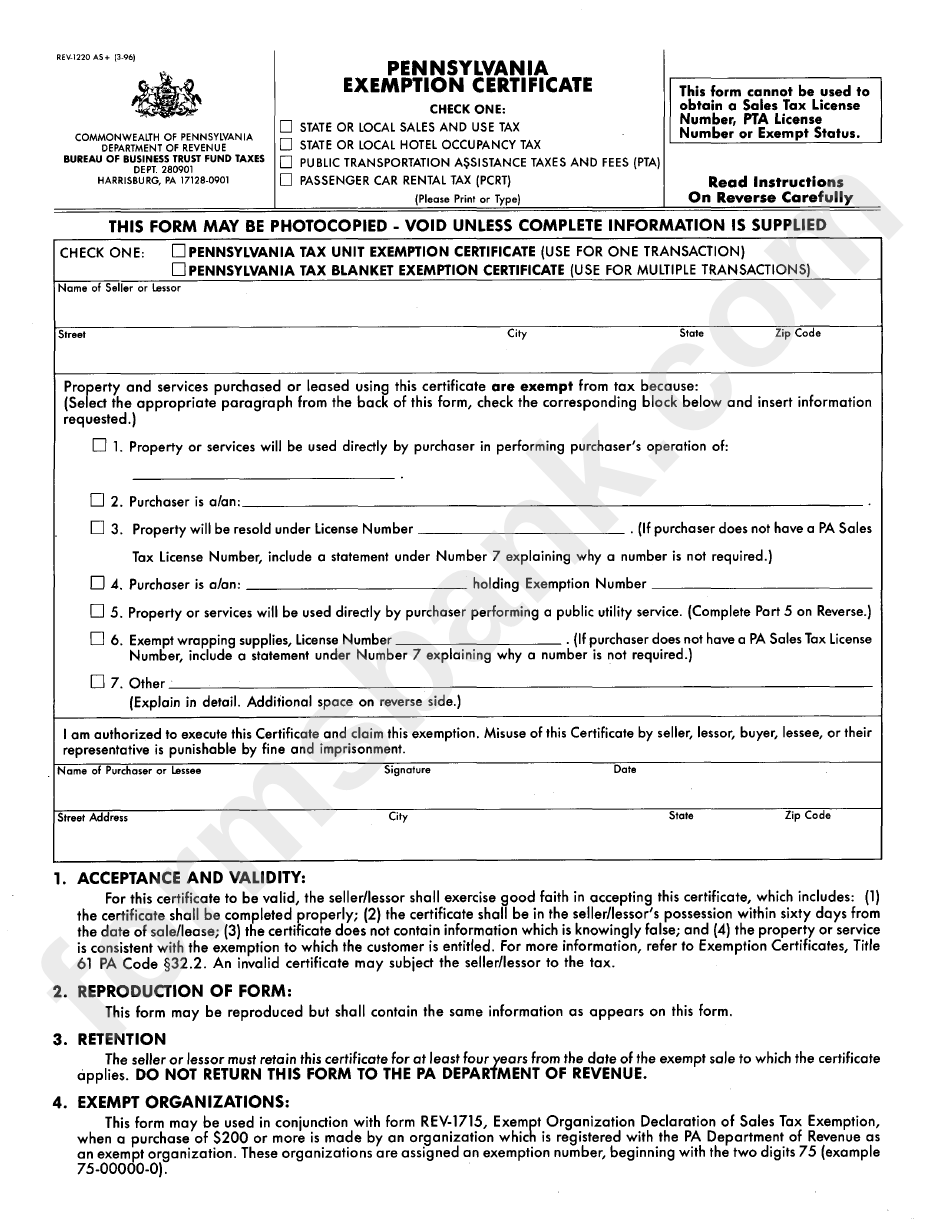

Pa Sales Tax Exempt Form

Pa Sales Tax Exempt Form - Select the type of tax for which you are claiming an exemption, e.g., to claim a resale exemption for sales tax you would select state and local sales and use tax. Pennsylvania online business tax registration. Web pennsylvania exemption certificate state and local sales and use tax state 6% and local 1% hotel occupancy tax public transportation assistance taxes and fees (pta) vehicle rental tax (vrt) additional local, city, county hotel tax * this form cannot be used to obtain a sales tax. Vendors may use this declaration to document purchases of tax free items by tax exempt organizations (charitable, religious and educational organizations and volunteer fire or ambulance companies) holding a valid exemption number issued by the. Due dates [pdf] tax types. Web tax exemption official use only this form may be photocopied purpose: Properly completed exemption certificates provide a valid reason for the exemption and are accepted in good faith to relieve the vendor from the collection of tax. Web form to the pa department of revenue. For other pennsylvania sales tax exemption certificates, go here. Web tax credits and incentives.

Web pennsylvania exemption certificate state and local sales and use tax state 6% and local 1% hotel occupancy tax public transportation assistance taxes and fees (pta) vehicle rental tax (vrt) additional local, city, county hotel tax * this form cannot be used to obtain a sales tax. For other pennsylvania sales tax exemption certificates, go here. Web tax credits and incentives. Due dates [pdf] tax types. Web form to the pa department of revenue. Web pennsylvania sales tax exemption / resale forms 1 pdfs. Vendors may use this declaration to document purchases of tax free items