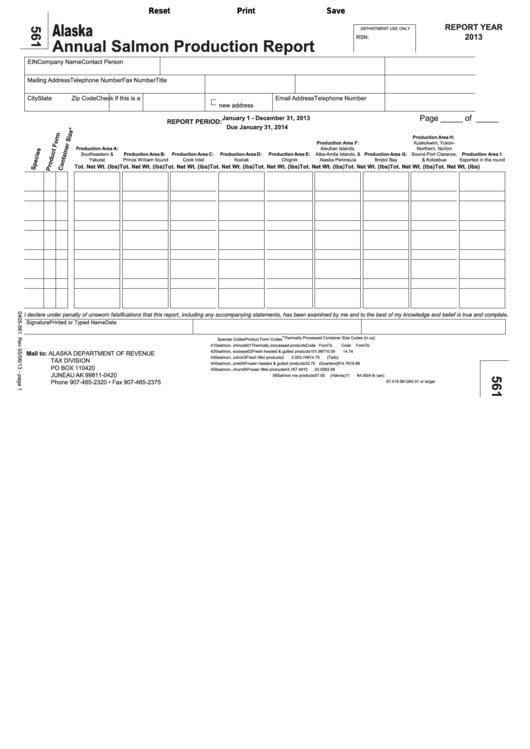

Fillable Form 561 Annual Salmon Production Report 2013 printable

Web state of oklahoma form 561 a2. Web list the nonresident partner’s share of the qualifying oklahoma capital gains and losses from federal form 8949, part ii or from federal schedule d, line 8a. 1040 oklahoma frequently asked questions overview. Web we last updated oklahoma form 561 in january 2023 from the oklahoma tax commission. Oklahoma location/address or federal id.

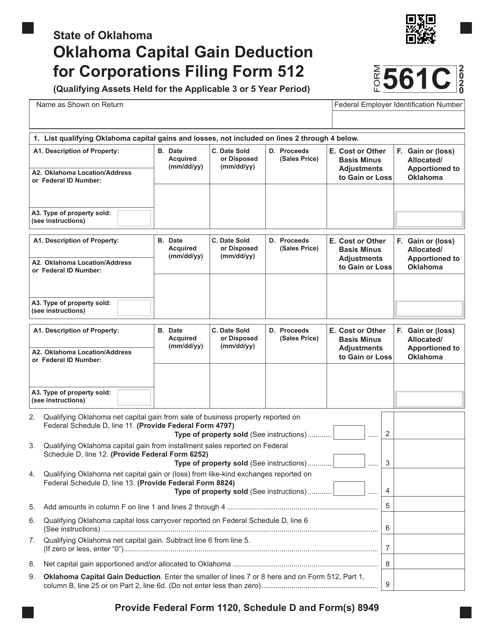

Form 561C Download Fillable PDF or Fill Online Oklahoma Capital Gain

Web list the nonresident partner’s share of the qualifying oklahoma capital gains and losses from federal form 8949, part ii or from federal schedule d, line 8a. Web we last updated oklahoma form 561 in january 2023 from the oklahoma tax commission. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web.

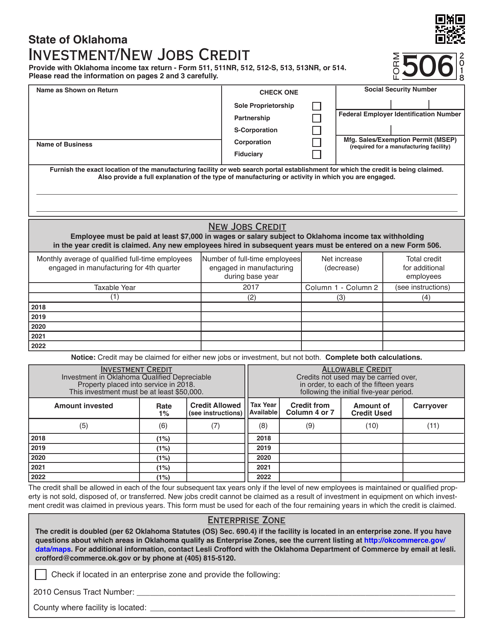

OTC Form 506 Download Fillable PDF 2018, Investment/New Jobs Credit

Web form 561 worksheet for (check one): Web we last updated the capital gain deduction in january 2023, so this is the latest version of form 561s, fully updated for tax year 2022. Do you have to pay taxes when you sell your house in oklahoma? If you owned and lived in your. Web here's a list of some of.

