Optum Dependent Care Fsa Form

Optum Dependent Care Fsa Form - With a dependent care fsa, you. Web tax savings your taxable income is reduced by the amounts you deposit into your fsa accounts, up to irs limits. • if i am enrolled in a. Web fsas are administered by optumhealth financial services. Dependent care flexible spending account. What is the difference between a health care fsa and a dependent care fsa? Use a dependent care fsa to pay for the care of loved ones while you work, including childcare or care for dependent adults. Web what is a dependent care fsa? Web up to 8% cash back learn about how to file a claim. You may be able to use your account to pay for:

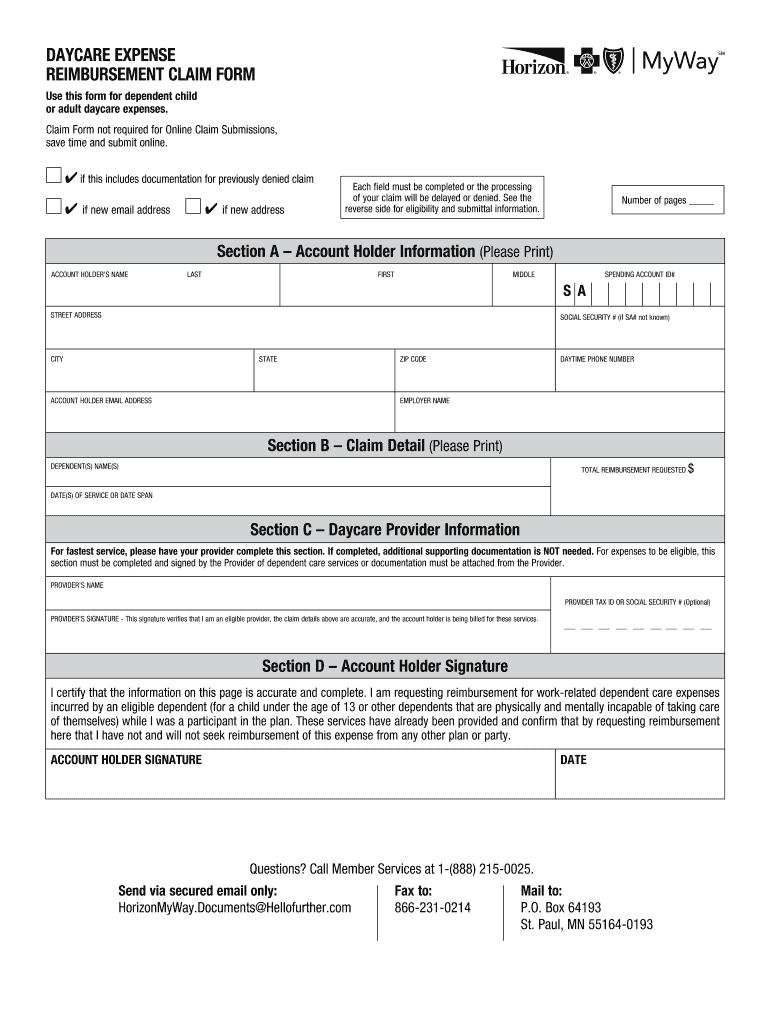

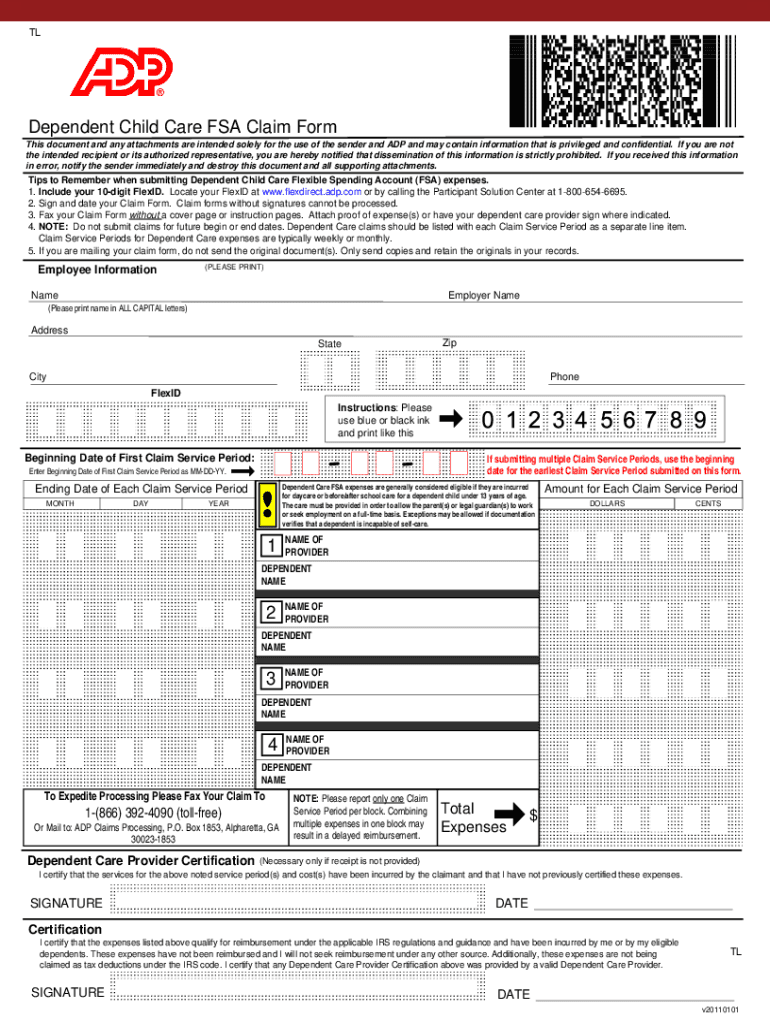

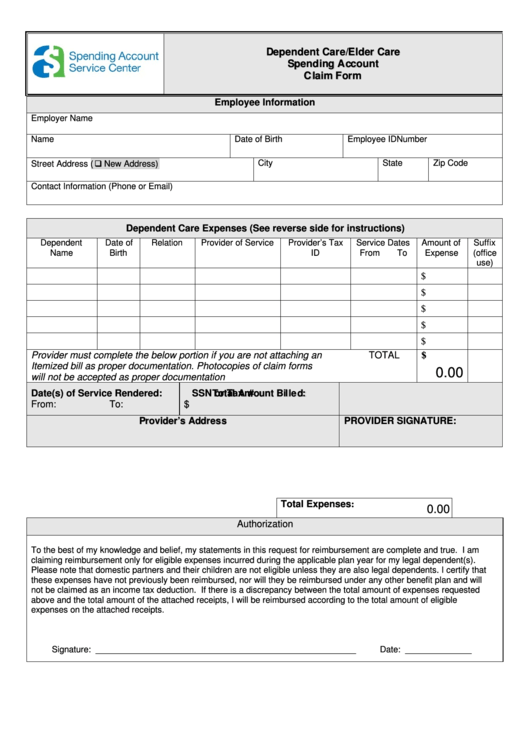

Web with a dependent care fsa, you choose how much to contribute, up to a maximum of $5,000 per household, per year. Web dependent care account claim and pr ovider documentation form use this form to submit your claims for reimbursement of eligible dependent care expenses. Web up to 8% cash back what is a dependent care fsa? Health care fsa max irs election: • nursery school and preschool •. Web fsas are administered by optumhealth financial services. Web up to 8% cash back dependent care fsa. With a dependent care fsa, you. What are the general features and tax benefits of an. Recurring dependent care reimbursement request you can be automatically reimbursed for dependent care.

Web up to 8% cash back discover how to get your claim paid faster for your dependent care flexible spending account (dcfsa). Web tax savings your taxable income is reduced by the amounts you deposit into your fsa accounts, up to irs limits. Web up to 8% cash back dependent care fsa. Web what is a dependent care fsa? Web dependent care account claim and pr ovider documentation form use this form to submit your claims for reimbursement of eligible dependent care expenses. With a dependent care fsa, you. Your employer deducts this amount from each. Web fsas are administered by optumhealth financial services. Web with a dependent care fsa, you choose how much to contribute, up to a maximum of $5,000 per household, per year. Browse additional solutions to help you better understand your fsa.