by tax exempt organizations (charitable, religious and educational organizations and volunteer fire or ambulance companies) holding a valid exemption number issued by the. Pennsylvania online business tax registration. Properly completed exemption certificates provide a valid reason for the exemption and are accepted in good faith to relieve the vendor from the collection of tax. Web tax exemption official use only this form may be photocopied purpose:

Properly completed exemption certificates provide a valid reason for the exemption and are accepted in good faith to relieve the vendor from the collection of tax. Web the purchaser gives the completed form to the seller when claiming an exemption on sales tax. Select the type of tax for which you are claiming an exemption, e.g., to claim a resale exemption for sales tax you would select state and local sales and use tax. Pennsylvania online business tax registration. Web pennsylvania sales tax exemption / resale forms 1 pdfs. Web tax credits and incentives. Vendors may use this declaration to document purchases of tax free items by tax exempt organizations (charitable, religious and educational organizations and volunteer fire or ambulance companies) holding a valid exemption number issued by the. Due dates [pdf] tax types. Web form to the pa department of revenue. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the pennsylvania sales tax.

FREE 10+ Sample Tax Exemption Forms in PDF

Properly completed exemption certificates provide a valid reason for the exemption and are accepted in good faith to relieve the vendor from the collection of tax. Web tax exemption official use only this form may be photocopied purpose: Pennsylvania online business tax registration. Web form to the pa department of revenue. Web tax credits and incentives.

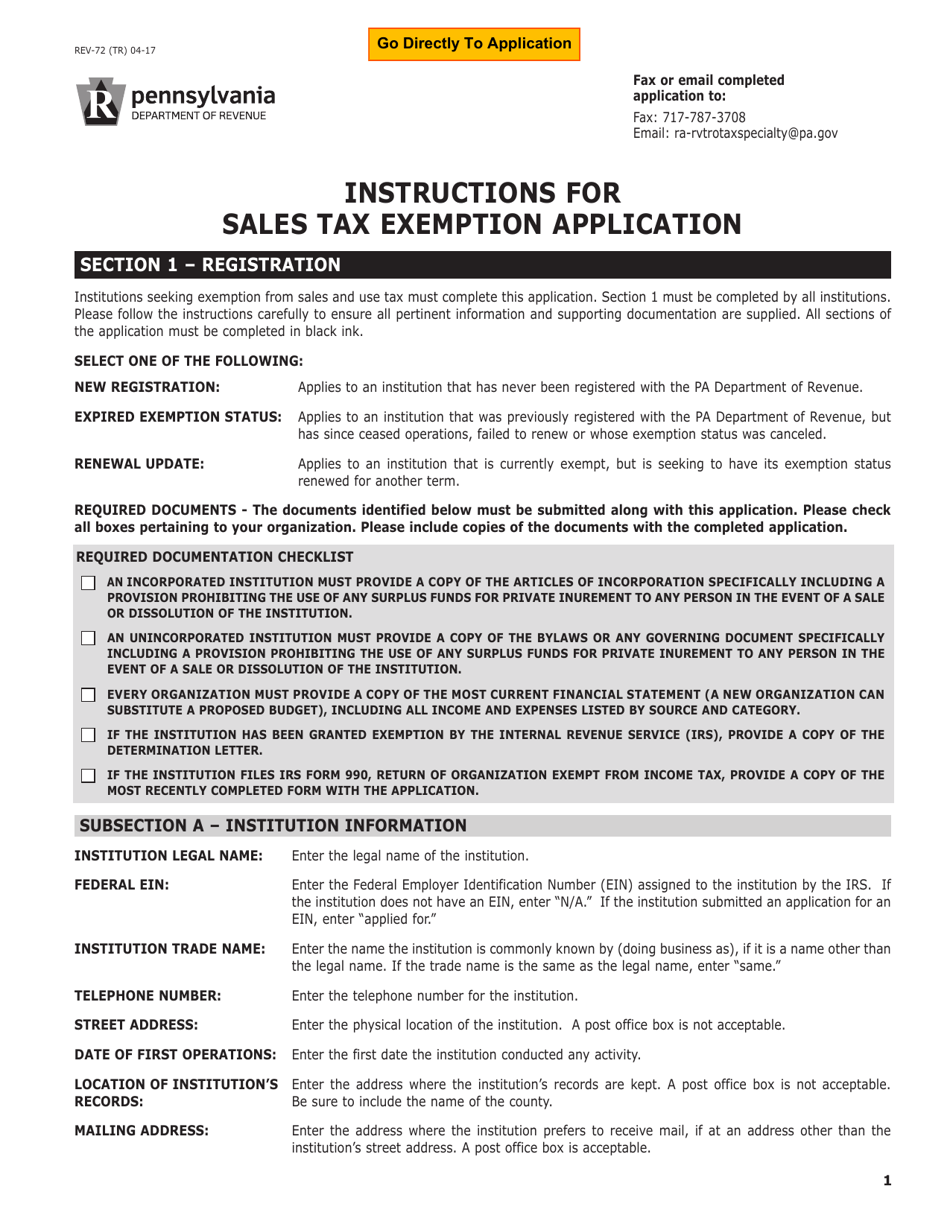

Form REV72 Download Fillable PDF or Fill Online Application for Sales

For other pennsylvania sales tax exemption certificates, go here. Web tax exemption official use only this form may be photocopied purpose: Properly completed exemption certificates provide a valid reason for the exemption and are accepted in good faith to relieve the vendor from the collection of tax. Vendors may use this declaration to document purchases of tax free items by.

Fet Exemption Certificate Master of Documents

For other pennsylvania sales tax exemption certificates, go here. Web pennsylvania exemption certificate state and local sales and use tax state 6% and local 1% hotel occupancy tax public transportation assistance taxes and fees (pta) vehicle rental tax (vrt) additional local, city, county hotel tax * this form cannot be used to obtain a sales tax. Web tax credits and.