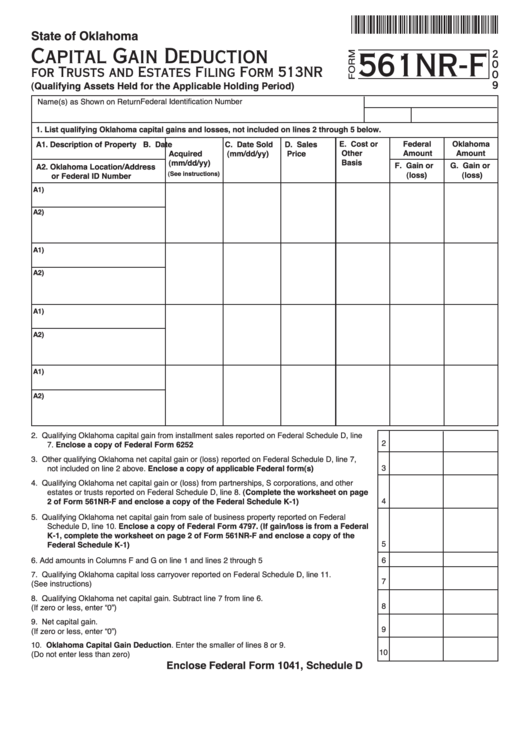

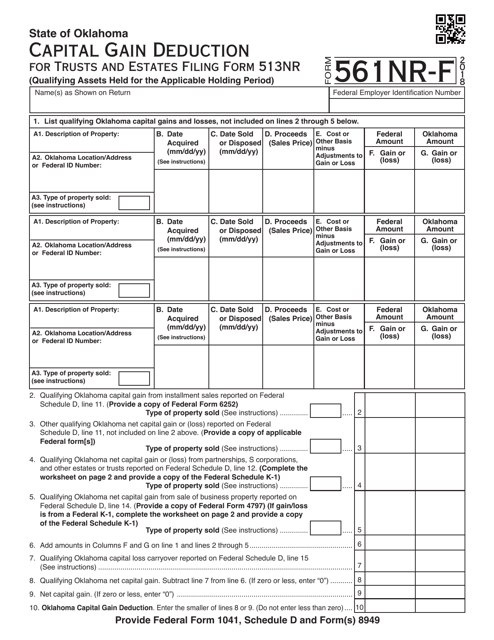

Form 561 NrF Capital Gain Deduction For Trusts And Estates 2009

All of your schedule d. Web form 561 worksheet for (check one): Web we last updated oklahoma form 561 in january 2023 from the oklahoma tax commission. “qualifying gains receiving capital treatment”. If federal form 6252 was used to report the installment method for gain on the sale of eligible.

Oklahoma Form 561 Fill Out and Sign Printable PDF Template signNow

Web we last updated oklahoma form 561 in january 2023 from the oklahoma tax commission. Amounts entered on federal screen. Do you have to pay taxes when you sell your house in oklahoma? 1040 oklahoma frequently asked questions overview. Web corporate taxpayers can deduct qualifying gains receiving capital gain treatment that are included in federal taxable income.

Fillable Form 561 Oklahoma Capital Gain Deduction For Residents

Web form 561 worksheet for (check one): Web list the nonresident partner’s share of the qualifying oklahoma capital gains and losses from federal form 8949, part ii or from federal schedule d, line 8a. You can download or print current or past. Line 3 or line 5 oklahoma capital gain deduction for residents filing form 511 68 oklahoma statutes (os).

