Oregon State Tax Form 2022

Oregon State Tax Form 2022 - Web federal tax law no extension to pay. Select a heading to view its forms, then u se the search feature to locate a form or publication by. Form 132 is filed with form oq on a quarterly basis. Web the library has received the following 2022 tax forms and instruction booklets from the irs: If amending for an nol, tax year the nol was generated: Be sure to verify that the form you. Download and save the form to your computer, then open it in adobe reader to complete and print. The current tax year is 2022, and most states will release updated tax forms between. Ad discover 2290 form due dates for heavy use vehicles placed into service. Web instructions oregon state income tax forms for current and previous tax years.

Select a heading to view its forms, then u se the search feature to locate a form or publication by. Web 2022 forms and publications. Forms are located on the community resources shelf. Web federal tax law no extension to pay. Web city _____ state _____ zip code _____ date moved in or out of the city of oregon _____ documents to include: Web view all of the current year's forms and publications by popularity or program area. Web instructions oregon state income tax forms for current and previous tax years. The current tax year is 2022, and most states will release updated tax forms between. We last updated the resident individual income tax. Download and save the form to your computer, then open it in adobe reader to complete and print.

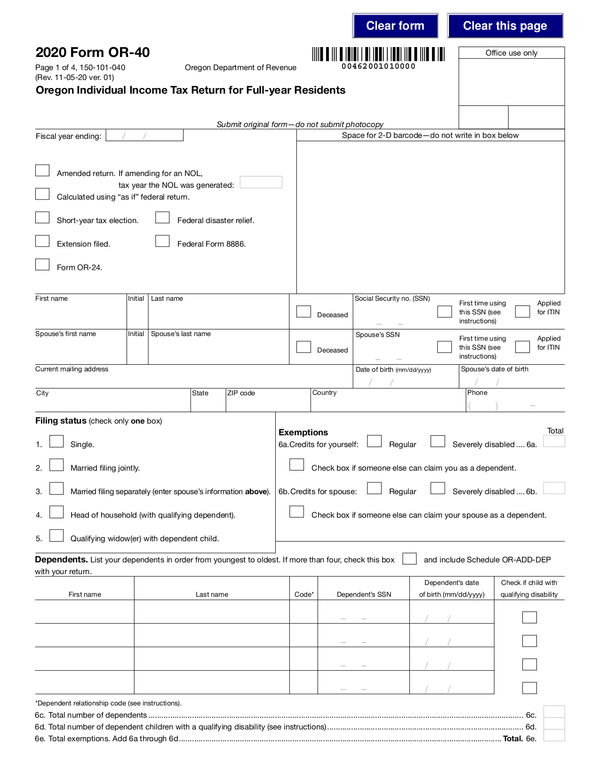

Form 40 can be efiled, or a paper copy can be filed via mail. Forms are located on the community resources shelf. Be sure to verify that the form you. Web city _____ state _____ zip code _____ date moved in or out of the city of oregon _____ documents to include: Web 2022 forms and publications. Oregon has a state income tax that ranges between 5% and 9.9%. Web taxformfinder provides printable pdf copies of 51 current oregon income tax forms. Form 132 is filed with form oq on a quarterly basis. Web federal tax law no extension to pay. Web the library has received the following 2022 tax forms and instruction booklets from the irs:

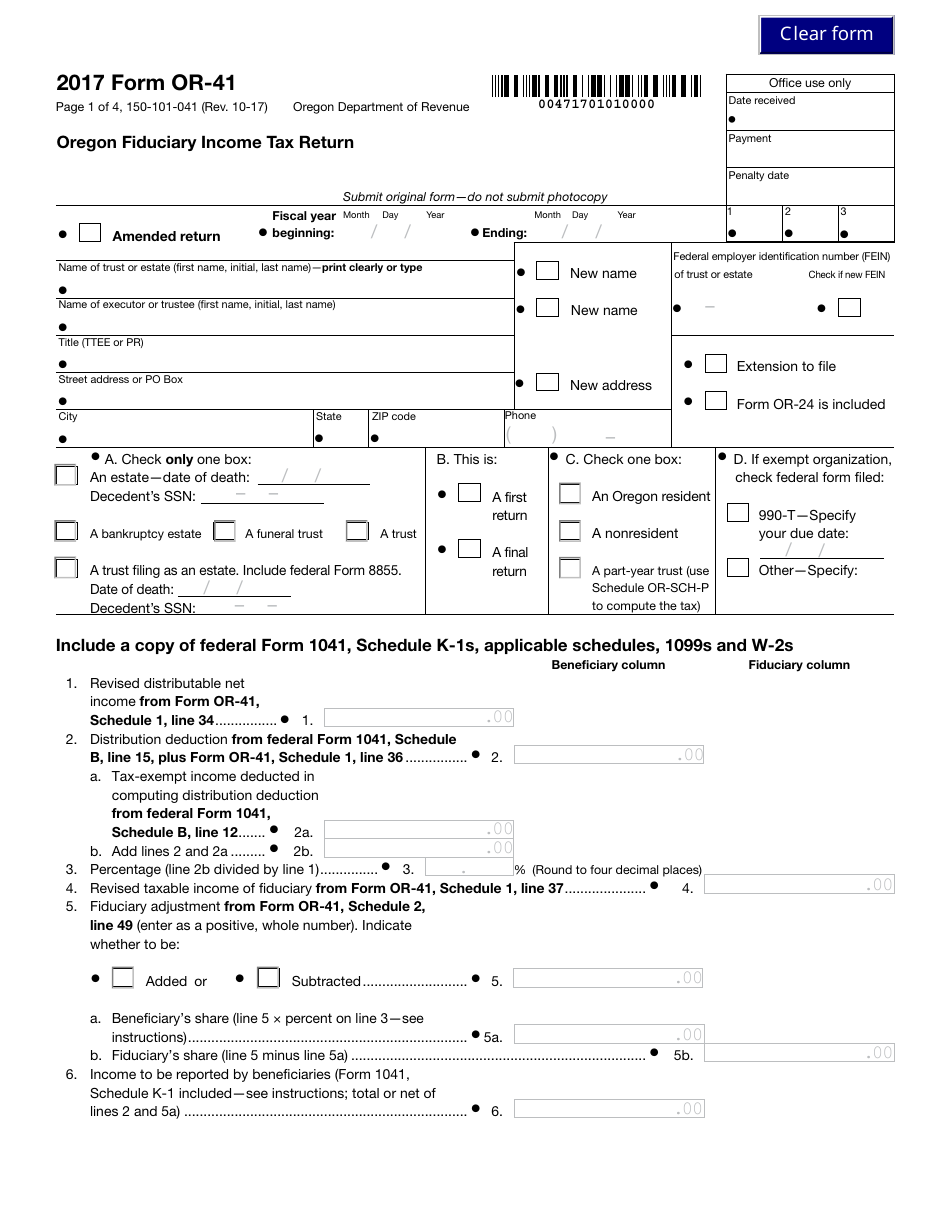

Form OR41 Download Fillable PDF or Fill Online Oregon Fiduciary

Form 40 can be efiled, or a paper copy can be filed via mail. Web city _____ state _____ zip code _____ date moved in or out of the city of oregon _____ documents to include: Ad discover 2290 form due dates for heavy use vehicles placed into service. Forms are located on the community resources shelf. Select a heading.

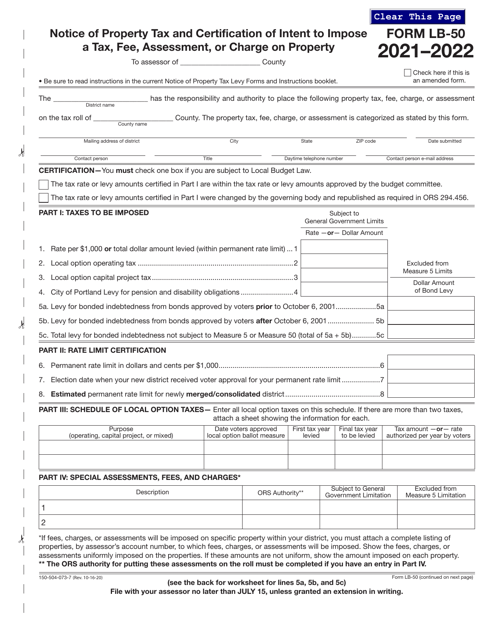

Form LB50 (1505040737) Download Fillable PDF or Fill Online Notice

Web instructions oregon state income tax forms for current and previous tax years. Be sure to verify that the form you. Ad pdffiller allows users to edit, sign, fill and share all type of documents online. We last updated the resident individual income tax. Form 40 can be efiled, or a paper copy can be filed via mail.

美国国税局(IRS)发布2020年的1040表(剧透警报:仍然不是明信片)_玩币族

We don't recommend using your. Your 2021 oregon tax is due april 18, 2022. Be sure to verify that the form you. The irs and dor will begin. Web federal tax law no extension to pay.

Oregon State Tax Fill Online, Printable, Fillable, Blank pdfFiller

Ne suite 180 salem or 97310. Form 132 is filed with form oq on a quarterly basis. Web city _____ state _____ zip code _____ date moved in or out of the city of oregon _____ documents to include: Web all oregon resident taxpayers preparing their own returns in 2023 can file electronically at no cost using one of oregon’s.

20 Oregon Fill Out and Sign Printable PDF Template signNow

If amending for an nol, tax year the nol was generated: Ne suite 180 salem or 97310. Form 132 is filed with form oq on a quarterly basis. The current tax year is 2022, and most states will release updated tax forms between. Web all oregon resident taxpayers preparing their own returns in 2023 can file electronically at no cost.