12 Things You Didn't Know About the Dependent Care FSA Fill Out and

Web up to 8% cash back what is a dependent care fsa? You may be able to use your account to pay for: Please note, an optum bank payment mastercard® is not provided for a dependent care fsa. With a dependent care fsa, you. Web up to 8% cash back dependent care fsa.

Dependent Care FSA Considerations for 2021

What is the difference between a health care fsa and a dependent care fsa? Web up to 8% cash back learn about how to file a claim. Use a dependent care fsa to pay for the care of loved ones while you work, including childcare or care for dependent adults. Web tax savings your taxable income is reduced by the.

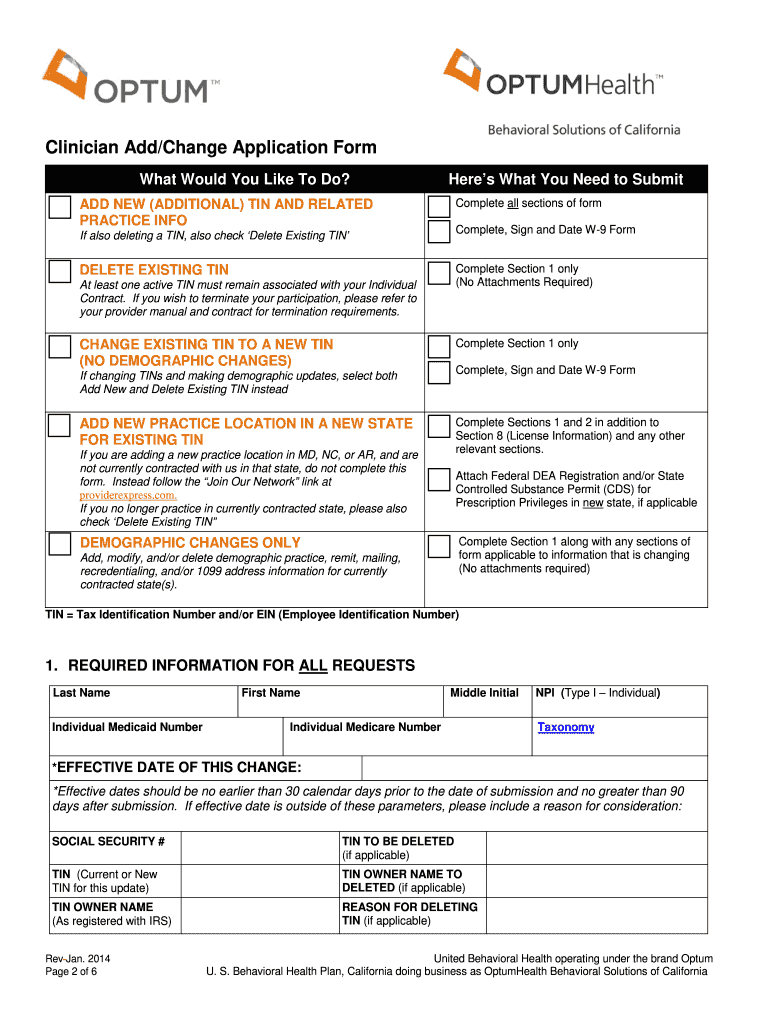

Optum clinician add change application form Fill out & sign online

Browse additional solutions to help you better understand your fsa. Web what is a dependent care fsa? What is the difference between a health care fsa and a dependent care fsa? Recurring dependent care reimbursement request you can be automatically reimbursed for dependent care. • nursery school and preschool •.

More Care Claim Form

Web • if i am enrolled in a health care fsa or an lpfsa, my eligible expenses must qualify as a health care deduction under irs publication 502 and 969. Web up to 8% cash back for eligible dependent care expenses. Recurring dependent care reimbursement request you can be automatically reimbursed for dependent care. With a dependent care fsa, you..

Fillable Dependent Care Fsa Claim Form printable pdf download

Web fsas are administered by optumhealth financial services. Web up to 8% cash back learn about how to file a claim. Use a dependent care fsa to pay for the care of loved ones while you work, including childcare or care for dependent adults. Your employer deducts this amount from each. With a dependent care fsa, you.

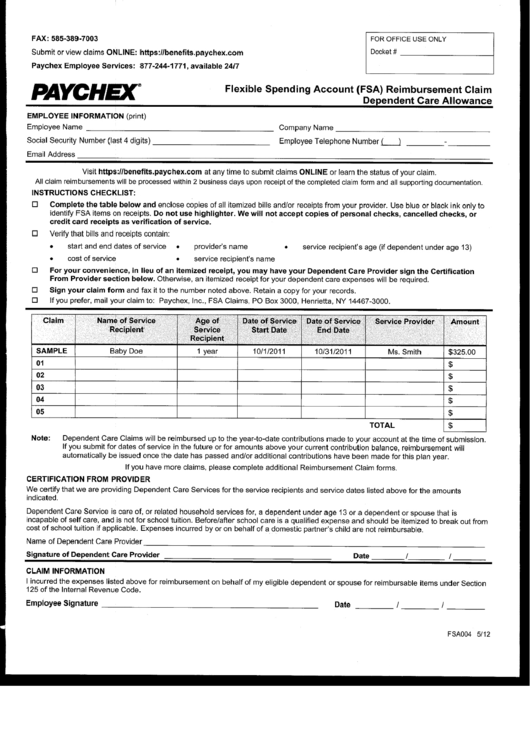

Form Fsa 004 Flexible Spending Account (Fsa) Reimbursement Claim

Web what is a dependent care fsa? Web fsas are administered by optumhealth financial services. Health care fsa max irs election: Web tax savings your taxable income is reduced by the amounts you deposit into your fsa accounts, up to irs limits. Web up to 8% cash back sign up for an optum bank dependent care fsa during benefits enrollment.

Browse Our Image of Dependent Care Receipt Template Receipt template

Dependent care flexible spending account. Web what is a flexible spending account (fsa)? Health care fsa max irs election: Web up to 8% cash back dependent care fsa. Please note, an optum bank payment mastercard® is not provided for a dependent care fsa.

Savings Calculator Flores247

Recurring dependent care reimbursement request you can be automatically reimbursed for dependent care. Web fsas are administered by optumhealth financial services. What is the difference between a health care fsa and a dependent care fsa? Web up to 8% cash back make the most of your fsa. Your employer deducts this amount from each.

FSA Dependent Care YouTube

Web with a dependent care fsa, you choose how much to contribute, up to a maximum of $5,000 per household, per year. With a dependent care fsa, you. Please note, an optum bank payment mastercard® is not provided for a dependent care fsa. Web up to 8% cash back learn about how to file a claim. With a dependent care.

Web What Is A Dependent Care Fsa?

What is the difference between a health care fsa and a dependent care fsa? Web up to 8% cash back dependent care fsa. In addition, you must send in a new recurring dependent care. Web what is a flexible spending account (fsa)?

Web Up To 8% Cash Back Learn About How To File A Claim.

Web dependent care account claim and pr ovider documentation form use this form to submit your claims for reimbursement of eligible dependent care expenses. What are the general features and tax benefits of an. Health care fsa max irs election: Recurring dependent care reimbursement request you can be automatically reimbursed for dependent care.

Web Up To 8% Cash Back For Eligible Dependent Care Expenses.

Web • if i am enrolled in a health care fsa or an lpfsa, my eligible expenses must qualify as a health care deduction under irs publication 502 and 969. Browse additional solutions to help you better understand your fsa. With a dependent care fsa, you. With a dependent care fsa, you.

• If I Am Enrolled In A.

Web fsas are administered by optumhealth financial services. Web up to 8% cash back discover how to get your claim paid faster for your dependent care flexible spending account (dcfsa). Use a dependent care fsa to pay for the care of loved ones while you work, including childcare or care for dependent adults. Your employer deducts this amount from each.