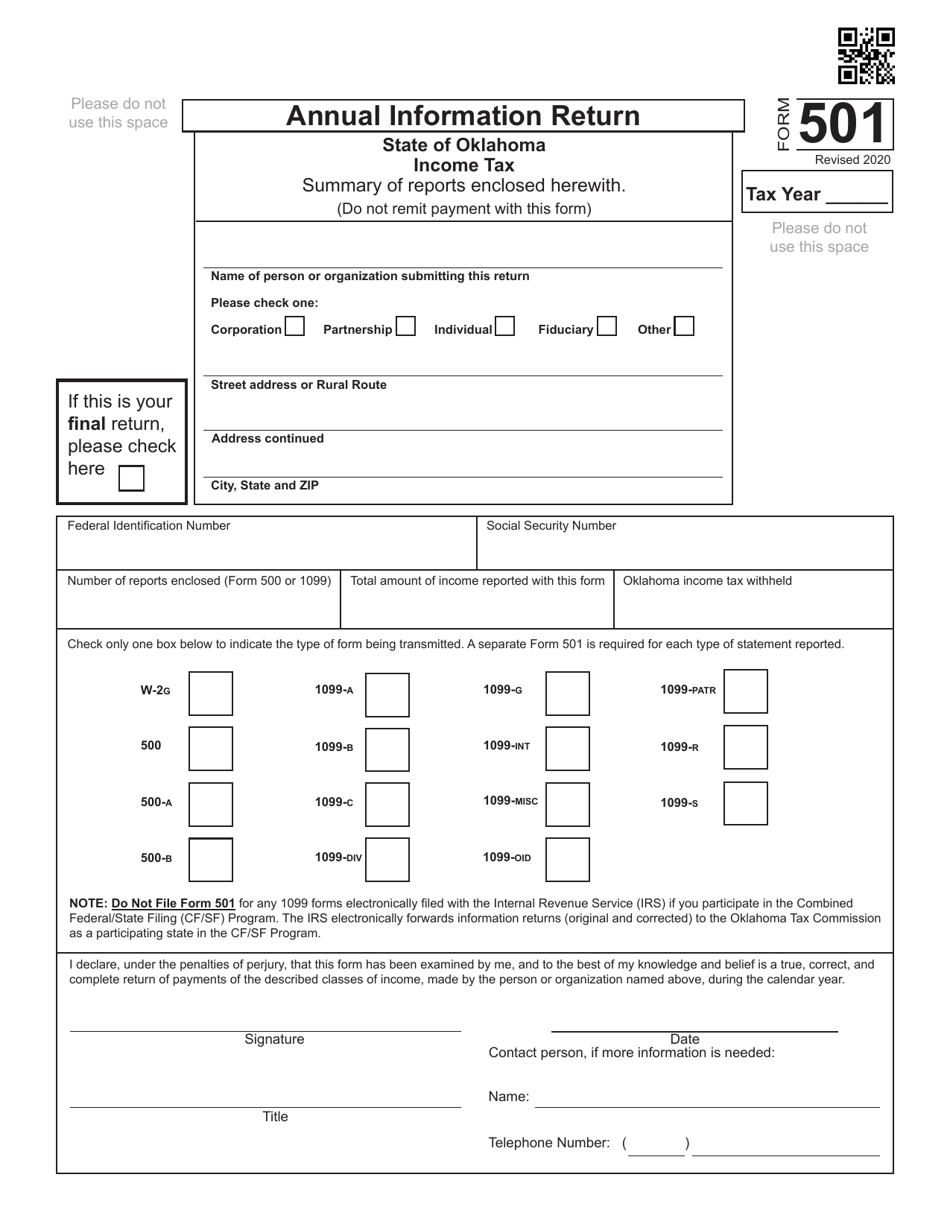

Form 501 Download Fillable PDF or Fill Online Annual Information Return

1040 oklahoma frequently asked questions overview. Web 2022 form 561 oklahoma capital gain deduction for residents filing form 511. If you owned and lived in your. Individual resident income tax return tax return: All of your schedule d.