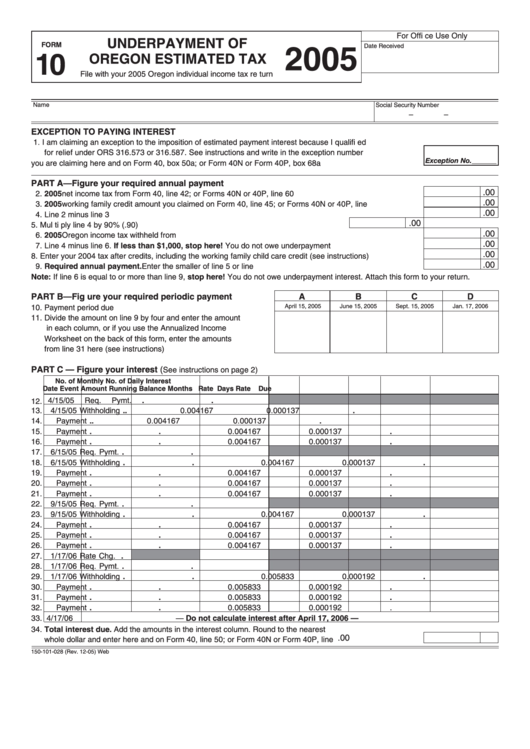

Fillable Form 10 Underpayment Of Oregon Estimated Tax 2005

Forms are located on the community resources shelf. Select a heading to view its forms, then u se the search feature to locate a form or publication by. Web all oregon resident taxpayers preparing their own returns in 2023 can file electronically at no cost using one of oregon’s free file options, the oregon department. We don't recommend using your..

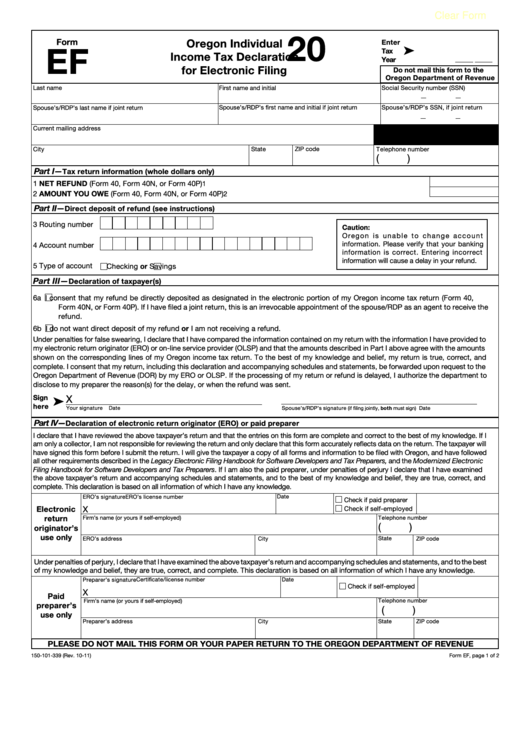

Fillable Form Ef Oregon Individual Tax Declaration For

Your 2021 oregon tax is due april 18, 2022. The current tax year is 2022, and most states will release updated tax forms between. Forms are located on the community resources shelf. Oregon has a state income tax that ranges between 5% and 9.9%. Download and save the form to your computer, then open it in adobe reader to complete.

Oregon Annual Withholding Tax Reconciliation Report 2019 20202022

Web instructions oregon state income tax forms for current and previous tax years. Ad pdffiller allows users to edit, sign, fill and share all type of documents online. Web taxformfinder provides printable pdf copies of 51 current oregon income tax forms. Oregon has a state income tax that ranges between 5% and 9.9%. Forms are located on the community resources.

Fill Free fillable forms for the state of Oregon

We last updated the resident individual income tax. Ne suite 180 salem or 97310. Form 40 can be efiled, or a paper copy can be filed via mail. Web view all of the current year's forms and publications by popularity or program area. Web taxformfinder provides printable pdf copies of 51 current oregon income tax forms.