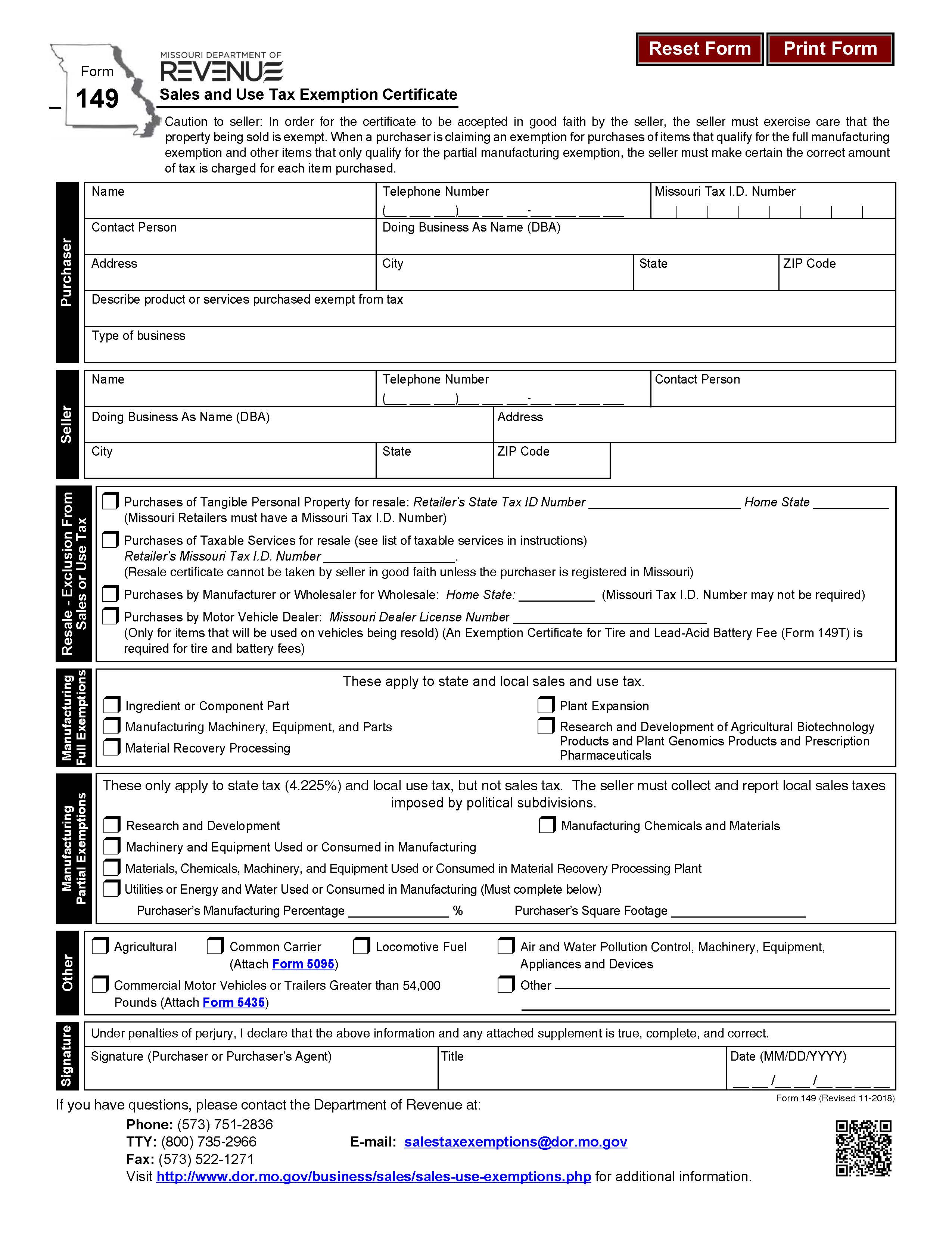

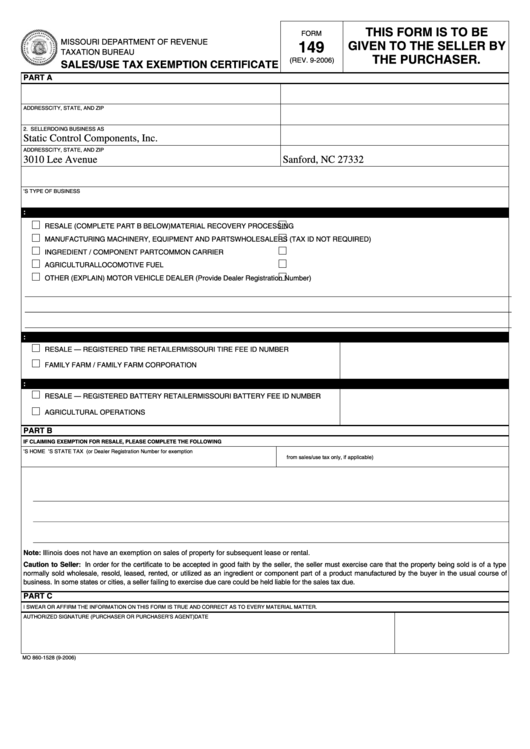

Missouri 149 Sales and Use Tax Exemption Certificate

Web tax credits and incentives. Web pennsylvania sales tax exemption / resale forms 1 pdfs. Pennsylvania online business tax registration. For other pennsylvania sales tax exemption certificates, go here. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the pennsylvania sales tax.

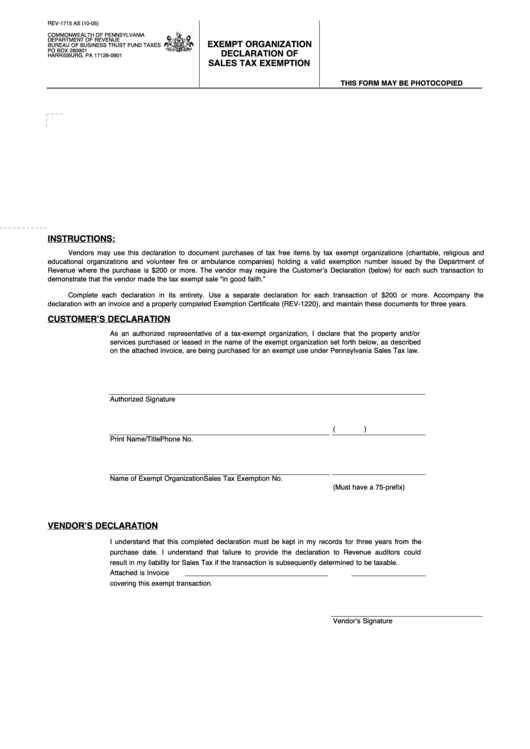

Form Rev1715 Exempt Organization Declaration Of Sales Tax Exemption

Web tax exemption official use only this form may be photocopied purpose: Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the pennsylvania sales tax. Pennsylvania online business tax registration. Web the purchaser gives the completed form to the seller when claiming an exemption on.

REV1220 Pennsylvania Exemption Certificate Free Download

Properly completed exemption certificates provide a valid reason for the exemption and are accepted in good faith to relieve the vendor from the collection of tax. For other pennsylvania sales tax exemption certificates, go here. Web form to the pa department of revenue. Web tax credits and incentives. Web a sales tax exemption certificate can be used by businesses (or.

Fillable Form 149, 2006, Sales/use Tax Exemption Certificate printable

Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the pennsylvania sales tax. Select the type of tax for which you are claiming an exemption, e.g., to claim a resale exemption for sales tax you would select state and local sales and use tax. Vendors.

20172022 Form PA REV72 Fill Online, Printable, Fillable, Blank

Web tax credits and incentives. Web the purchaser gives the completed form to the seller when claiming an exemption on sales tax. Due dates [pdf] tax types. Web pennsylvania sales tax exemption / resale forms 1 pdfs. For other pennsylvania sales tax exemption certificates, go here.

Fillable Form Rev 1220 As+ Pennsylvania Exemption Certificate

Web pennsylvania sales tax exemption / resale forms 1 pdfs. Web form to the pa department of revenue. Web tax credits and incentives. For other pennsylvania sales tax exemption certificates, go here. Select the type of tax for which you are claiming an exemption, e.g., to claim a resale exemption for sales tax you would select state and local sales.

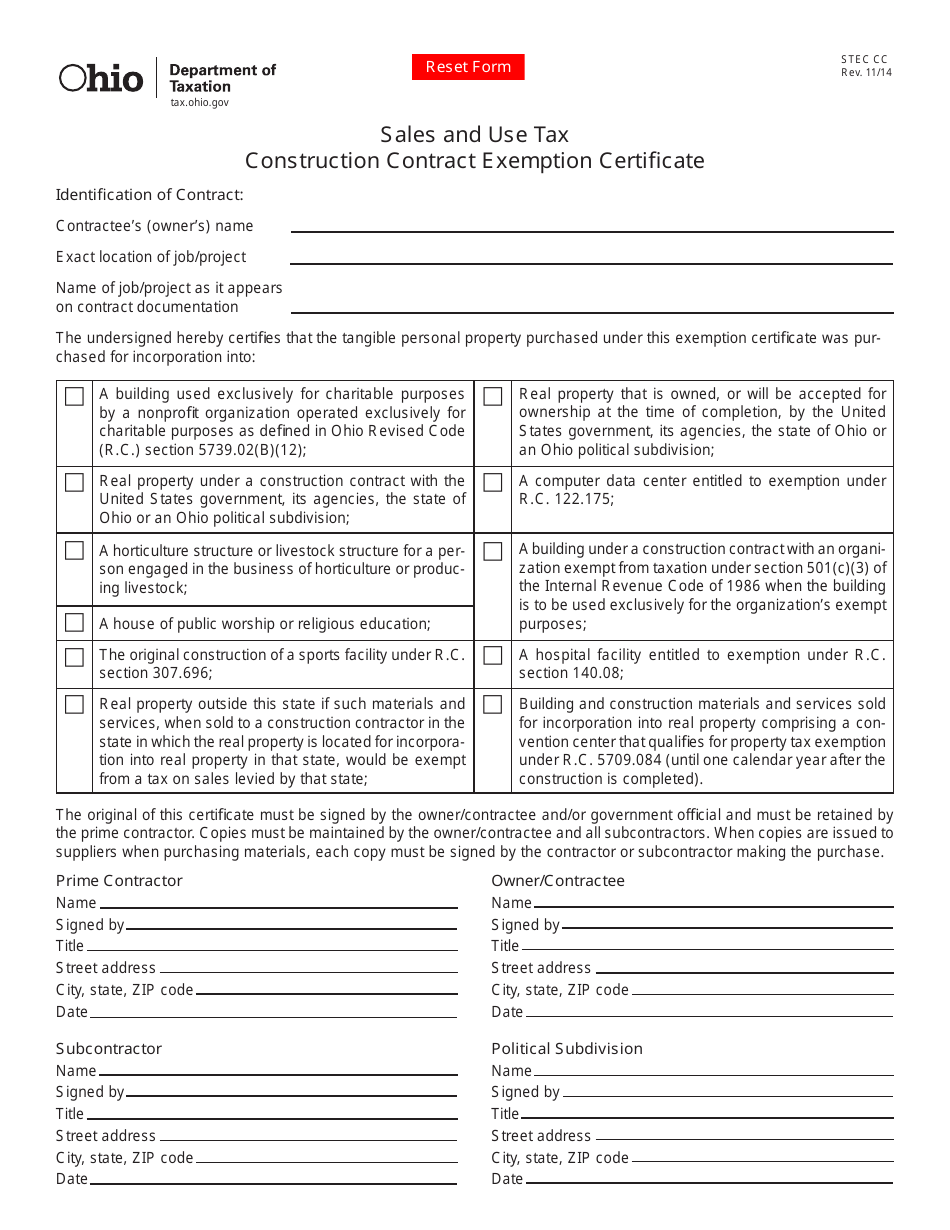

Form STEC CC Download Fillable PDF or Fill Online Sales and Use Tax

Vendors may use this declaration to document purchases of tax free items by tax exempt organizations (charitable, religious and educational organizations and volunteer fire or ambulance companies) holding a valid exemption number issued by the. Web form to the pa department of revenue. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who.

Web Tax Exemption Official Use Only This Form May Be Photocopied Purpose:

Pennsylvania online business tax registration. Select the type of tax for which you are claiming an exemption, e.g., to claim a resale exemption for sales tax you would select state and local sales and use tax. Due dates [pdf] tax types. Web pennsylvania exemption certificate state and local sales and use tax state 6% and local 1% hotel occupancy tax public transportation assistance taxes and fees (pta) vehicle rental tax (vrt) additional local, city, county hotel tax * this form cannot be used to obtain a sales tax.

Vendors May Use This Declaration To Document Purchases Of Tax Free Items By Tax Exempt Organizations (Charitable, Religious And Educational Organizations And Volunteer Fire Or Ambulance Companies) Holding A Valid Exemption Number Issued By The.

Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the pennsylvania sales tax. Web tax credits and incentives. Web the purchaser gives the completed form to the seller when claiming an exemption on sales tax. Web pennsylvania sales tax exemption / resale forms 1 pdfs.

Web Form To The Pa Department Of Revenue.

For other pennsylvania sales tax exemption certificates, go here. Properly completed exemption certificates provide a valid reason for the exemption and are accepted in good faith to relieve the vendor from the collection of tax.