2015 Form SSA561U2 Fill Online, Printable, Fillable, Blank pdfFiller

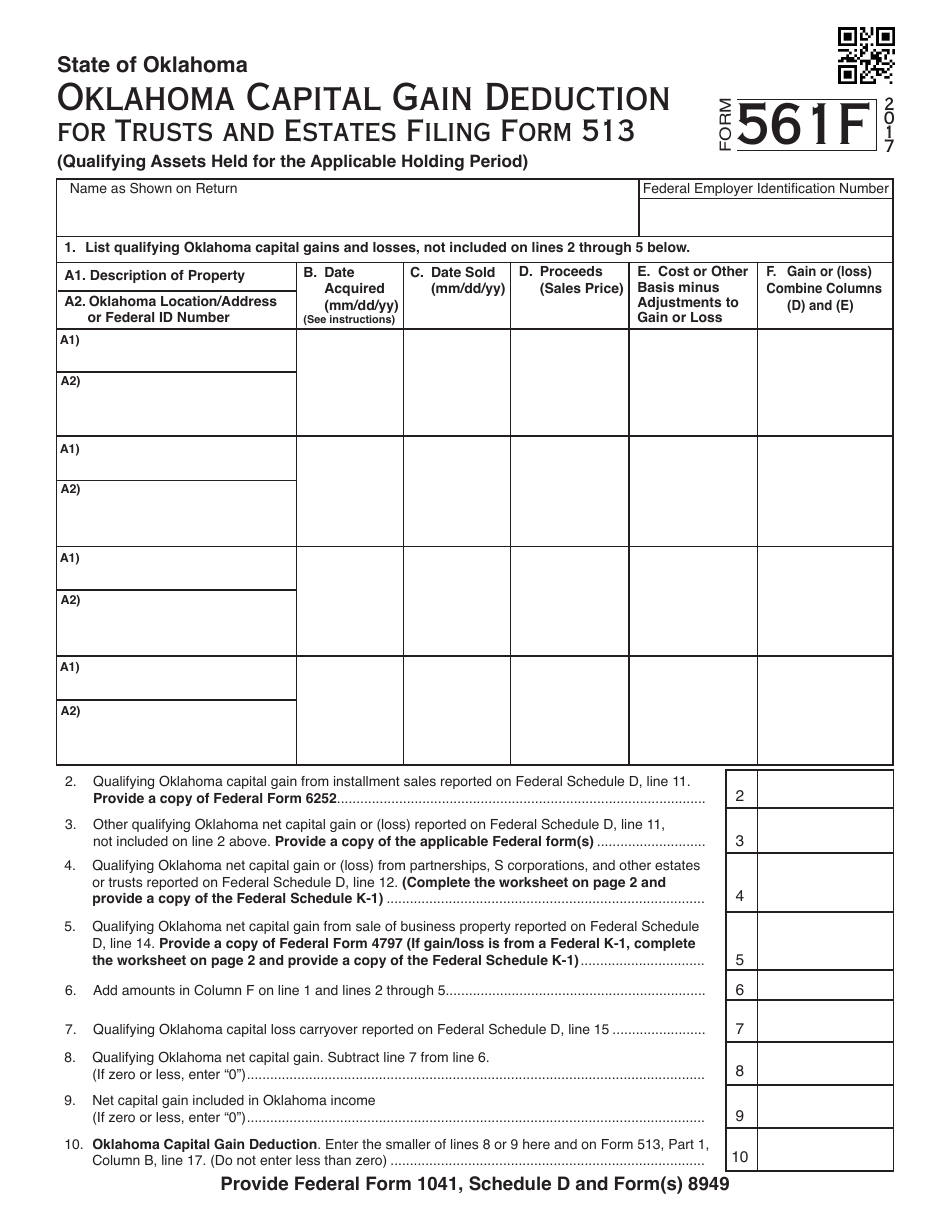

“qualifying gains receiving capital treatment”. Qualifying gains included in federal distributable income. Web corporate taxpayers can deduct qualifying gains receiving capital gain treatment that are included in federal taxable income. Web we last updated oklahoma form 561 in january 2023 from the oklahoma tax commission. Web list the nonresident partner’s share of the qualifying oklahoma capital gains and losses from.

OTC Form 561F Download Fillable PDF or Fill Online Oklahoma Capital

Web corporate taxpayers can deduct qualifying gains receiving capital gain treatment that are included in federal taxable income. If you owned and lived in your. Oklahoma location/address or federal id number a1) a2) a1) a2) a1) a2) a1) a2) 1. Web on this form to compute your oklahoma capital gain deduction. Web here's a list of some of the most.

OTC Form 561NRF Download Fillable PDF or Fill Online Capital Gain

Web on this form to compute your oklahoma capital gain deduction. 1040 oklahoma frequently asked questions overview. Web we last updated the capital gain deduction in january 2023, so this is the latest version of form 561s, fully updated for tax year 2022. Web form 561 allows you to report qualifying sales of oklahoma assets to get a break on.

If You Owned And Lived In Your.

Web list the nonresident partner’s share of the qualifying oklahoma capital gains and losses from federal form 8949, part ii or from federal schedule d, line 8a. Web on this form to compute your oklahoma capital gain deduction. You can download or print current or past. Web 2022 form 561 oklahoma capital gain deduction for residents filing form 511.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April 2023.

Web a 2021 report prepared for oklahoma’s incentive evaluation commission estimated that the capital gains tax deduction led to an estimated $716.3 million in. If federal form 6252 was used to report the installment method for gain on the sale of eligible. “qualifying gains receiving capital treatment”. Web form 561 allows you to report qualifying sales of oklahoma assets to get a break on oklahoma state tax on a resulting capital gain.

Web We Last Updated The Capital Gain Deduction In January 2023, So This Is The Latest Version Of Form 561S, Fully Updated For Tax Year 2022.

Web state of oklahoma form 561 a2. Line 3 or line 5 oklahoma capital gain deduction for residents filing form 511 68 oklahoma statutes (os) sec. Web do not include gains and losses reported on form 561 lines 2 through 5. Use this screen to calculate the oklahoma forms 561 and 561nr.

Web Here's A List Of Some Of The Most Commonly Used Oklahoma Tax Forms:

Web we last updated oklahoma form 561 in january 2023 from the oklahoma tax commission. Qualifying gains included in federal distributable income. Amounts entered on federal screen. Web form 561 worksheet for (check one):