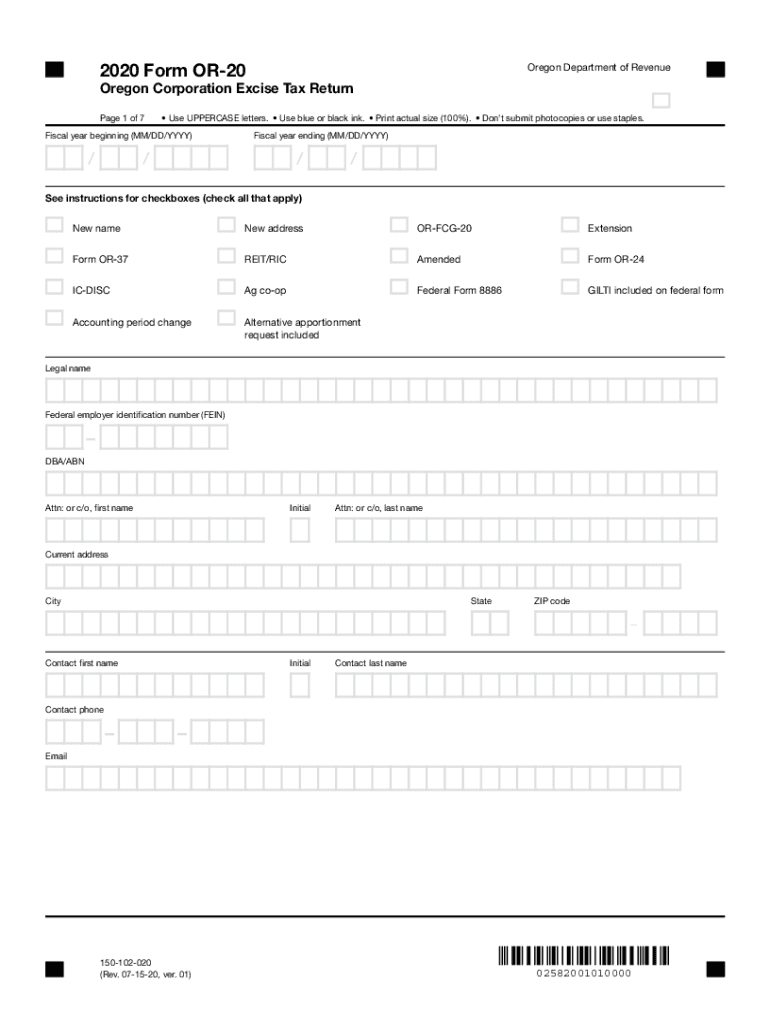

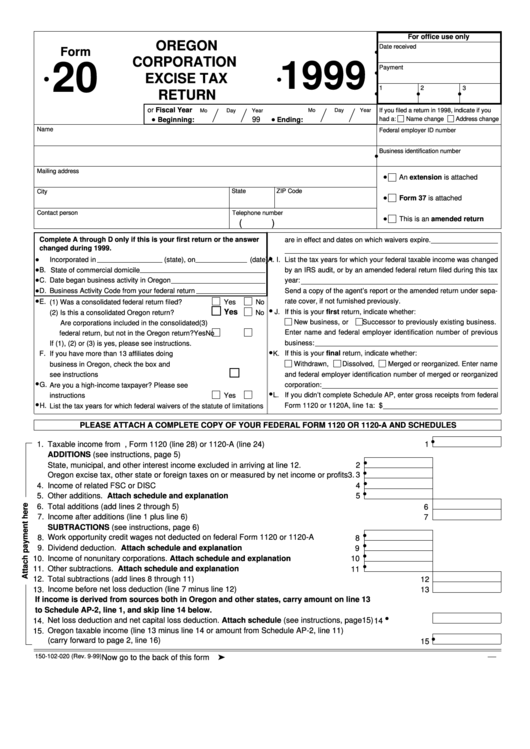

Fillable Form 20 Oregon Corporation Excise Tax Return 1999

Web the library has received the following 2022 tax forms and instruction booklets from the irs: Web 2022 forms and publications. We don't recommend using your. Ne suite 180 salem or 97310. Edit pdfs, create forms, collect data, collaborate with your team, secure docs and more.

Web All Oregon Resident Taxpayers Preparing Their Own Returns In 2023 Can File Electronically At No Cost Using One Of Oregon’s Free File Options, The Oregon Department.

Your 2021 oregon tax is due april 18, 2022. Oregon has a state income tax that ranges between 5% and 9.9%. Web city _____ state _____ zip code _____ date moved in or out of the city of oregon _____ documents to include: Select a heading to view its forms, then u se the search feature to locate a form or publication by.

Web View All Of The Current Year's Forms And Publications By Popularity Or Program Area.

Edit pdfs, create forms, collect data, collaborate with your team, secure docs and more. We don't recommend using your. Web form 40 is the general income tax return for oregon residents. Web the library has received the following 2022 tax forms and instruction booklets from the irs:

Ad Discover 2290 Form Due Dates For Heavy Use Vehicles Placed Into Service.

Be sure to verify that the form you. The current tax year is 2022, and most states will release updated tax forms between. Download and save the form to your computer, then open it in adobe reader to complete and print. We last updated the resident individual income tax.

Web 2022 Forms And Publications.

Ad pdffiller allows users to edit, sign, fill and share all type of documents online. Ne suite 180 salem or 97310. The irs and dor will begin. If amending for an nol, tax year the nol was generated: